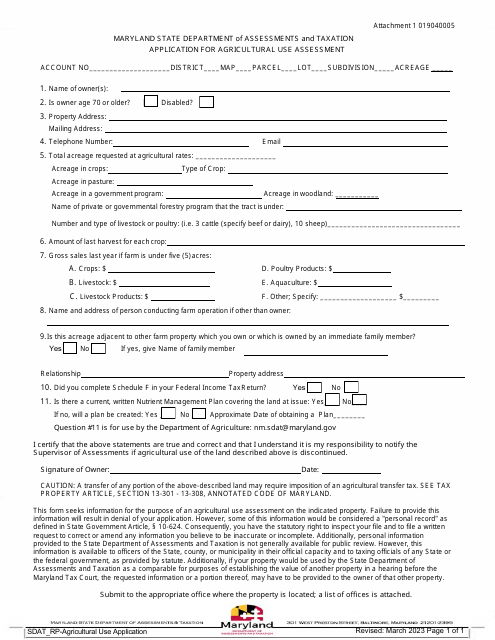

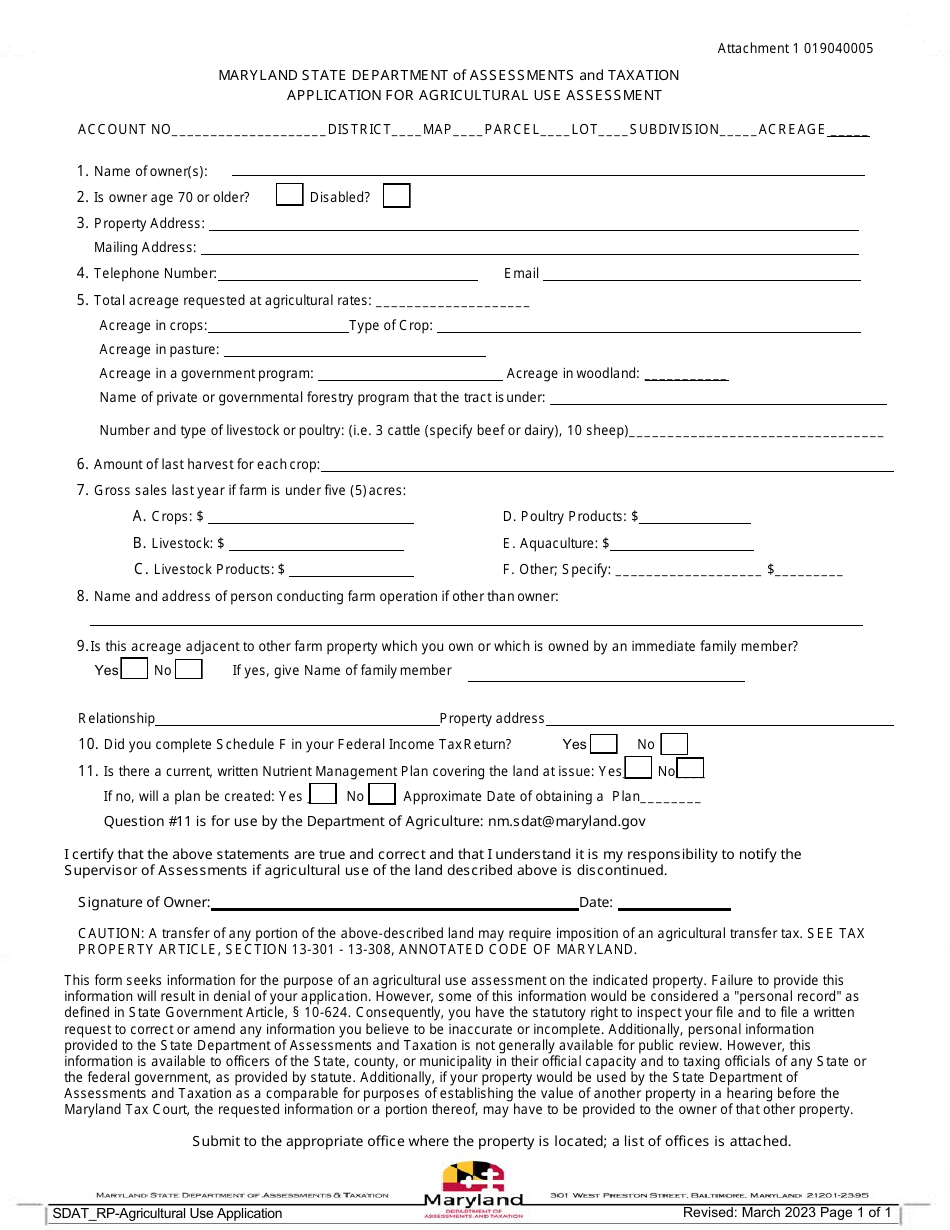

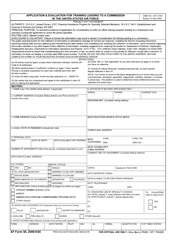

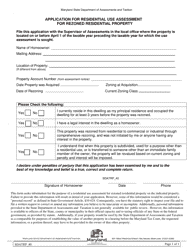

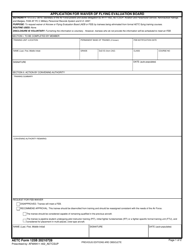

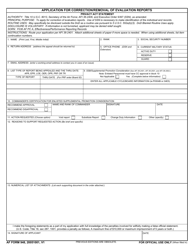

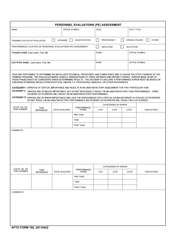

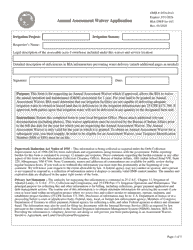

Attachment 1 Application for Agricultural Use Assessment - Maryland

What Is Attachment 1?

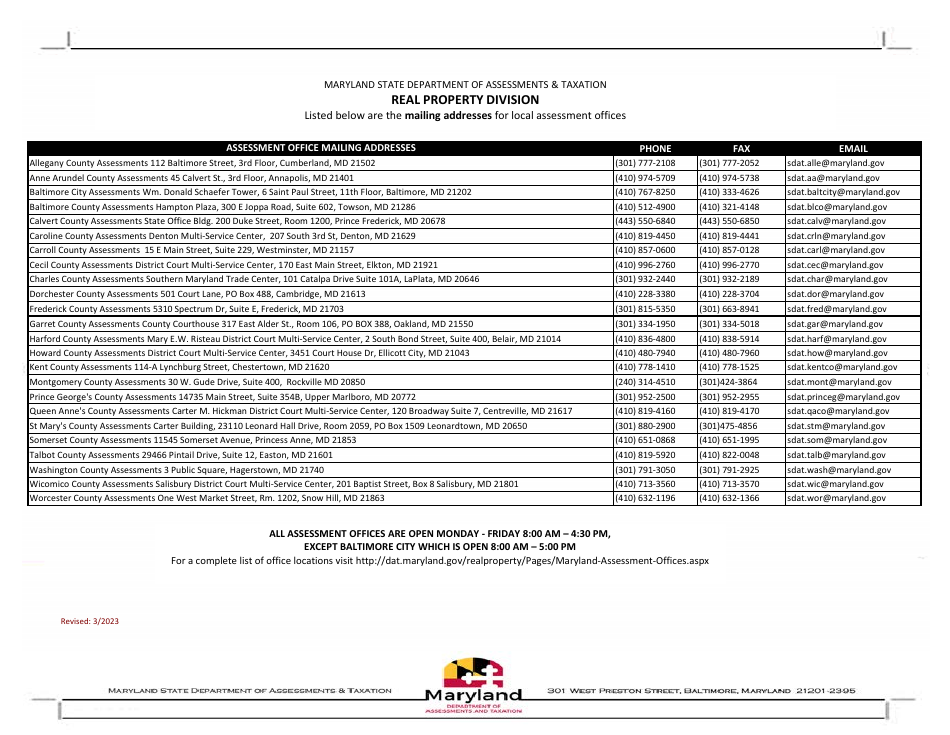

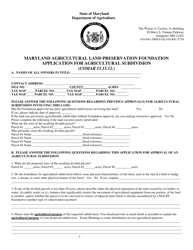

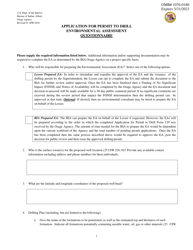

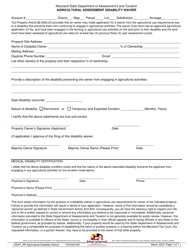

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an Agricultural Use Assessment?

A: An Agricultural Use Assessment is a program in Maryland that allows landowners to value their property at its agricultural use rather than its fair market value.

Q: Who qualifies for Agricultural Use Assessment?

A: To qualify, the land must be actively used for agricultural purposes, meet minimum acreage requirements, and generate a certain amount of income from agricultural activities.

Q: How can I apply for Agricultural Use Assessment in Maryland?

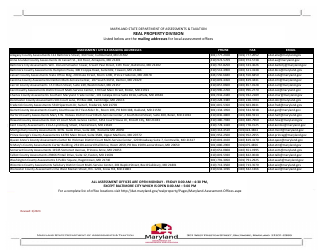

A: You can apply for Agricultural Use Assessment by submitting the Application for Agricultural Use Assessment to the Maryland Department of Assessments and Taxation.

Q: What are the benefits of Agricultural Use Assessment?

A: The benefits of Agricultural Use Assessment include lower property taxes, protection against residential development, and access to certain agricultural programs and incentives.

Q: Are there any obligations or requirements for landowners under Agricultural Use Assessment?

A: Yes, landowners must follow certain rules and obligations, such as maintaining the agricultural use of the land and providing annual income reports.

Q: Can I appeal if my application for Agricultural Use Assessment is denied?

A: Yes, you can appeal a denial by submitting an appeal to the Maryland Department of Assessments and Taxation within 45 days of the denial letter.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Attachment 1 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.