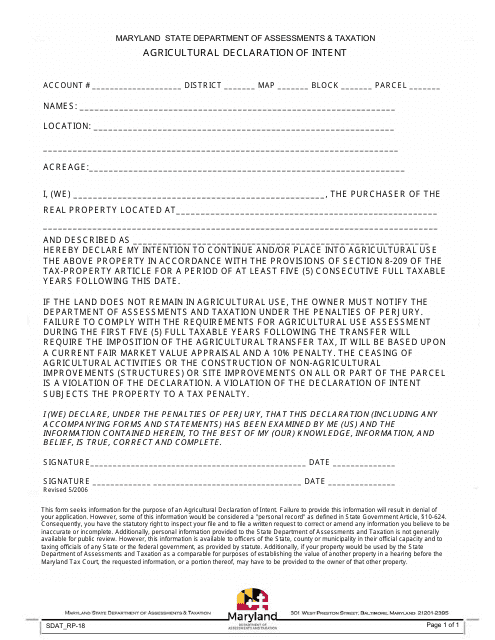

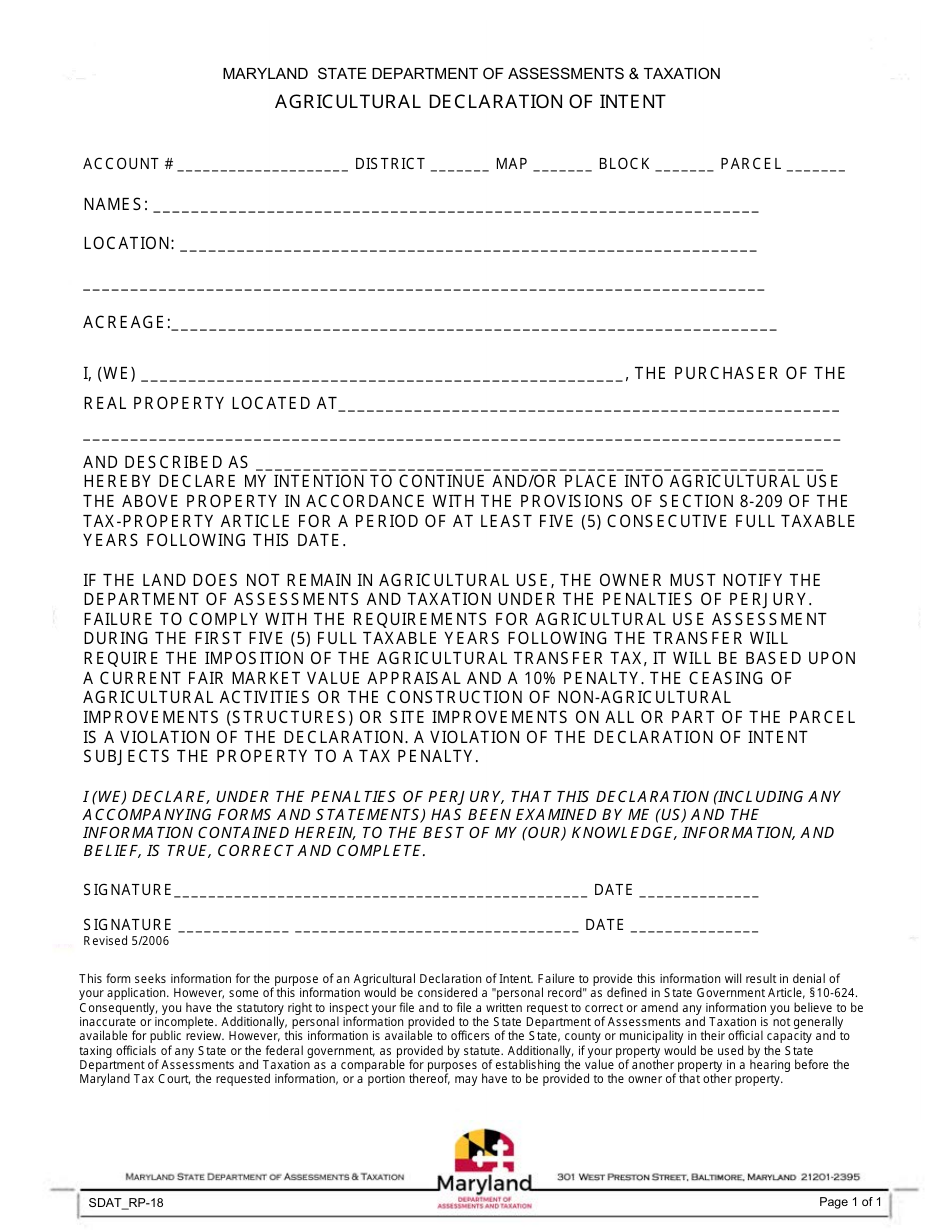

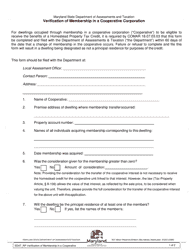

Form SDAT_RP-18 Agricultural Declaration of Intent - Maryland

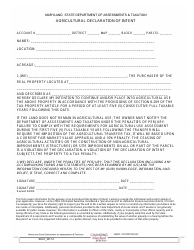

Form SDAT_RP-18, also known as the Agricultural Declaration of Intent, is a document used in the state of Maryland, USA. It allows landowners to declare their intent to use their land for agricultural purposes for at least the next five years. This declaration can provide certain tax benefits and supports the continuation of agricultural practices. However, if the landowner does not follow through with their intent and the land is not used for agricultural production, penalties can be applied.

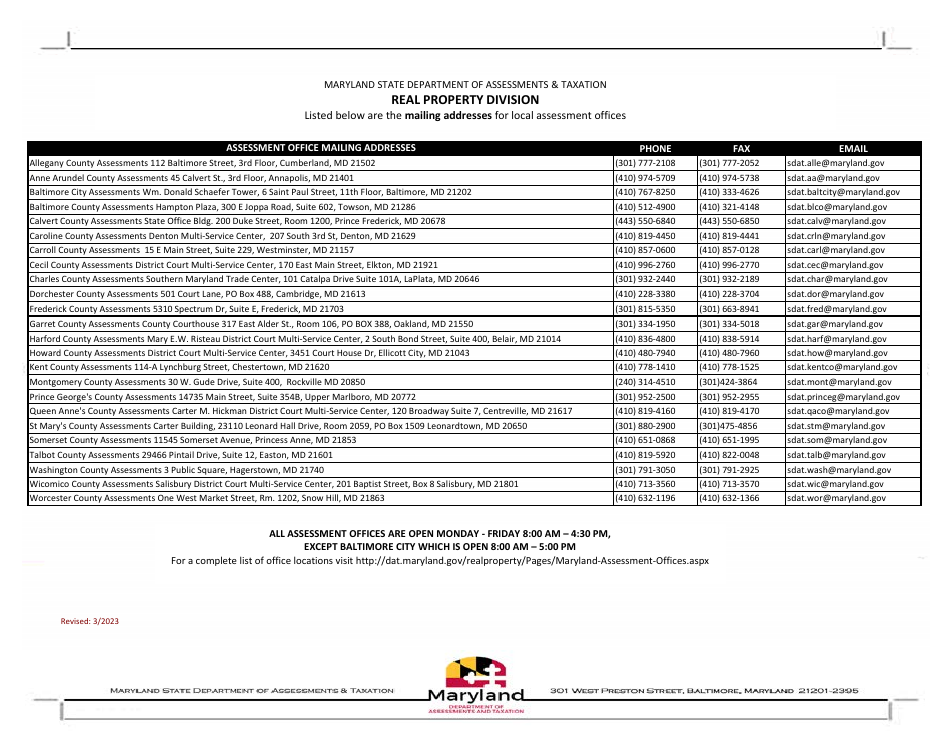

The Form SDAT_RP-18 Agricultural Declaration of Intent - Maryland is filed by landowners in Maryland, U.S. who have agricultural land use for their property, and wish to have their land appraised based on that use. This form is submitted to the Maryland Department of Assessments and Taxation. The purpose of this form is to declare intent to use land for agricultural purposes so as to benefit from the tax credit program available for such uses.

FAQ

Q: What is the SDAT_RP-18 Agricultural Declaration of Intent?

A: SDAT_RP-18 Agricultural Declaration of Intent is a Maryland legal document used by landowner(s) to declare their intention to keep their property under farm or agricultural use, provided certain conditions are met.

Q: Why is the SDAT_RP-18 Agricultural Declaration of Intent necessary?

A: The declaration of intent is necessary as it allows landowners to qualify their lands for the Maryland Agricultural Land Preservation Foundation program. This program provides tax benefits to landowners who commit to keeping their land for farming or agricultural purposes.

Q: How to file the SDAT_RP-18 Agricultural Declaration of Intent?

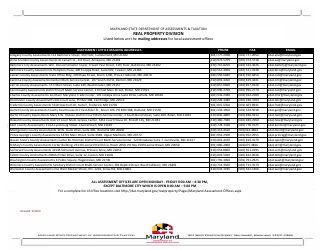

A: The SDAT_RP-18 form should be filled in completely and accurately, signed by all landowners, and submitted to the local assessment office along with any supporting documentation as required.

Q: What are the eligibility criteria to file the SDAT_RP-18 Agricultural Declaration of Intent?

A: The property owner must be an active farmer or the property should be actively farmed. The property must have produced $2,500 or more of gross agricultural income in the last three years, or the landowner must anticipate it will generate this amount in the near future.

Q: What happens if the property no longer meets the requirements for the agricultural use under the SDAT_RP-18 declaration?

A: If a property no longer qualifies for agricultural use, the owner could face penalties and be liable to pay the difference between the agricultural and the residential tax rate for the last five years, plus interest. The property might also become ineligible for the agricultural land preservation program.