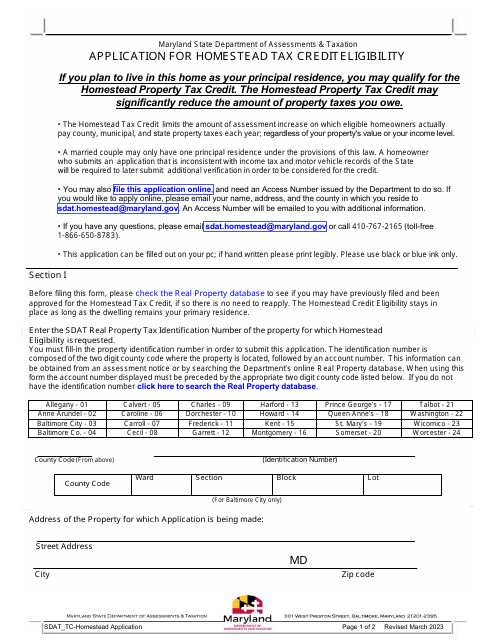

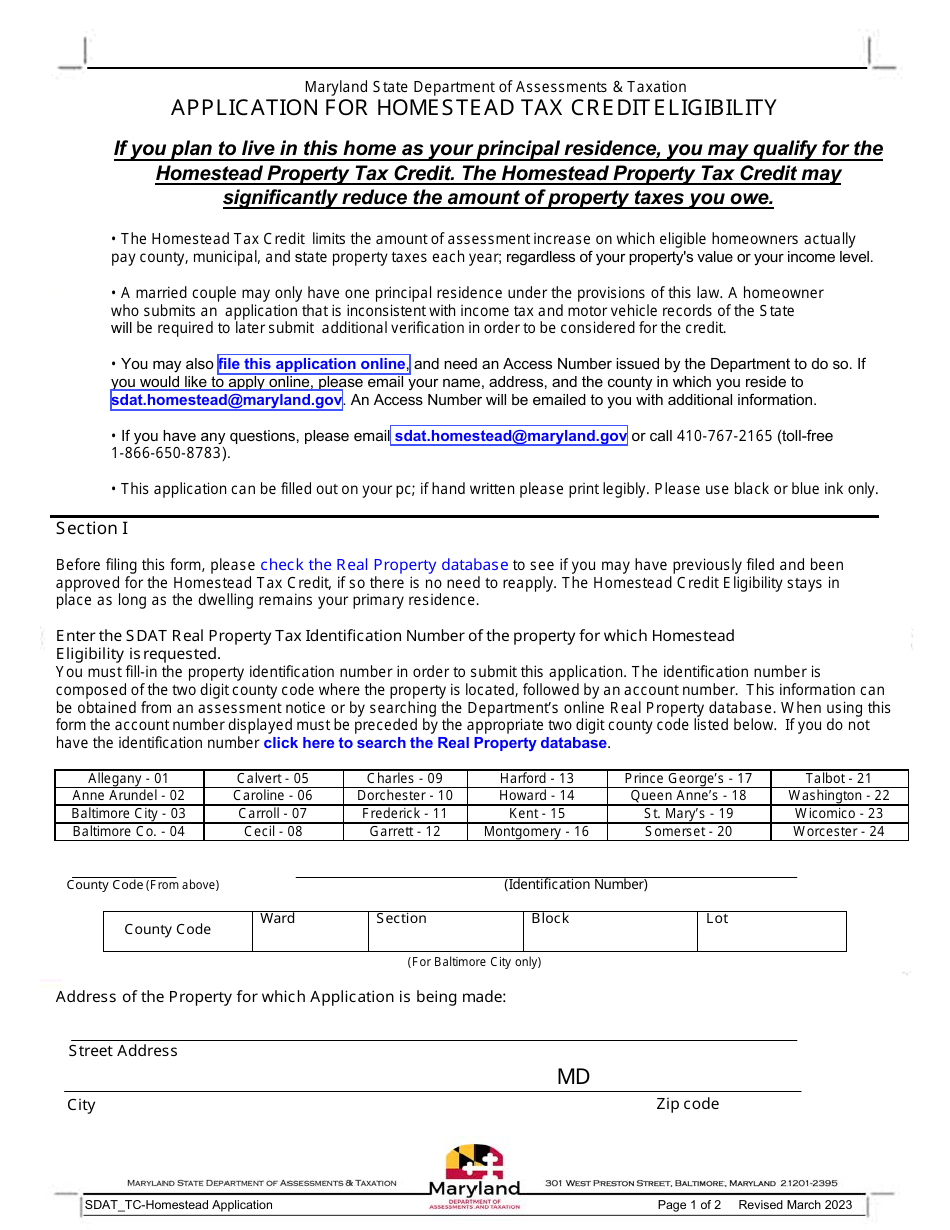

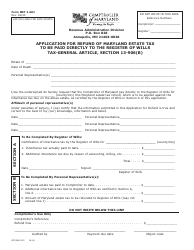

Application for Homestead Tax Crediteligibility - Maryland

Application for Homestead Tax Crediteligibility is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

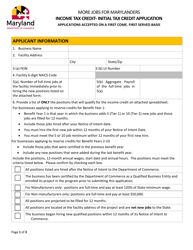

Q: What is the Homestead Tax Credit?

A: The Homestead Tax Credit is a program in Maryland that provides property tax relief to eligible homeowners.

Q: Who is eligible for the Homestead Tax Credit?

A: Maryland homeowners who live in their property as their primary residence are eligible for the Homestead Tax Credit.

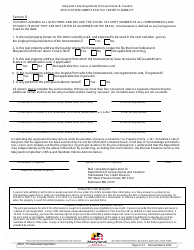

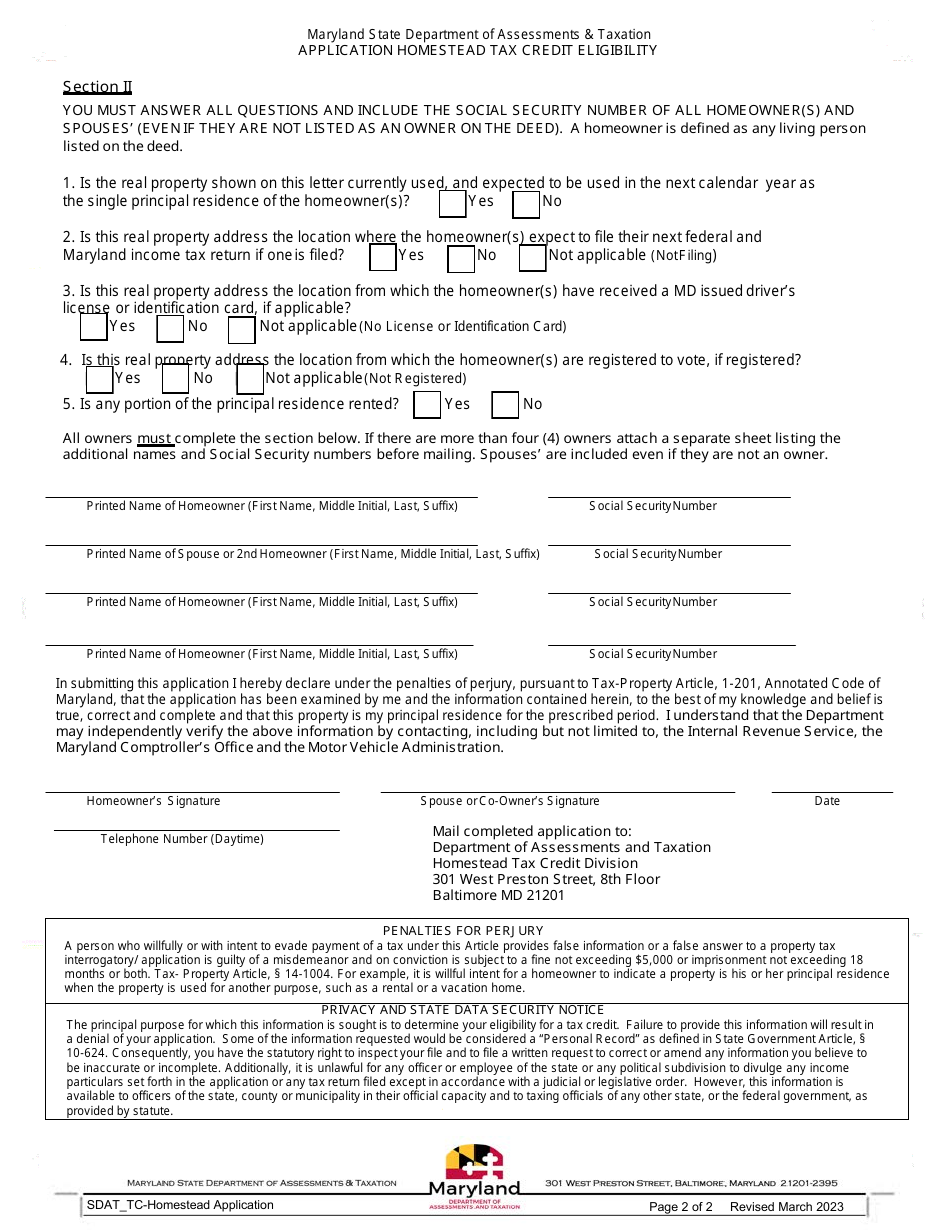

Q: How do I apply for the Homestead Tax Credit?

A: To apply for the Homestead Tax Credit in Maryland, you need to complete and submit the Application for Homestead Tax Credit Eligibility form to your local Department of Assessments and Taxation office.

Q: What is the deadline to apply for the Homestead Tax Credit?

A: The deadline to apply for the Homestead Tax Credit in Maryland is usually December 31st of the year in which you purchase or begin occupying the property.

Q: What benefits does the Homestead Tax Credit provide?

A: The Homestead Tax Credit limits the increase in assessed value of your property for tax purposes, which can result in lower property tax bills.

Q: Can I transfer the Homestead Tax Credit to another property?

A: No, the Homestead Tax Credit is specific to the property that is your primary residence.

Q: Do I need to reapply for the Homestead Tax Credit every year?

A: No, once you're approved for the Homestead Tax Credit and meet the eligibility requirements, you do not need to reapply annually. However, it's important to notify the Department of Assessments and Taxation if your primary residence changes.

Q: Are there income limits to qualify for the Homestead Tax Credit?

A: No, there are no income limits to qualify for the Homestead Tax Credit in Maryland.

Q: Are there any other property tax credits available in Maryland?

A: Yes, in addition to the Homestead Tax Credit, there are other property tax credits available in Maryland for eligible homeowners, such as the Senior Tax Credit and the Veterans Tax Credit.

Form Details:

- Released on March 1, 2023;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.