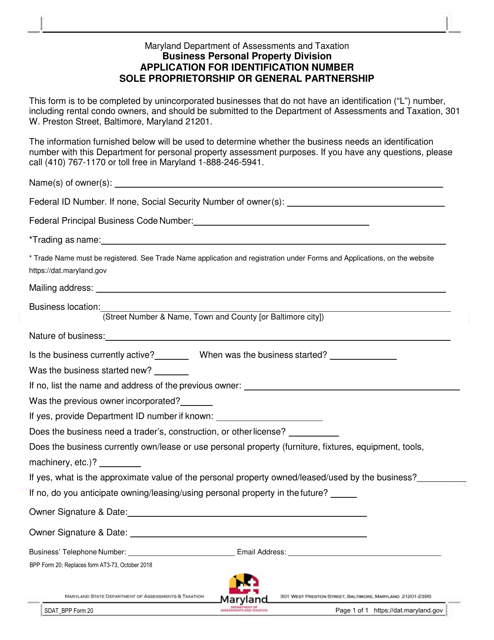

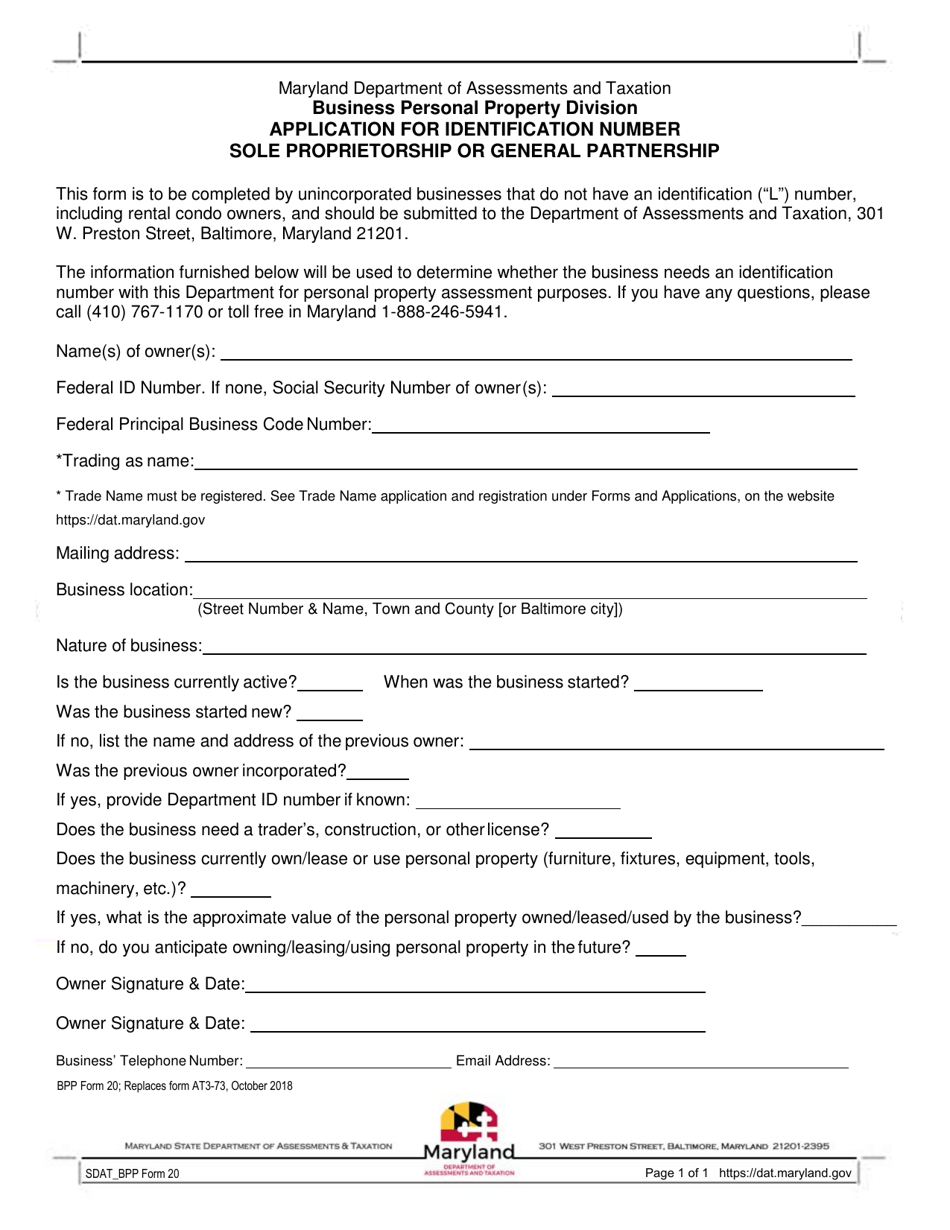

BPP Form 20 Application for Identification Number Sole Proprietorship or General Partnership - Maryland

What Is BPP Form 20?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BPP Form 20?

A: BPP Form 20 is an application for an identification number for a sole proprietorship or general partnership in Maryland.

Q: Who needs to fill out BPP Form 20?

A: Anyone who is starting a sole proprietorship or general partnership in Maryland needs to fill out BPP Form 20.

Q: What is the purpose of BPP Form 20?

A: The purpose of BPP Form 20 is to obtain an identification number for taxation purposes for a sole proprietorship or general partnership in Maryland.

Q: Is there a fee associated with BPP Form 20?

A: No, there is no fee associated with filing BPP Form 20.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of BPP Form 20 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.