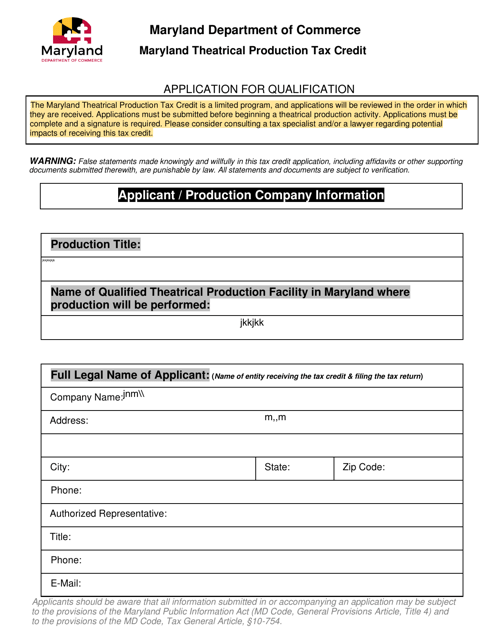

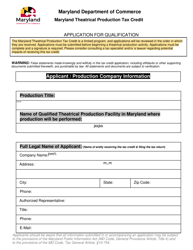

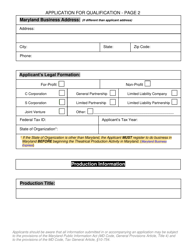

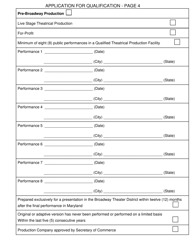

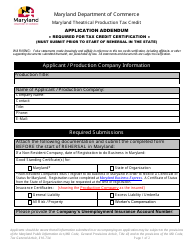

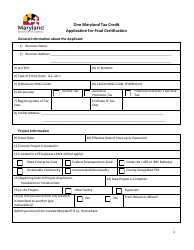

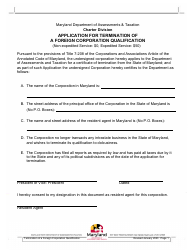

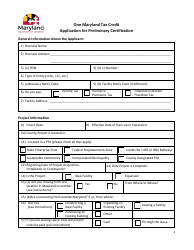

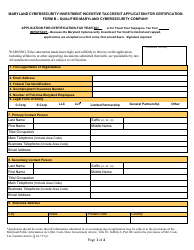

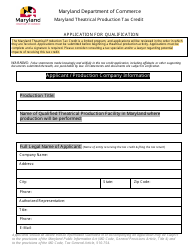

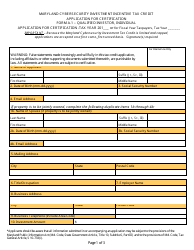

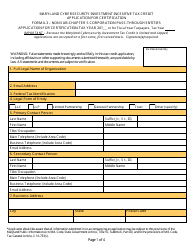

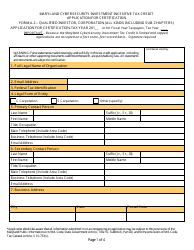

Application for Qualification - Maryland Theatrical Production Tax Credit - Maryland

Application for Qualification - Maryland Theatrical Production Tax Credit is a legal document that was released by the Maryland Department of Commerce - a government authority operating within Maryland.

FAQ

Q: What is the Maryland Theatrical Production Tax Credit?

A: The Maryland Theatrical Production Tax Credit is a tax incentive program in Maryland that provides financial incentives to qualifying theatrical productions.

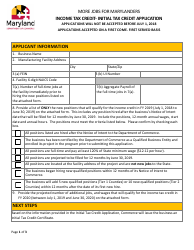

Q: Who is eligible to apply for the Maryland Theatrical Production Tax Credit?

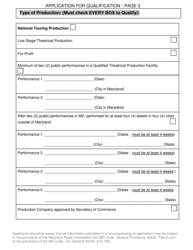

A: Qualifying theatrical productions, including live performances, touring productions, and recorded performances, are eligible to apply.

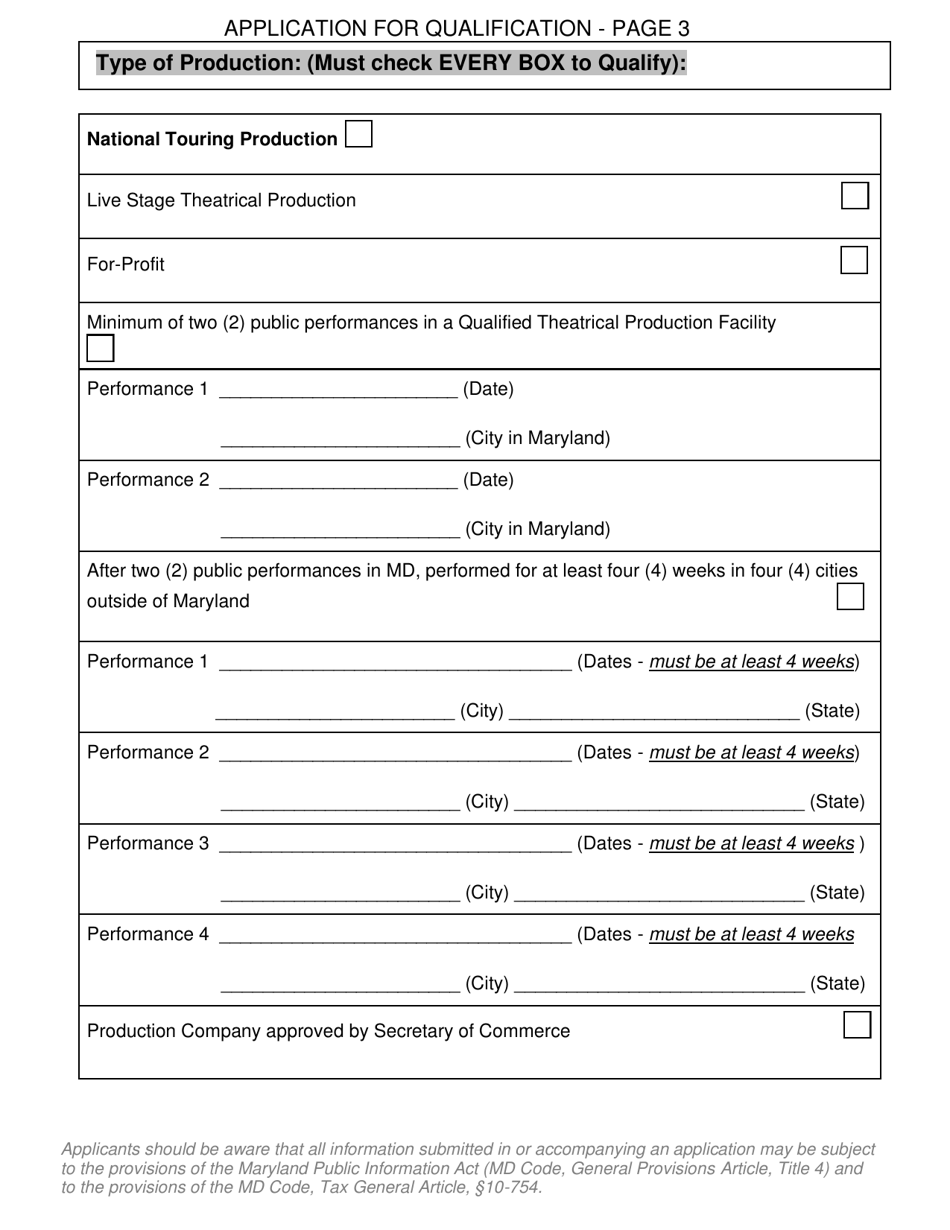

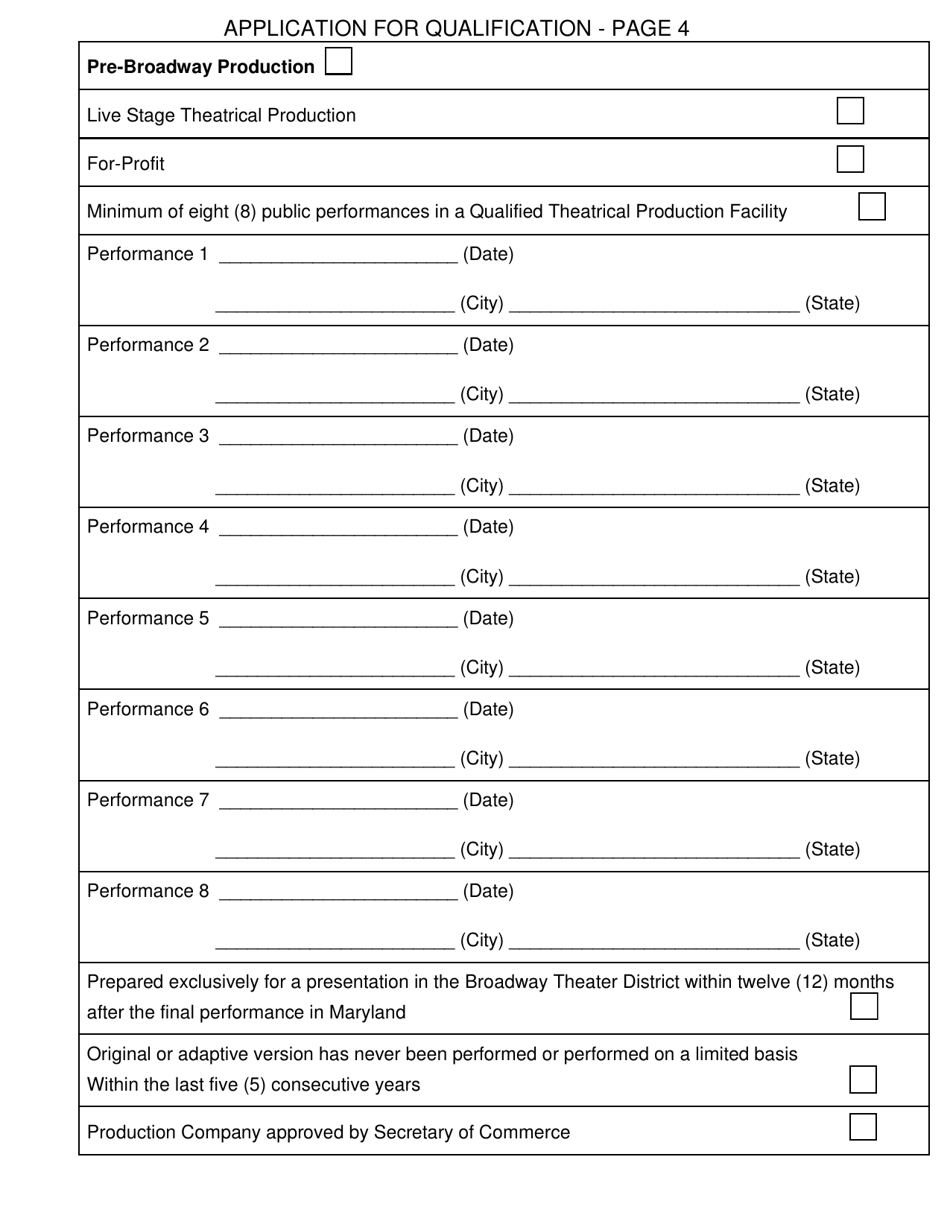

Q: What types of productions are eligible for the tax credit?

A: Live performances, touring productions, and recorded performances that meet the criteria outlined by the Maryland Department of Commerce are eligible for the tax credit.

Q: What are the benefits of the Maryland Theatrical Production Tax Credit?

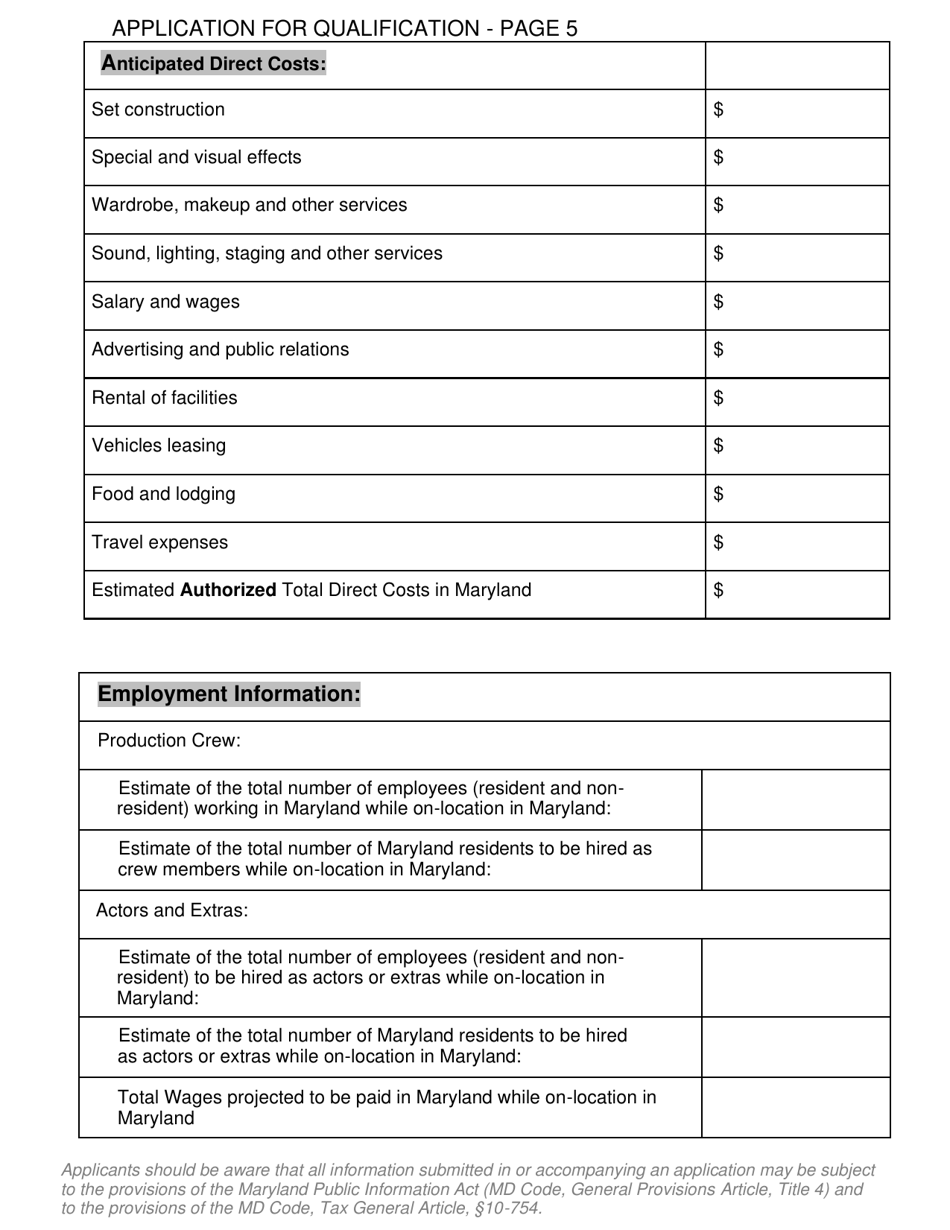

A: The tax credit provides financial incentives to qualifying productions, including a refundable tax credit based on qualified expenses incurred in Maryland.

Q: How can I apply for the Maryland Theatrical Production Tax Credit?

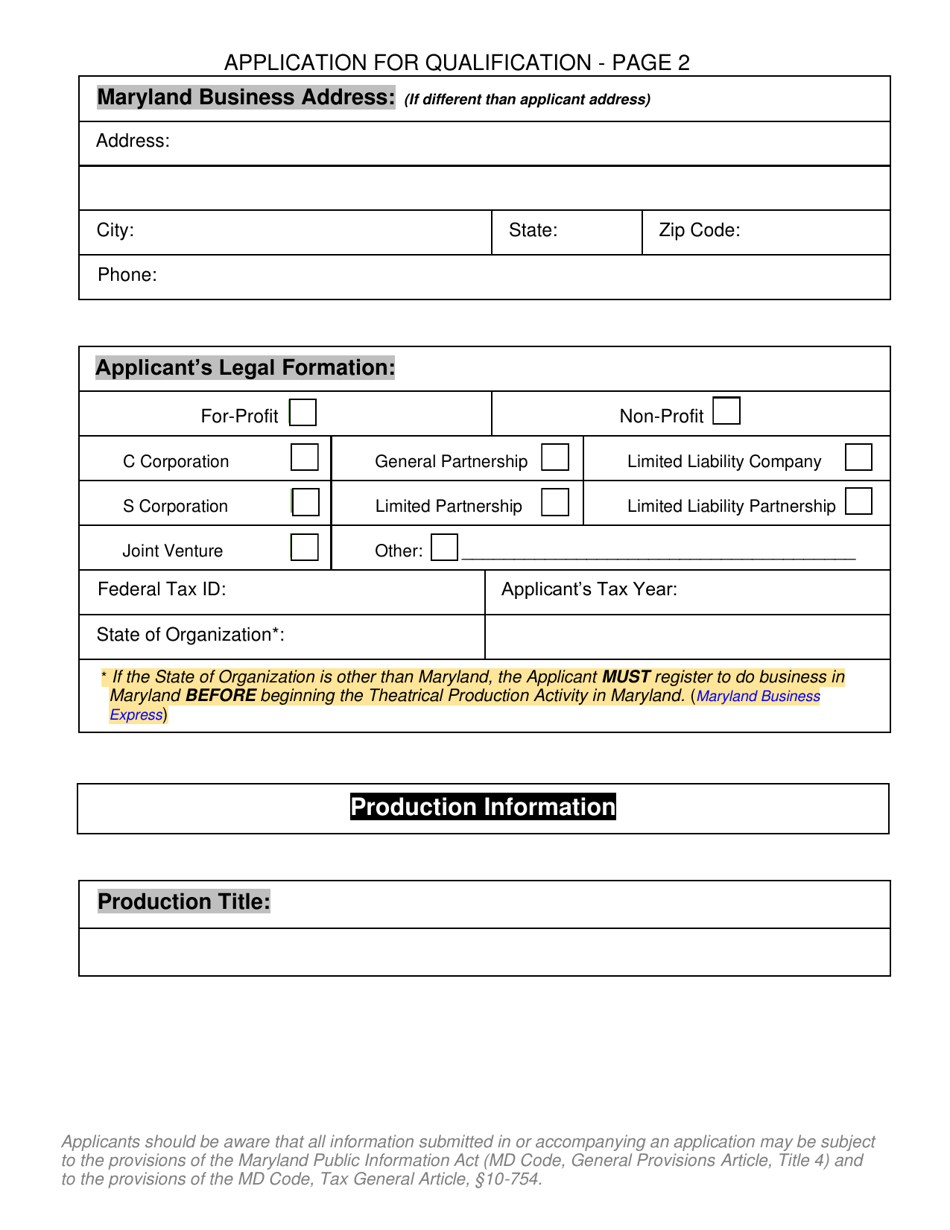

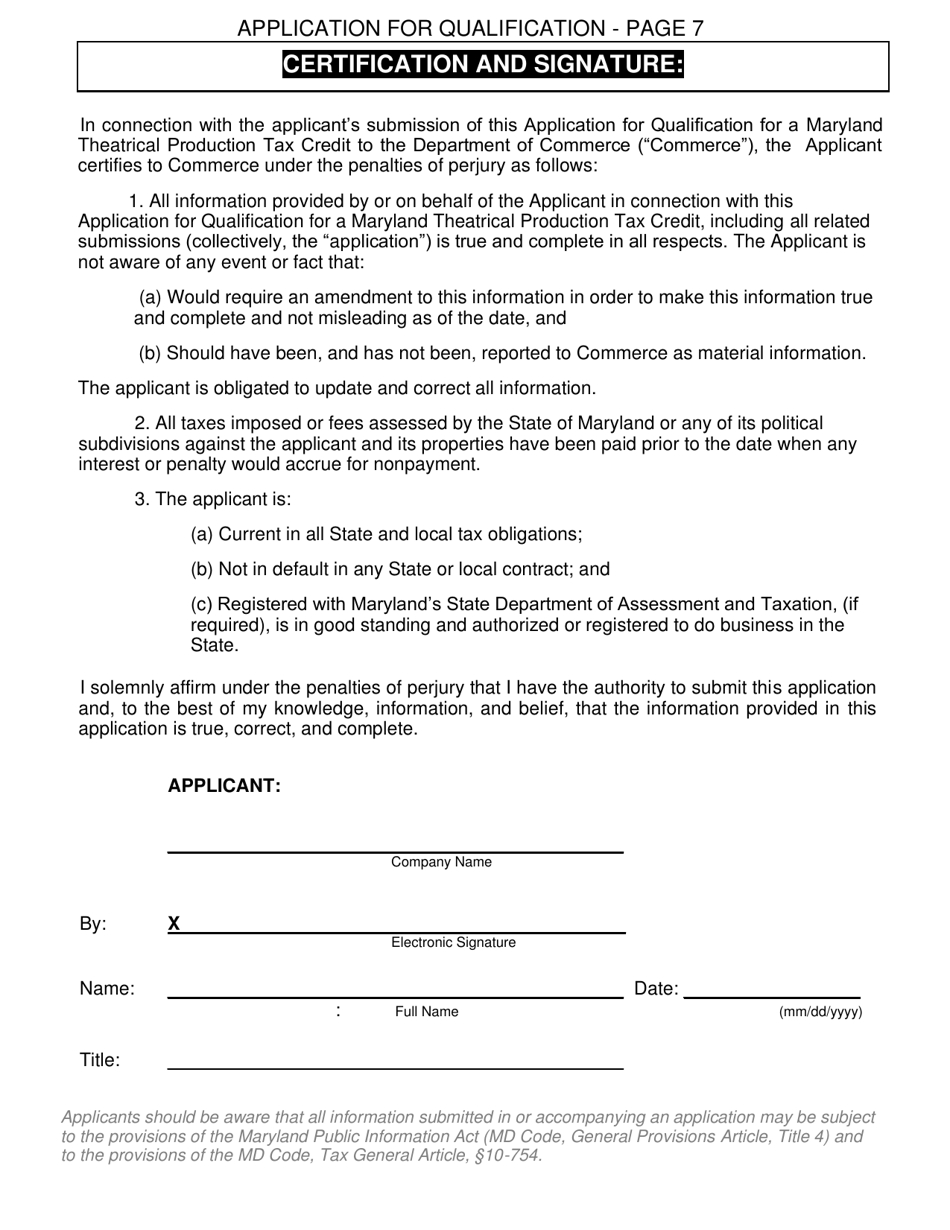

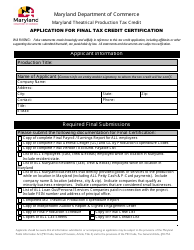

A: You can apply for the tax credit by submitting an application to the Maryland Department of Commerce. The application must include all required documentation and meet the eligibility criteria.

Q: Are there any deadlines for applying for the Maryland Theatrical Production Tax Credit?

A: Yes, there are specific deadlines for applying for the tax credit. It is important to consult the Maryland Department of Commerce for the current application deadlines.

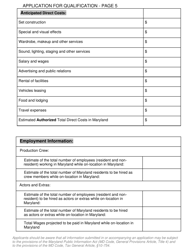

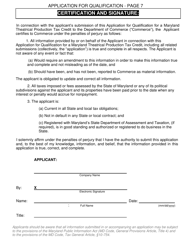

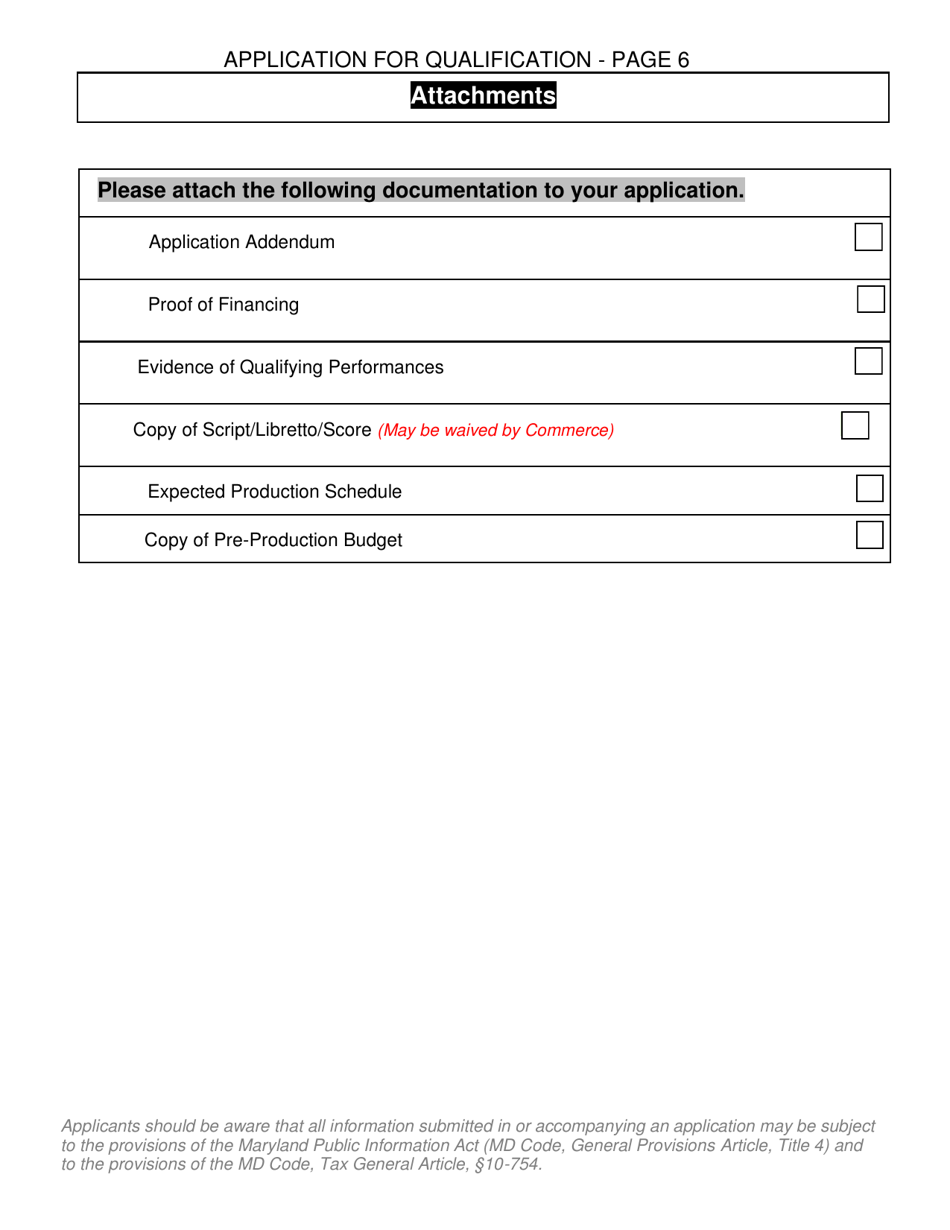

Q: What documentation is required for the application?

A: The application requires documentation such as a detailed budget, proof of expenses, documentation of Maryland-based activities, and other supporting materials as outlined by the Maryland Department of Commerce.

Q: Can the tax credit be transferred or sold?

A: Yes, the tax credit can be transferred or sold to another individual or entity with approval from the Maryland Department of Commerce.

Q: Is there a limit to the amount of tax credit that can be received?

A: Yes, there is a limit to the amount of tax credit that can be received per production. The limit is outlined by the Maryland Department of Commerce and may vary each year.

Form Details:

- The latest edition currently provided by the Maryland Department of Commerce;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Commerce.