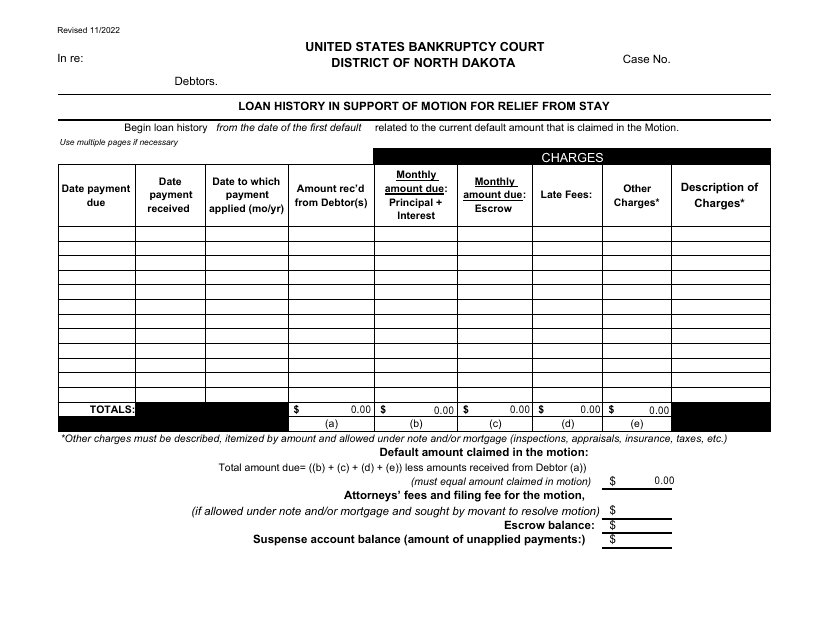

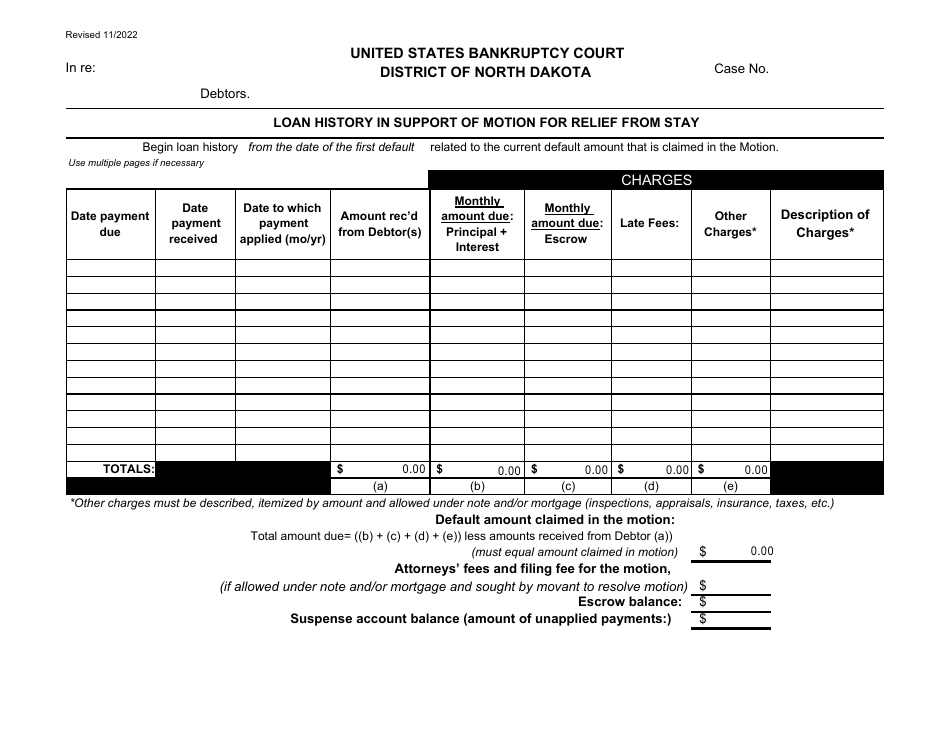

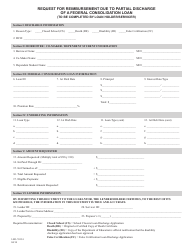

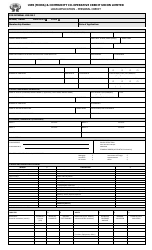

Loan History in Support of Motion for Relief From Stay - North Dakota

Loan History in Support of Motion for Relief From Stay is a legal document that was released by the United States Bankruptcy Court for the District of North Dakota - a government authority operating within North Dakota.

FAQ

Q: What is a Motion for Relief From Stay?

A: A Motion for Relief From Stay is a legal request made by a creditor to the court to lift the protection that prevents them from taking certain actions, such as foreclosing on a property or repossessing a vehicle, during a bankruptcy case.

Q: What is the purpose of a Motion for Relief From Stay?

A: The purpose of a Motion for Relief From Stay is to allow a creditor to continue or resume their collection efforts against a debtor's property that is subject to the automatic stay in bankruptcy.

Q: What is the automatic stay in bankruptcy?

A: The automatic stay is a legal protection that goes into effect when a person or business files for bankruptcy. It immediately stops most creditors from pursuing collection actions, such as lawsuits, foreclosure, repossession, or wage garnishment.

Q: Why would a creditor file a Motion for Relief From Stay?

A: A creditor would file a Motion for Relief From Stay if they believe that they have a valid reason to continue their collection efforts despite the debtor's bankruptcy filing. This may be due to delinquency on loan payments or other contractual obligations.

Q: What is the role of the loan history in a Motion for Relief From Stay?

A: The loan history is a record of the borrower's payment and delinquency history regarding the loan in question. It helps the creditor demonstrate to the court that the debtor has not been fulfilling their payment obligations, thus justifying the need for relief from the automatic stay.

Q: How does the loan history support a Motion for Relief From Stay?

A: The loan history provides evidence to the court that the debtor has a pattern of failing to make timely payments or defaulting on the loan. This information strengthens the creditor's argument that the automatic stay should be lifted, allowing them to resume their collection efforts.

Q: What happens after a creditor files a Motion for Relief From Stay?

A: After a creditor files a Motion for Relief From Stay, the debtor has an opportunity to respond and present their own arguments to the court. The court will then review the motion and any responses before making a decision on whether to grant or deny the motion.

Q: What are the possible outcomes of a Motion for Relief From Stay?

A: The possible outcomes of a Motion for Relief From Stay include the court granting the motion, allowing the creditor to proceed with collection actions, or denying the motion, thereby maintaining the automatic stay and continuing the protection for the debtor's assets.

Q: How can a debtor oppose a Motion for Relief From Stay?

A: A debtor can oppose a Motion for Relief From Stay by providing evidence or arguments to the court that demonstrate the creditor's case is unfounded or that lifting the stay would harm the debtor's ability to successfully complete their bankruptcy case.

Q: Do debtors need legal representation to respond to a Motion for Relief From Stay?

A: Although it is not required, it is highly advisable for debtors to seek legal representation when responding to a Motion for Relief From Stay. An attorney can help navigate the legal process, protect the debtor's rights, and present their case effectively to the court.

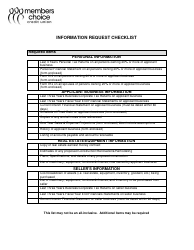

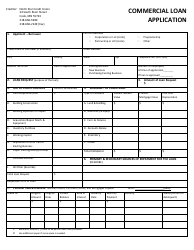

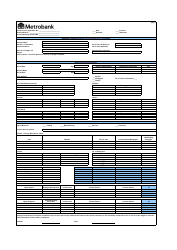

Form Details:

- Released on November 1, 2022;

- The latest edition currently provided by the United States Bankruptcy Court for the District of North Dakota;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court for the District of North Dakota.