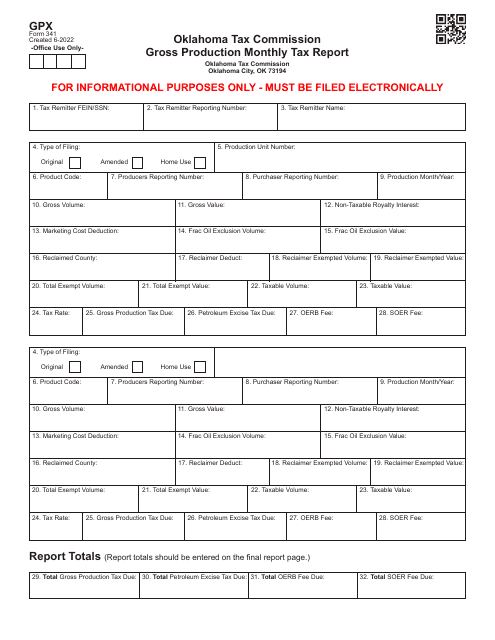

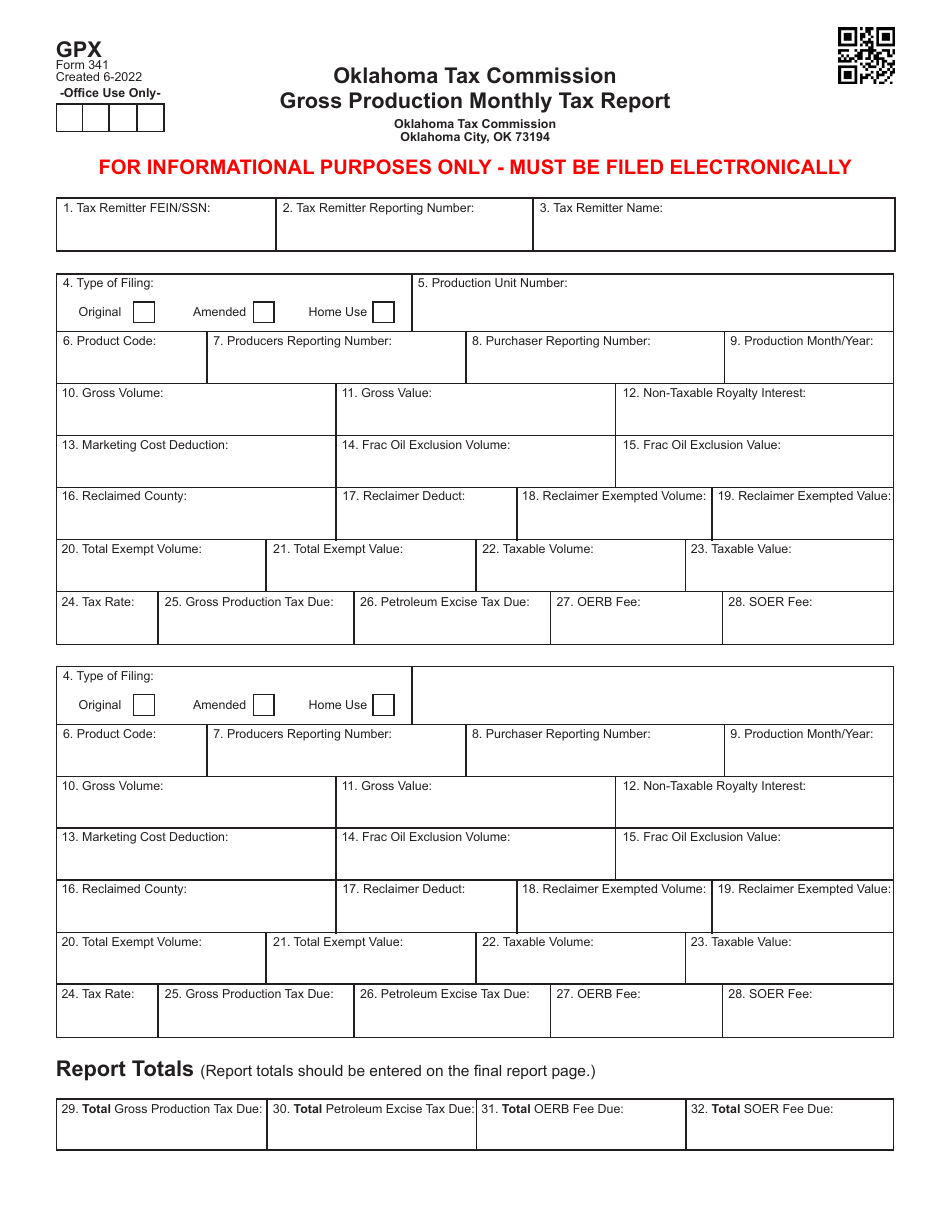

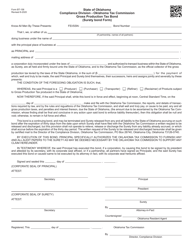

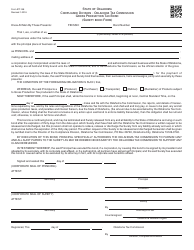

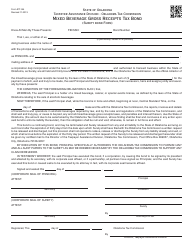

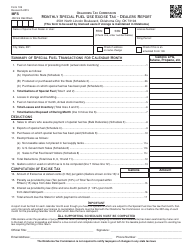

Form 341 Gross Production Monthly Tax Report - Oklahoma

What Is Form 341?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 341?

A: Form 341 is the Gross Production Monthly Tax Report specific to the state of Oklahoma.

Q: Who needs to file Form 341?

A: Operators of oil and gas wells in Oklahoma need to file Form 341.

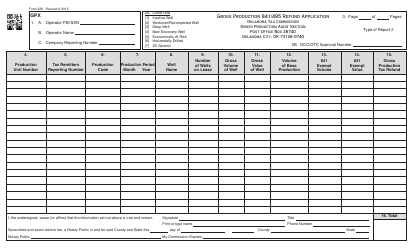

Q: What is the purpose of Form 341?

A: Form 341 is used to report and pay the monthly gross production tax on oil and gas produced in Oklahoma.

Q: How often should Form 341 be filed?

A: Form 341 should be filed monthly.

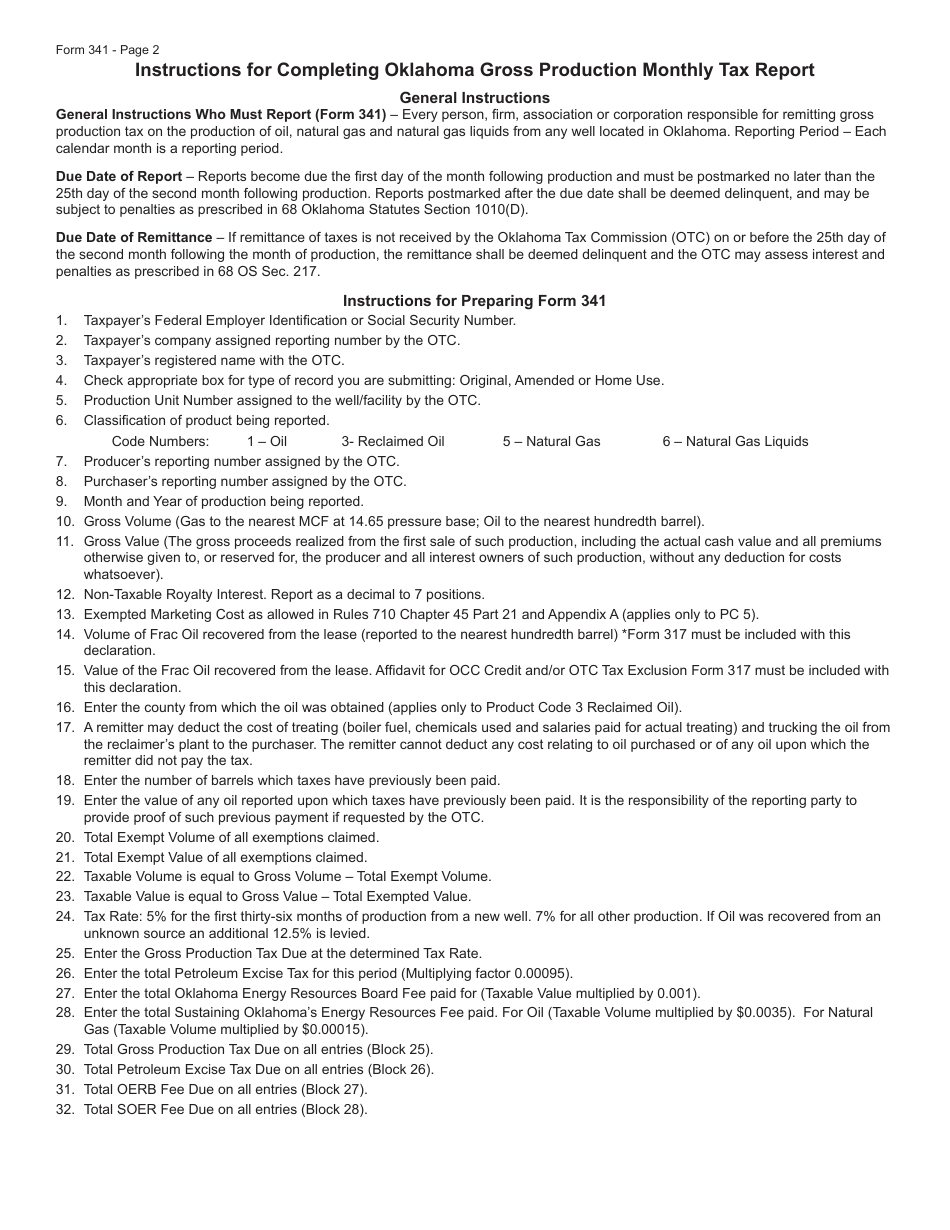

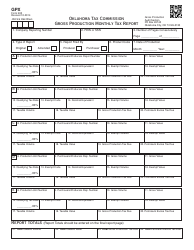

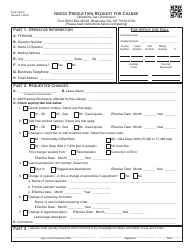

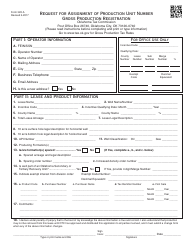

Q: What information is required on Form 341?

A: Form 341 requires information about the well(s) being reported, including production volumes and the applicable tax rates.

Q: Can Form 341 be filed electronically?

A: Yes, Form 341 can be filed electronically using the Oklahoma Taxpayer Access Point (OKTAP) system.

Q: Are there any penalties for late filing of Form 341?

A: Yes, there are penalties for late filing of Form 341, including interest charges and potential legal actions.

Q: Can I get an extension to file Form 341?

A: Yes, you can request an extension to file Form 341, but it must be done before the original due date of the report.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 341 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.