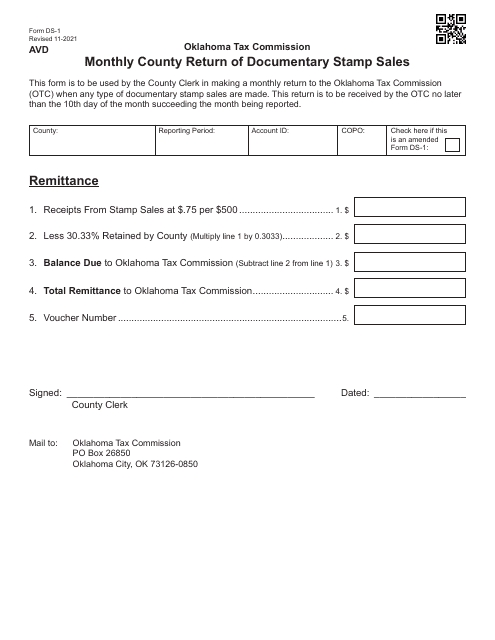

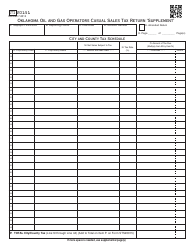

Form DS-1 Monthly County Return of Documentary Stamp Sales - Oklahoma

What Is Form DS-1?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DS-1?

A: Form DS-1 is the Monthly County Return of Documentary Stamp Sales in Oklahoma.

Q: What is the purpose of Form DS-1?

A: The purpose of Form DS-1 is to report and remit documentary stamp sales in Oklahoma.

Q: Who needs to file Form DS-1?

A: Any person or entity engaged in the sale or transfer of specified documents in Oklahoma needs to file Form DS-1.

Q: What are documentary stamp sales?

A: Documentary stamp sales are taxes on certain types of documents, such as deeds, mortgages, and contracts.

Q: When is Form DS-1 due?

A: Form DS-1 is due on or before the 20th day of each month following the month in which the sales occurred.

Q: Are there any penalties for late filing of Form DS-1?

A: Yes, there may be penalties for late filing or failure to file Form DS-1.

Q: How do I calculate the amount of documentary stamp sales?

A: The amount of documentary stamp sales is based on the consideration or value of the documents being sold or transferred.

Q: Are there any exemptions from documentary stamp sales?

A: Yes, there are certain exemptions from documentary stamp sales, such as transfers between spouses or transfers to governmental entities.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DS-1 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.