This version of the form is not currently in use and is provided for reference only. Download this version of

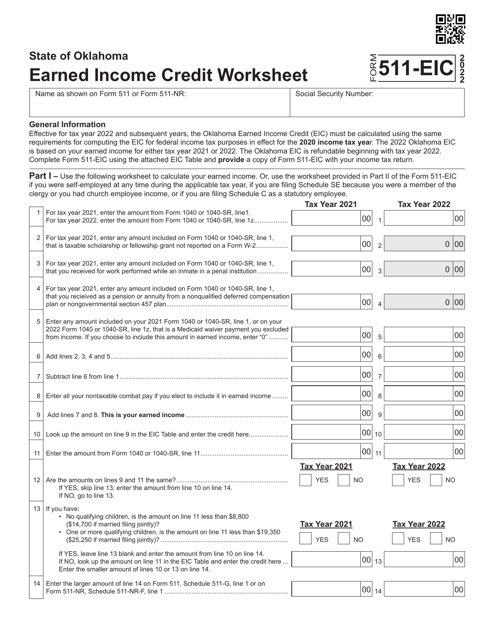

Form 511-EIC

for the current year.

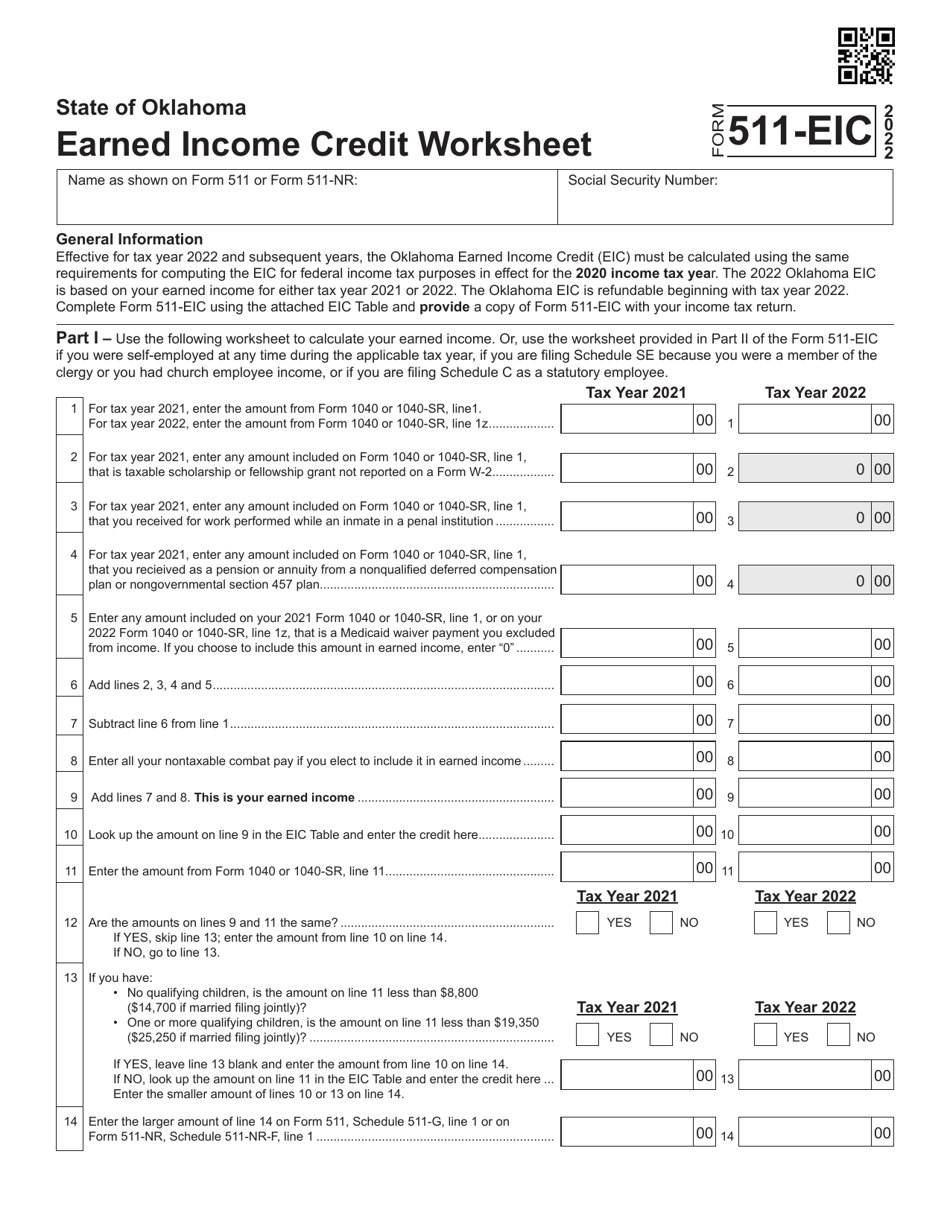

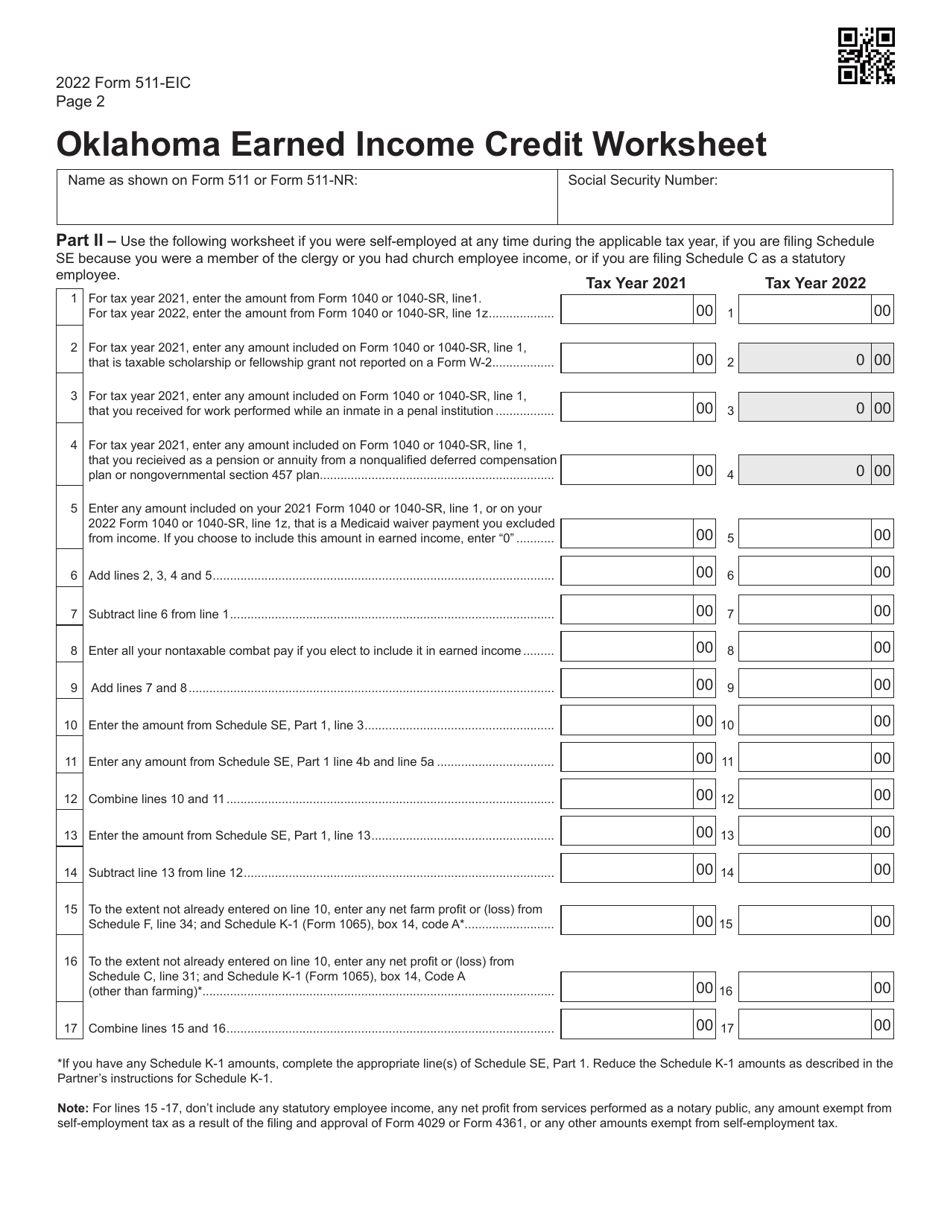

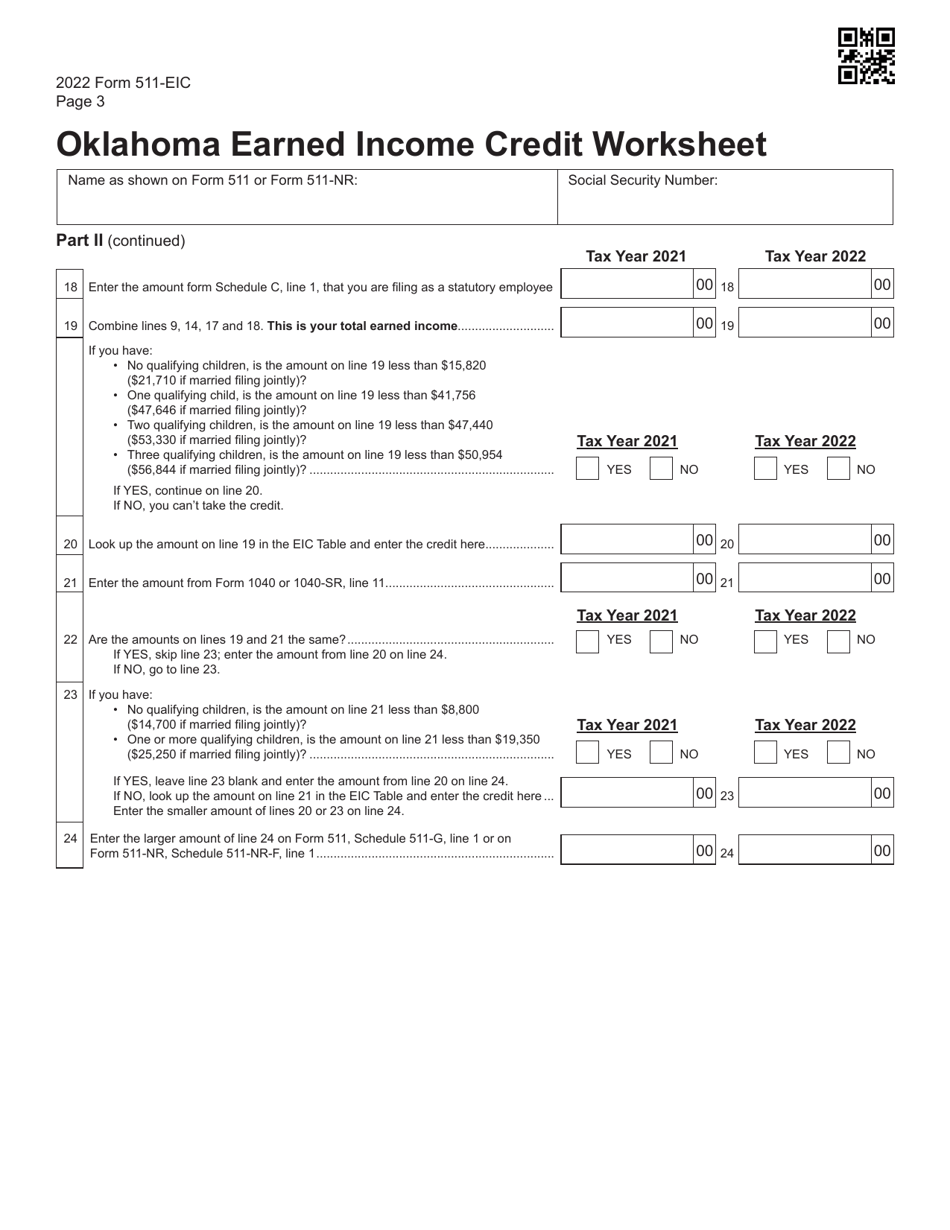

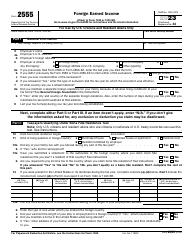

Form 511-EIC Earned Income Credit Worksheet - Oklahoma

What Is Form 511-EIC?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 511-EIC?

A: Form 511-EIC is the Earned Income Credit Worksheet for the state of Oklahoma.

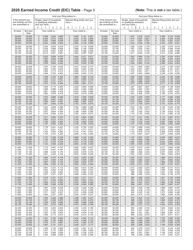

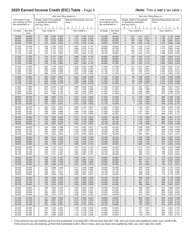

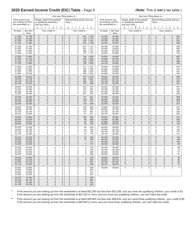

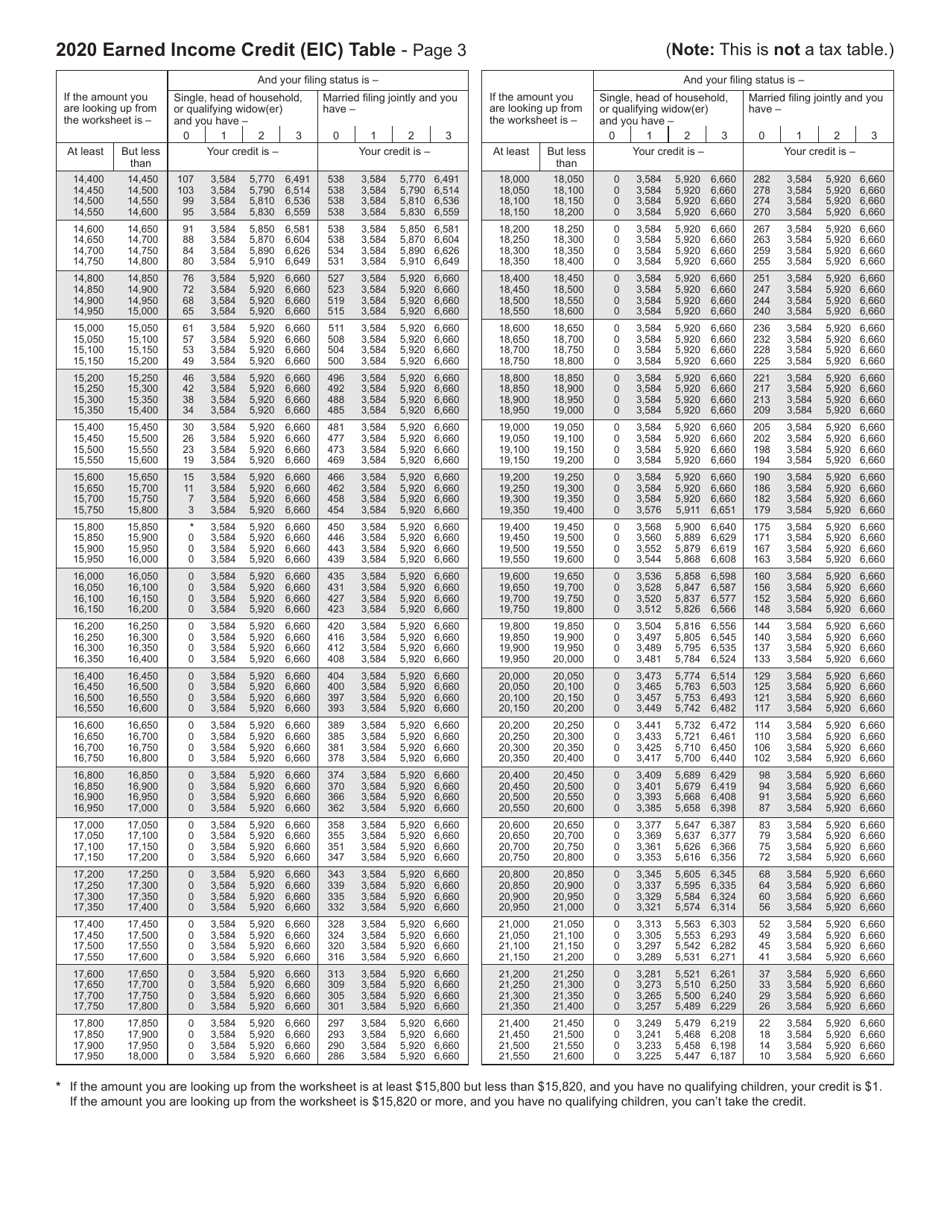

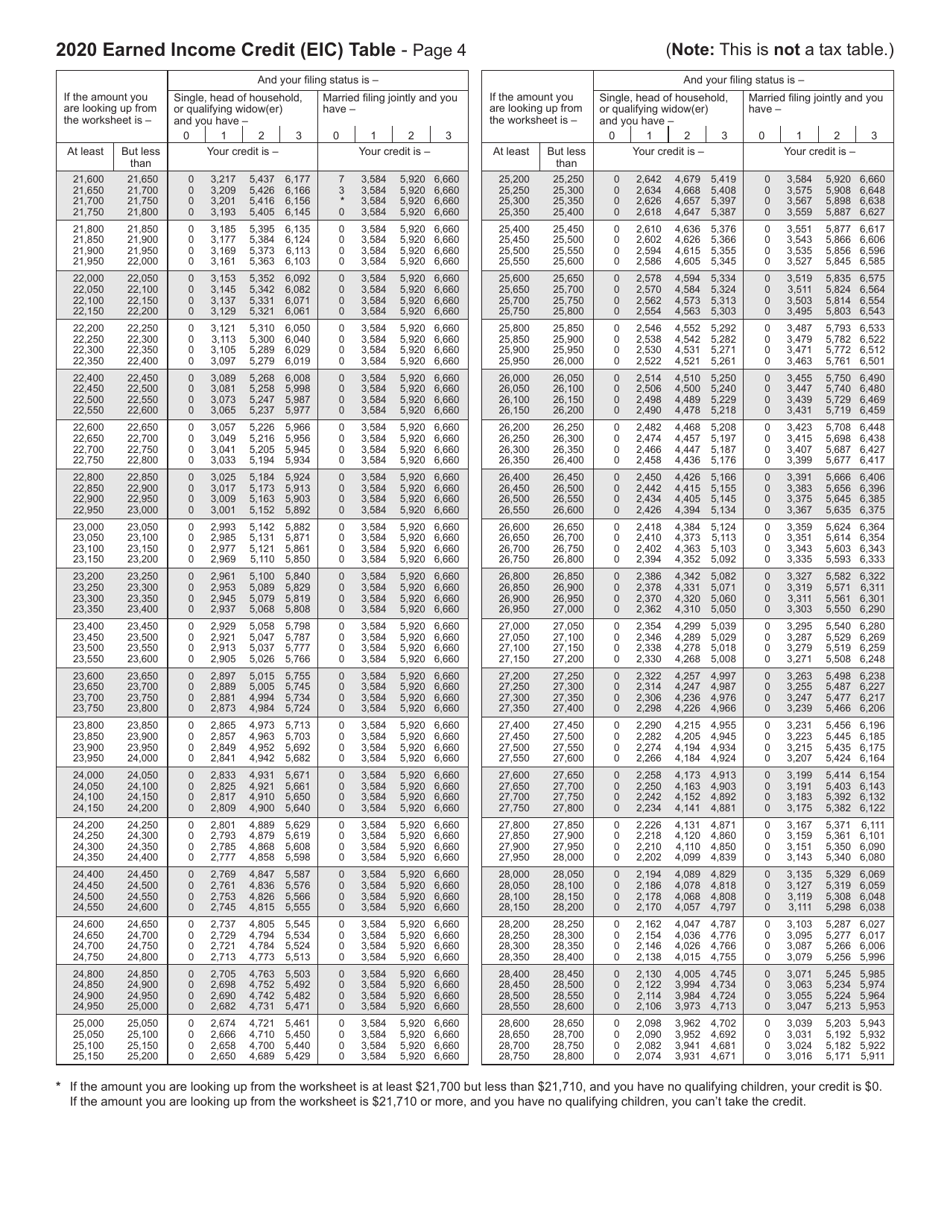

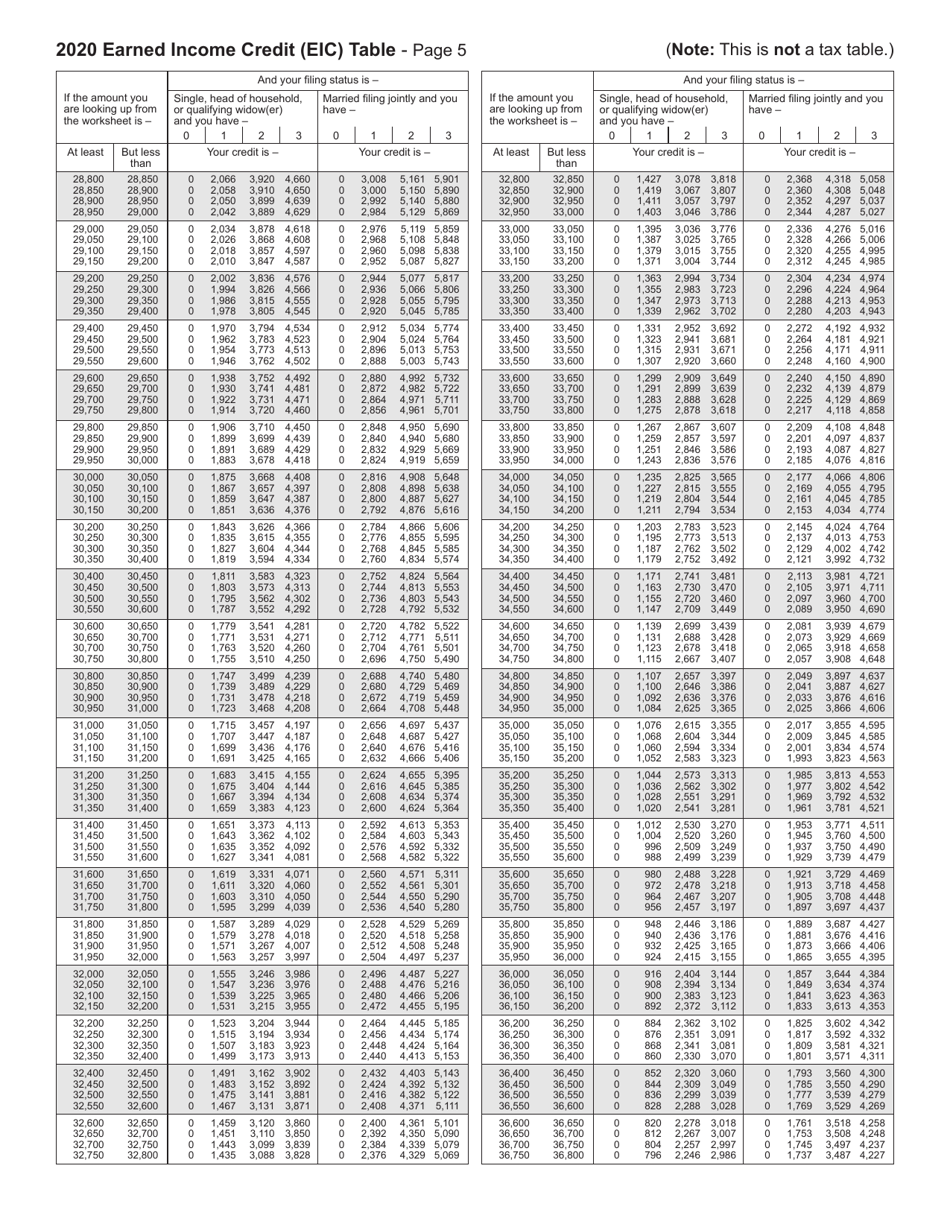

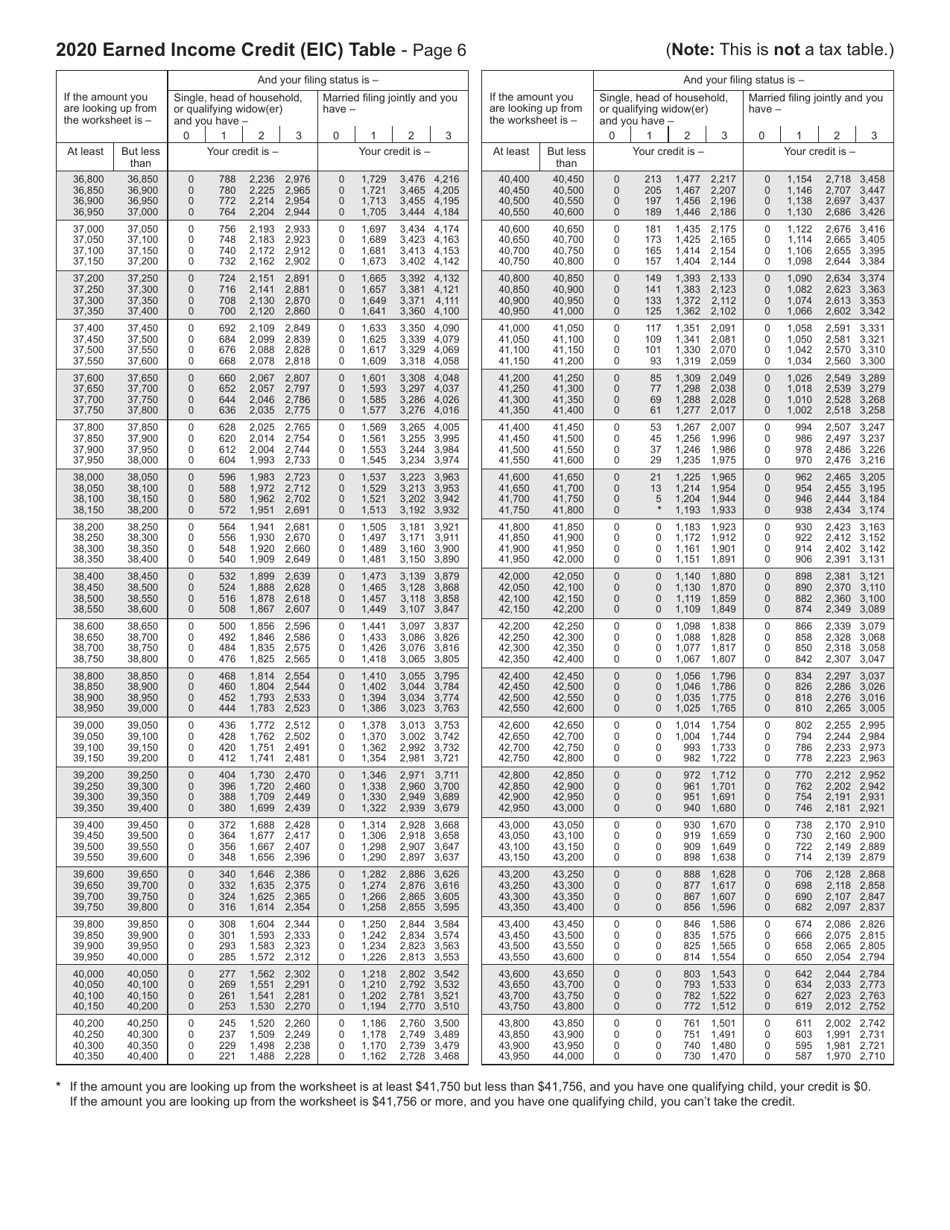

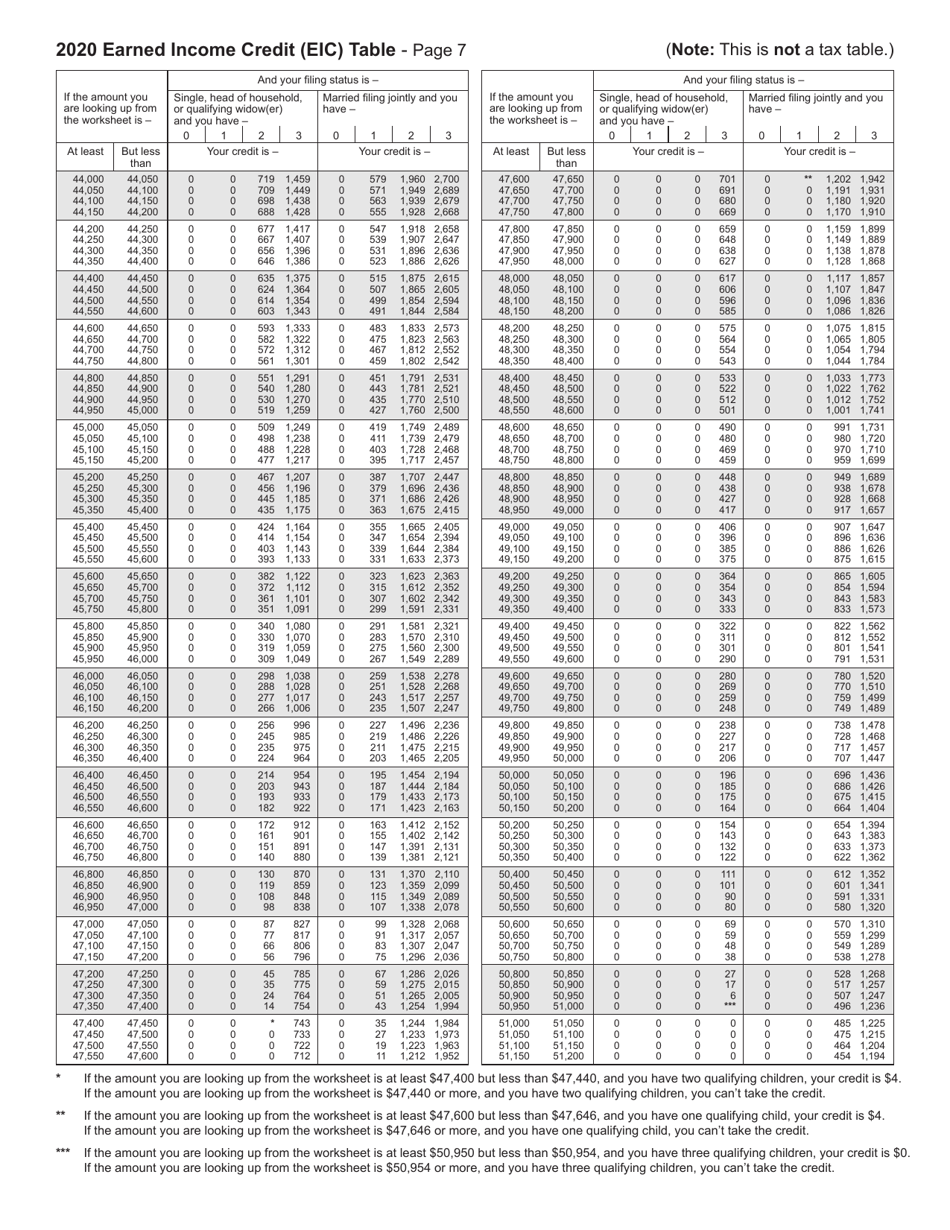

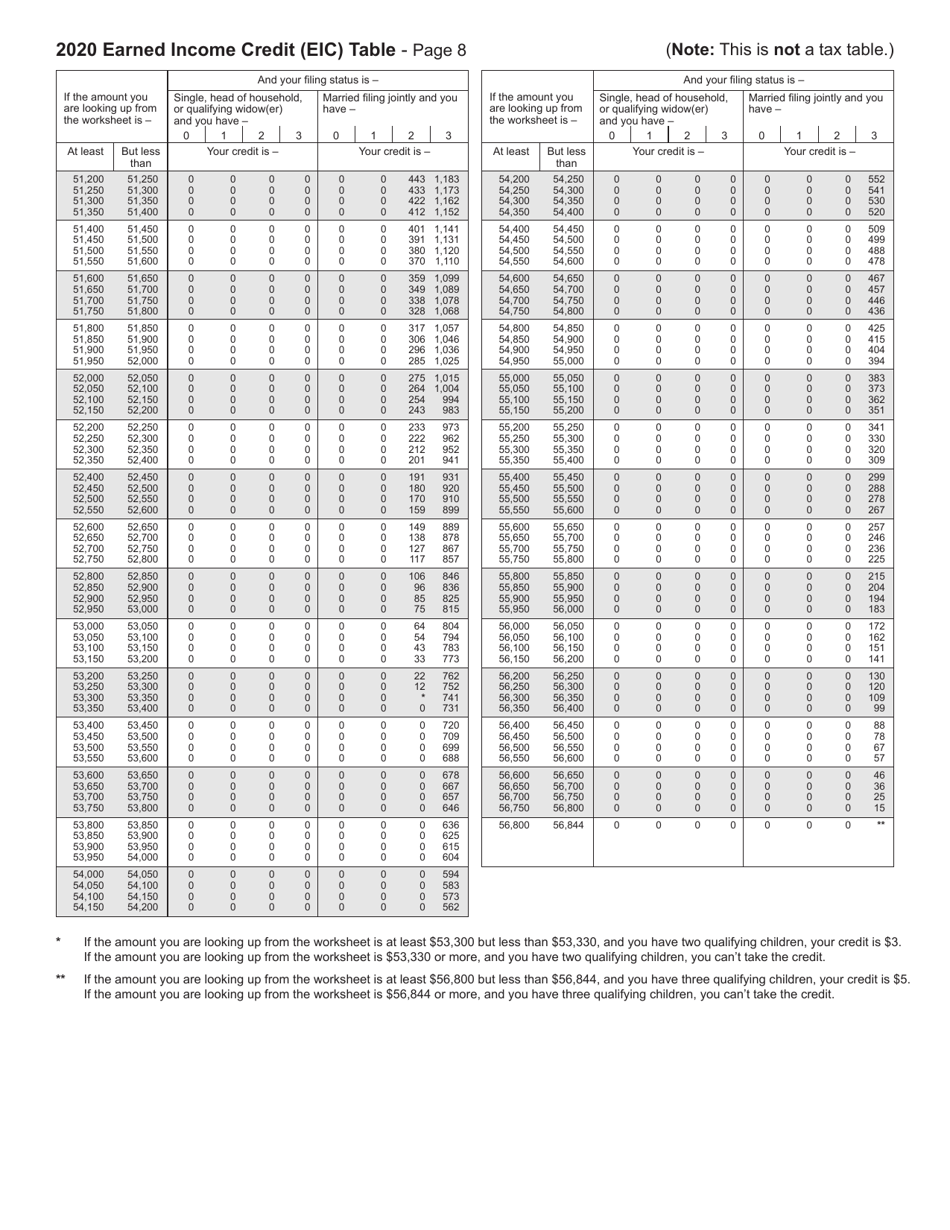

Q: What is the Earned Income Credit (EIC)?

A: The Earned Income Credit (EIC) is a tax benefit for low-income working individuals and families.

Q: Who is eligible for the EIC in Oklahoma?

A: Residents of Oklahoma who meet certain income requirements may be eligible for the EIC.

Q: How can I determine if I am eligible for the EIC?

A: You can determine if you are eligible for the EIC by completing the Form 511-EIC worksheet.

Q: Do I have to file the Form 511-EIC even if I don't owe taxes?

A: Yes, you must file the Form 511-EIC even if you don't owe any taxes to claim the Earned Income Credit.

Q: Can I claim the EIC if I am filing as a dependent?

A: No, you cannot claim the EIC if you are being claimed as a dependent on someone else's tax return.

Q: Is the EIC refundable?

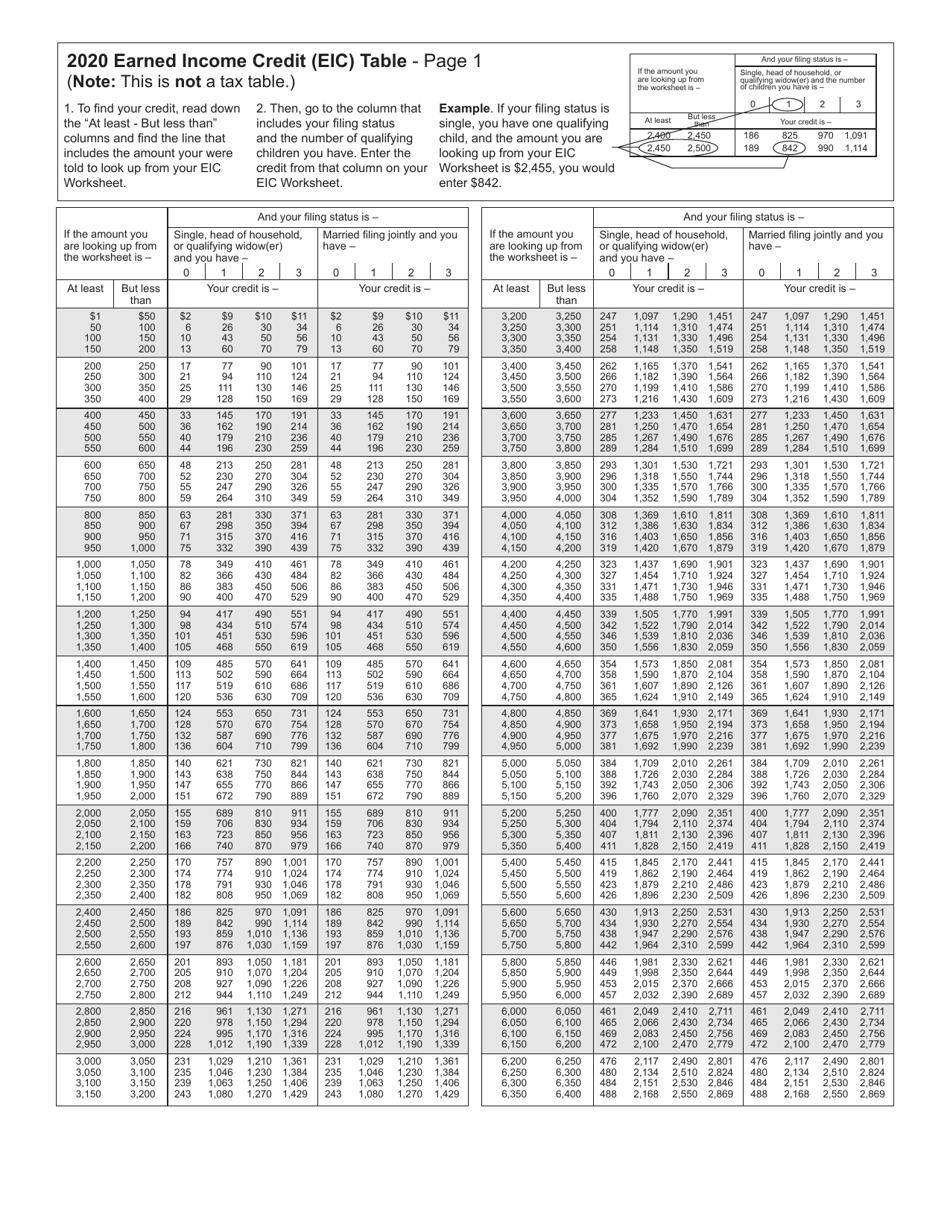

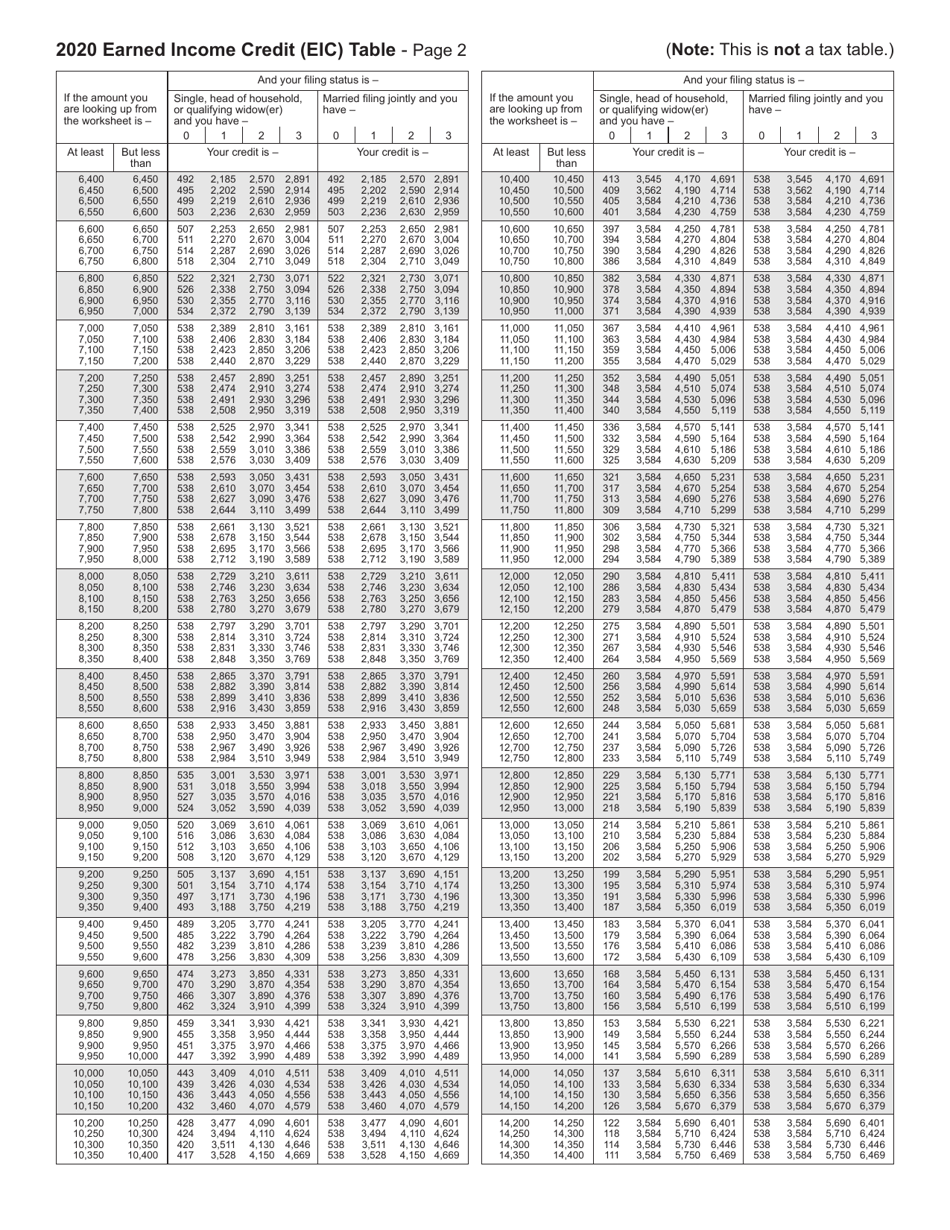

A: Yes, the EIC is a refundable credit, which means that if the credit exceeds your tax liability, you may receive the excess amount as a refund.

Q: What other documents do I need to attach with the Form 511-EIC?

A: You may need to attach additional documents such as your federal tax return and any supporting documentation related to your earned income.

Q: Is the EIC amount the same for everyone?

A: No, the amount of the EIC varies depending on factors such as your income, filing status, and number of qualifying children.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 511-EIC by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.