This version of the form is not currently in use and is provided for reference only. Download this version of

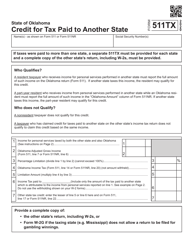

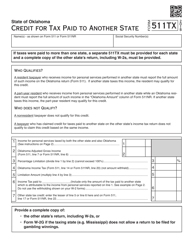

Form 511-TX

for the current year.

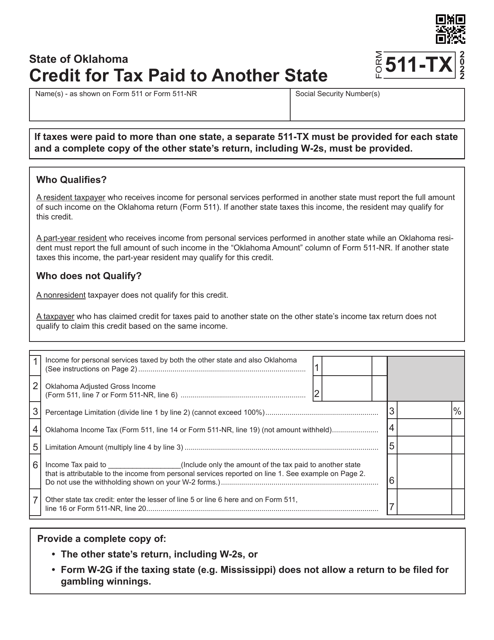

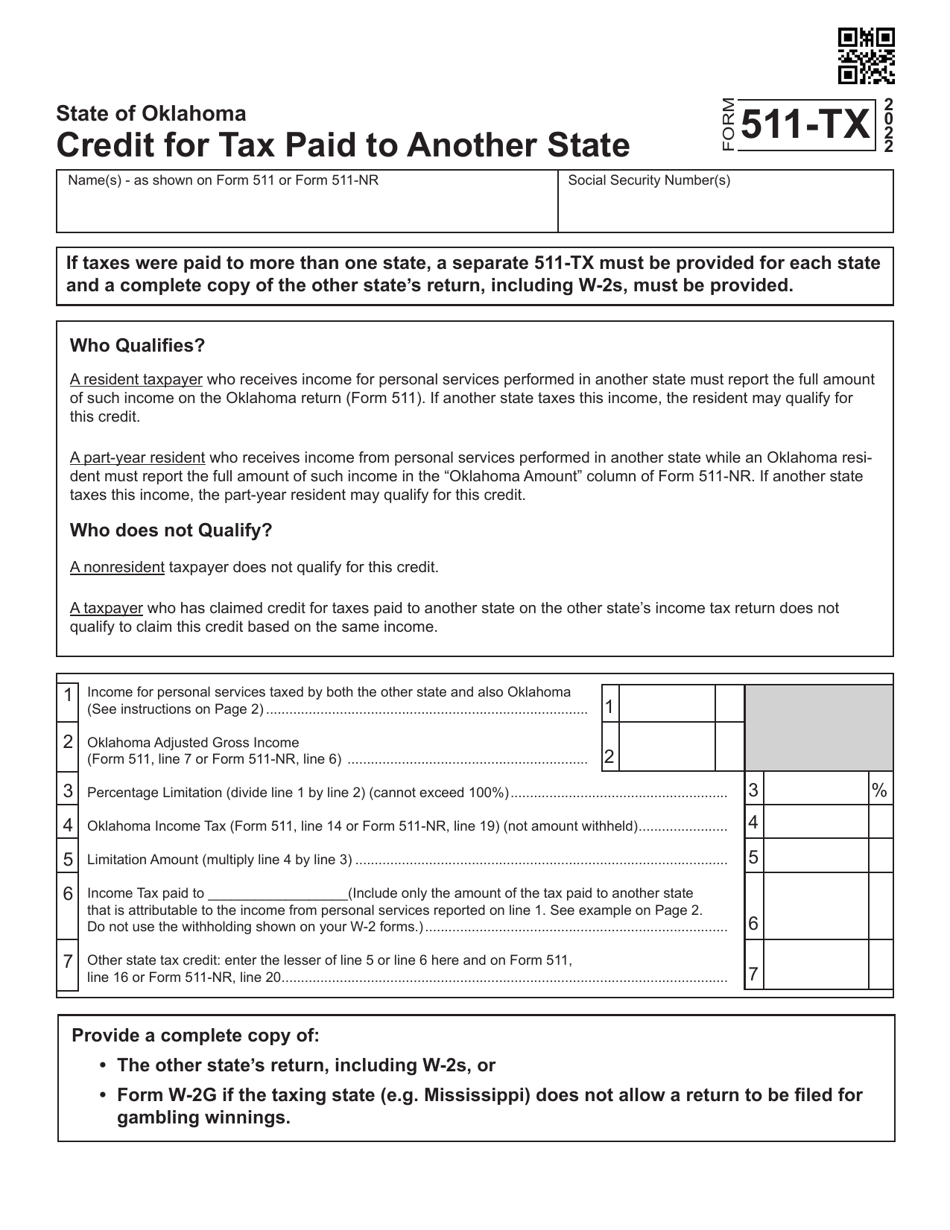

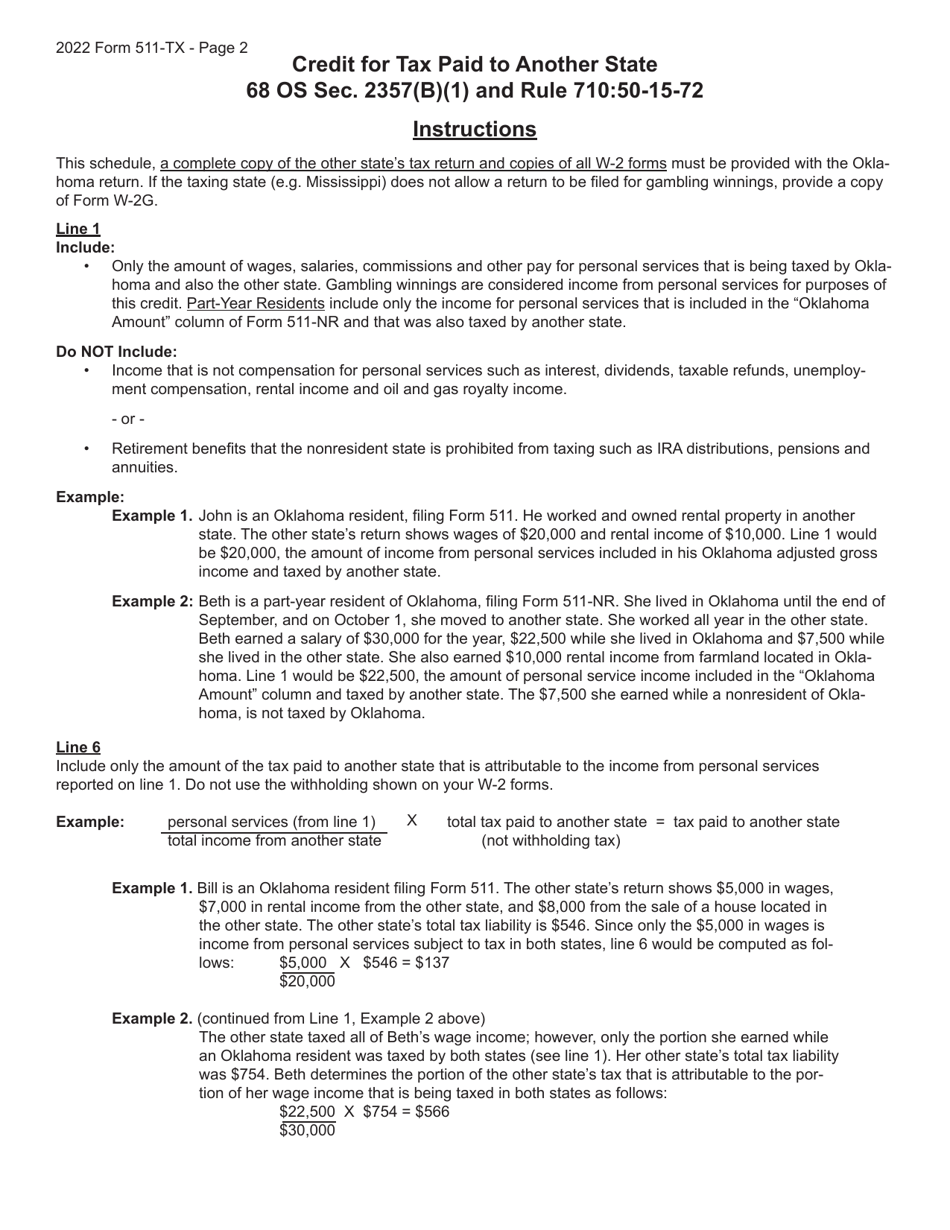

Form 511-TX Credit for Tax Paid to Another State - Oklahoma

What Is Form 511-TX?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 511-TX?

A: Form 511-TX is a state tax form used by residents of Texas to claim a credit for taxes paid to another state, in this case, Oklahoma.

Q: Who can use Form 511-TX?

A: Form 511-TX can be used by residents of Texas who have paid taxes to Oklahoma and want to claim a credit for those payments.

Q: What is the purpose of the credit for tax paid to another state?

A: The purpose of the credit is to prevent double taxation on income earned in one state and taxed by another state.

Q: Are there any eligibility requirements to use Form 511-TX?

A: To be eligible to use Form 511-TX, you must be a resident of Texas and have paid taxes to Oklahoma.

Q: How do I file Form 511-TX?

A: You can file Form 511-TX by filling it out with the required information and submitting it to the Texas Comptroller of Public Accounts.

Q: Is there a deadline for filing Form 511-TX?

A: The deadline for filing Form 511-TX is the same as the deadline for filing your Texas state tax return, typically April 15.

Q: What documentation do I need to include with Form 511-TX?

A: You will need to include documentation of the taxes paid to Oklahoma, such as copies of your Oklahoma tax return or W-2 forms.

Q: Can I e-file Form 511-TX?

A: Yes, you can e-file Form 511-TX using approved tax software or through a tax professional.

Q: Is there a fee to file Form 511-TX?

A: There is no fee to file Form 511-TX.

Q: Will I receive a refund for the credit claimed on Form 511-TX?

A: If you are eligible for the credit, you may receive a refund for the amount claimed on Form 511-TX.

Q: What if I have additional questions or need assistance with Form 511-TX?

A: If you have additional questions or need assistance with Form 511-TX, you can contact the Texas Comptroller of Public Accounts for guidance.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 511-TX by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.