This version of the form is not currently in use and is provided for reference only. Download this version of

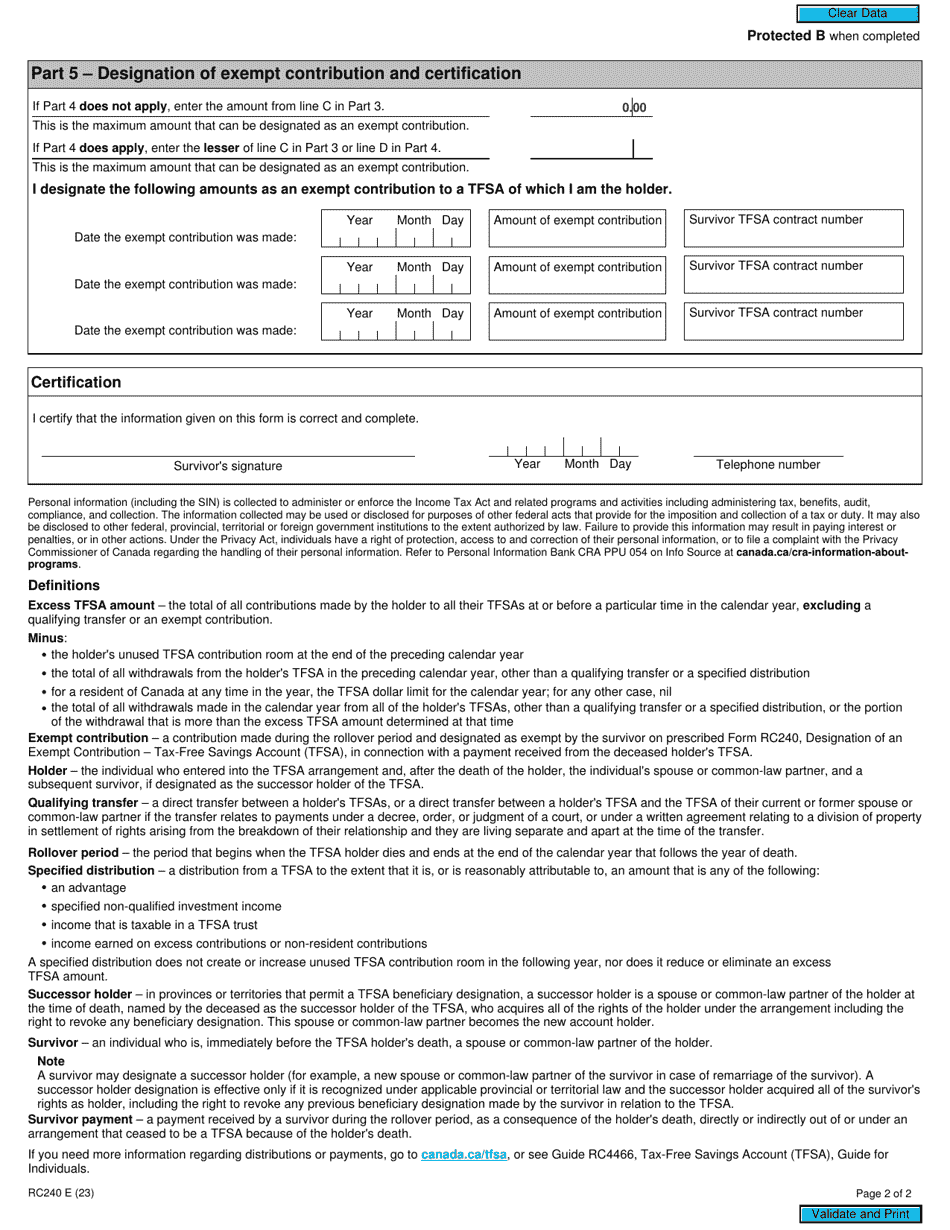

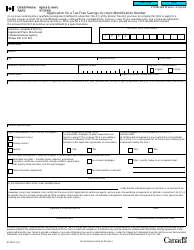

Form RC240

for the current year.

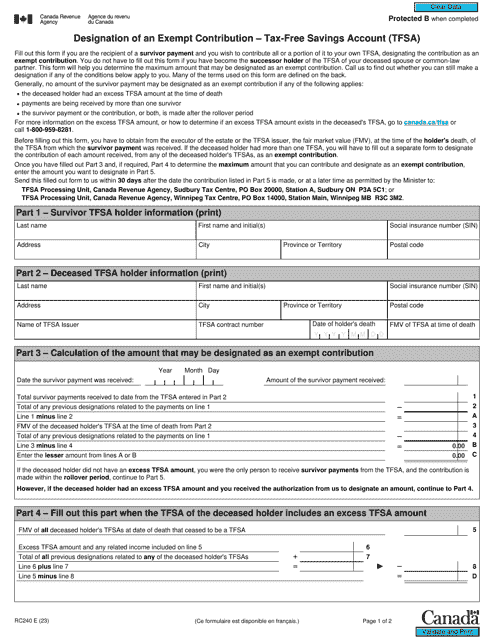

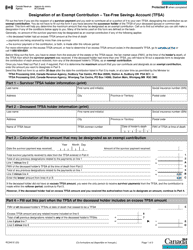

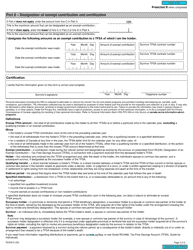

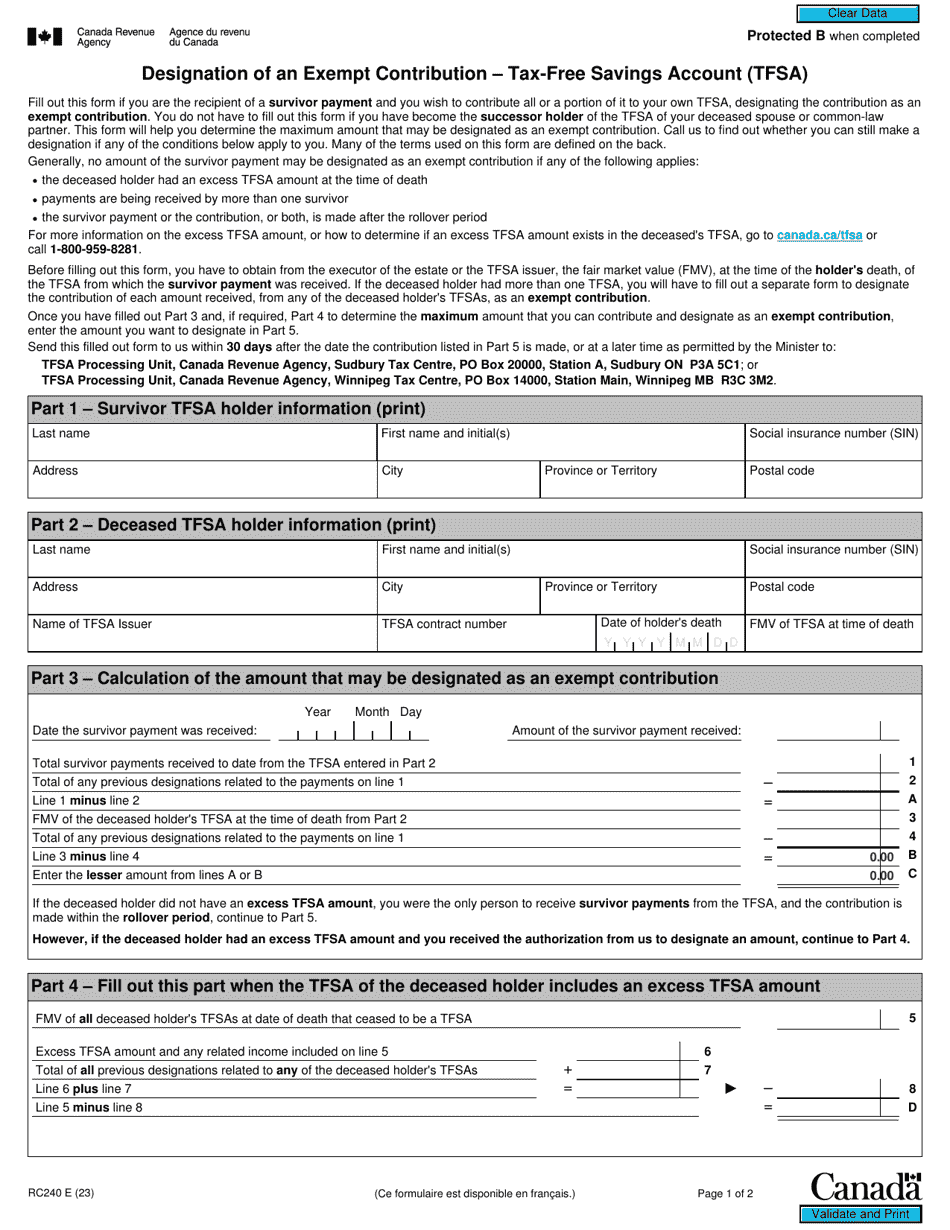

Form RC240 Designation of an Exempt Contribution - Tax-Free Savings Account (Tfsa) - Canada

Form RC240 Designation of an Exempt Contribution is used for designating contributions made to a Tax-Free Savings Account (TFSA) in Canada as exempt.

Individuals who have made contributions to a Tax-Free Savings Account (TFSA) in Canada are required to file Form RC240, Designation of an Exempt Contribution.

FAQ

Q: What is Form RC240?

A: Form RC240 is the Designation of an Exempt Contribution for a Tax-Free Savings Account (TFSA) in Canada.

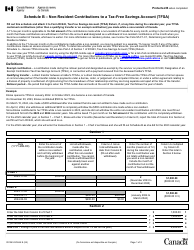

Q: What is a Tax-Free Savings Account (TFSA)?

A: A Tax-Free Savings Account (TFSA) is a type of registered account in Canada that allows individuals to save and invest money without being subject to tax on the income earned within the account.

Q: What is the purpose of Form RC240?

A: The purpose of Form RC240 is to designate a contribution made to a Tax-Free Savings Account (TFSA) as an exempt contribution.

Q: What is an exempt contribution?

A: An exempt contribution is a contribution made to a TFSA that is not subject to any penalty or tax.

Q: Who needs to fill out Form RC240?

A: Individuals who want to designate a contribution to their TFSA as an exempt contribution need to fill out Form RC240.

Q: How do I fill out Form RC240?

A: The form requires you to provide your personal information, such as your name, social insurance number, and address, as well as information about the TFSA and the contribution you want to designate as exempt.

Q: Is there a deadline for filing Form RC240?

A: There is no specific deadline for filing Form RC240, but it is recommended to do so as soon as possible after making the contribution to your TFSA.

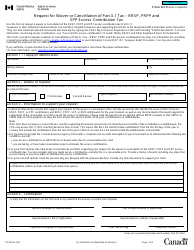

Q: What happens after I submit Form RC240?

A: Once you submit Form RC240, the Canada Revenue Agency (CRA) will review the information and determine whether your contribution can be designated as an exempt contribution.

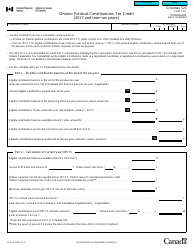

Q: Can I make multiple exempt contributions to my TFSA?

A: Yes, you can make multiple exempt contributions to your TFSA, but you must ensure that the total contributions do not exceed the annual TFSA contribution limit.