This version of the form is not currently in use and is provided for reference only. Download this version of

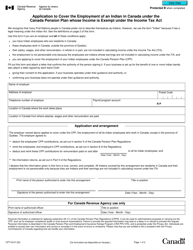

Form T3P

for the current year.

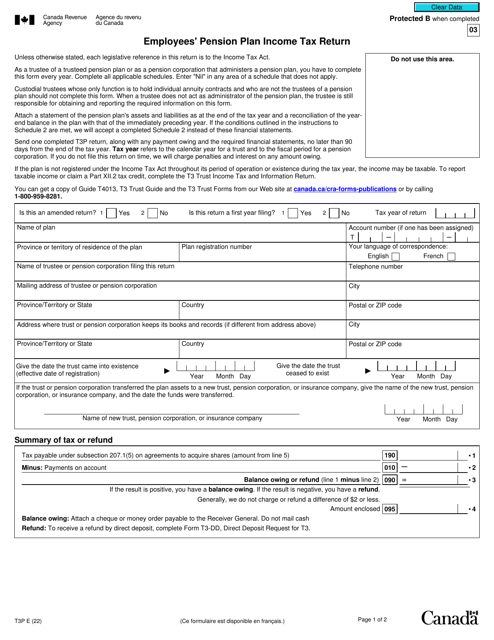

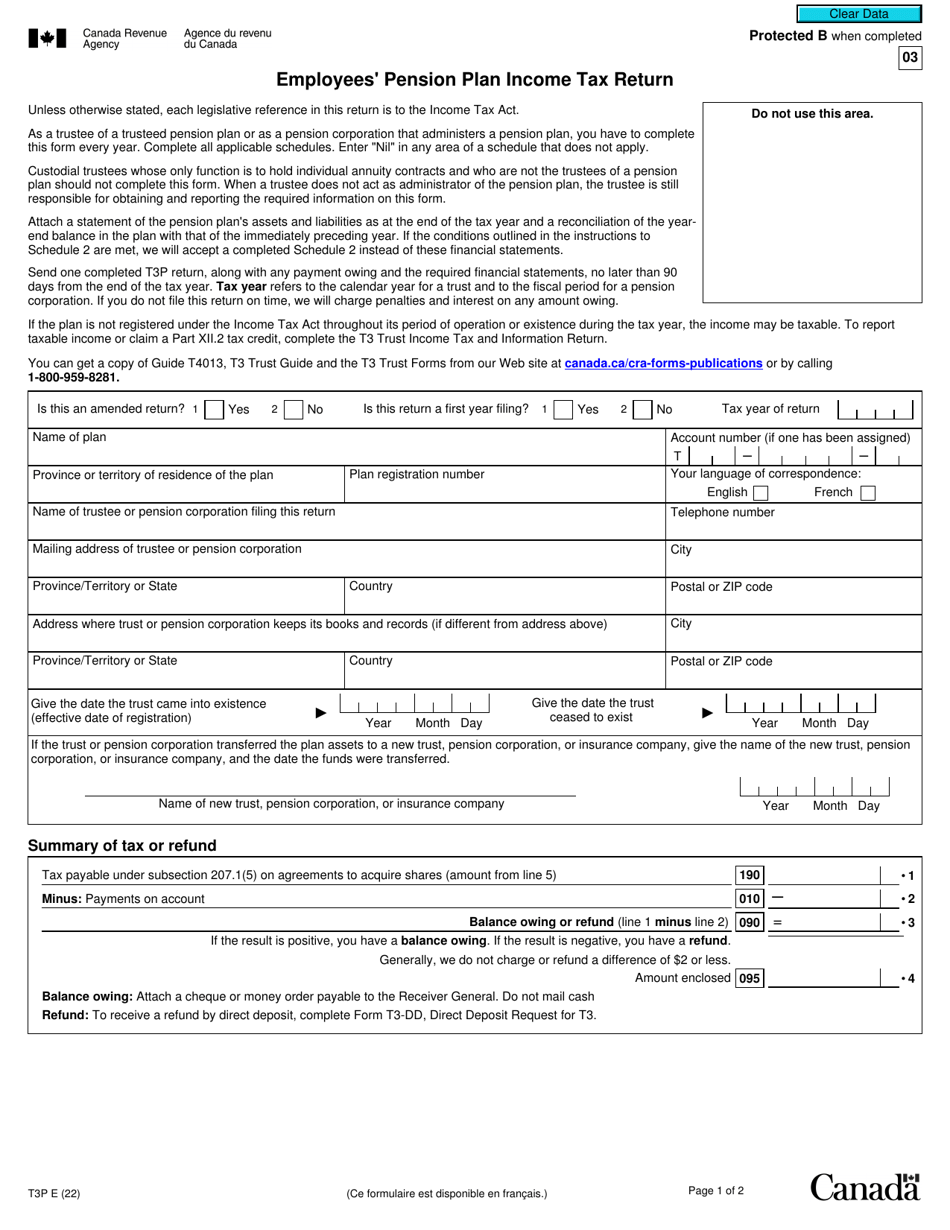

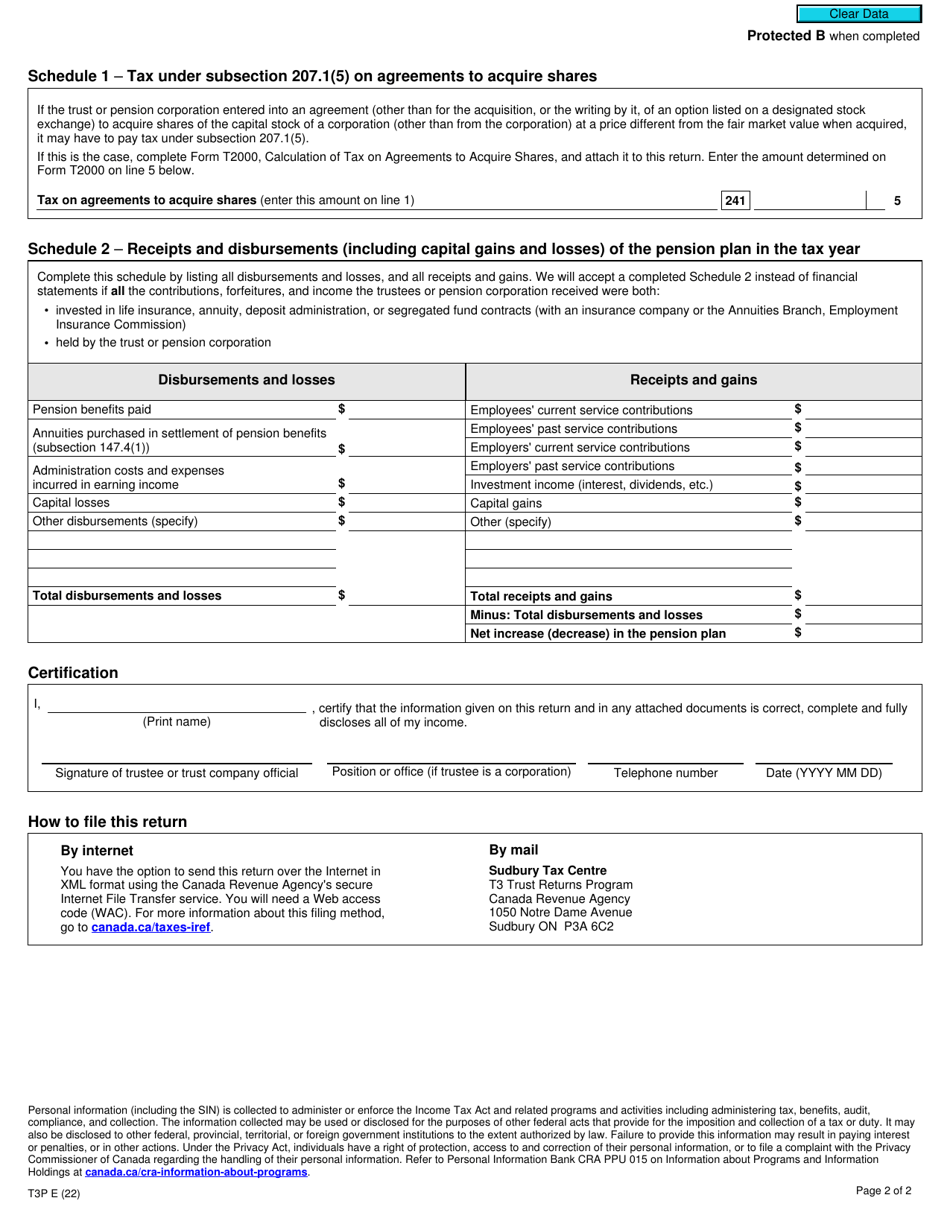

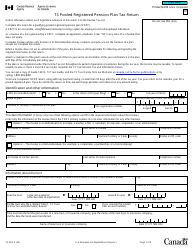

Form T3P Employees' Pension Plan Income Tax Return - Canada

Form T3P is used by employers in Canada to report and remit income tax withheld from payments made to employees participating in a registered pension plan. This form ensures compliance with the tax obligations related to employees' pension plan income.

The employer or plan administrator files the Form T3P Employees' Pension Plan Income Tax Return in Canada.

FAQ

Q: What is Form T3P?

A: Form T3P is the Employees' Pension Plan Income Tax Return in Canada.

Q: Who should file Form T3P?

A: Individuals who are responsible for administering an Employees' Pension Plan in Canada should file Form T3P.

Q: What is the purpose of Form T3P?

A: The purpose of Form T3P is to report the income and deductions of the Employees' Pension Plan.

Q: When is the deadline to file Form T3P?

A: The deadline to file Form T3P is 90 days after the end of the plan's fiscal year.

Q: Are there any penalties for late filing of Form T3P?

A: Yes, there are penalties for late filing of Form T3P. The penalty is based on the number of days the return is late and the value of the assets of the plan.

Q: Is there a fee to file Form T3P?

A: No, there is no fee to file Form T3P.

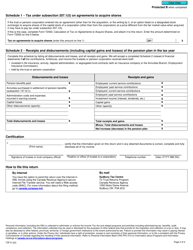

Q: What supporting documents should be included with Form T3P?

A: Supporting documents such as financial statements, investment schedules, and actuarial reports should be included with Form T3P.