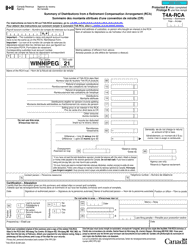

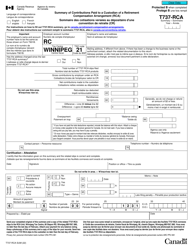

This version of the form is not currently in use and is provided for reference only. Download this version of

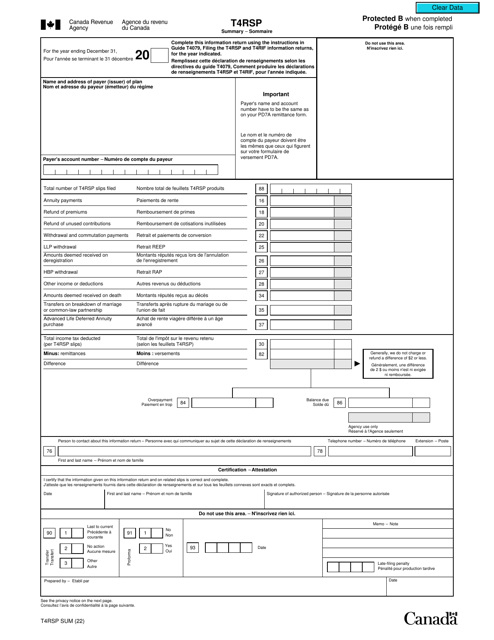

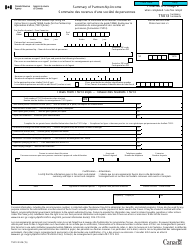

Form T4RSP SUM

for the current year.

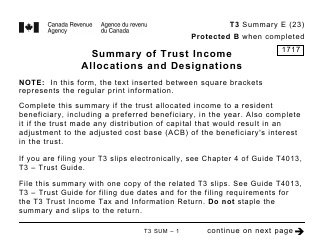

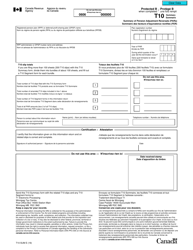

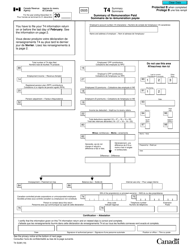

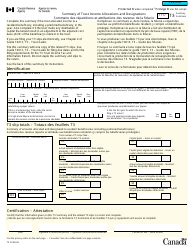

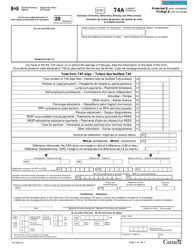

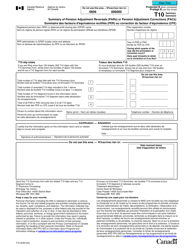

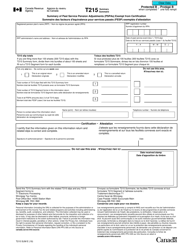

Form T4RSP SUM T4rsp Summary - Canada (English / French)

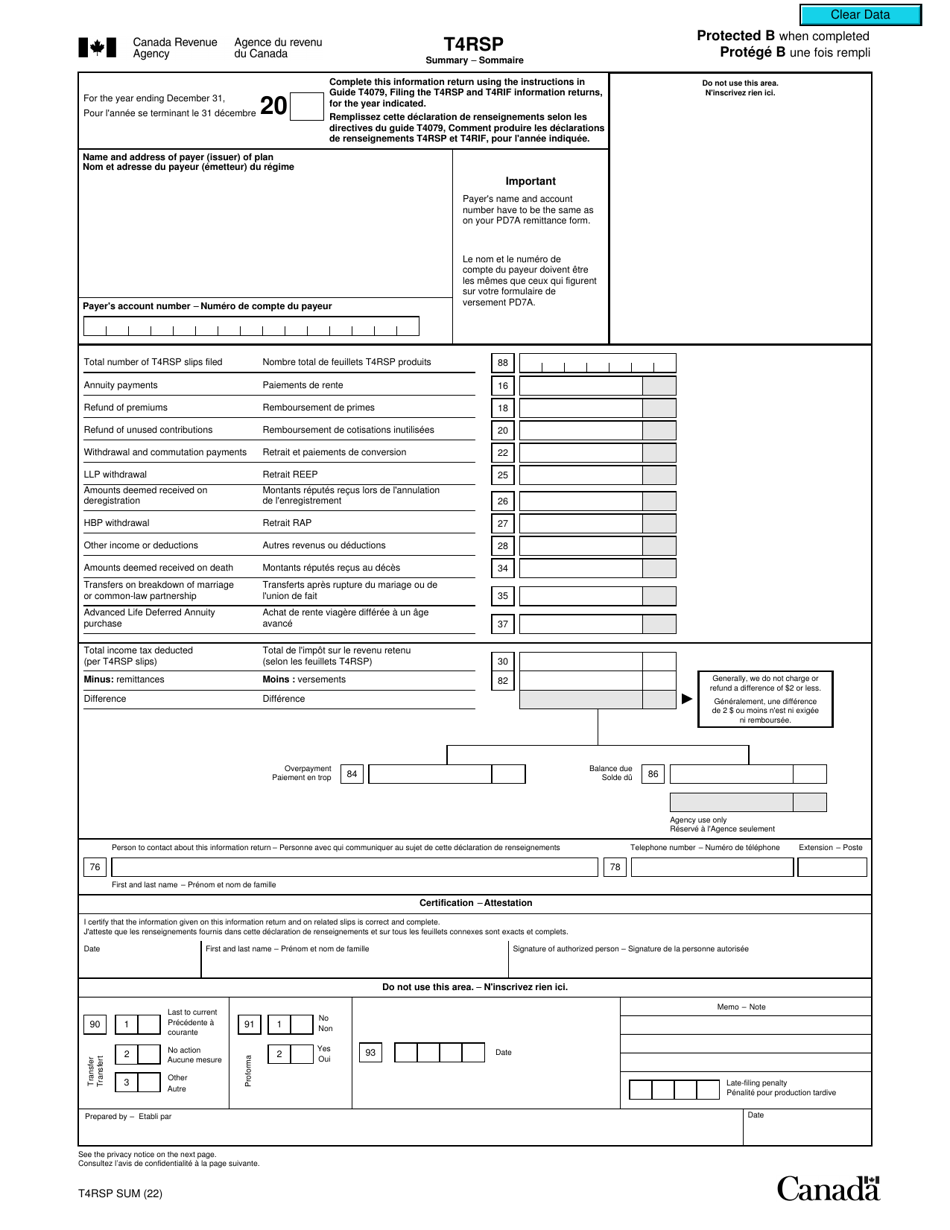

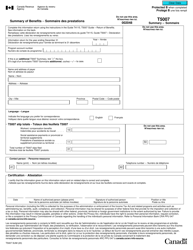

Form T4RSP SUM T4rsp Summary is used in Canada to summarize the details of withdrawals made from registered retirement savings plans (RRSPs). This form provides information regarding the amounts withdrawn, taxes withheld, and other relevant details related to RRSP withdrawals. It is used for reporting and tax purposes.

The Form T4RSP SUM T4rsp Summary is typically filed by Canadian individuals who have received payments from a Registered Retirement Savings Plan (RRSP) or a Registered Retirement Income Fund (RRIF).

FAQ

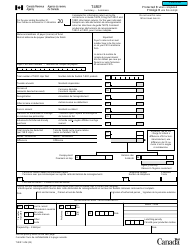

Q: What is a T4RSP form?

A: A T4RSP form is a tax form in Canada that reports any amounts received from a registered retirement savings plan (RSP).

Q: What is the purpose of a T4RSP form?

A: The purpose of a T4RSP form is to report income received from an RSP, which may be subject to taxation.

Q: Who should receive a T4RSP form?

A: Any individual who received funds from an RSP during the tax year should receive a T4RSP form.

Q: Are T4RSP forms available in both English and French?

A: Yes, T4RSP forms are available in both English and French to accommodate residents in Canada.

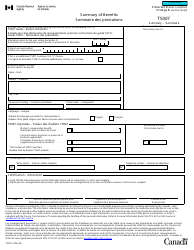

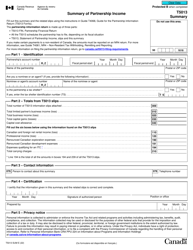

Q: What does the T4RSP Summary report?

A: The T4RSP Summary is a document that summarizes the total amounts reported on T4RSP forms for a particular tax year.

Q: Is the T4RSP Summary required to file taxes?

A: No, the T4RSP Summary is not required to file taxes, but it provides a summary of RSP income for your records.

Q: When should I expect to receive my T4RSP form?

A: T4RSP forms must be provided by the issuer by the end of February following the tax year in question.

Q: How do I report income from my T4RSP form on my tax return?

A: You will need to report the income from your T4RSP form on your tax return using the appropriate sections or schedules provided by the Canada Revenue Agency.

Q: Can I file my taxes without a T4RSP form?

A: Technically, you can file your taxes without a T4RSP form, but it is important to report any income received from an RSP to ensure accurate and complete tax filing.