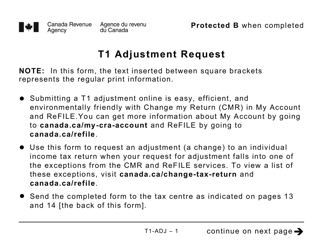

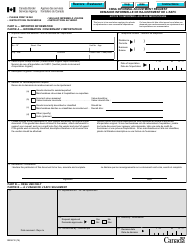

This version of the form is not currently in use and is provided for reference only. Download this version of

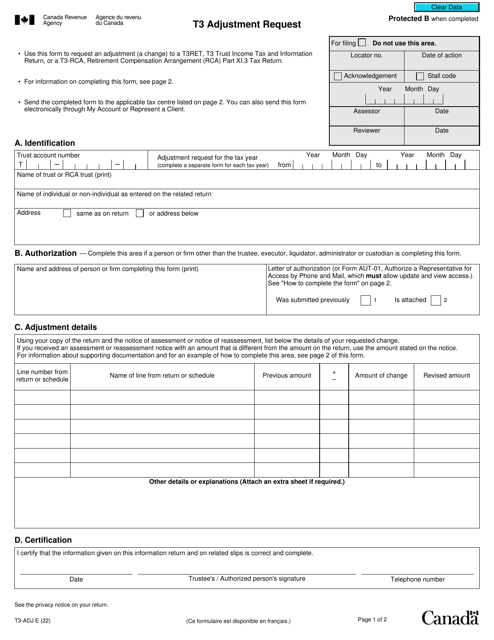

Form T3-ADJ

for the current year.

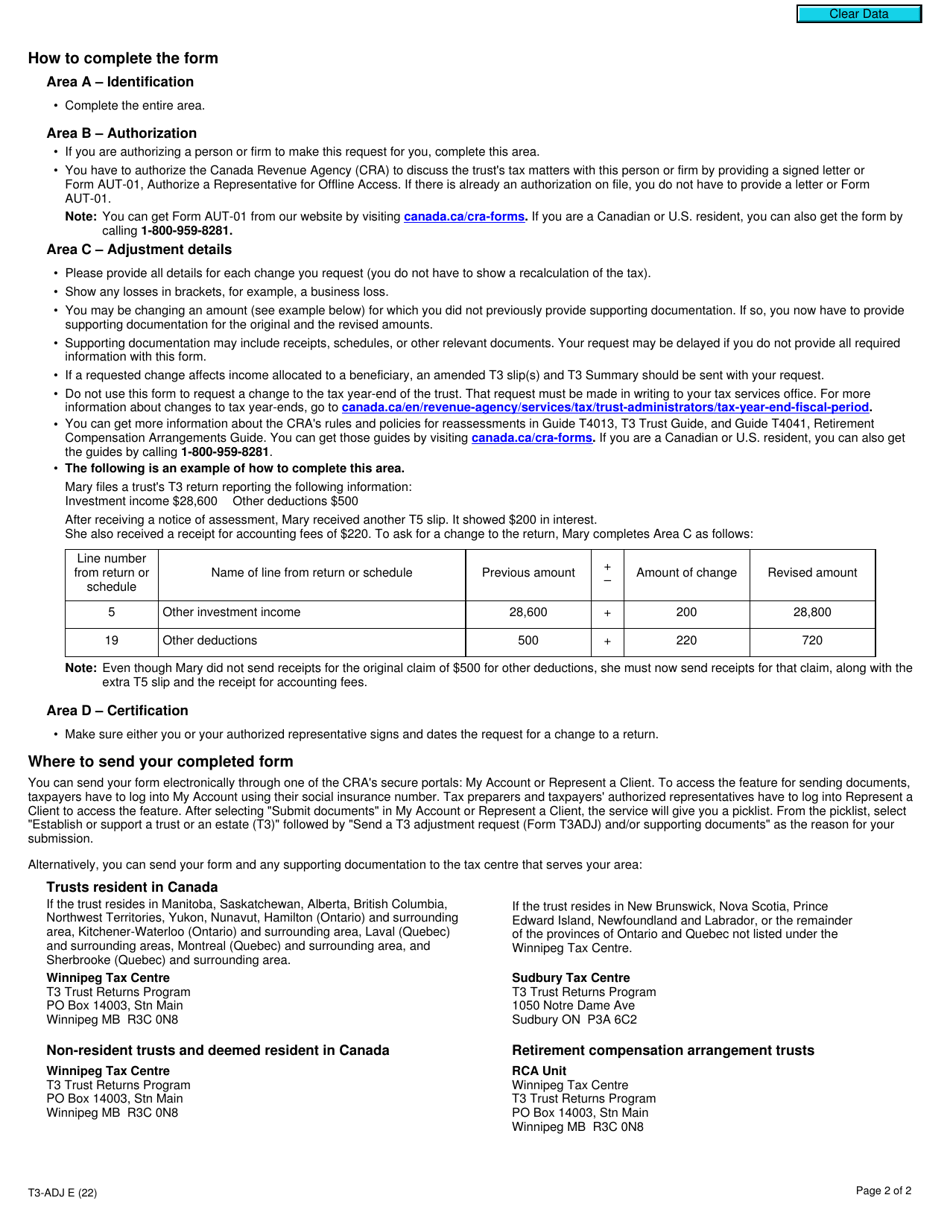

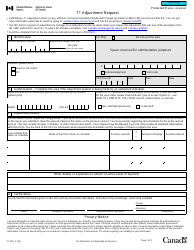

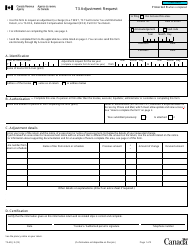

Form T3-ADJ T3 Adjustment Request - Canada

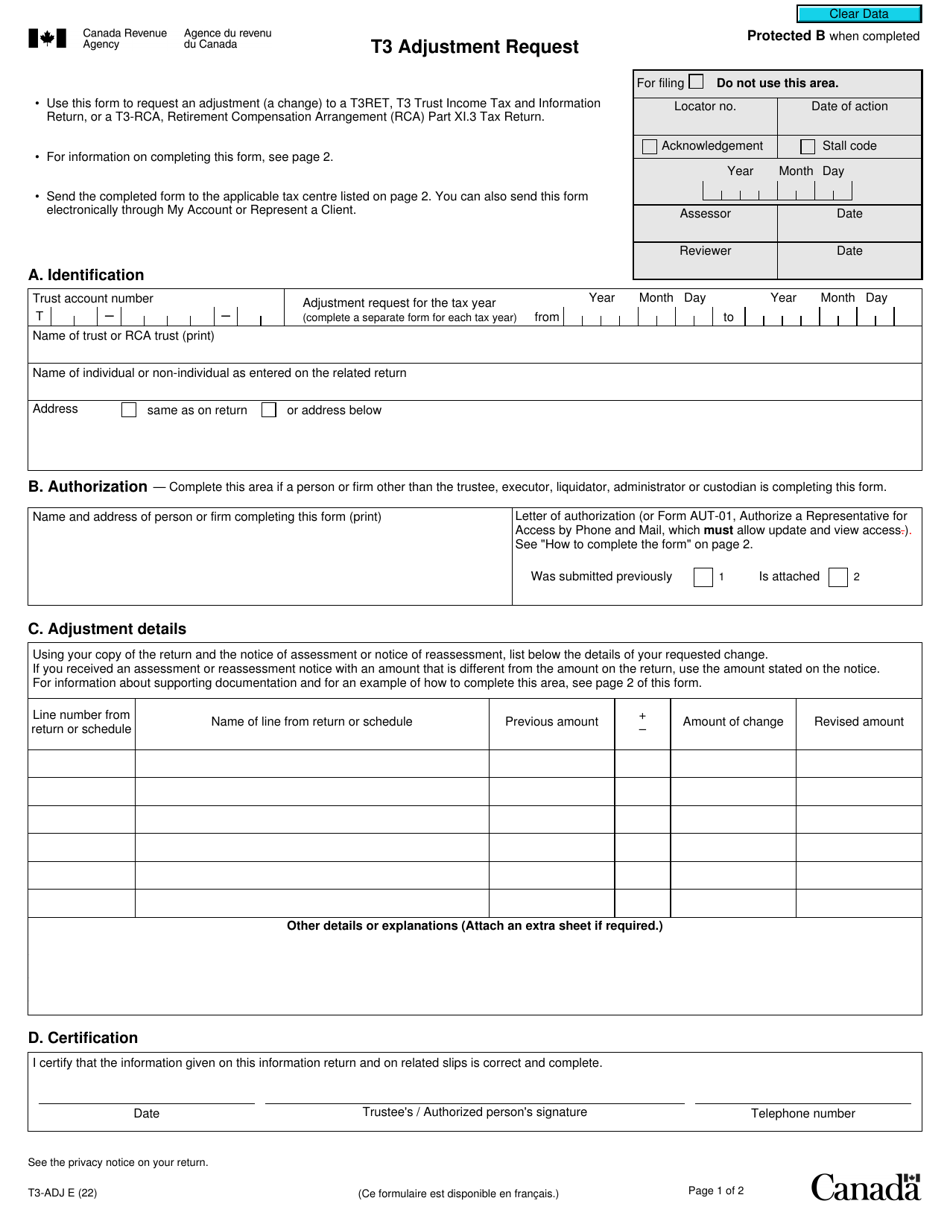

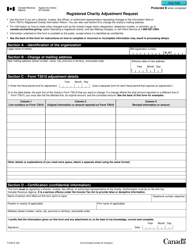

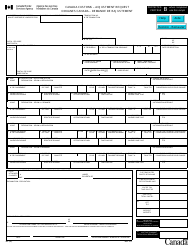

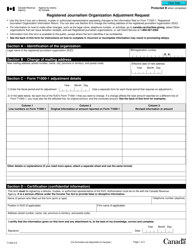

Form T3-ADJ, also known as the T3 Adjustment Request, is used in Canada to request adjustments to a T3 Trust Income Tax and Information Return. It is typically used when there are changes or corrections needed to the original T3 return that was filed. This form allows taxpayers to report changes in income, deductions, or other information to the Canada Revenue Agency (CRA) for a specific tax year. It is important to fill out this form accurately and include all necessary supporting documents.

The taxpayer or their authorized representative files the Form T3-ADJ T3 Adjustment Request in Canada.

FAQ

Q: What is Form T3-ADJ?

A: Form T3-ADJ is the T3 Adjustment Request form in Canada.

Q: What is the purpose of Form T3-ADJ?

A: The purpose of Form T3-ADJ is to request adjustments to a T3 tax return.

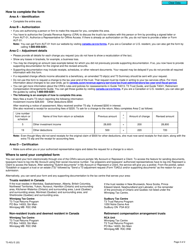

Q: What information is required on Form T3-ADJ?

A: Form T3-ADJ requires information such as the taxpayer's name, social insurance number, and details of the adjustments being requested.

Q: When should I submit Form T3-ADJ?

A: Form T3-ADJ should be submitted as soon as possible after discovering an error or omission in your T3 tax return.

Q: Is there a deadline for submitting Form T3-ADJ?

A: There is no specific deadline for submitting Form T3-ADJ, but it is recommended to submit it within three years of the original filing date.

Q: How long does it take for the CRA to process Form T3-ADJ?

A: The processing time for Form T3-ADJ varies, but it may take several weeks or months for the CRA to review and process your request.

Q: What should I do if my Form T3-ADJ is rejected?

A: If your Form T3-ADJ is rejected, you may need to provide additional documentation or make corrections before resubmitting the form.