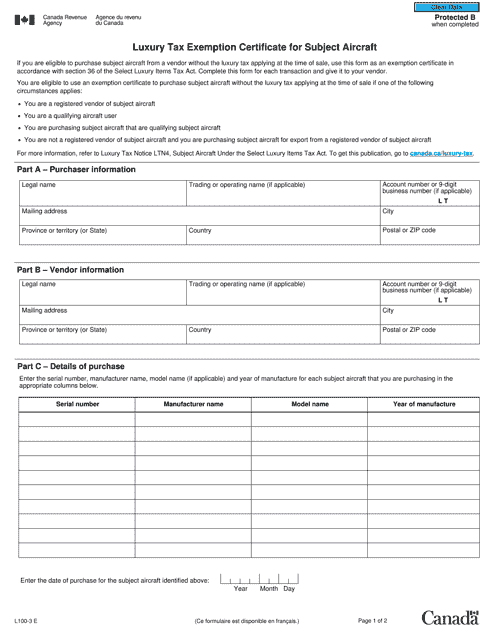

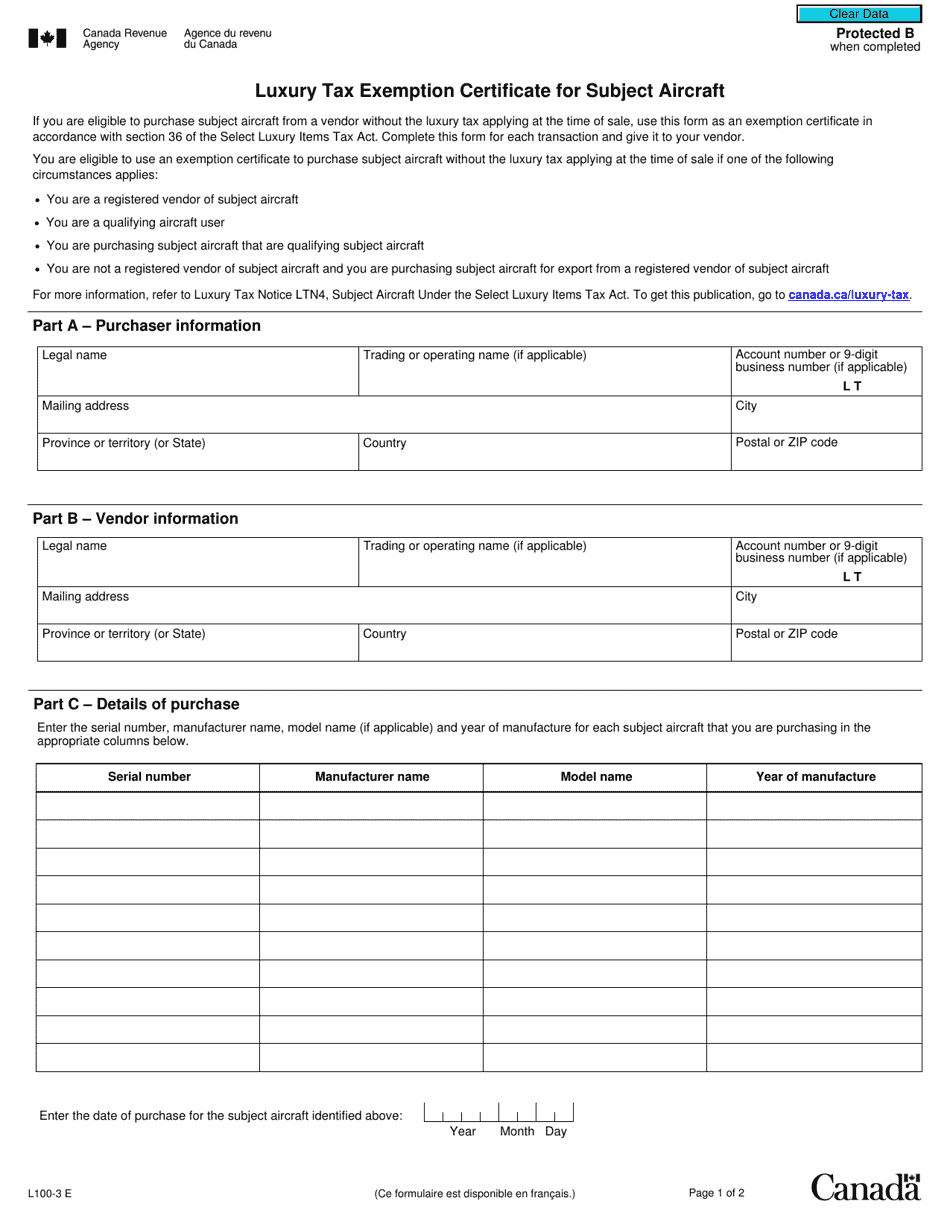

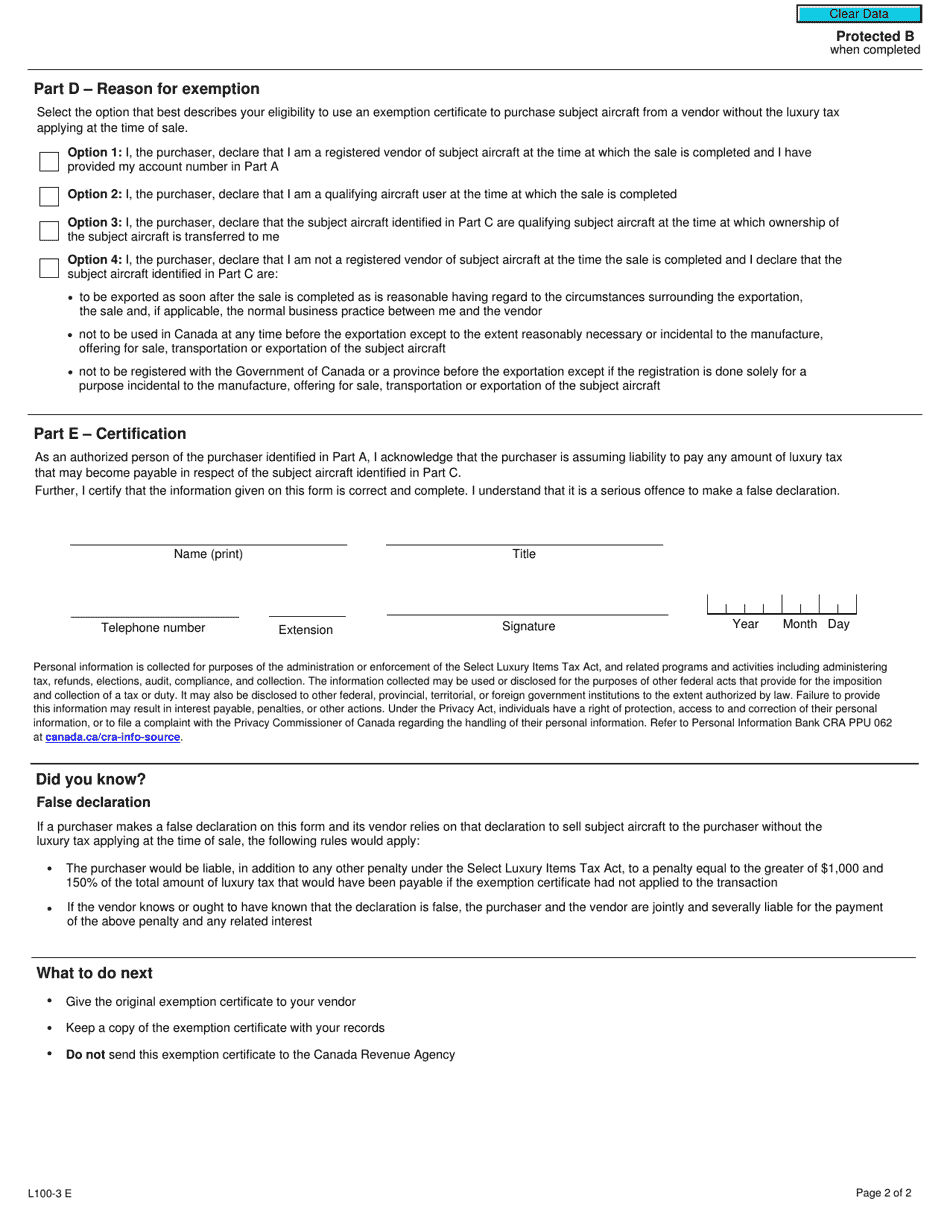

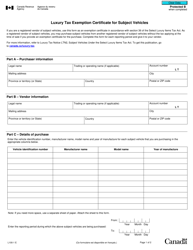

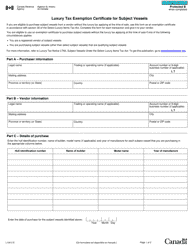

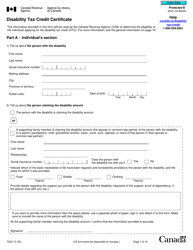

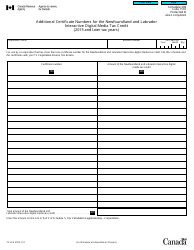

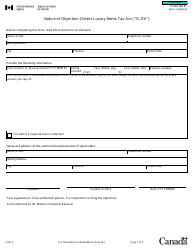

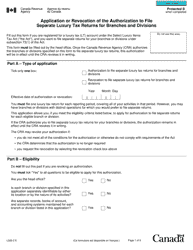

Form L100-3 Luxury Tax Exemption Certificate for Subject Aircraft - Canada

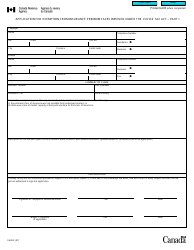

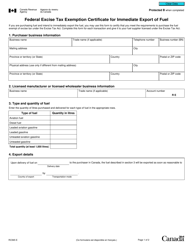

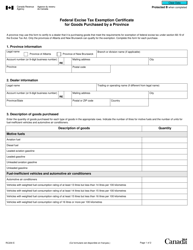

Form L100-3 Luxury Tax Exemption Certificate for Subject Aircraft in Canada is used to apply for a luxury tax exemption on an aircraft that meets certain criteria in Canada. This form helps individuals or entities claim an exemption from paying luxury tax on the purchase or importation of a qualifying aircraft.

In Canada, the entity or person purchasing the subject aircraft files the Form L100-3 Luxury Tax Exemption Certificate.

FAQ

Q: What is form L100-3?

A: Form L100-3 is a Luxury Tax Exemption Certificate for Subject Aircraft in Canada.

Q: What is the purpose of form L100-3?

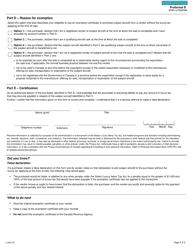

A: The purpose of form L100-3 is to claim exemption from luxury tax for a subject aircraft in Canada.

Q: Who needs to fill out form L100-3?

A: Owners or purchasers of subject aircraft in Canada who wish to claim luxury tax exemption need to fill out form L100-3.

Q: What information is required in form L100-3?

A: Form L100-3 requires information such as aircraft details, ownership or purchase information, and reasons for claiming luxury tax exemption.

Q: Are there any fees associated with filing form L100-3?

A: No, there are no fees associated with filing form L100-3 for luxury tax exemption on subject aircraft in Canada.

Q: Is form L100-3 applicable in the USA?

A: No, form L100-3 is specific to luxury tax exemption for subject aircraft in Canada only.