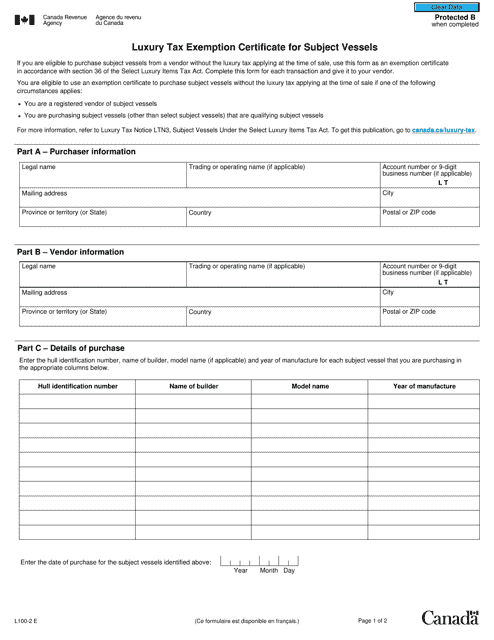

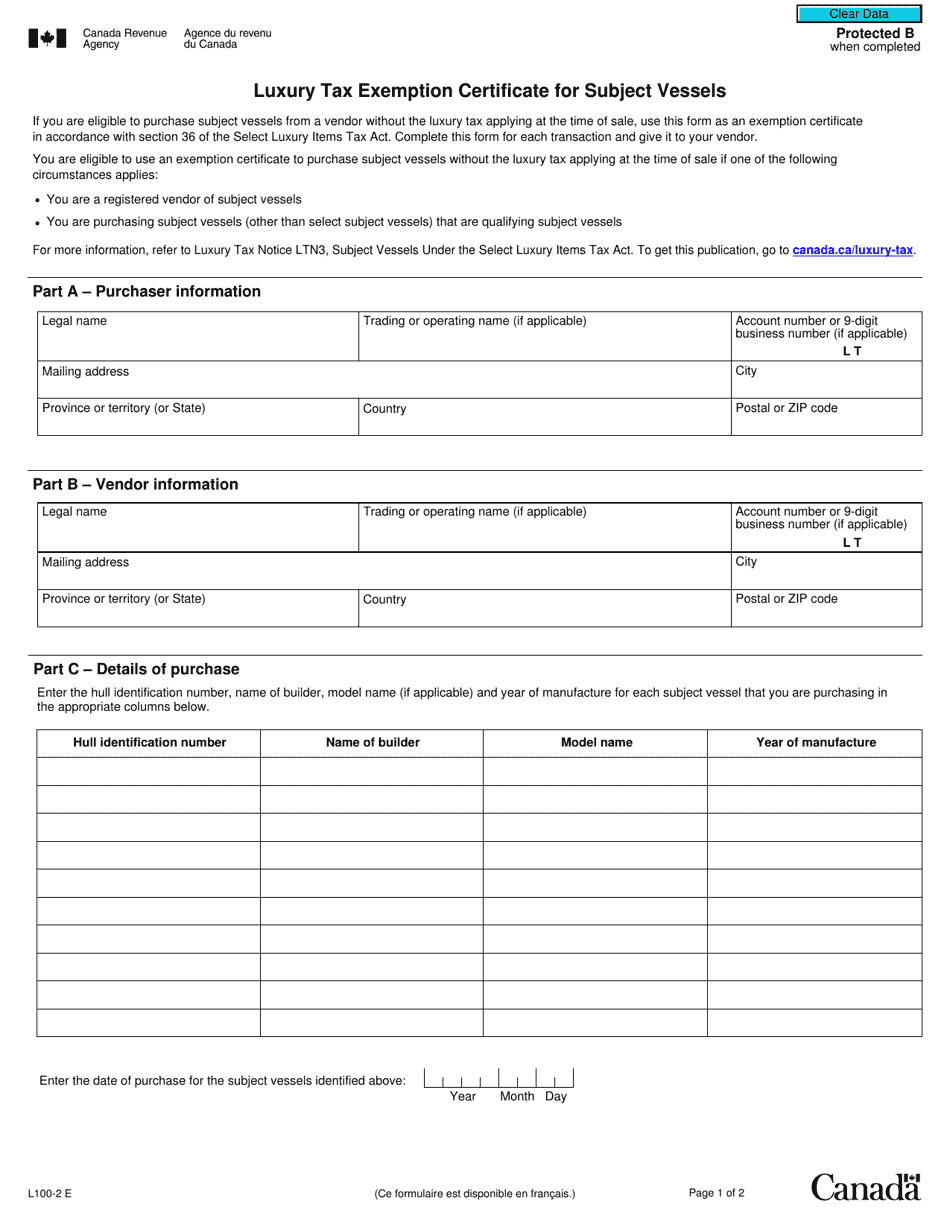

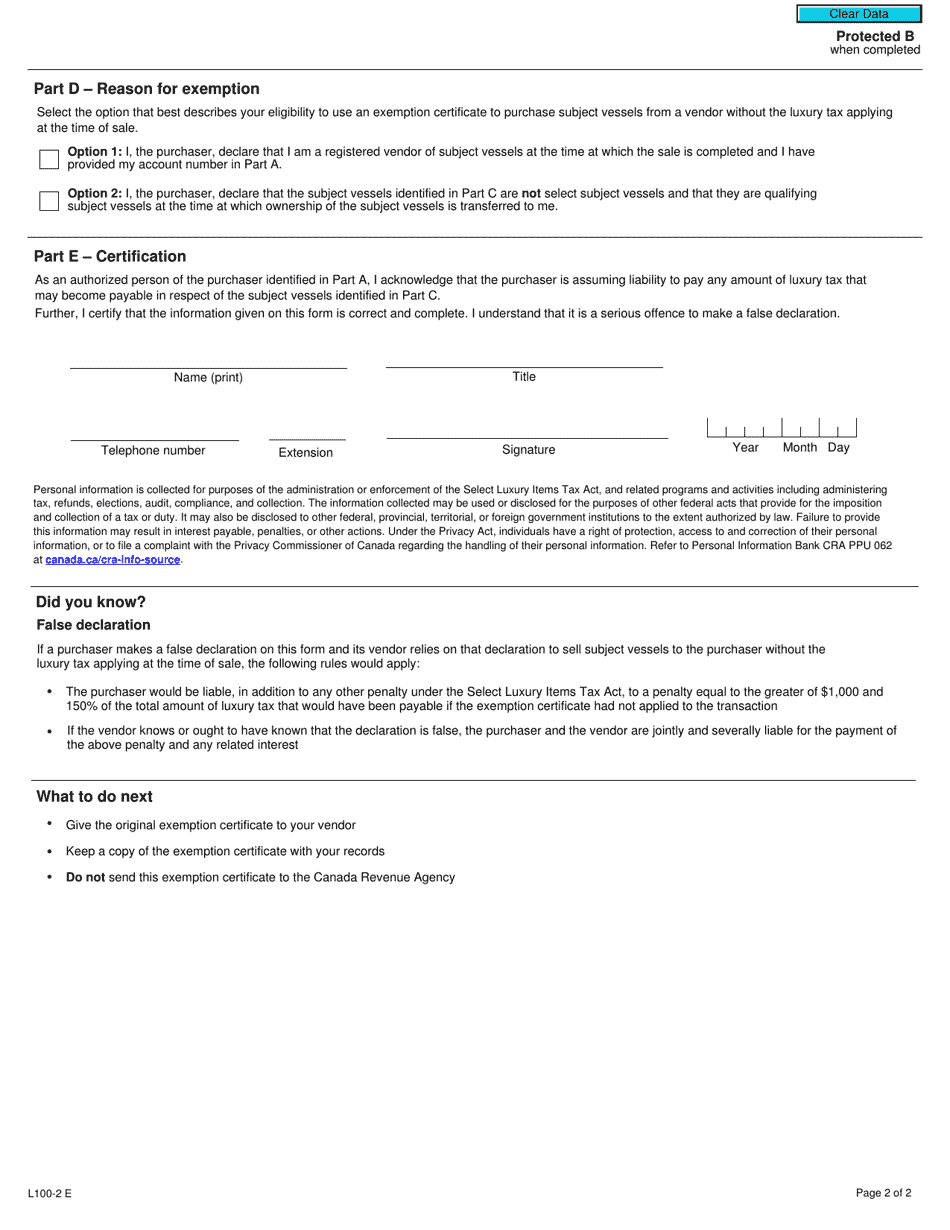

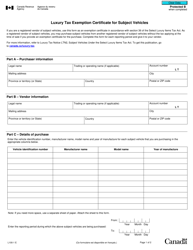

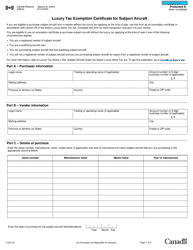

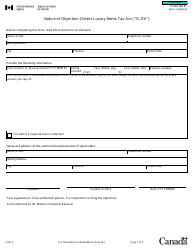

Form L100-2 Luxury Tax Exemption Certificate for Subject Vessels - Canada

Form L100-2 Luxury Tax Exemption Certificate for Subject Vessels in Canada is used to claim exemption from luxury tax for certain vessels.

FAQ

Q: What is the Form L100-2?

A: The Form L100-2 is a Luxury Tax Exemption Certificate for Subject Vessels in Canada.

Q: What is the purpose of the Form L100-2?

A: The purpose of the Form L100-2 is to claim an exemption from the luxury tax on subject vessels in Canada.

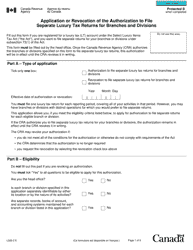

Q: Who can use the Form L100-2?

A: The Form L100-2 can be used by individuals or businesses who meet the eligibility requirements for the luxury tax exemption on subject vessels in Canada.

Q: What is a subject vessel?

A: A subject vessel refers to a specific type of vessel that qualifies for the luxury tax exemption.

Q: What is the luxury tax in Canada?

A: The luxury tax in Canada is a tax imposed on the purchase or importation of certain high-end goods, including subject vessels.

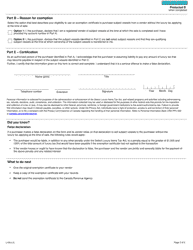

Q: What are the eligibility requirements for the luxury tax exemption?

A: The eligibility requirements for the luxury tax exemption on subject vessels vary and can include criteria such as vessel length, use, and intended purpose.

Q: Are there any fees associated with the luxury tax exemption?

A: There may be fees associated with the luxury tax exemption, such as application fees or administrative charges. It is advisable to check with the tax authority for specific details.

Q: What should I do after completing the Form L100-2?

A: After completing the Form L100-2, you should submit it to the appropriate tax authority along with any required supporting documentation.