This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2033

for the current year.

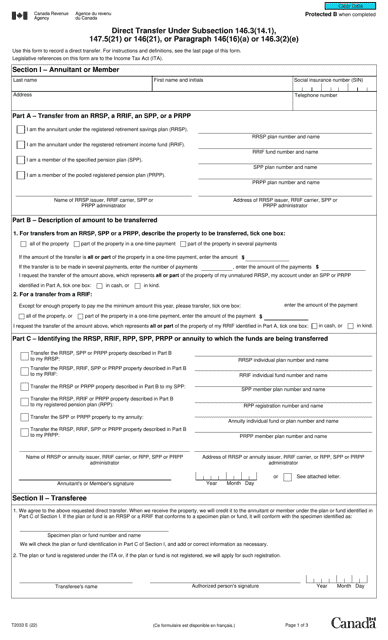

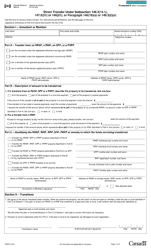

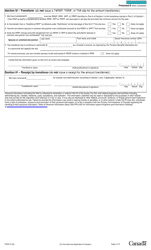

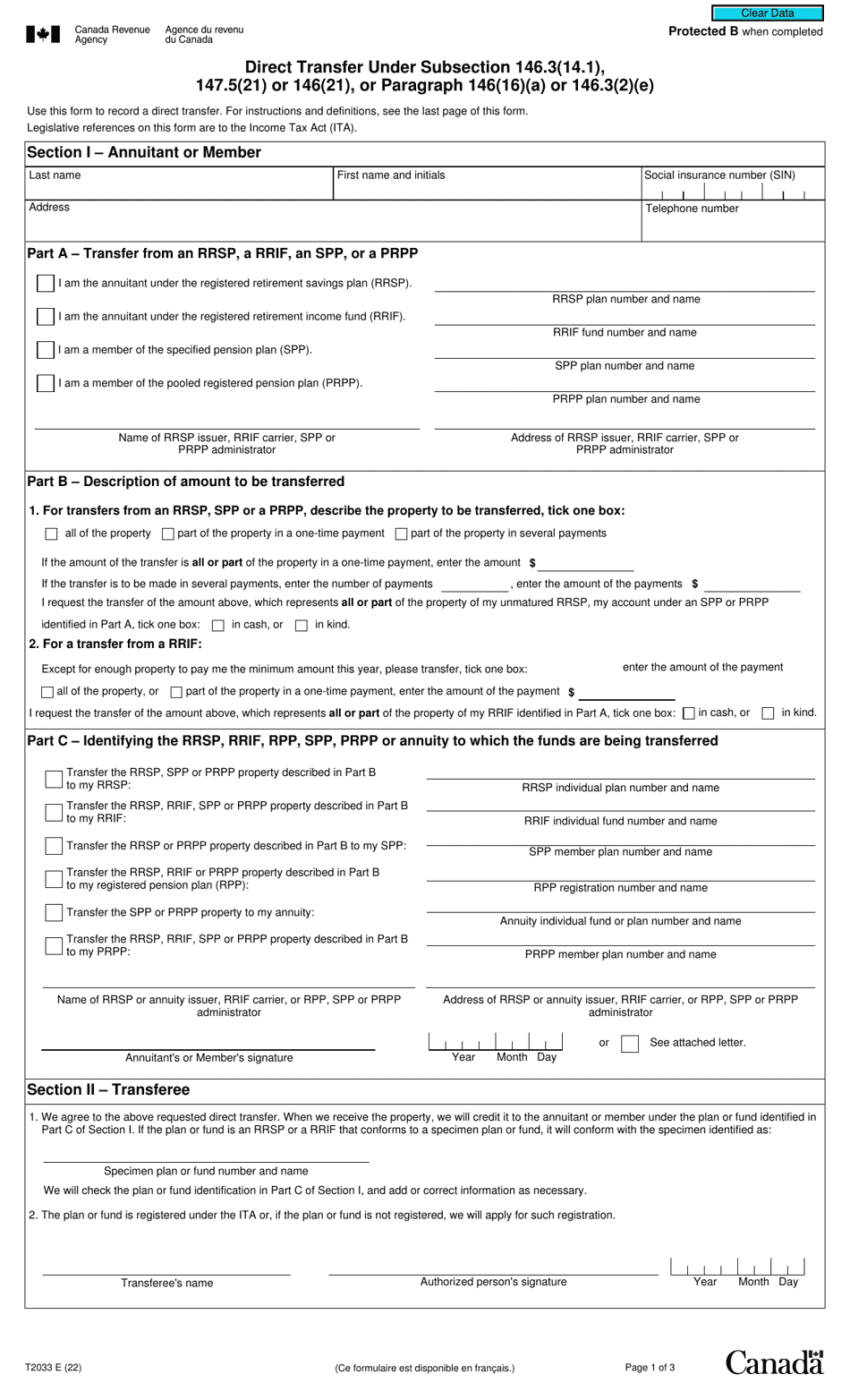

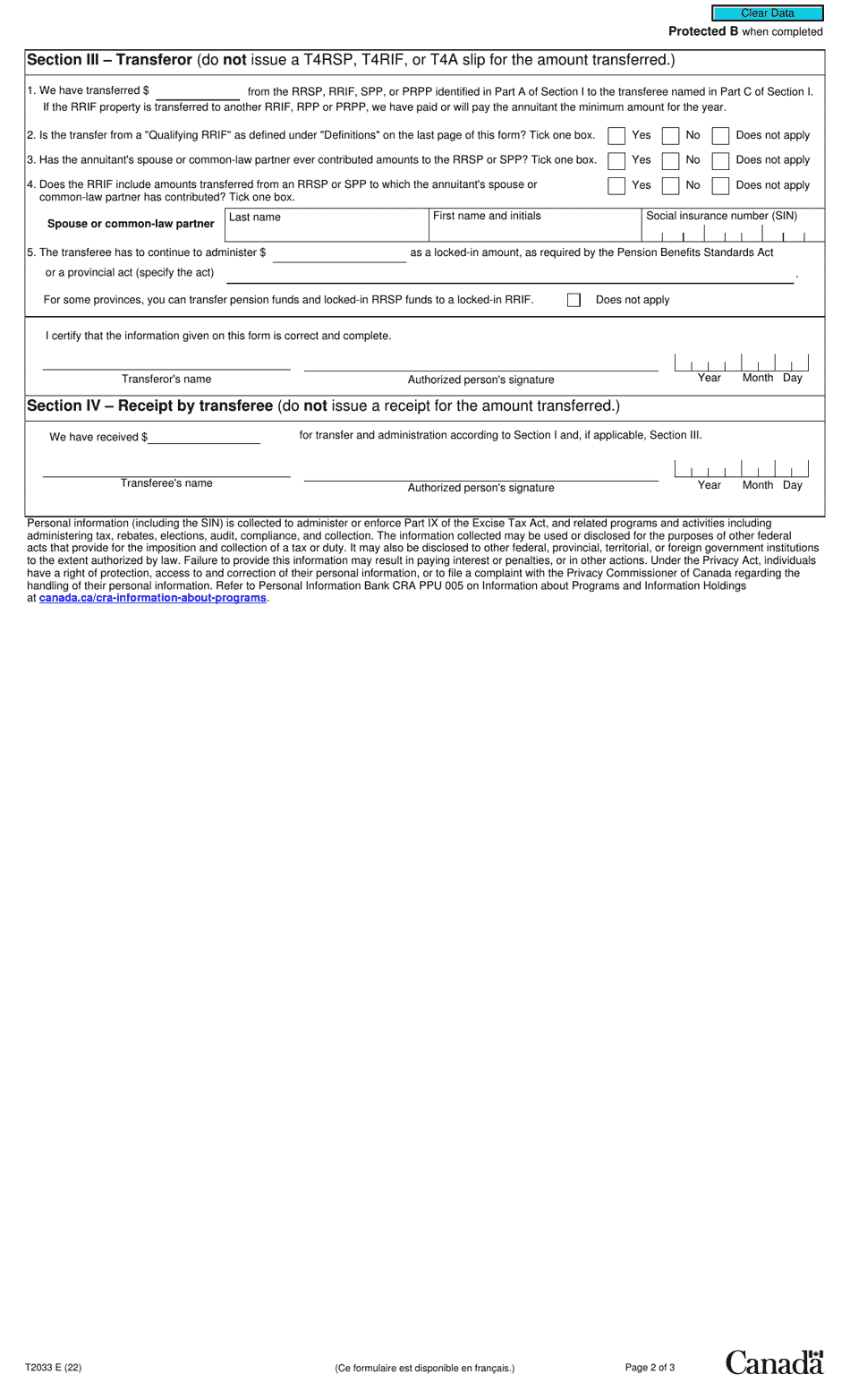

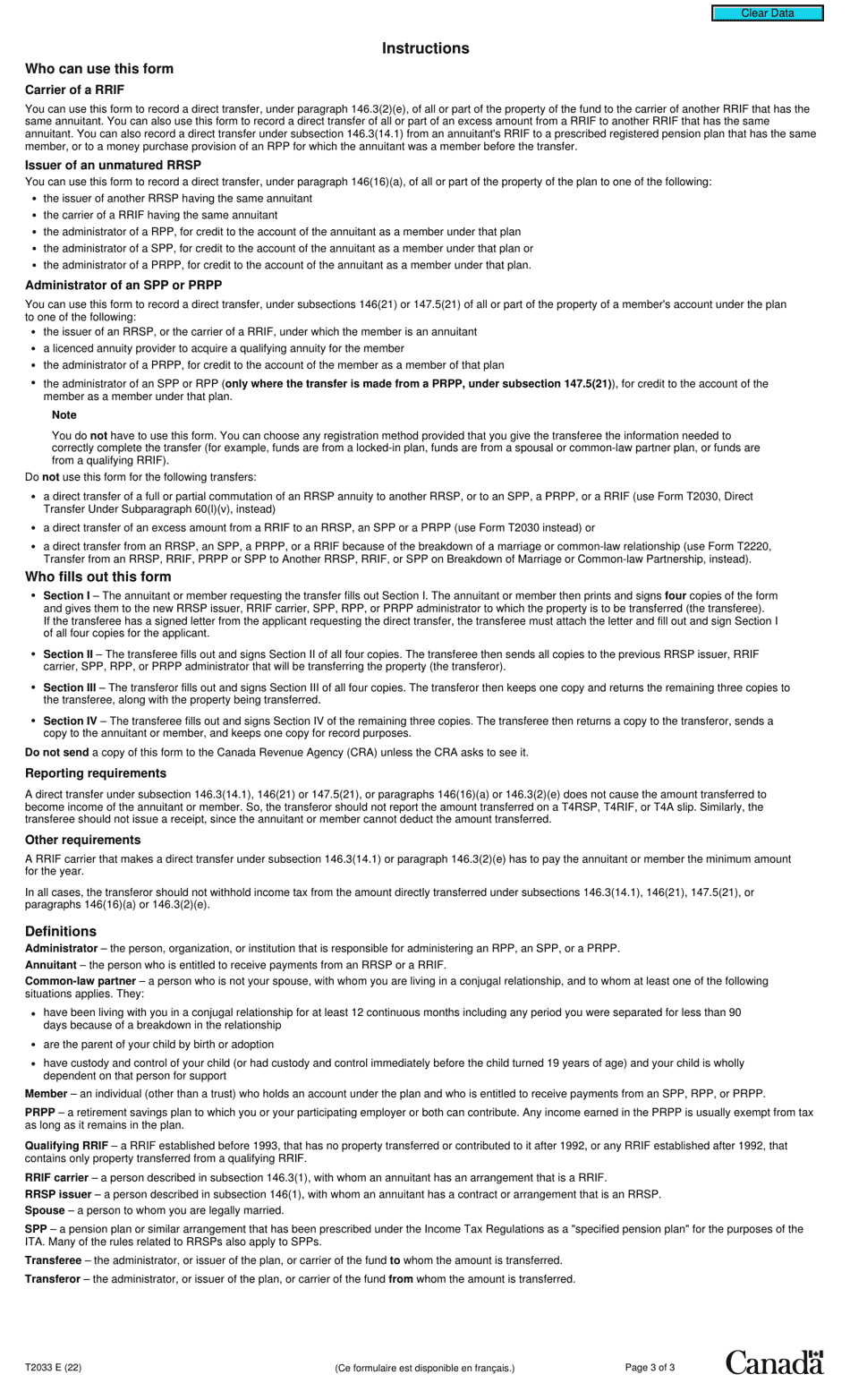

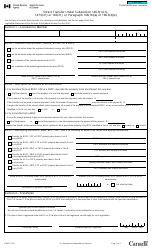

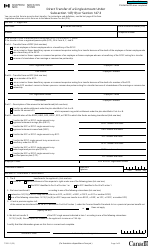

Form T2033 Direct Transfer Under Subsection 146.3(14.1), 147.5(21) or 146(21), or Paragraph 146(16)(A) or 146.3(2)(E) - Canada

Form T2033 Direct Transfer Under Subsection 146.3(14.1), 147.5(21) or 146(21), or Paragraph 146(16)(A) or 146.3(2)(E) - Canada is used for transferring funds from one registered account to another, such as transferring money from one Registered Retirement Savings Plan (RRSP) to another.

The individual or institution transferring funds files the Form T2033 Direct Transfer in Canada.

FAQ

Q: What is Form T2033?

A: Form T2033 is a form used for direct transfers under certain sections of the Canadian tax code.

Q: What is a direct transfer?

A: A direct transfer refers to the transfer of funds or assets directly from one registered plan to another, without incurring tax consequences.

Q: Which sections of the Canadian tax code are covered by Form T2033?

A: Form T2033 is used for direct transfers under subsections 146.3(14.1), 147.5(21) or 146(21), or paragraphs 146(16)(A) or 146.3(2)(E).

Q: What is the purpose of Form T2033?

A: Form T2033 is used to report transfers between registered plans to the Canada Revenue Agency (CRA).

Q: Who needs to file Form T2033?

A: Form T2033 needs to be filed by the transferring plan holder or their authorized representative.

Q: Are there any tax consequences for direct transfers using Form T2033?

A: No, direct transfers made using Form T2033 do not incur tax consequences.