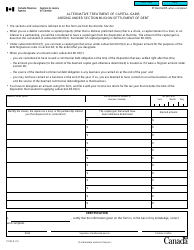

This version of the form is not currently in use and is provided for reference only. Download this version of

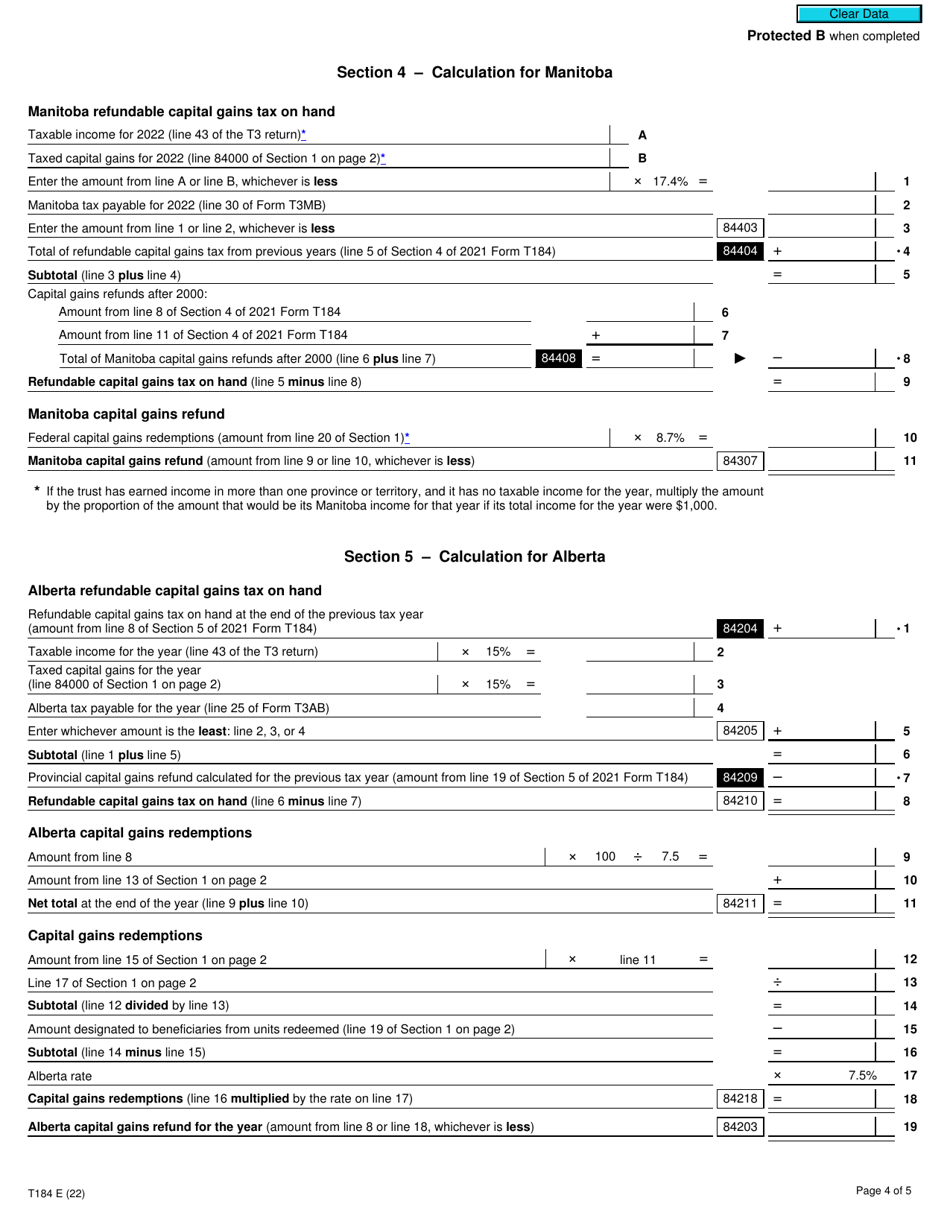

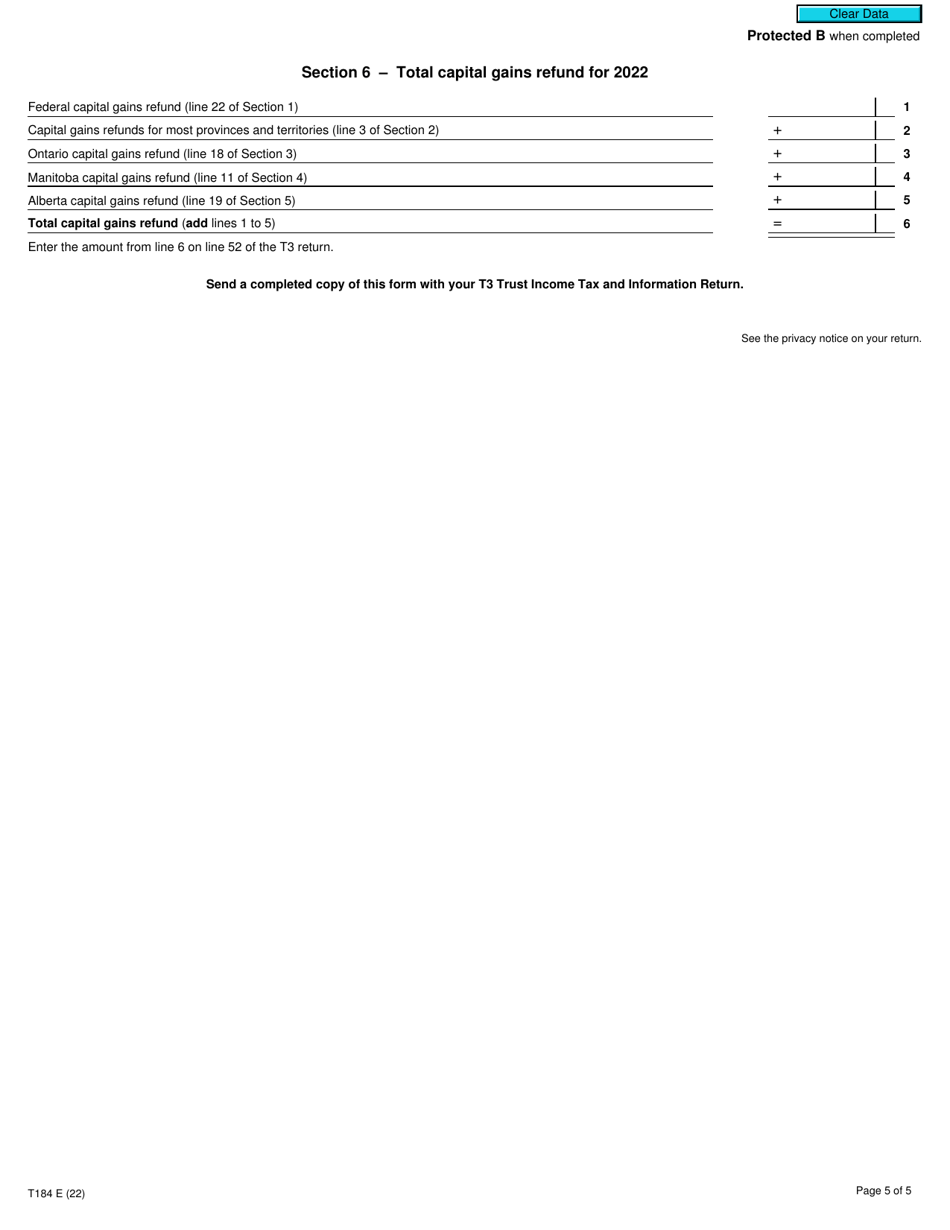

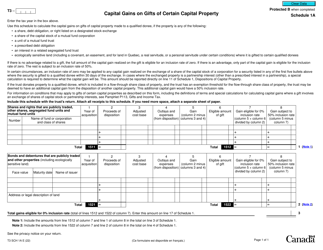

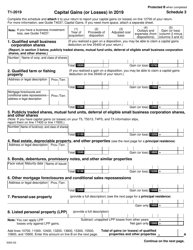

Form T184

for the current year.

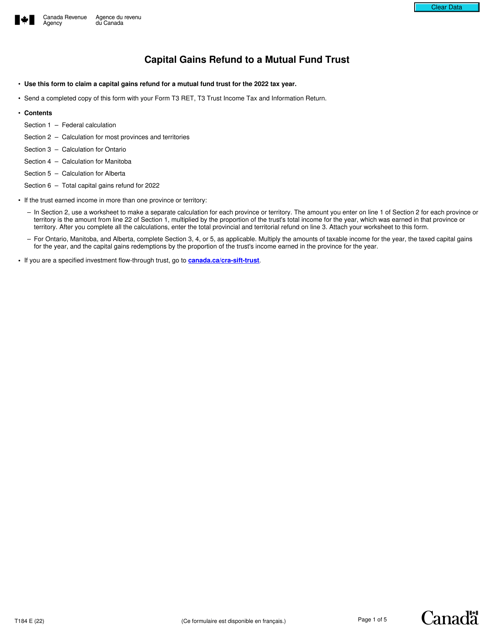

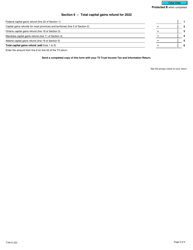

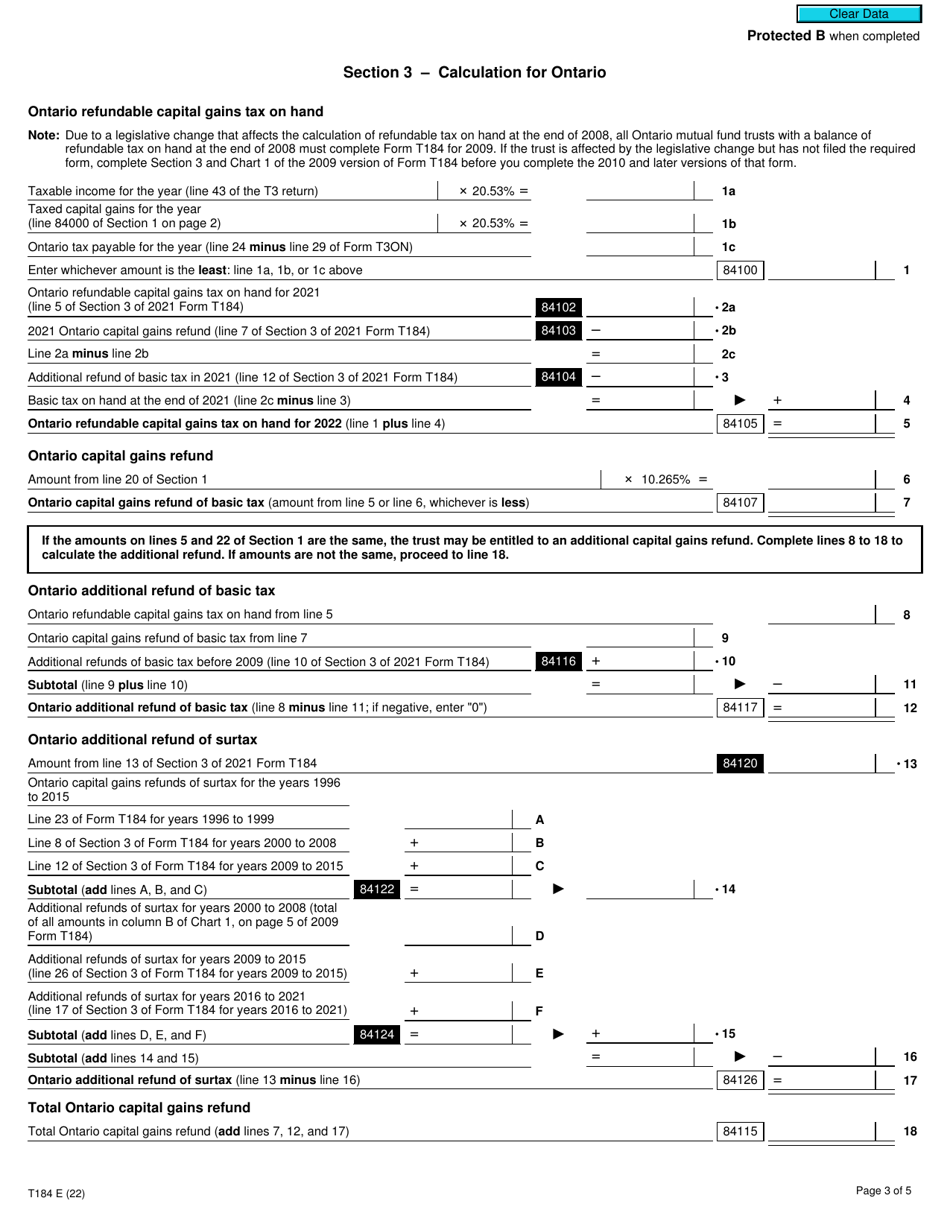

Form T184 Capital Gains Refund to a Mutual Fund Trust - Canada

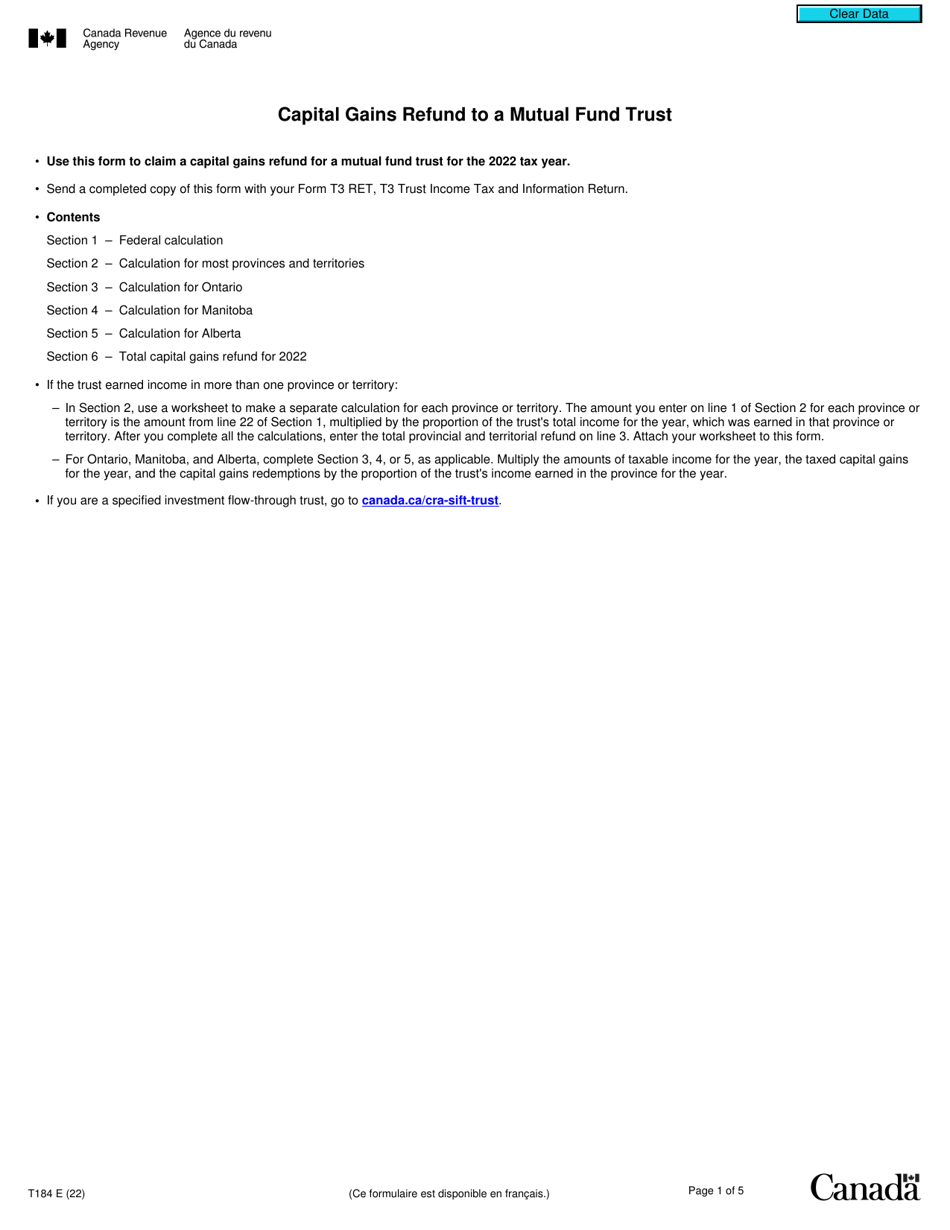

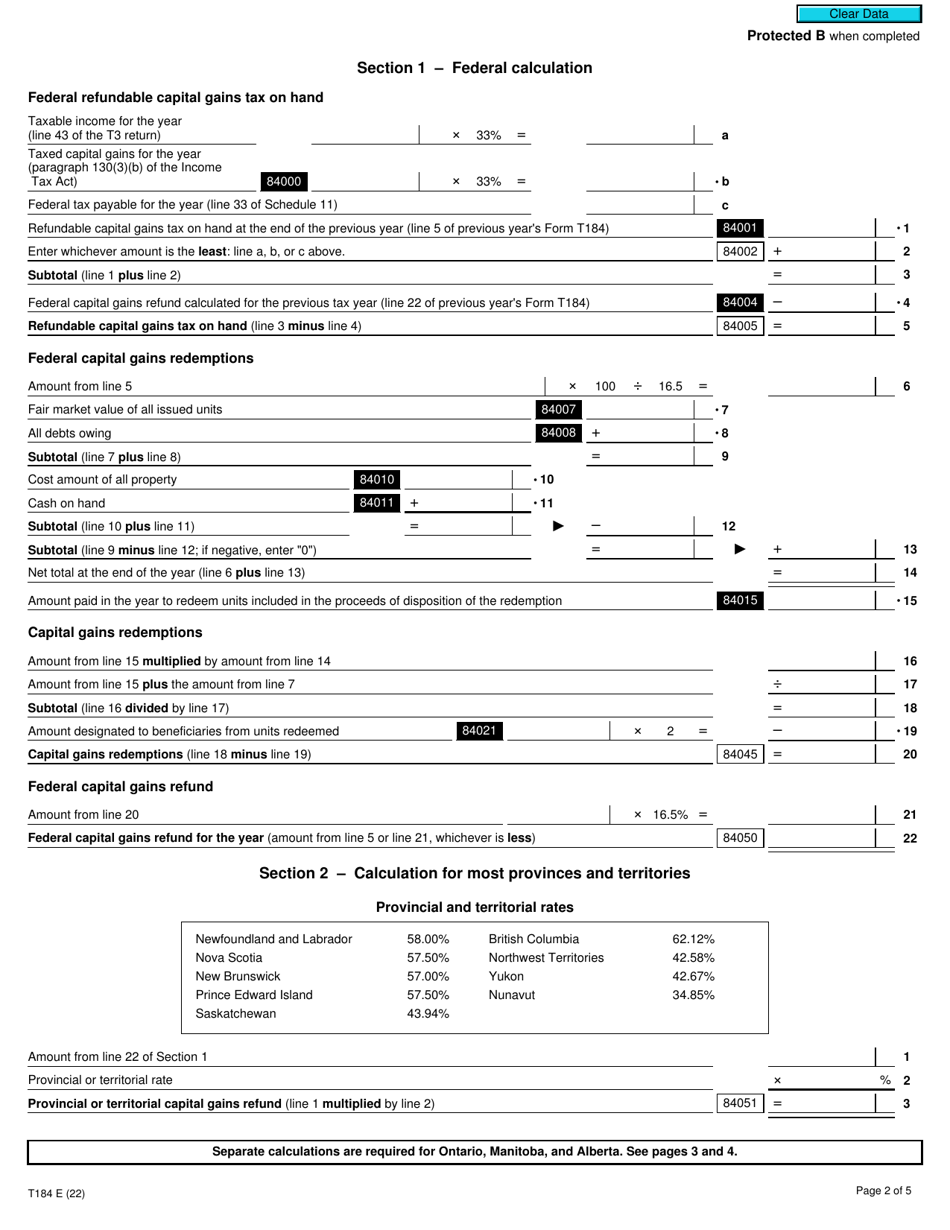

Form T184 is used in Canada to claim a capital gains refund from a mutual fund trust. This form is filed by investors who have sold units of a mutual fund trust and are eligible for a refund of a portion of the capital gains tax paid. It allows investors to report their gains and request the refund from the trust.

The investor who is claiming the capital gains refund would file the Form T184 for a mutual fund trust in Canada.

FAQ

Q: What is Form T184?

A: Form T184 is a tax form in Canada used to request a capital gains refund for a mutual fund trust.

Q: What is a capital gains refund?

A: A capital gains refund is a return of a portion of the taxes paid on capital gains.

Q: Who can use Form T184?

A: Form T184 can be used by individuals who have invested in a mutual fund trust in Canada.

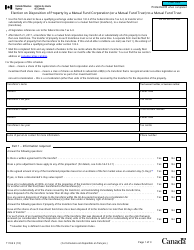

Q: How do I request a capital gains refund using Form T184?

A: To request a capital gains refund, you need to complete Form T184 and submit it to the Canada Revenue Agency (CRA).

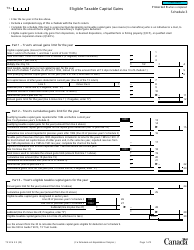

Q: What information do I need to provide on Form T184?

A: On Form T184, you will need to provide details about your investment in the mutual fund trust, including the name of the trust, the date of acquisition, and the amount of the capital gain.

Q: When should I submit Form T184?

A: Form T184 should be submitted along with your annual tax return for the year in which you sold your units in the mutual fund trust.

Q: Are there any deadlines for submitting Form T184?

A: Yes, Form T184 should be submitted within three years from the end of the year in which the capital gain occurred.

Q: Is there a fee for submitting Form T184?

A: No, there is no fee for submitting Form T184.