This version of the form is not currently in use and is provided for reference only. Download this version of

Form T4PS SUM

for the current year.

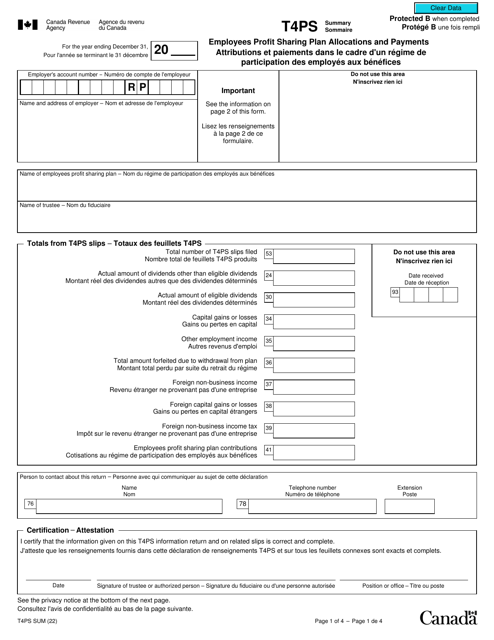

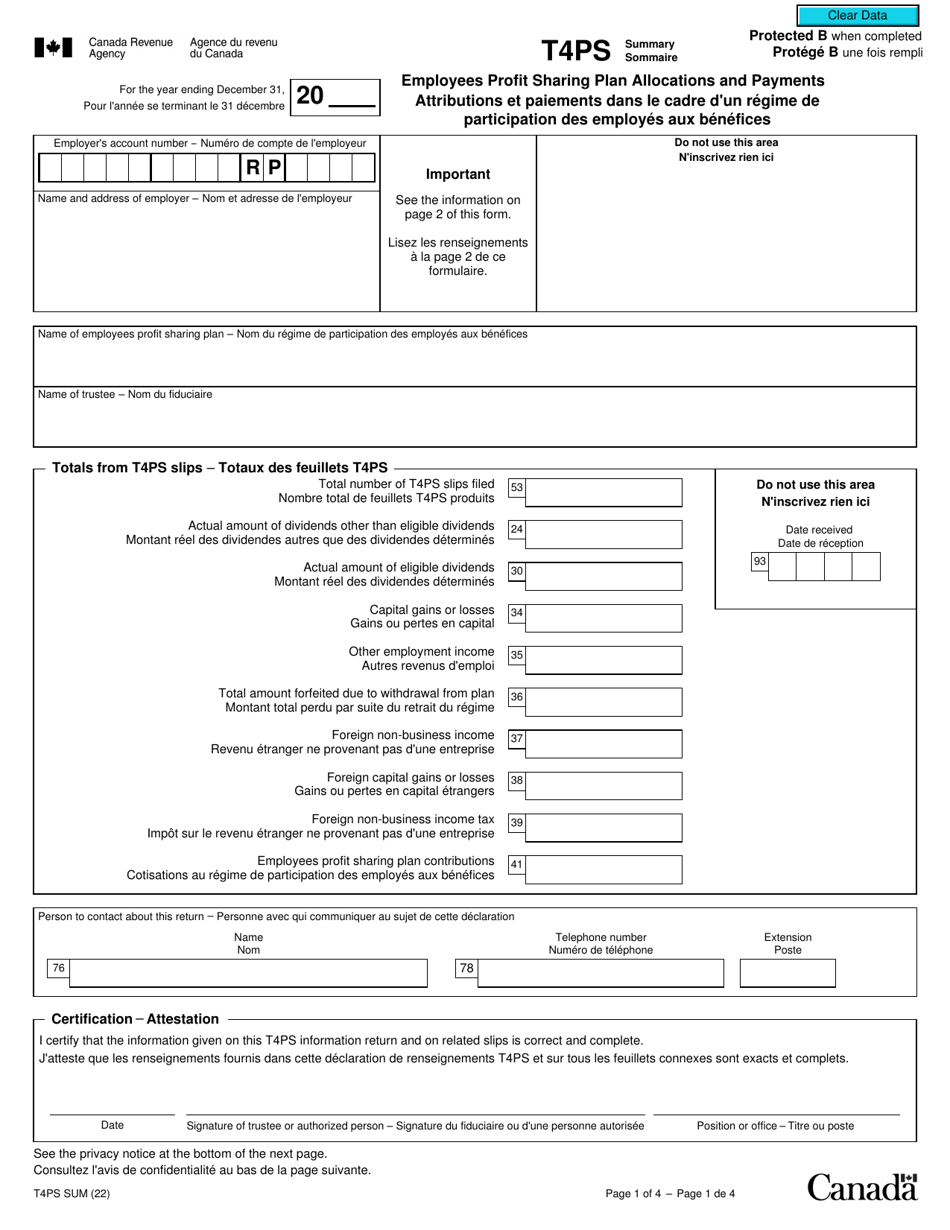

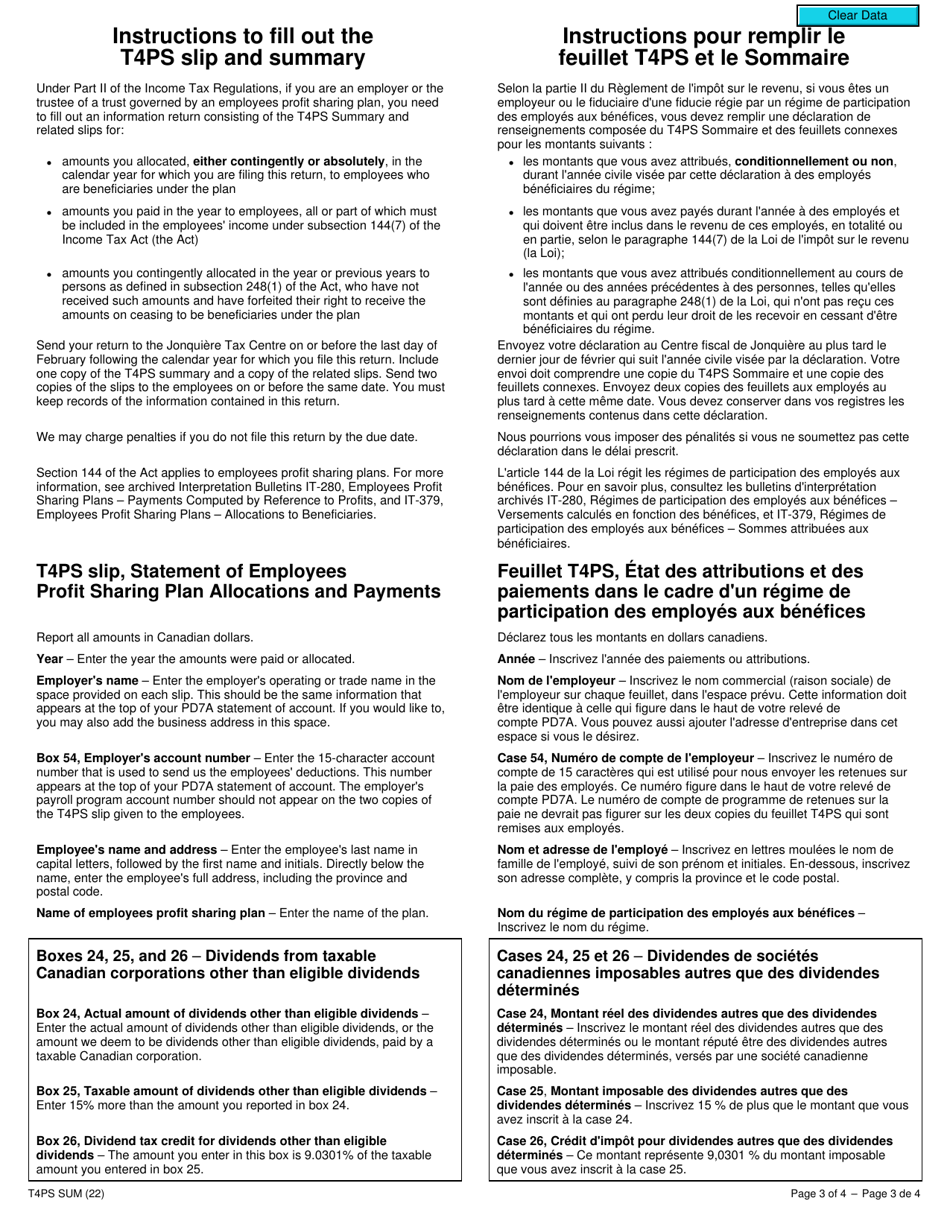

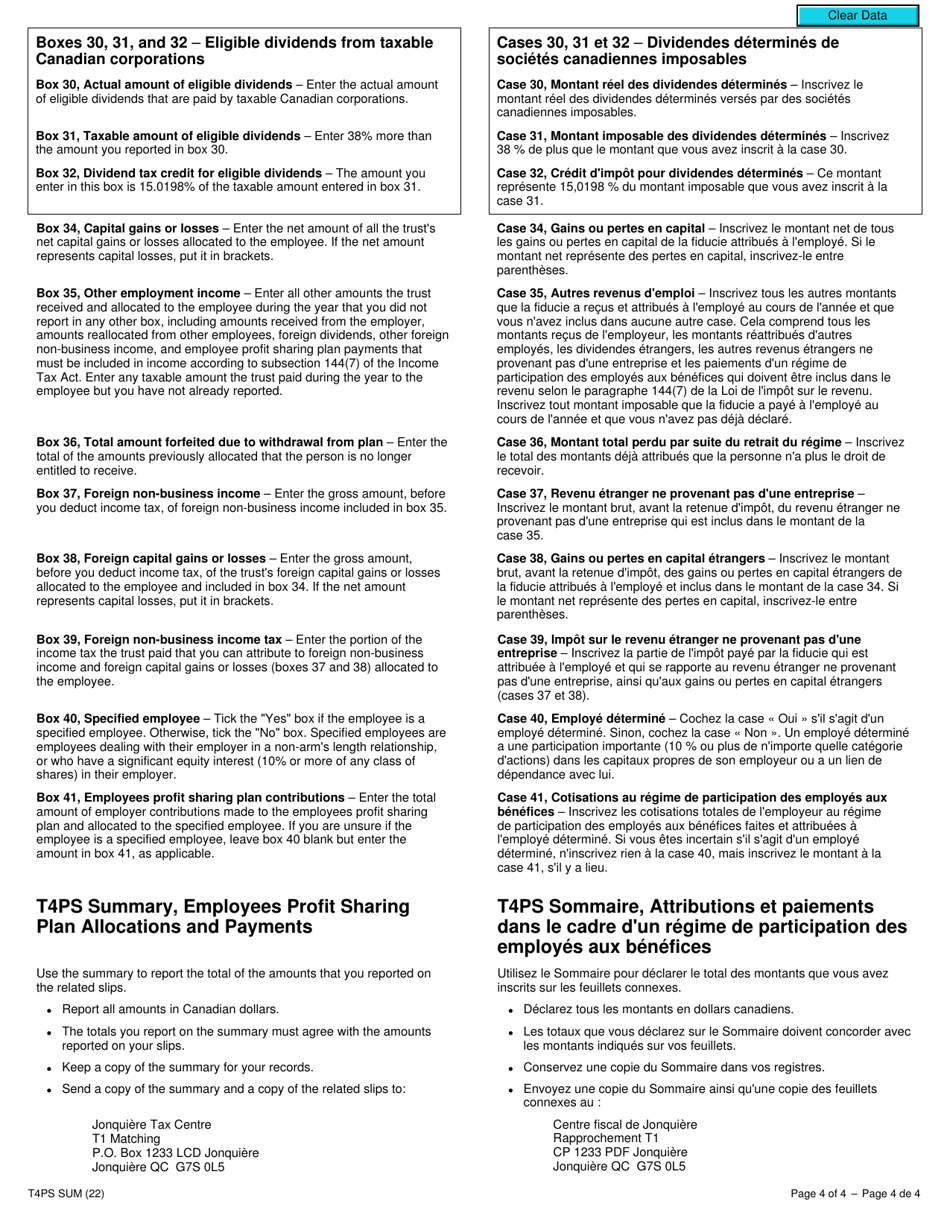

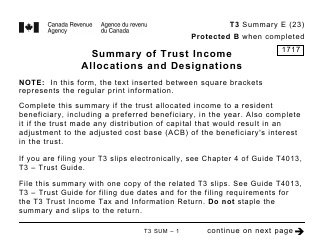

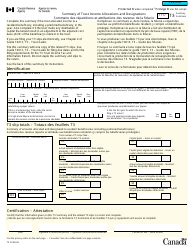

Form T4PS SUM Employees Profit Sharing Plan Allocations and Payments - Canada (English / French)

Form T4PS is used in Canada to report the allocations and payments made by an employer to employees' profit sharing plans. This form is used to report the income earned by employees through the profit sharing plans for income tax purposes. It is available in both English and French.

The employer or the person responsible for managing the profit sharing plan files the Form T4PS SUM Employees Profit Sharing Plan Allocations and Payments in Canada.

FAQ

Q: What is Form T4PS?

A: Form T4PS is a tax form used in Canada to report employees' profit sharing plan allocations and payments.

Q: Who needs to file Form T4PS?

A: Employers who have made allocations or payments from a profit sharing plan to their employees in Canada need to file Form T4PS.

Q: What information is required on Form T4PS?

A: Form T4PS requires information such as the employee's name, social insurance number, and the amounts allocated or paid from the profit sharing plan.

Q: Is Form T4PS available in both English and French?

A: Yes, Form T4PS is available in both English and French.

Q: When is Form T4PS due?

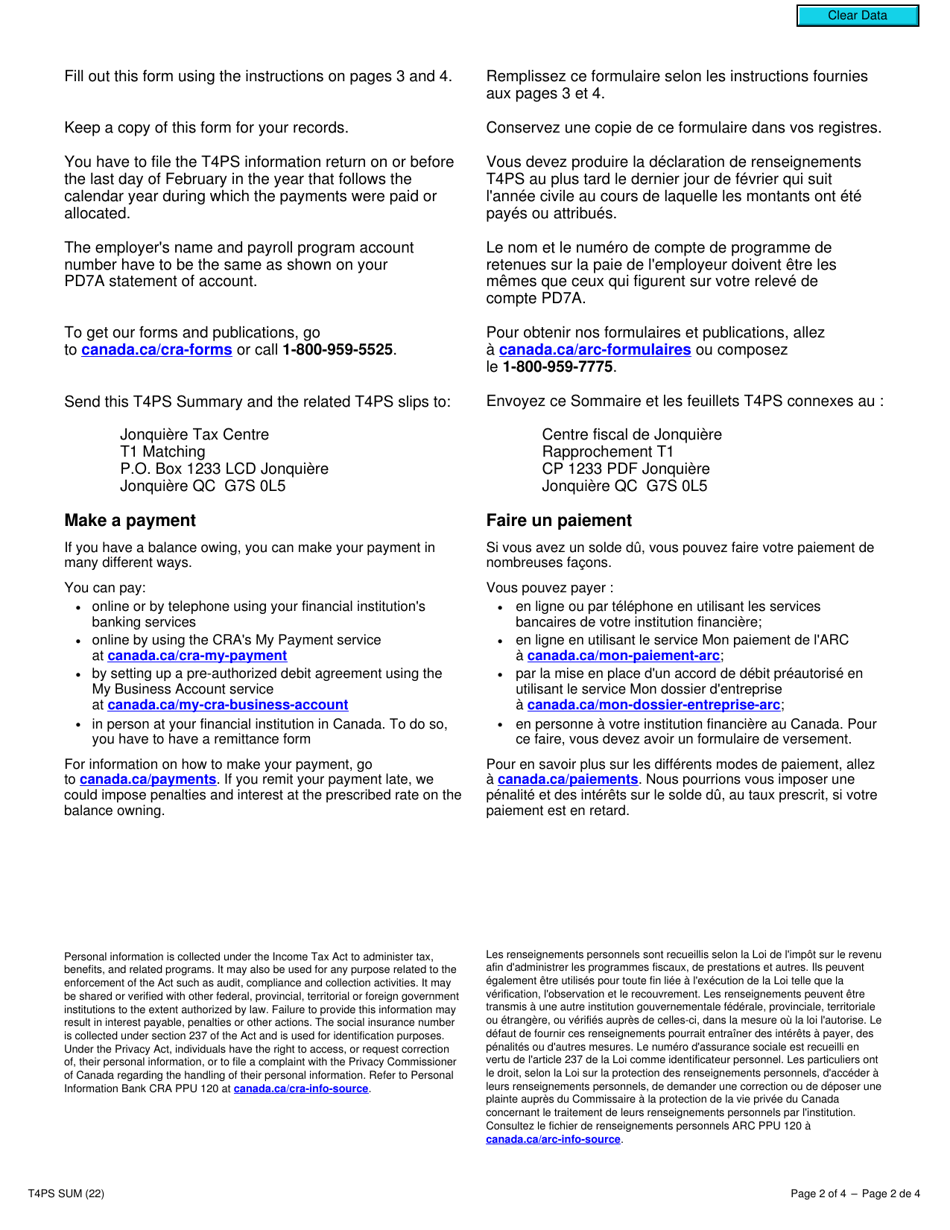

A: Form T4PS is typically due on the last day of February following the calendar year in which the allocations or payments were made.

Q: What are the consequences of not filing Form T4PS?

A: Failure to file Form T4PS or providing incorrect information may result in penalties and interest charges from the Canada Revenue Agency.