This version of the form is not currently in use and is provided for reference only. Download this version of

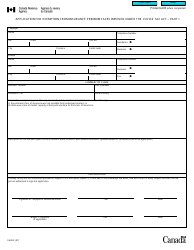

Form T5001

for the current year.

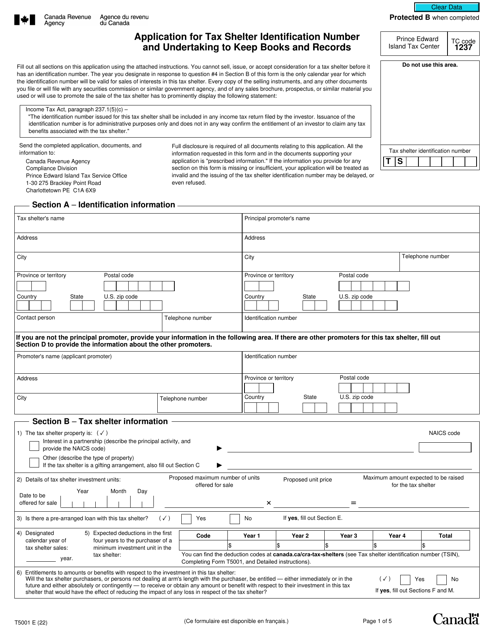

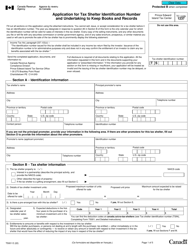

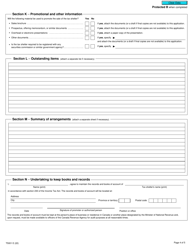

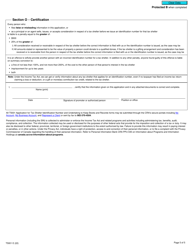

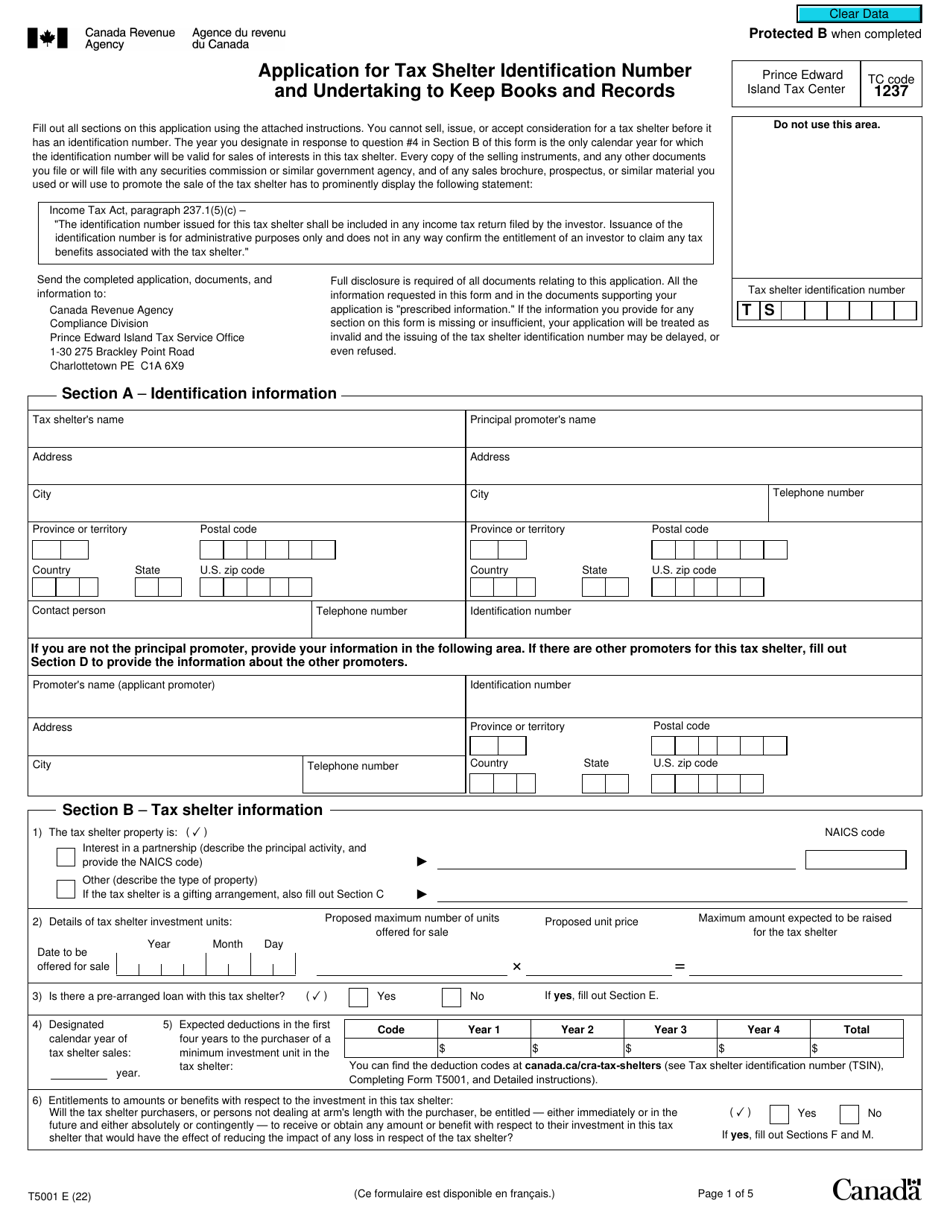

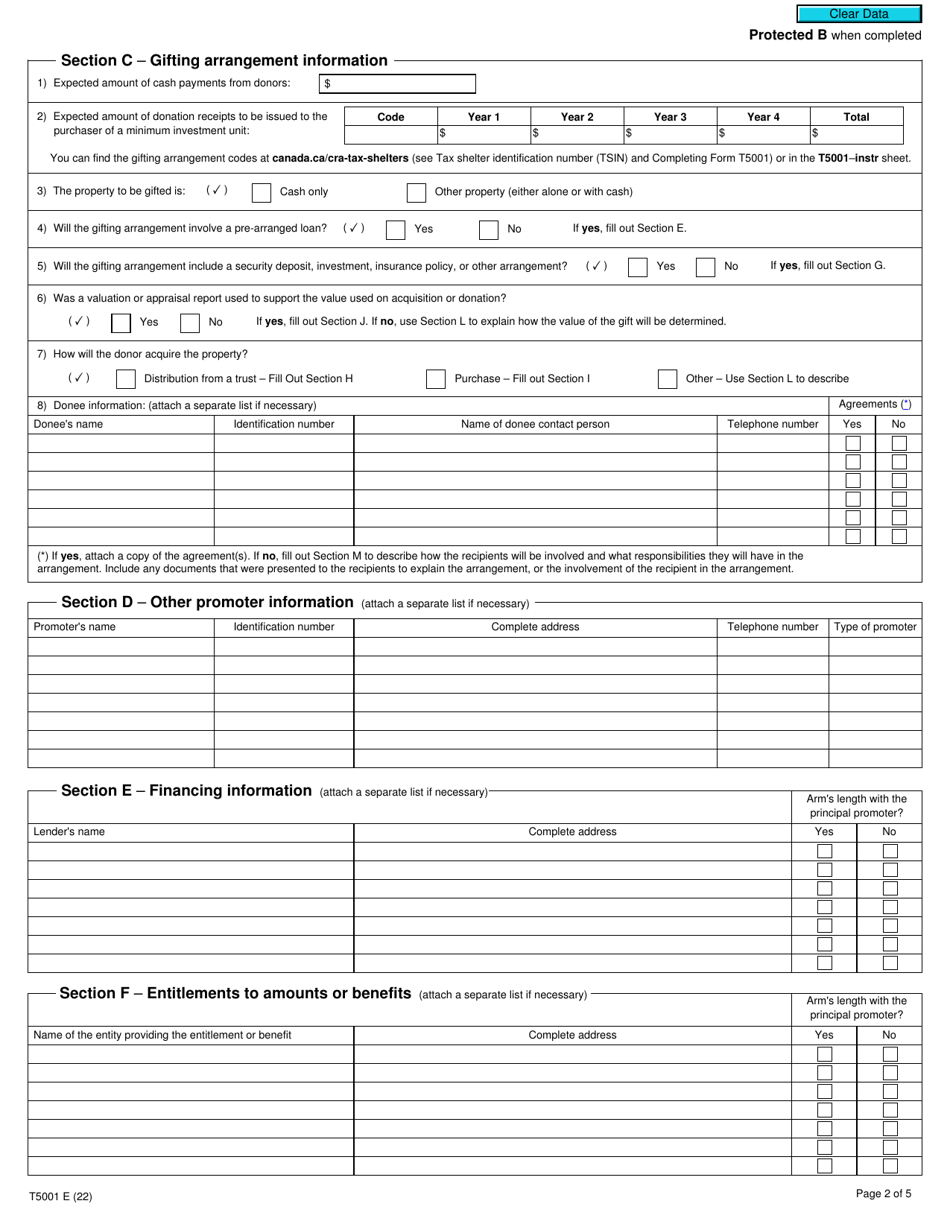

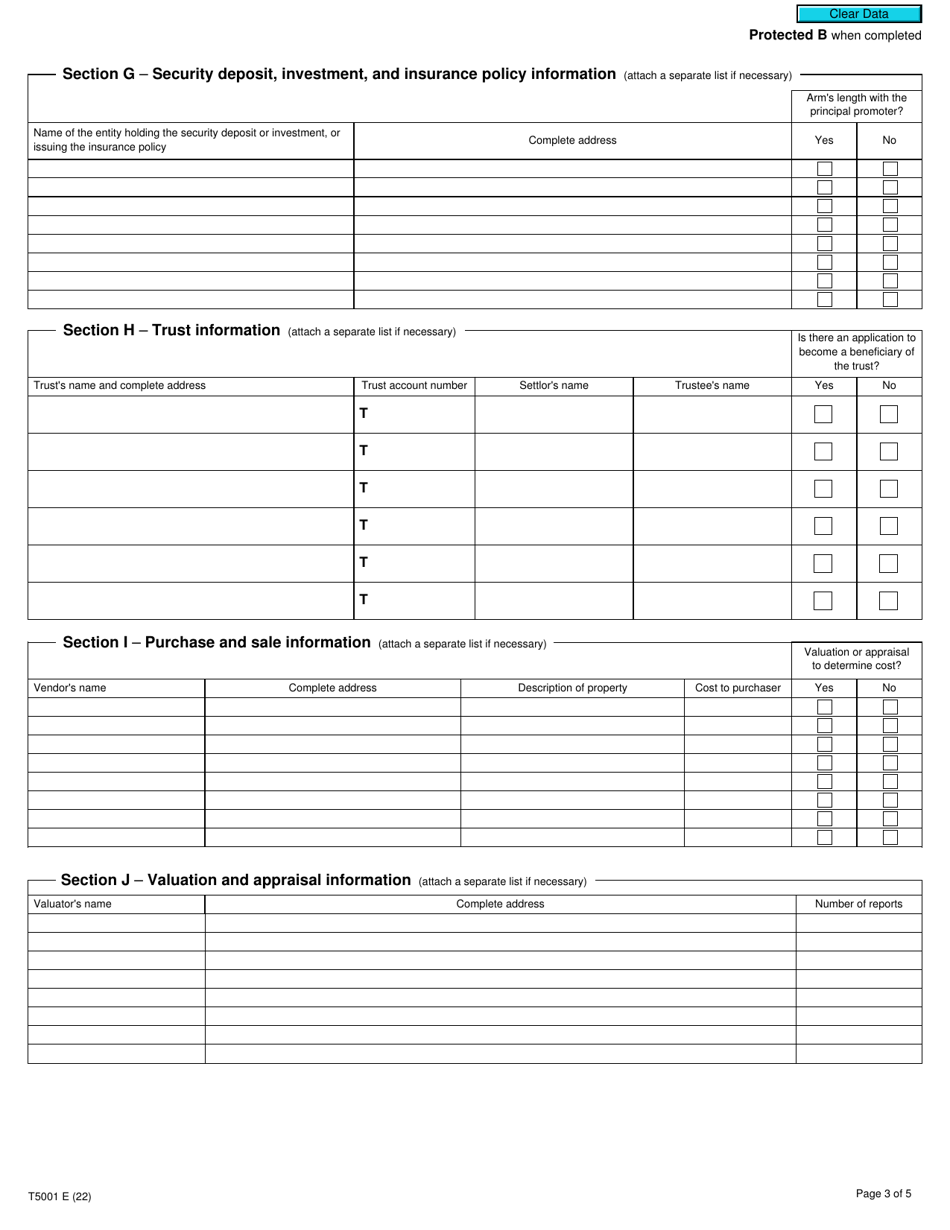

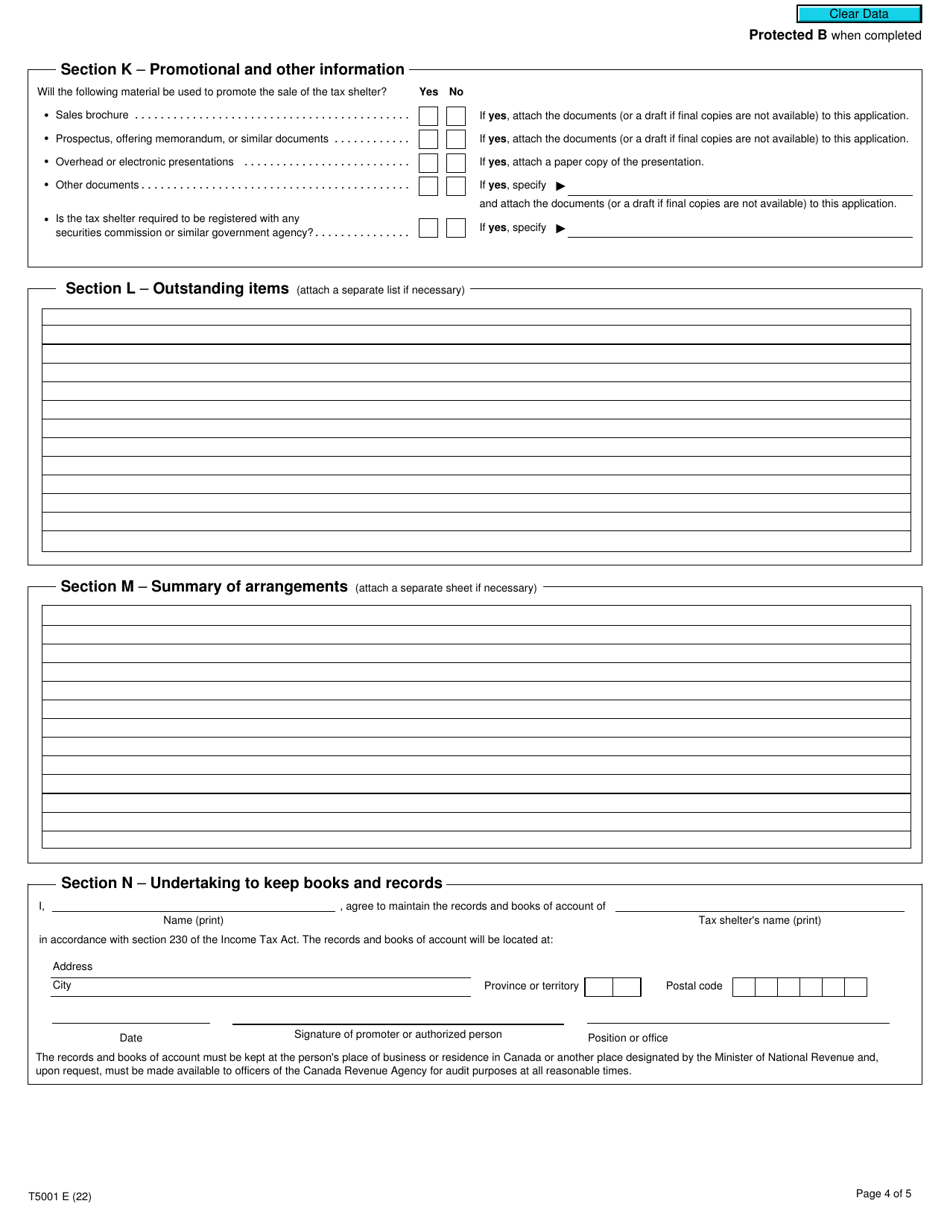

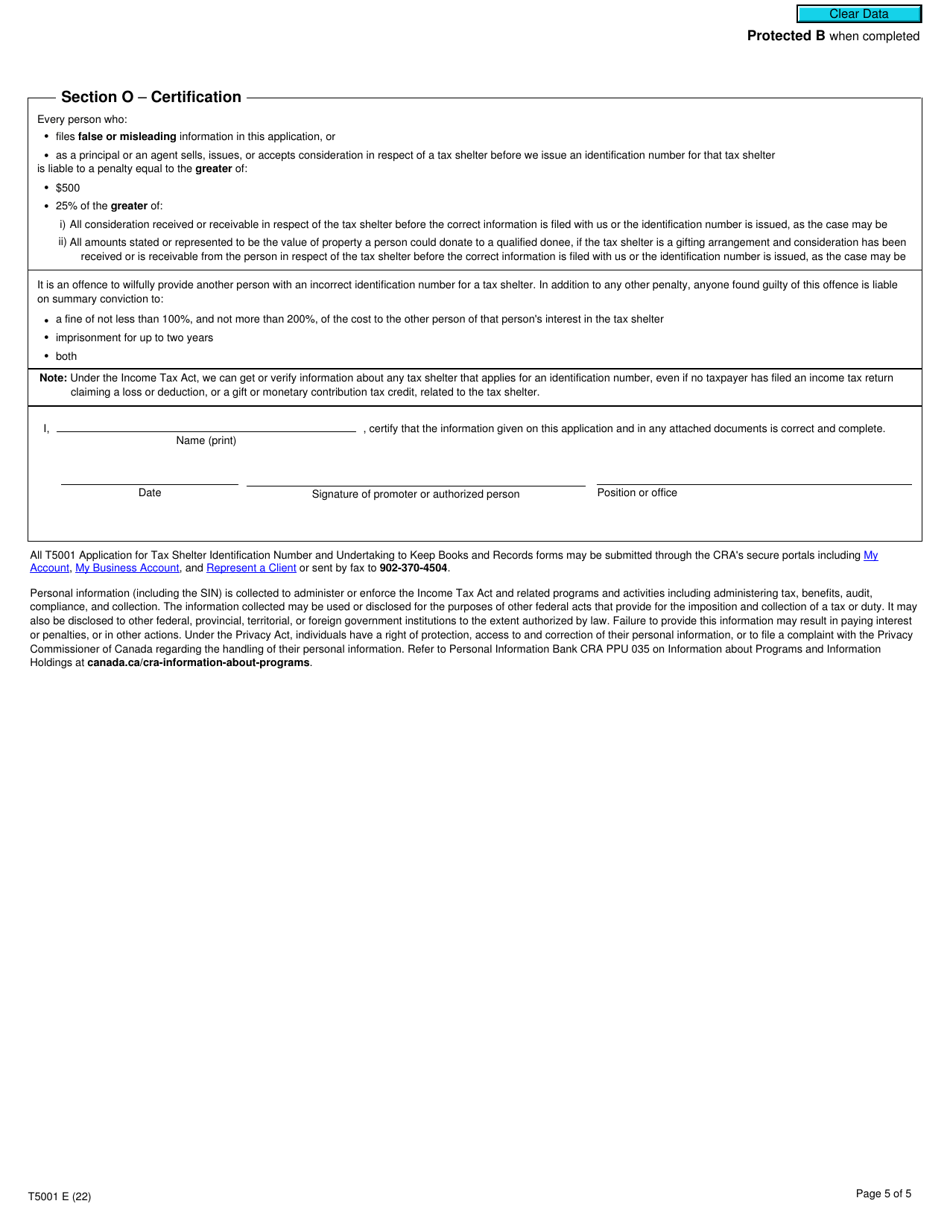

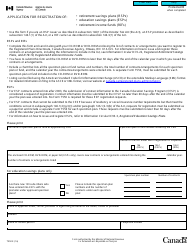

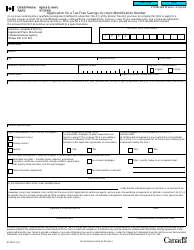

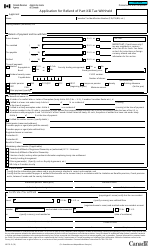

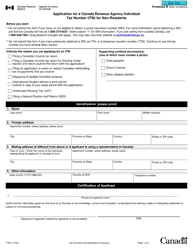

Form T5001 Application for Tax Shelter Identification Number and Undertaking to Keep Books and Records - Canada

Form T5001 is used in Canada to apply for a Tax Shelter Identification Number (TSIN) and make an undertaking to keep books and records. It is required when individuals or organizations are involved in tax shelter activities as defined by the Canada Revenue Agency (CRA). The TSIN is a unique identifier assigned to tax shelters to facilitate monitoring and enforcement by the CRA. The undertaking to keep books and records is a commitment to maintain accurate and complete records related to the tax shelter for a specified period.

The person or entity who operates or manages a tax shelter in Canada is responsible for filing the Form T5001.

FAQ

Q: What is Form T5001?

A: Form T5001 is an application for a Tax Shelter Identification Number and an undertaking to keep books and records in Canada.

Q: Who needs to file Form T5001?

A: Individuals or organizations that are offering or promoting a tax shelter in Canada need to file Form T5001.

Q: What is a Tax Shelter Identification Number?

A: A Tax Shelter Identification Number is a unique number issued by the Canada Revenue Agency (CRA) to identify a specific tax shelter.

Q: Why do I need a Tax Shelter Identification Number?

A: You need a Tax Shelter Identification Number to legally promote or offer a tax shelter in Canada.

Q: What information is required on Form T5001?

A: Form T5001 requires information about the tax shelter, including its name, structure, and any tax benefits or deductions claimed.

Q: Are there any fees for filing Form T5001?

A: No, there are no fees for filing Form T5001.

Q: What happens after I submit Form T5001?

A: The CRA will review your application and issue a Tax Shelter Identification Number if it meets the requirements.

Q: What are the obligations associated with a Tax Shelter Identification Number?

A: If you have a Tax Shelter Identification Number, you are required to keep books and records related to the tax shelter and provide them to the CRA upon request.