This version of the form is not currently in use and is provided for reference only. Download this version of

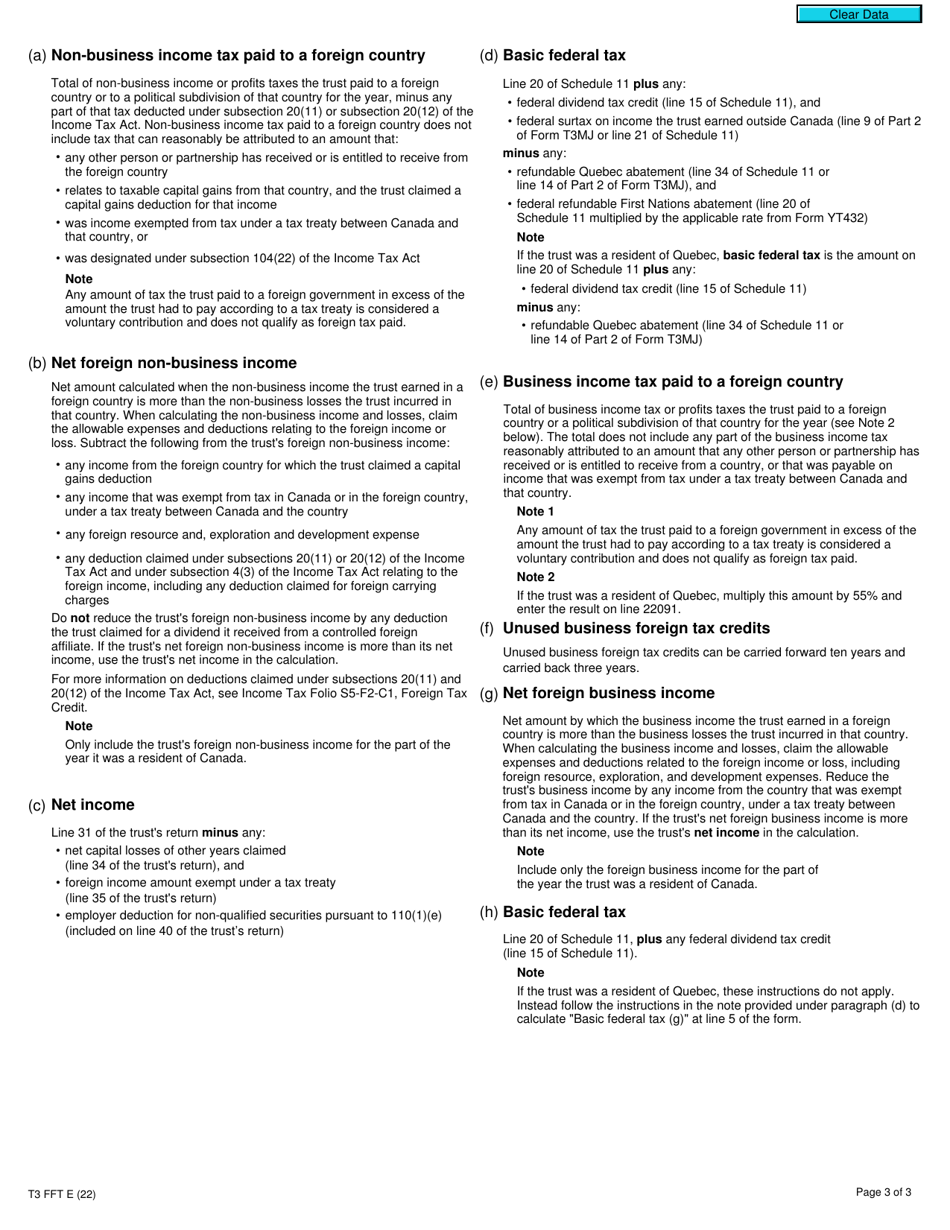

Form T3 FFT

for the current year.

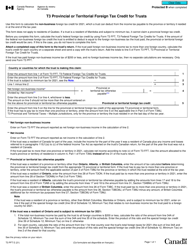

Form T3 FFT T3 Federal Foreign Tax Credits for Trusts - Canada

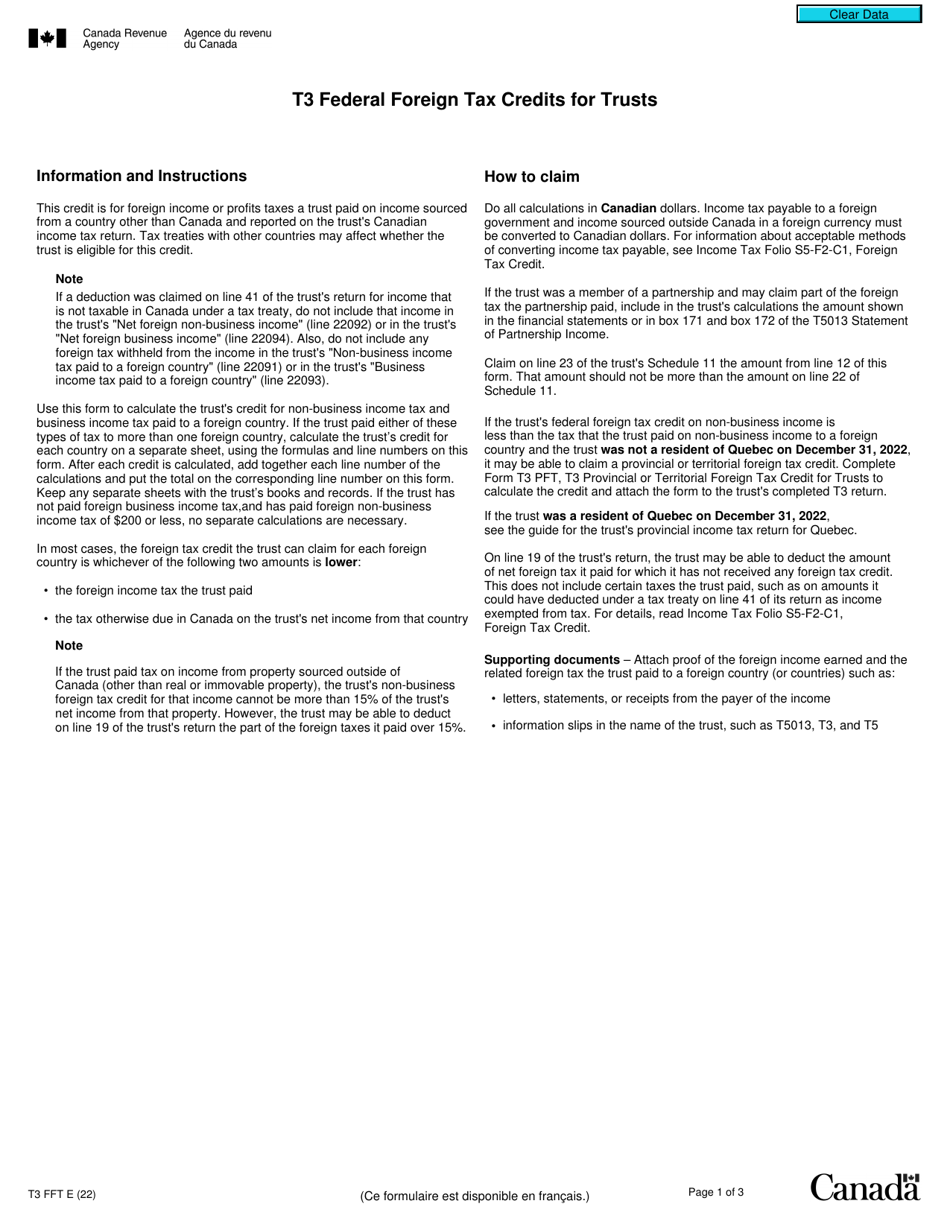

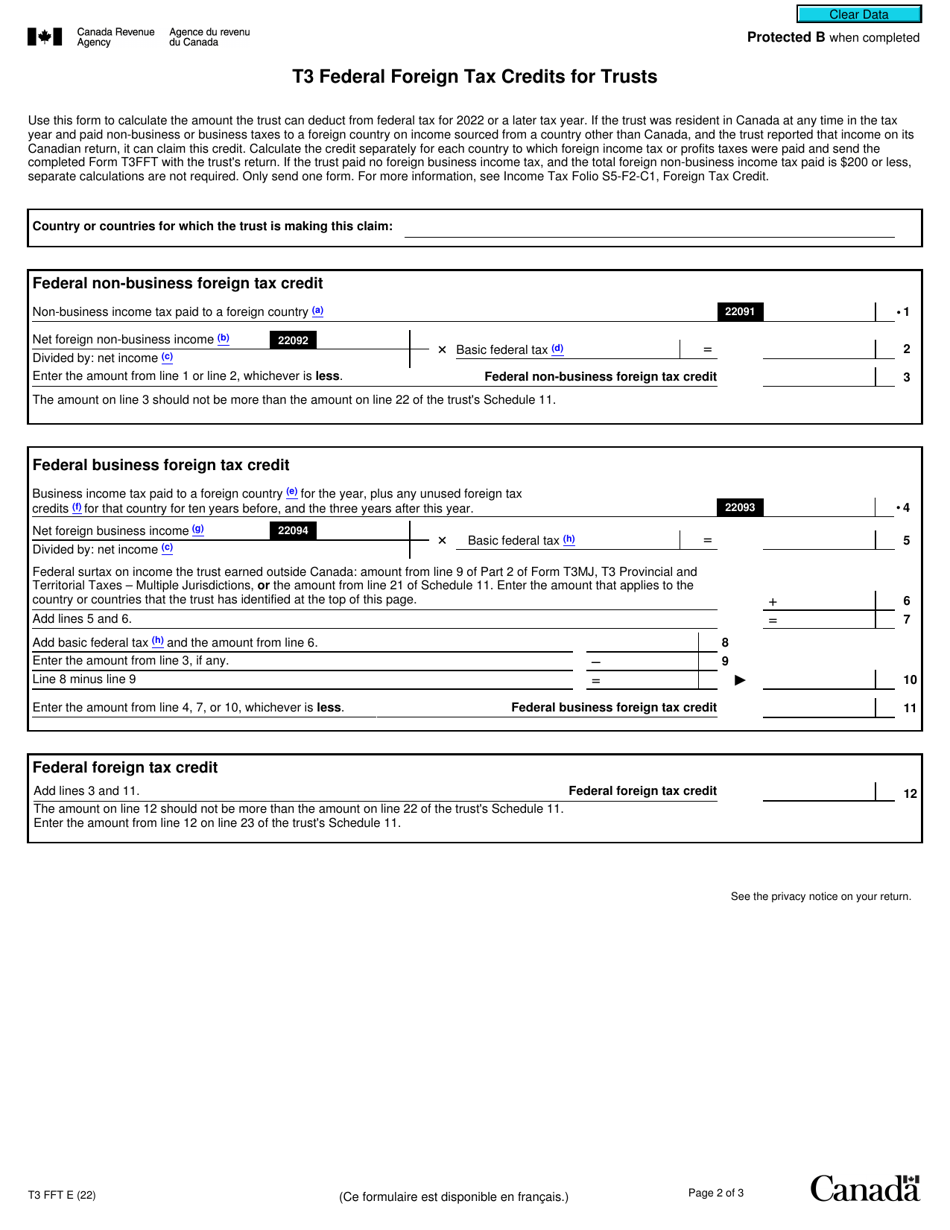

Form T3 FFT (T3 Federal Foreign Tax Credits for Trusts - Canada) is used by Canadian trusts to calculate and report the foreign tax credits they are eligible for. These credits can help reduce the amount of tax a trust needs to pay on foreign income that has already been taxed in another country.

The Form T3 FFT T3 Federal Foreign Tax Credits for Trusts in Canada is filed by trusts that are claiming foreign tax credits.

FAQ

Q: What is Form T3 FFT?

A: Form T3 FFT is a form used in Canada for reporting federal foreign tax credits for trusts.

Q: Who needs to file Form T3 FFT?

A: Trusts in Canada that are claiming federal foreign tax credits.

Q: What are federal foreign tax credits?

A: Federal foreign tax credits are credits given to Canadian taxpayers to offset or reduce their taxes on income earned from foreign sources.

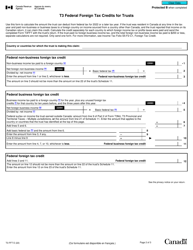

Q: What information is required on Form T3 FFT?

A: The form requires information on the type of foreign income, the amount of foreign tax paid, and any exemptions or deductions claimed.

Q: When is Form T3 FFT due?

A: Form T3 FFT is usually due on or before the filing due date for the trust's income tax return.

Q: Are there any penalties for late or incorrect filing of Form T3 FFT?

A: Yes, there are penalties for late or incorrect filing of Form T3 FFT. It's important to file the form accurately and on time to avoid penalties.