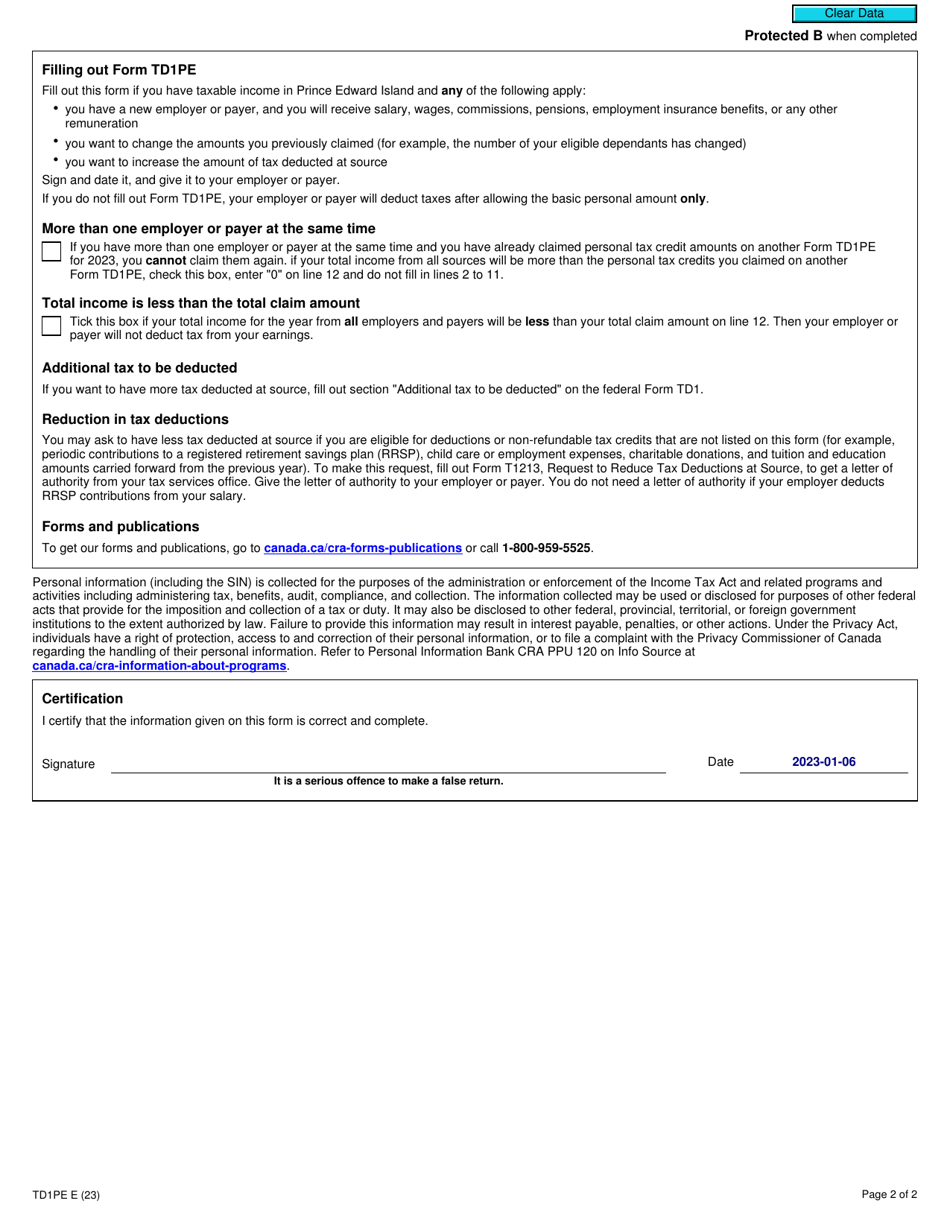

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1PE

for the current year.

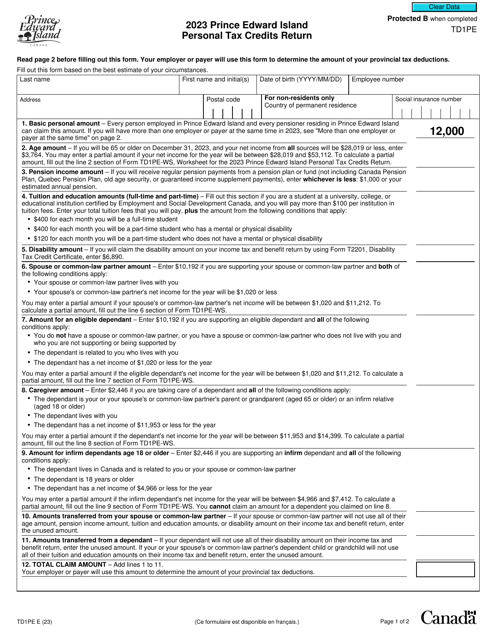

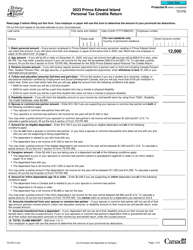

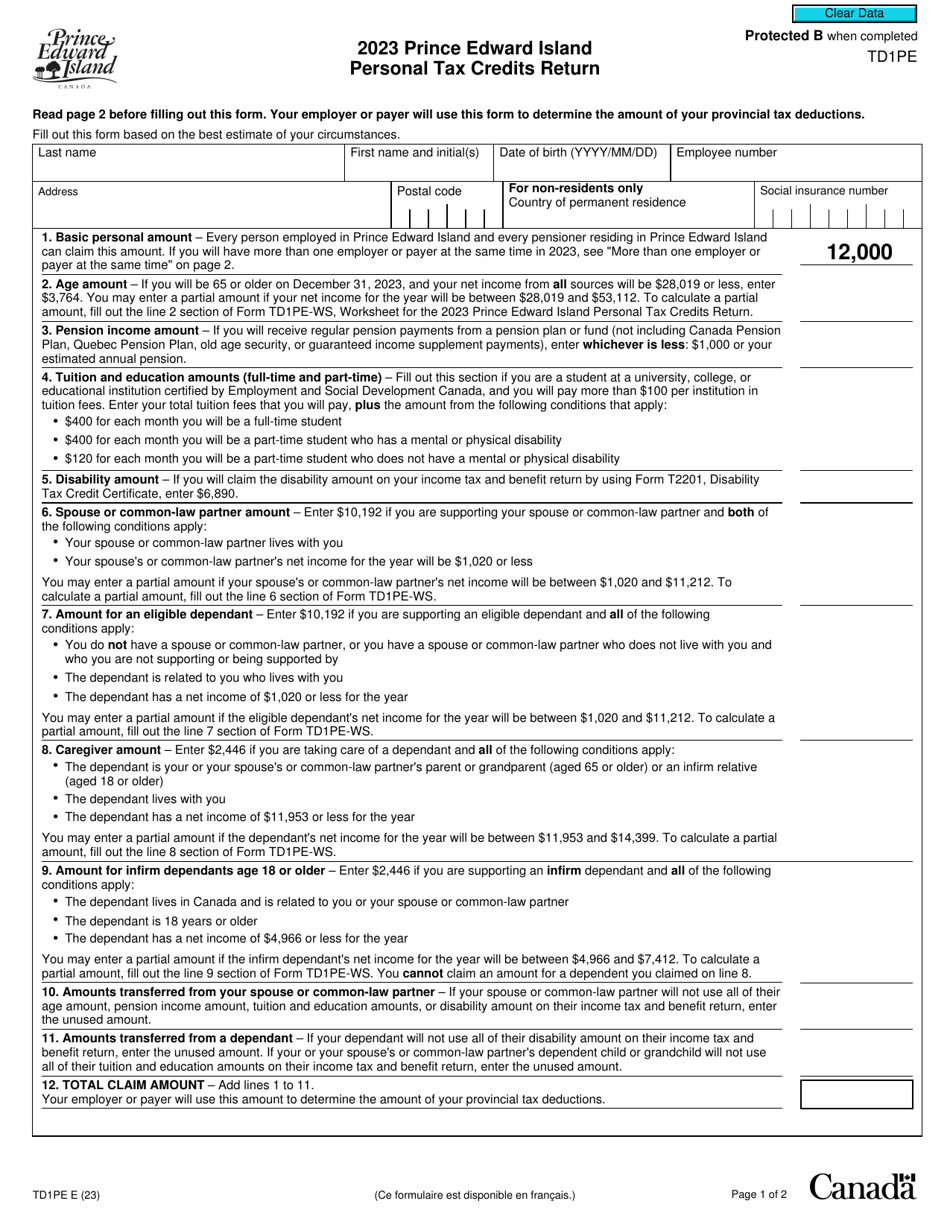

Form TD1PE Prince Edward Island Personal Tax Credits Return - Canada

Form TD1PE, also known as the Prince Edward Island Personal Tax Credits Return, is used by residents of Prince Edward Island in Canada to determine the amount of personal tax credits they are eligible for. By completing this form, individuals can claim various tax credits, deductions, and exemptions, which can reduce the amount of income tax they need to pay.

Individuals who reside in Prince Edward Island (PEI) and want to claim provincial personal tax credits on their income tax return in Canada must file a Form TD1PE (Prince Edward Island Personal Tax Credits Return).

FAQ

Q: What is Form TD1PE?

A: Form TD1PE is the Prince Edward Island Personal Tax Credits Return, which residents of Prince Edward Island in Canada use to declare their personal tax credits.

Q: Who needs to fill out Form TD1PE?

A: Residents of Prince Edward Island who want to claim personal tax credits against their income taxes need to fill out Form TD1PE.

Q: What information does Form TD1PE require?

A: Form TD1PE requires you to provide personal information such as your name, social insurance number, and contact details. It also requires information about your tax credits and deductions.

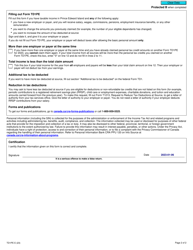

Q: When should I submit Form TD1PE?

A: You should submit Form TD1PE to your employer as soon as possible, preferably at the start of your employment or when your personal tax credits change.

Q: Can I claim tax credits from both Prince Edward Island and another province?

A: No, you can only claim tax credits from one province or territory in Canada. If you live in Prince Edward Island, you should only claim tax credits from that province.

Q: Are there any specific tax credits available in Prince Edward Island?

A: Yes, Prince Edward Island offers various tax credits such as the Basic Personal Amount, the Age Amount, and the Disability Amount. You can check the tax credit details on Form TD1PE.

Q: What happens if I don't submit Form TD1PE to my employer?

A: If you don't submit Form TD1PE to your employer, they will deduct taxes from your pay based on the default federal tax credits, without considering any provincial tax credits you may be eligible for.

Q: Can I make changes to my Form TD1PE during the year?

A: Yes, if your personal tax credits change during the year, you can submit a new Form TD1PE to your employer to reflect those changes.

Q: Do I need to keep a copy of Form TD1PE for my records?

A: Yes, it is recommended to keep a copy of Form TD1PE for your records in case you need to refer to it in the future or if the Canada Revenue Agency requests it.