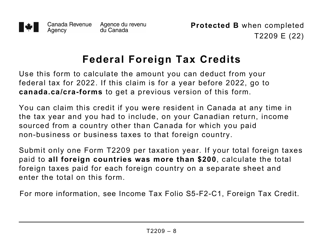

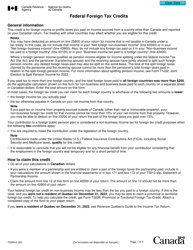

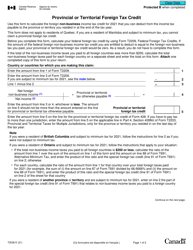

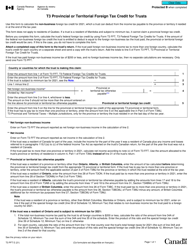

Form T2209 Federal Foreign Tax Credits - Large Print - Canada

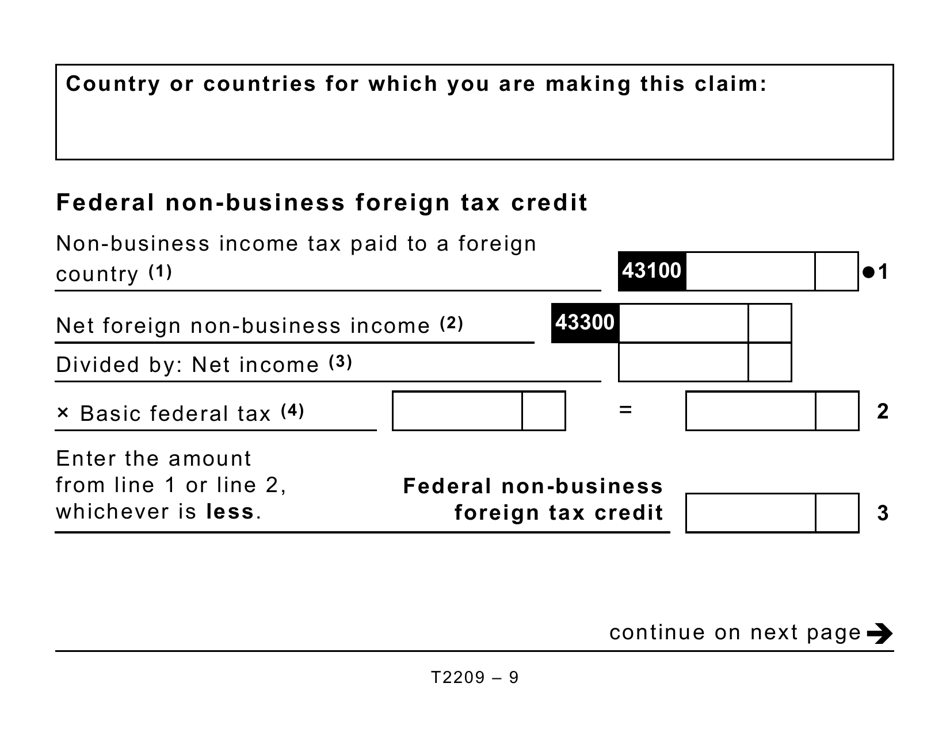

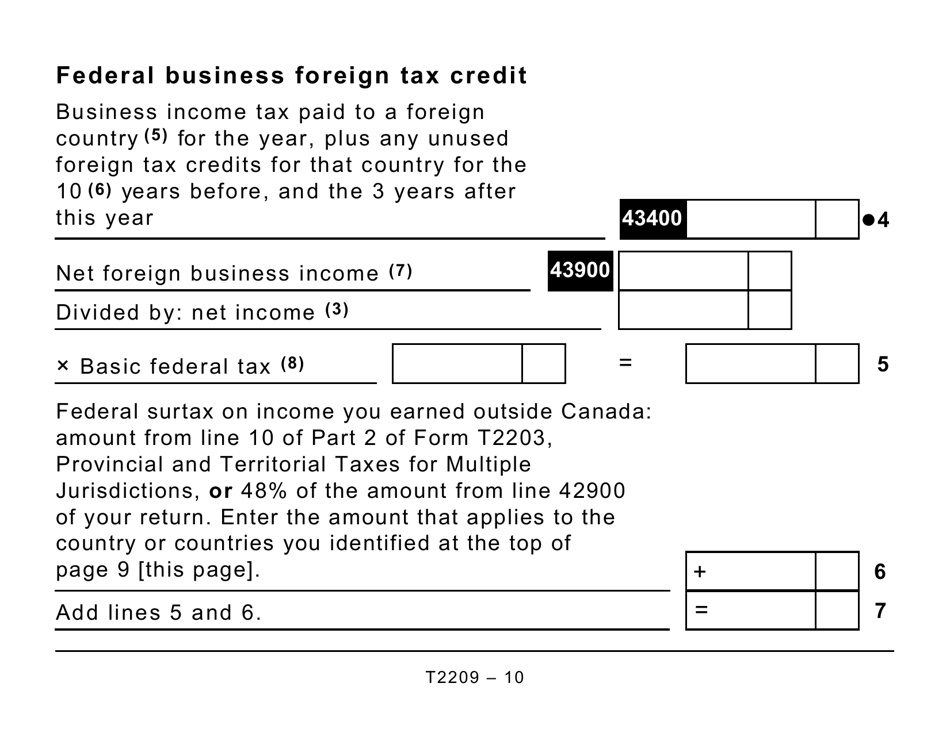

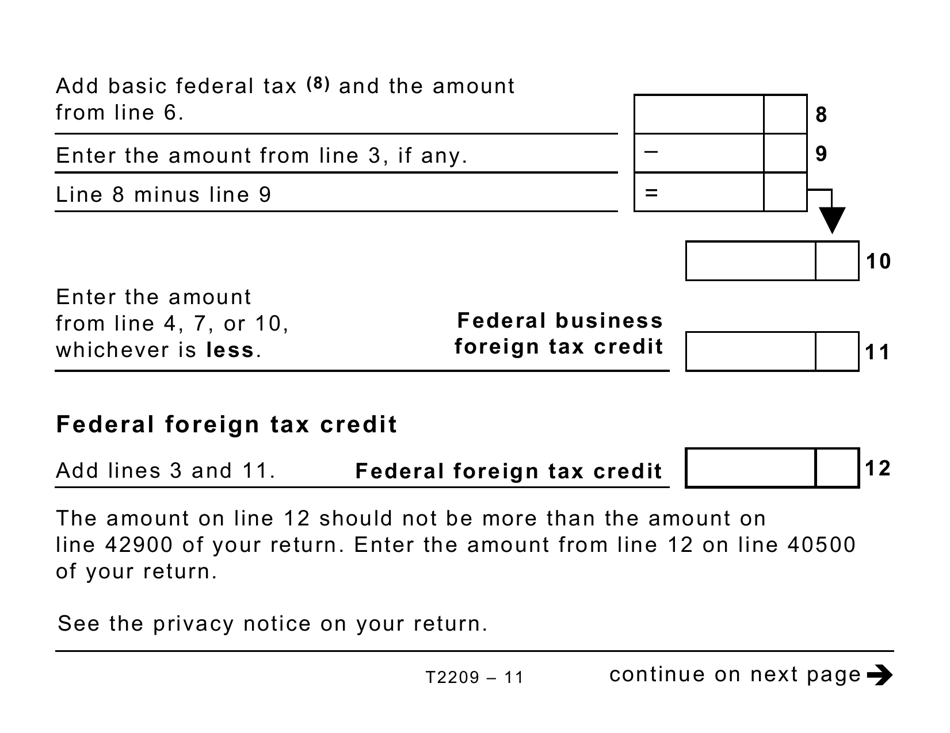

Form T2209 Federal Foreign Tax Credits - Large Print - Canada is used by individuals and corporations in Canada to claim a tax credit for foreign taxes paid on income that has already been taxed in another country. This form helps taxpayers reduce their Canadian tax liability by offsetting the taxes they have paid to foreign countries.

Individuals who are Canadian residents and have paid foreign taxes on income earned outside of Canada can file Form T2209 Federal Foreign Tax Credits - Large Print in Canada. This form allows individuals to claim a credit for the foreign taxes paid, reducing their overall tax liability in Canada.

FAQ

Q: What is Form T2209?

A: Form T2209 is a federal tax form used in Canada to claim foreign tax credits.

Q: What are foreign tax credits?

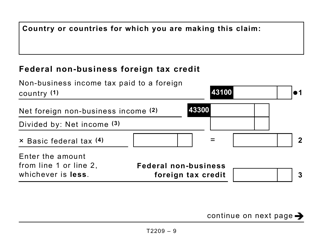

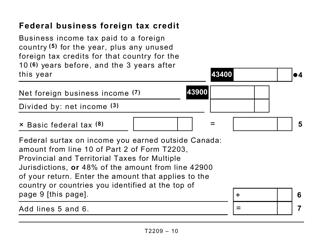

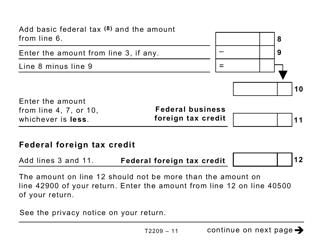

A: Foreign tax credits are credits that can be claimed to offset taxes paid on income earned in foreign countries.

Q: Who can use Form T2209?

A: Canadian residents who have paid foreign taxes on income earned in another country can use Form T2209.

Q: What information is required on Form T2209?

A: Form T2209 requires information such as the foreign income earned, the amount of foreign taxes paid, and any deductions or exemptions that apply.

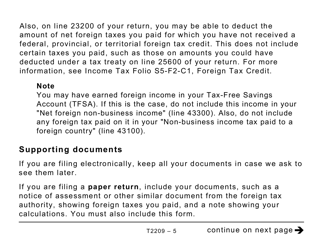

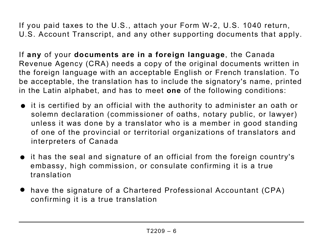

Q: Do I need to attach any supporting documents with Form T2209?

A: Yes, you may be required to attach certain supporting documents such as copies of foreign tax returns or tax payment receipts.

Q: When should I file Form T2209?

A: Form T2209 should be filed with your annual income tax return.

Q: What will happen if I don't file Form T2209?

A: If you are eligible for foreign tax credits but fail to file Form T2209, you may miss out on potential tax savings.

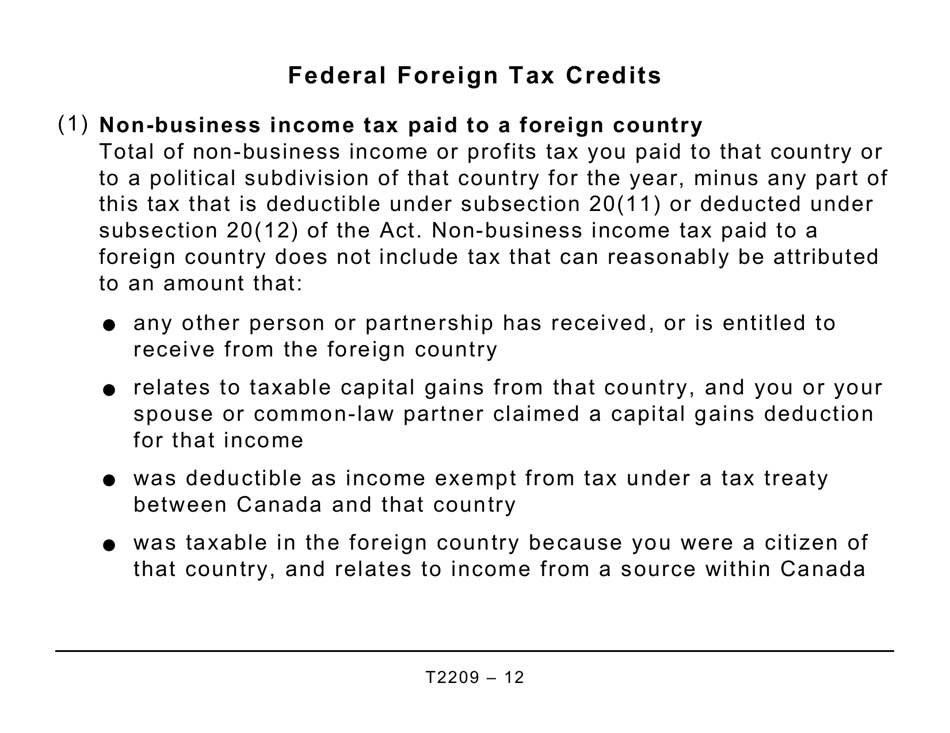

Q: Can I claim foreign tax credits for taxes paid to any country?

A: Generally, you can claim foreign tax credits for taxes paid to any country, as long as the taxes were paid on income that is also subject to Canadian tax.