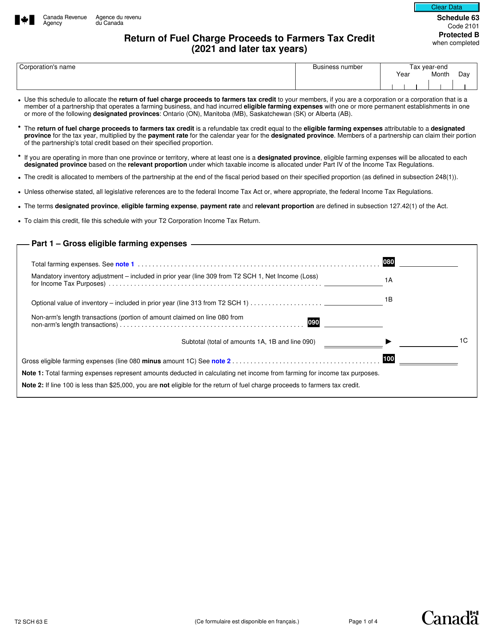

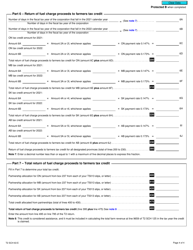

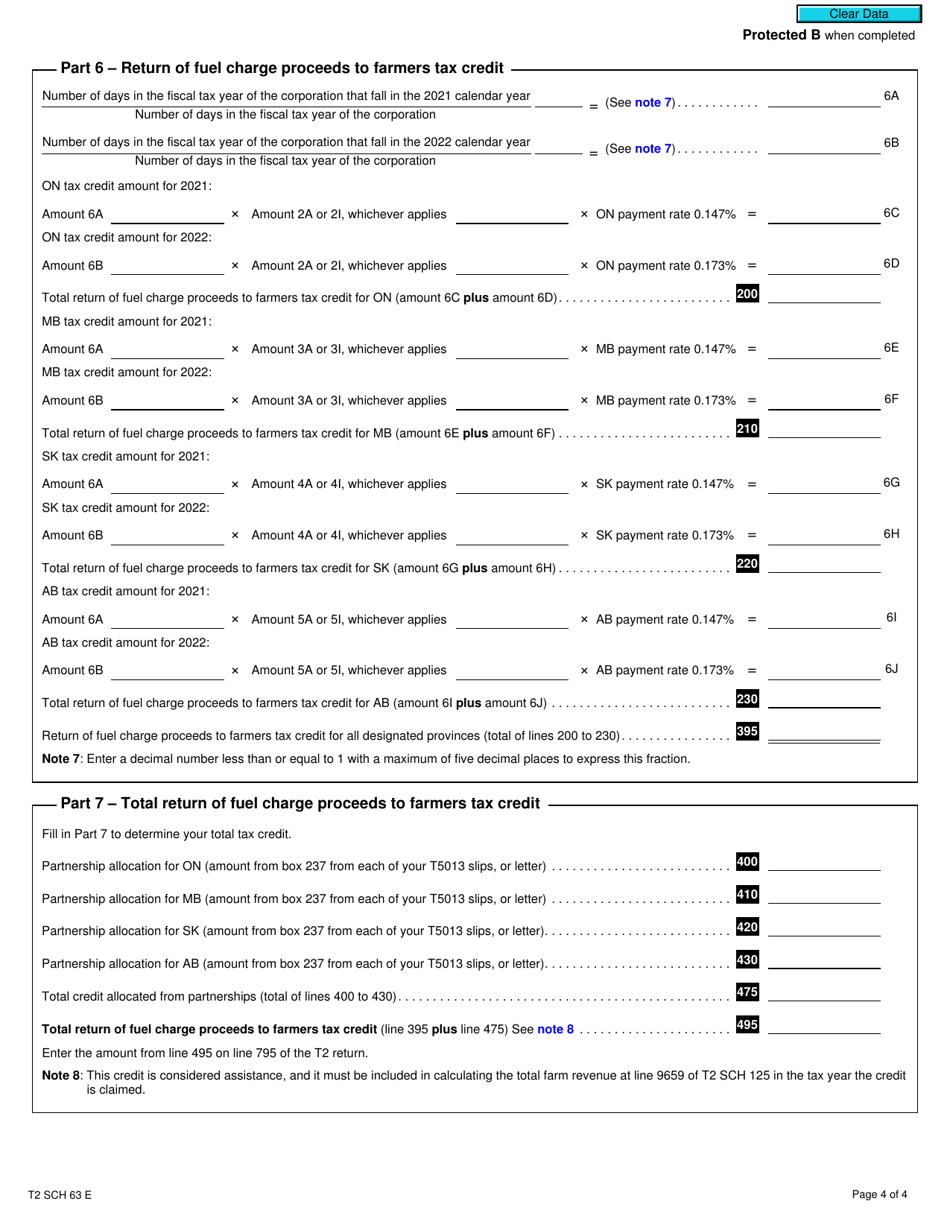

Form T2 Schedule 63 Return of Fuel Charge Proceeds to Farmers Tax Credit (2021 and Later Tax Years) - Canada

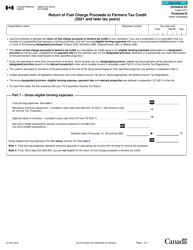

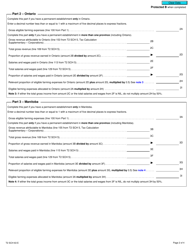

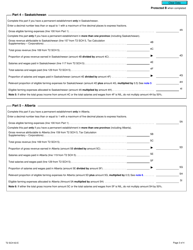

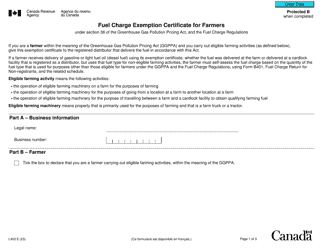

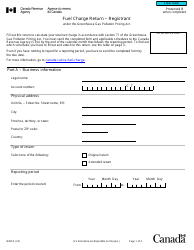

Form T2 Schedule 63 is used by farmers in Canada to claim the Fuel Charge Proceeds to Farmers Tax Credit for the years 2021 and later. This credit is intended to provide relief to farmers for the federal carbon pricing system's impact on the cost of fuel they use for farming activities.

The Form T2 Schedule 63 Return of Fuel Charge Proceeds to Farmers Tax Credit is filed by farmers in Canada who qualify for the tax credit.

FAQ

Q: What is Form T2 Schedule 63?

A: Form T2 Schedule 63 is a tax form in Canada for claiming the Fuel Charge Proceeds to Farmers Tax Credit.

Q: What is the purpose of Form T2 Schedule 63?

A: The purpose of Form T2 Schedule 63 is to claim the Fuel Charge Proceeds to Farmers Tax Credit.

Q: Who is eligible to use Form T2 Schedule 63?

A: Farmers in Canada who are eligible for the Fuel Charge Proceeds to Farmers Tax Credit can use Form T2 Schedule 63.

Q: When should Form T2 Schedule 63 be filed?

A: Form T2 Schedule 63 should be filed with the corresponding tax return for the applicable tax year.

Q: What is the Fuel Charge Proceeds to Farmers Tax Credit?

A: The Fuel Charge Proceeds to Farmers Tax Credit is a tax credit in Canada that provides relief to farmers for the carbon pricing on specified fuels.

Q: Are there any deadlines for filing Form T2 Schedule 63?

A: The deadlines for filing Form T2 Schedule 63 are the same as the deadlines for filing the corresponding tax return for the applicable tax year.