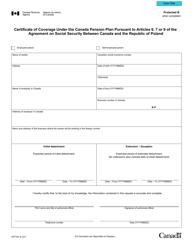

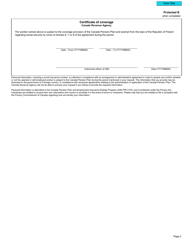

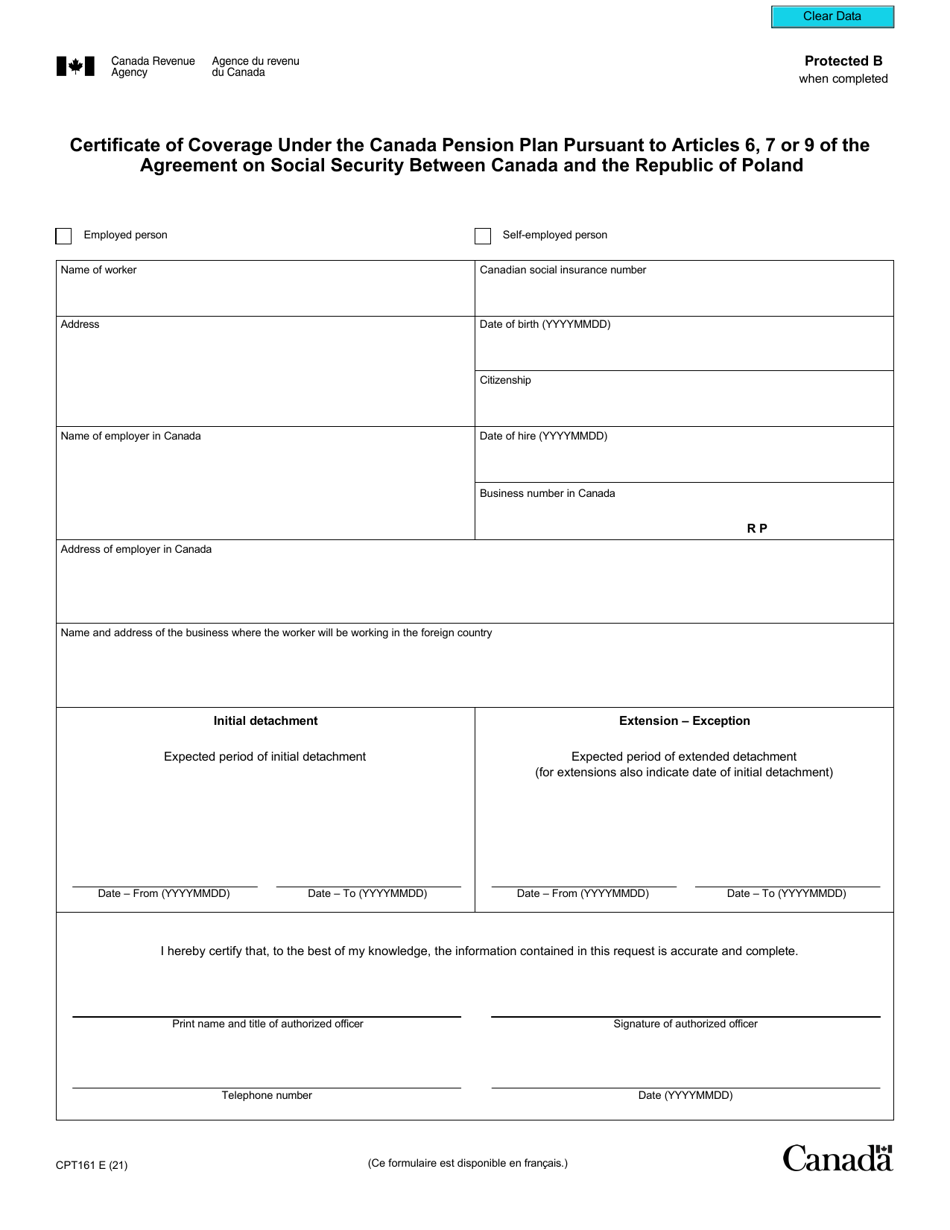

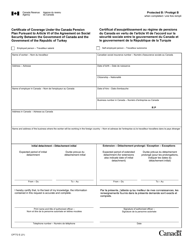

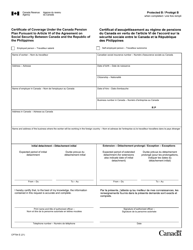

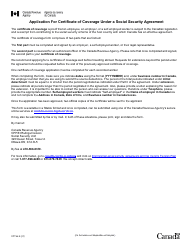

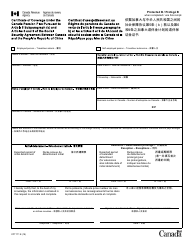

Form CPT161 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article 6, 7 or 9 of the Agreement on Social Security Between Canada and the Republic of Poland - Canada

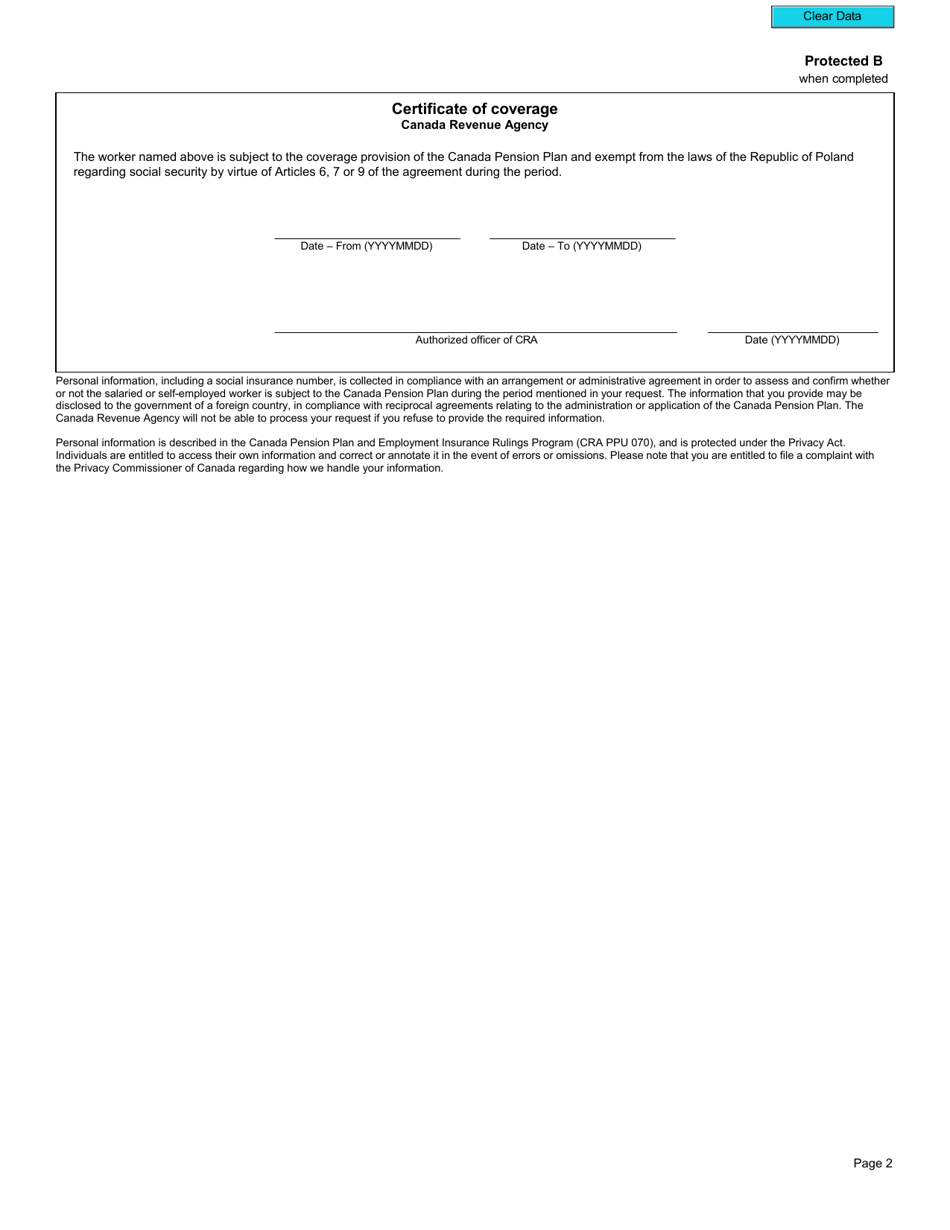

The Form CPT161 Certificate of Coverage is used to certify an individual's coverage under the Canada Pension Plan (CPP) as per the agreement on social security between Canada and Poland. This form is typically used by individuals who have worked or will be working in both Canada and Poland and need proof of their coverage for social security benefits.

The individual who needs to file Form CPT161 Certificate of Coverage Under the Canada Pension Plan pursuant to Article 6, 7, or 9 of the Agreement on Social Security between Canada and the Republic of Poland is the person who wants to obtain coverage under the Canada Pension Plan.

FAQ

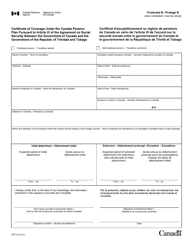

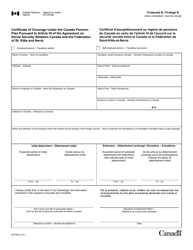

Q: What is Form CPT161?

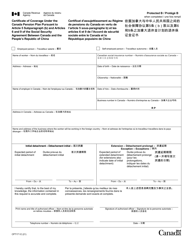

A: Form CPT161 is a Certificate of Coverage under the Canada Pension Plan.

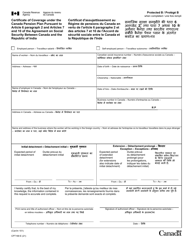

Q: What is the purpose of Form CPT161?

A: The purpose of Form CPT161 is to certify that an individual is exempt from paying Canada Pension Plan contributions while working in Poland.

Q: Who needs to file Form CPT161?

A: Individuals who are covered under the Canada Pension Plan and are temporarily working in Poland need to file Form CPT161.

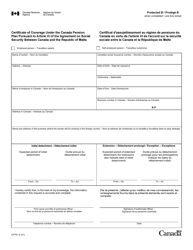

Q: When should Form CPT161 be filed?

A: Form CPT161 should be filed before the start of employment in Poland.

Q: How long is the coverage period specified in Form CPT161?

A: The coverage period specified in Form CPT161 is for a maximum of 60 months.

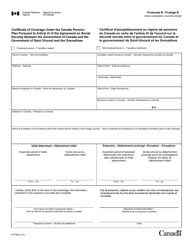

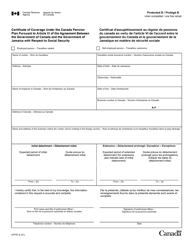

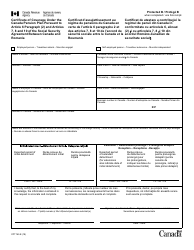

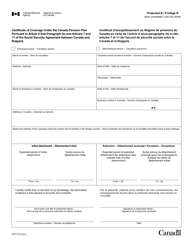

Q: What is the Agreement on Social Security Between Canada and the Republic of Poland?

A: The Agreement on Social Security Between Canada and the Republic of Poland is an agreement that ensures social security coverage for individuals who have lived or worked in both countries.