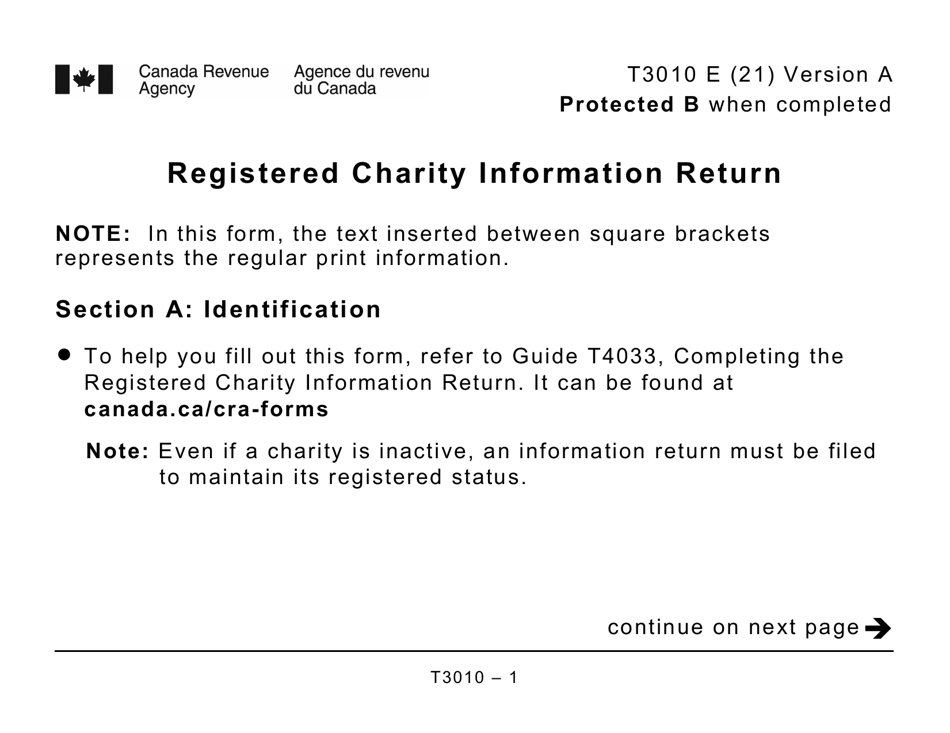

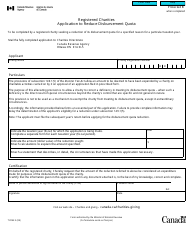

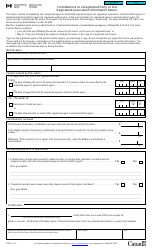

Form T3010 Registered Charity Information Return (Large Print) - Canada

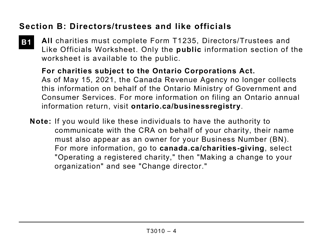

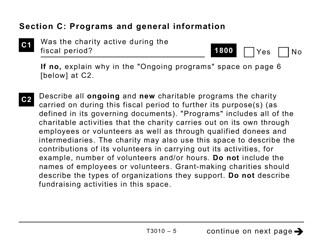

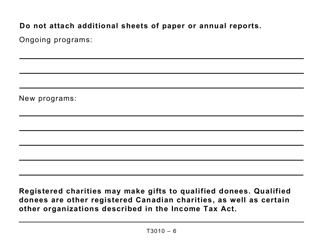

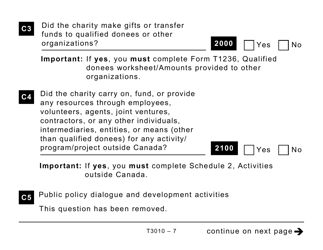

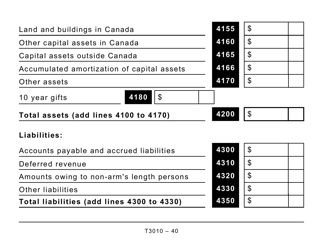

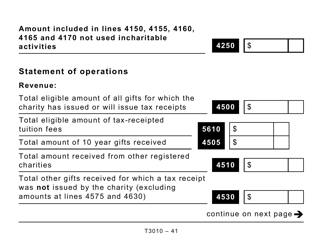

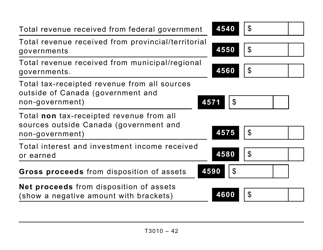

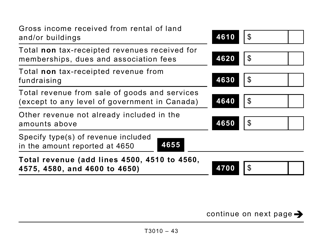

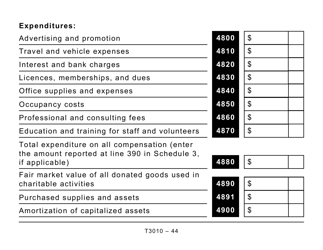

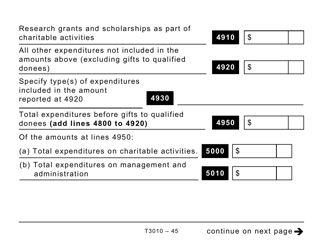

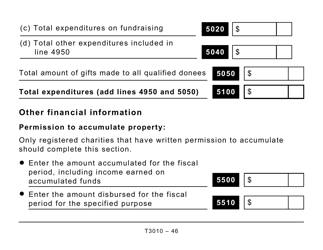

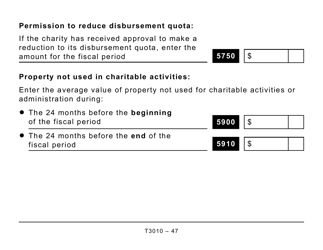

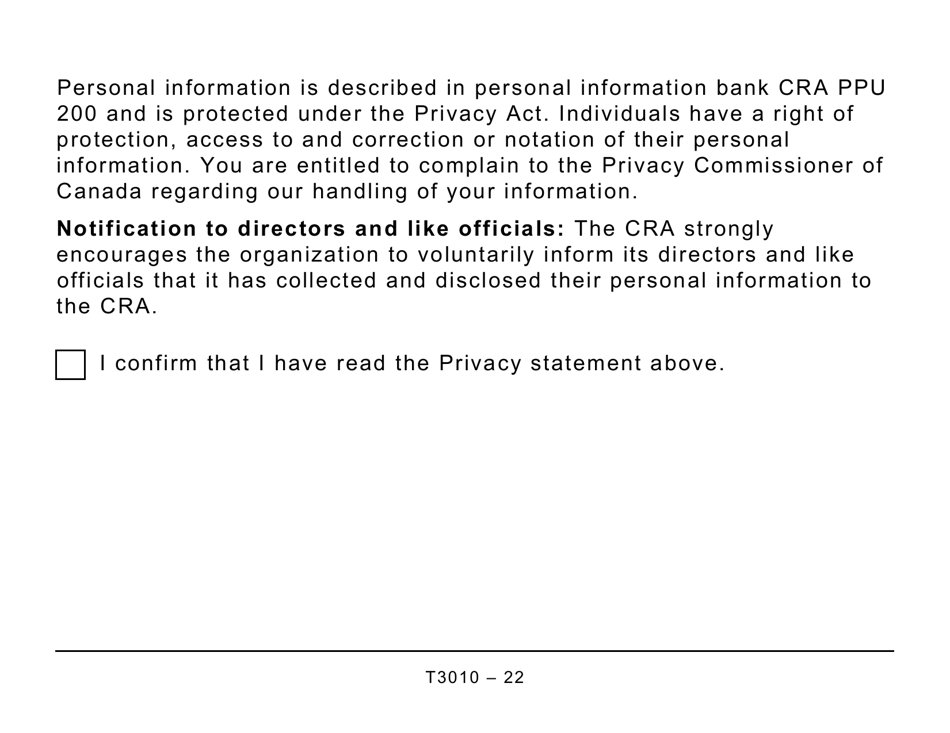

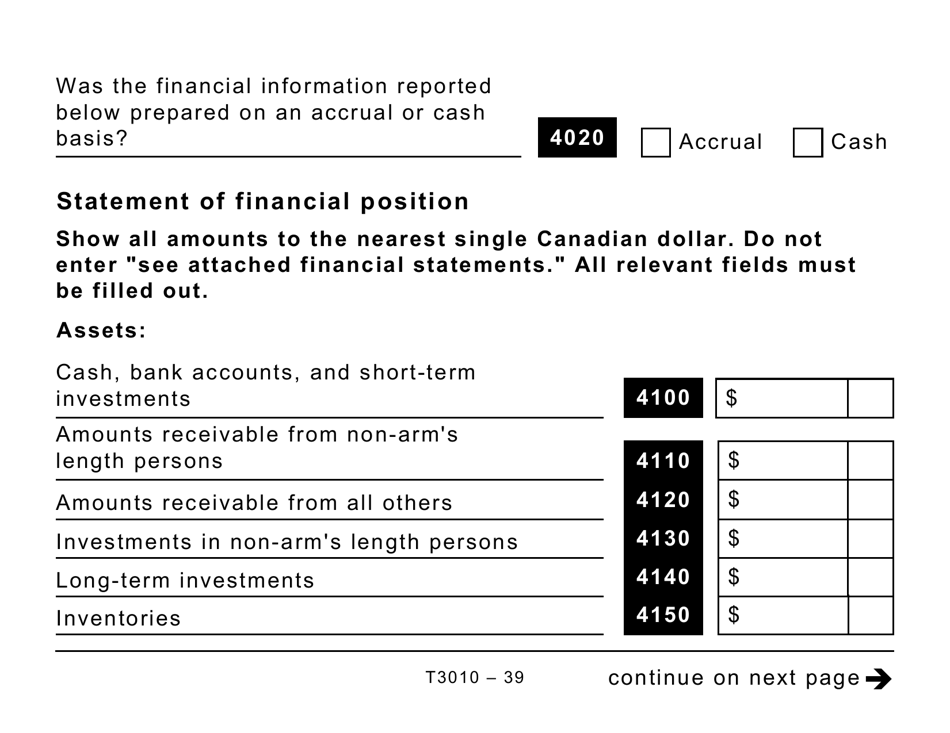

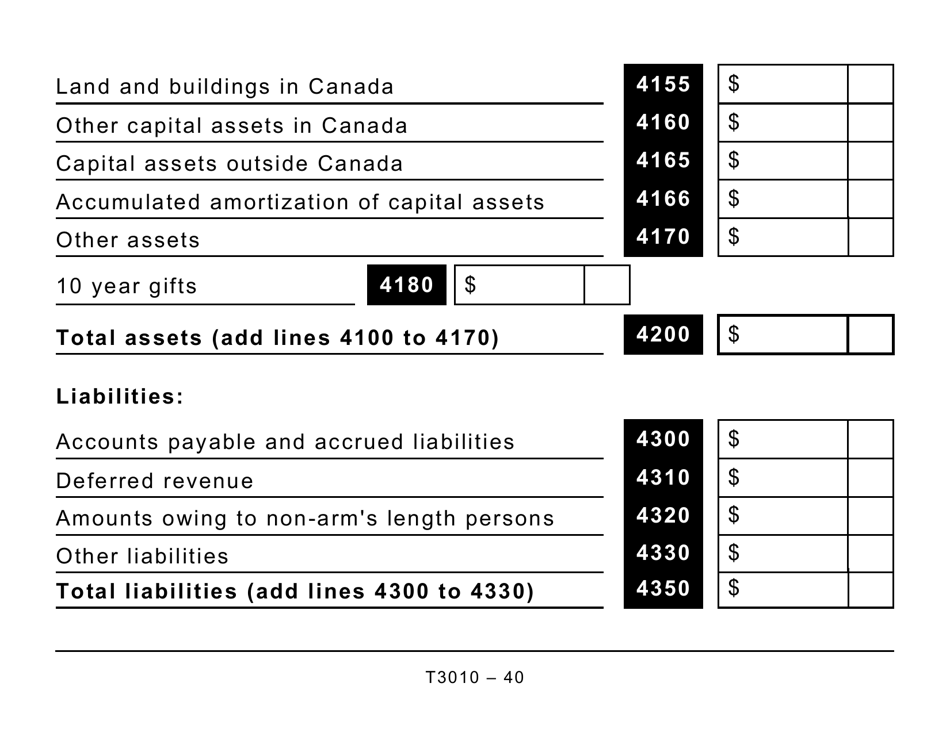

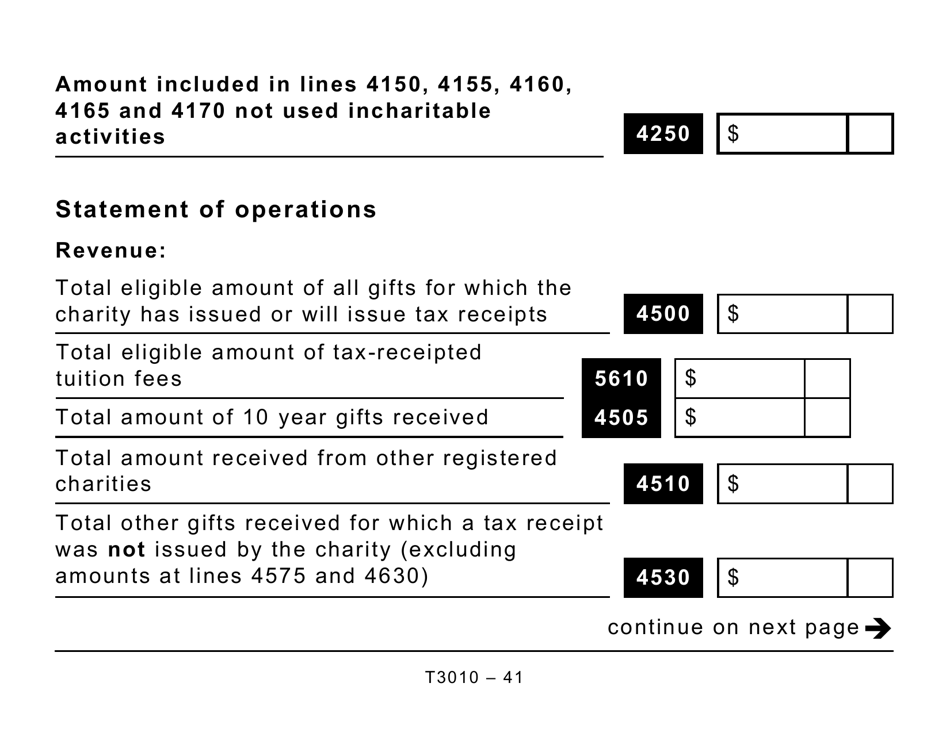

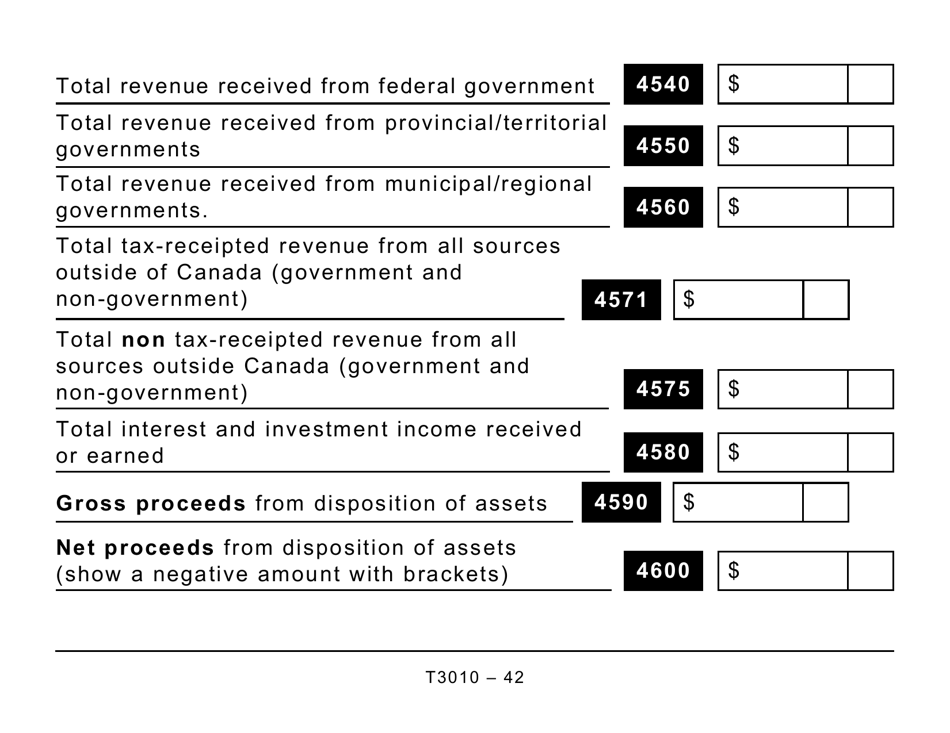

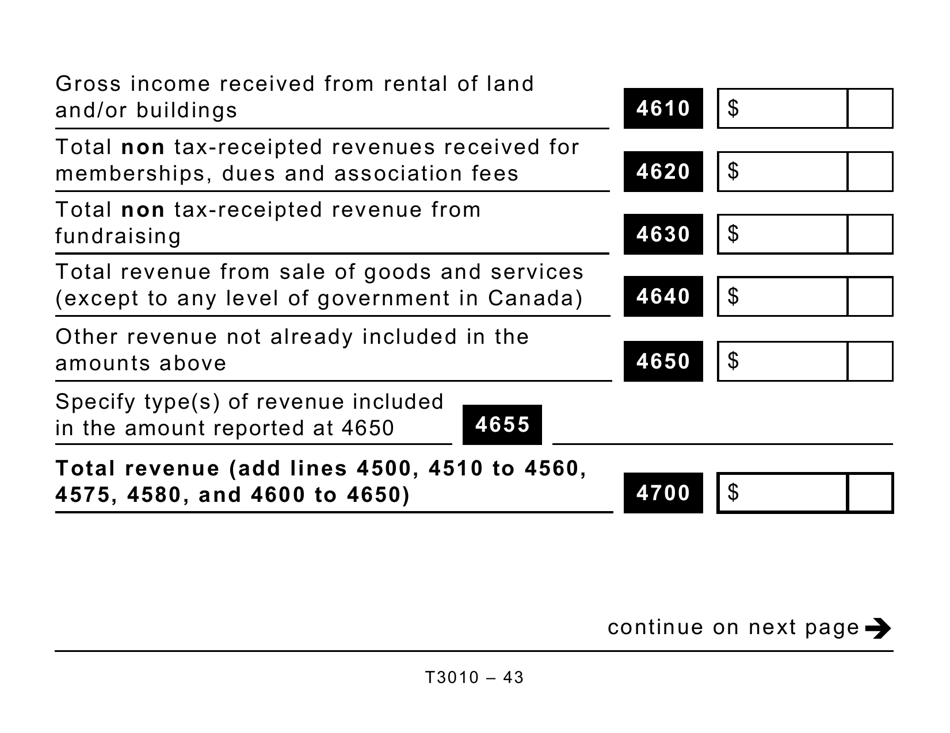

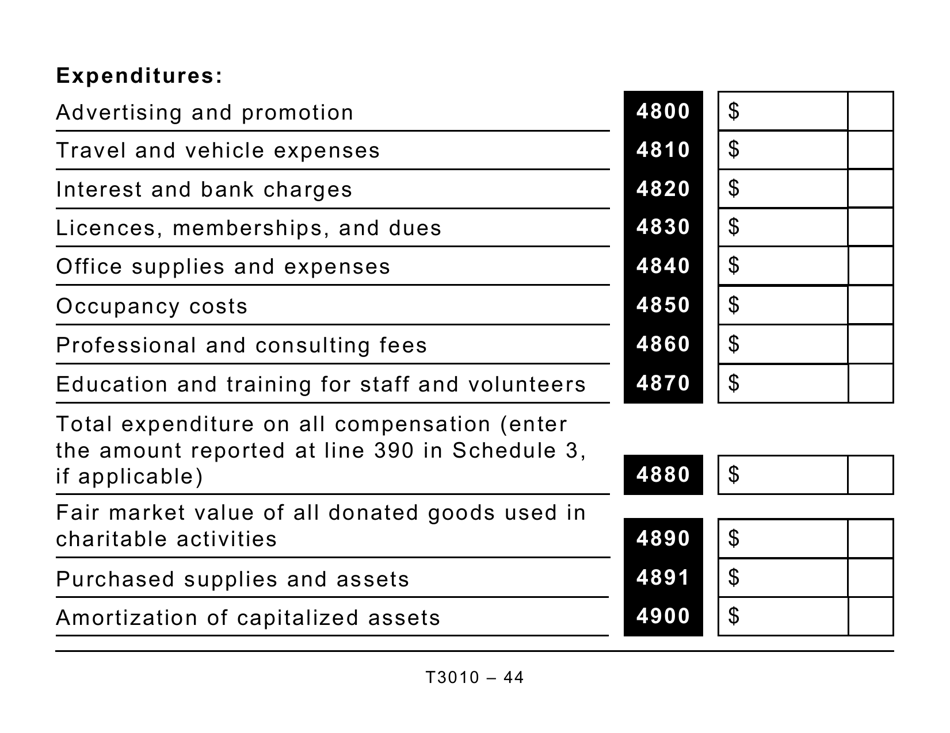

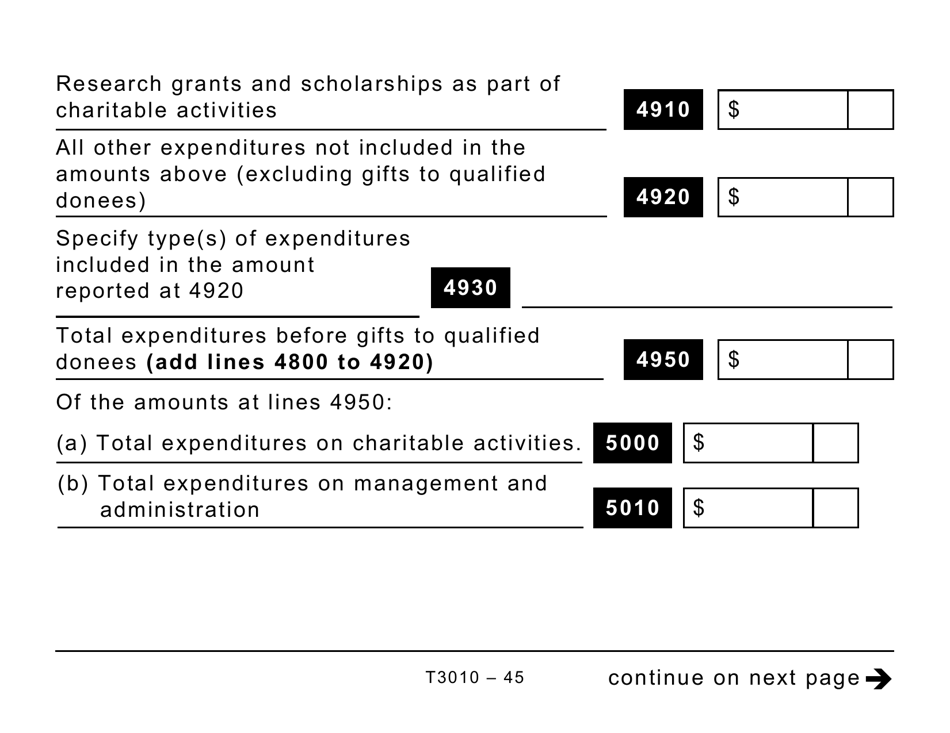

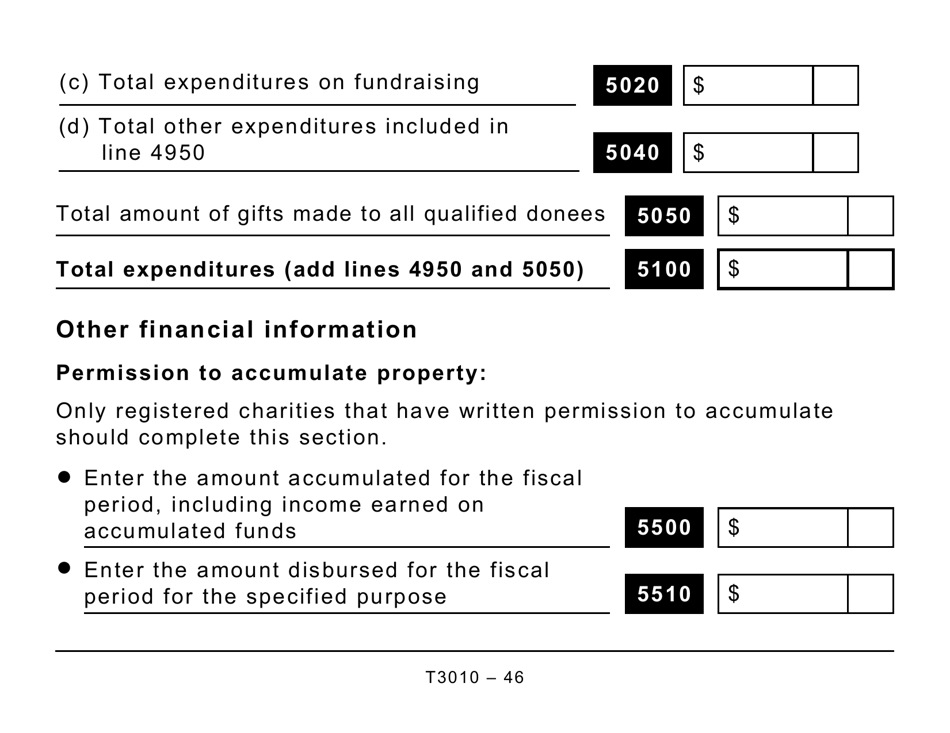

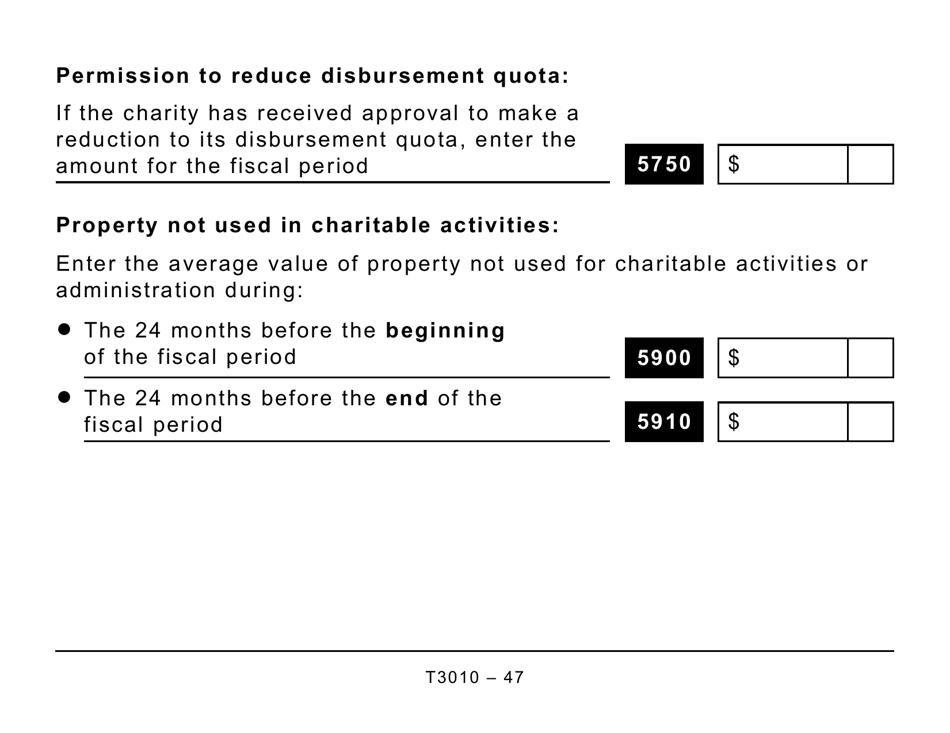

Form T3010 Registered Charity Information Return (Large Print) in Canada is used by registered charities to report their financial information to the Canada Revenue Agency (CRA). It provides a comprehensive overview of a charity's activities, including details on its income, expenses, assets, and programs. The large print version of the form is specifically designed to accommodate individuals with visual impairments or those who require larger text size for ease of reading and completion.

The Form T3010 Registered Charity Information Return (Large Print) in Canada is filed by registered charities.

FAQ

Q: What is Form T3010?

A: Form T3010 is the Registered Charity Information Return required by the Canada Revenue Agency (CRA) for registered charities in Canada.

Q: Who needs to file Form T3010?

A: All registered charities in Canada are required to file Form T3010.

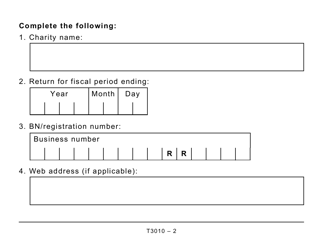

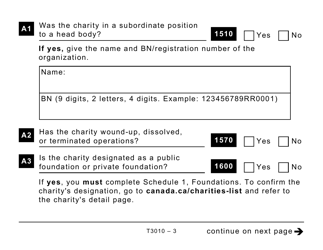

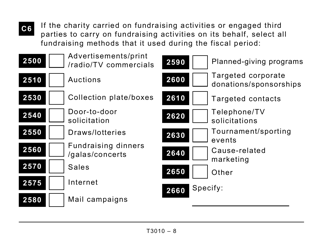

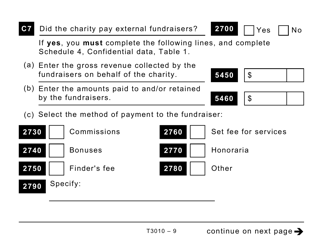

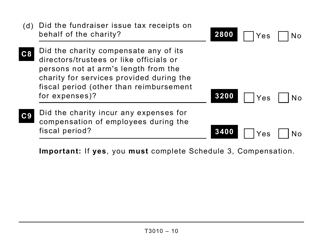

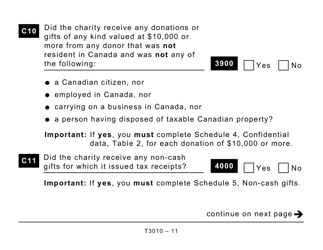

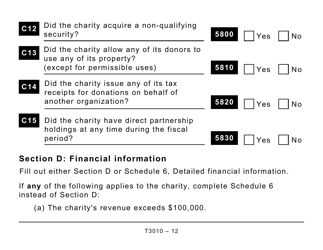

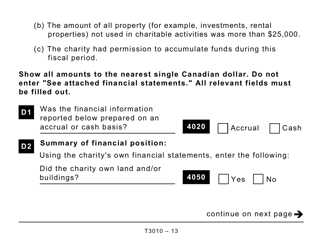

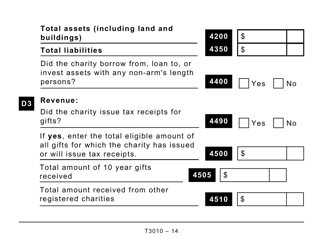

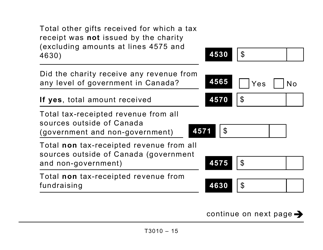

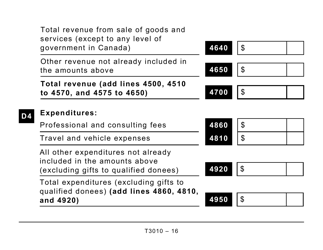

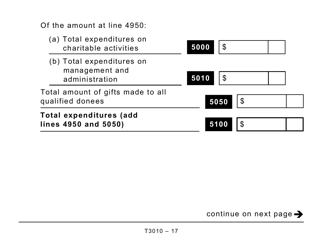

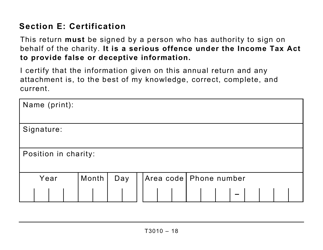

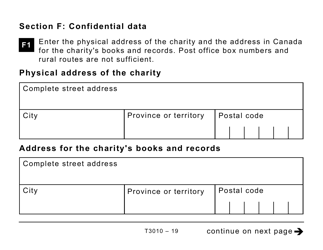

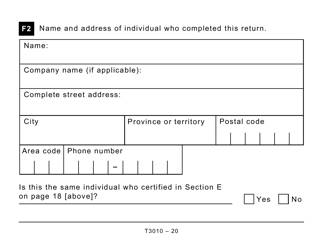

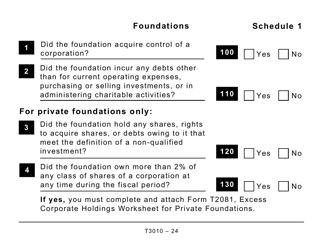

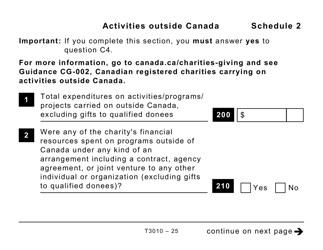

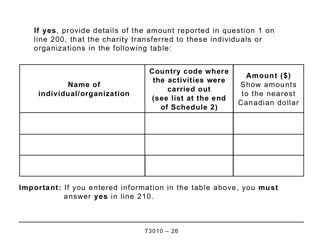

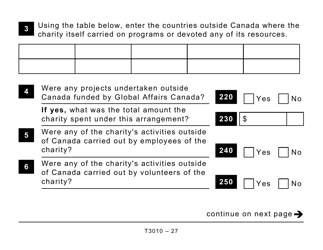

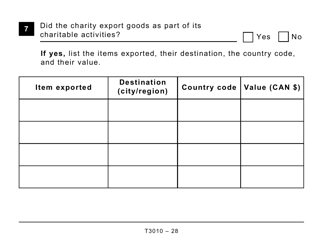

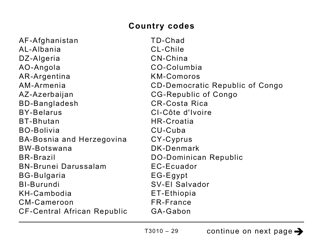

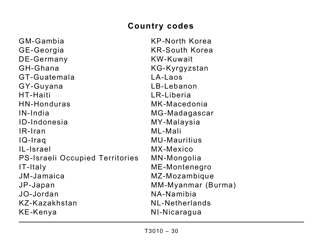

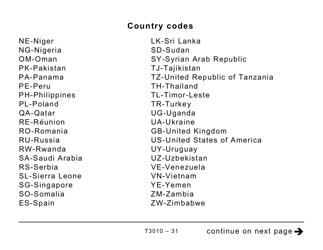

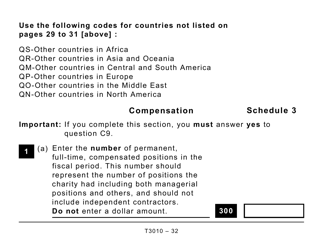

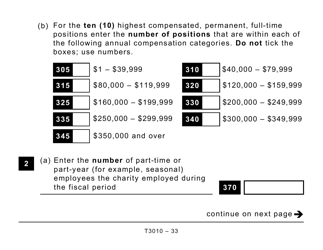

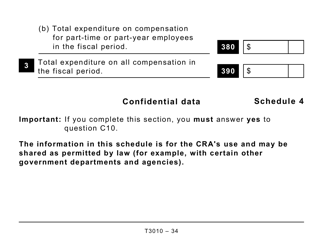

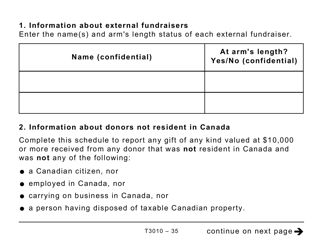

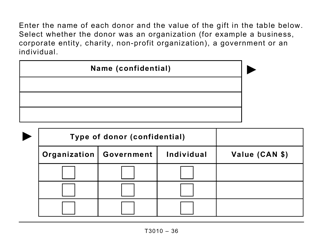

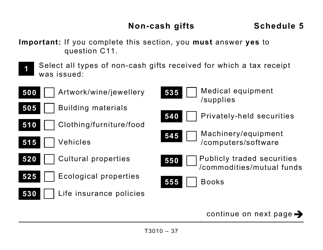

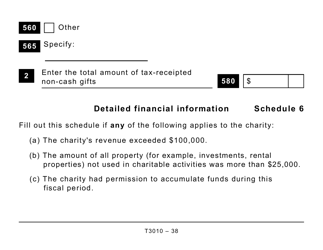

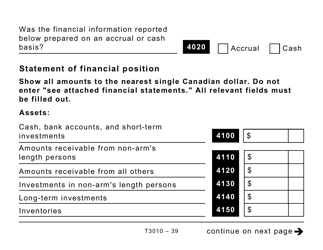

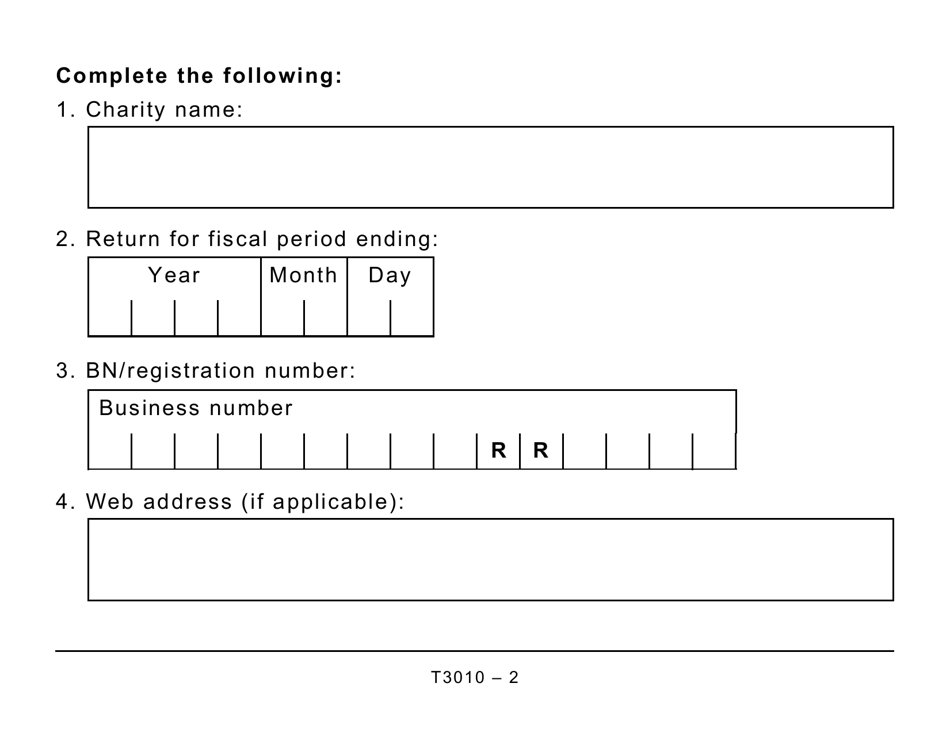

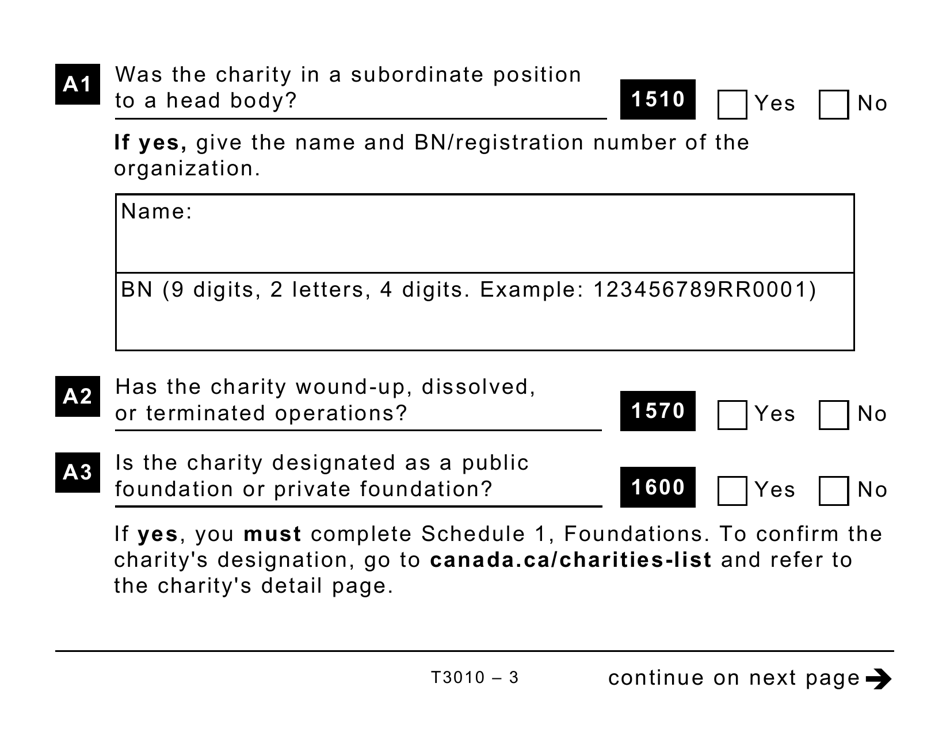

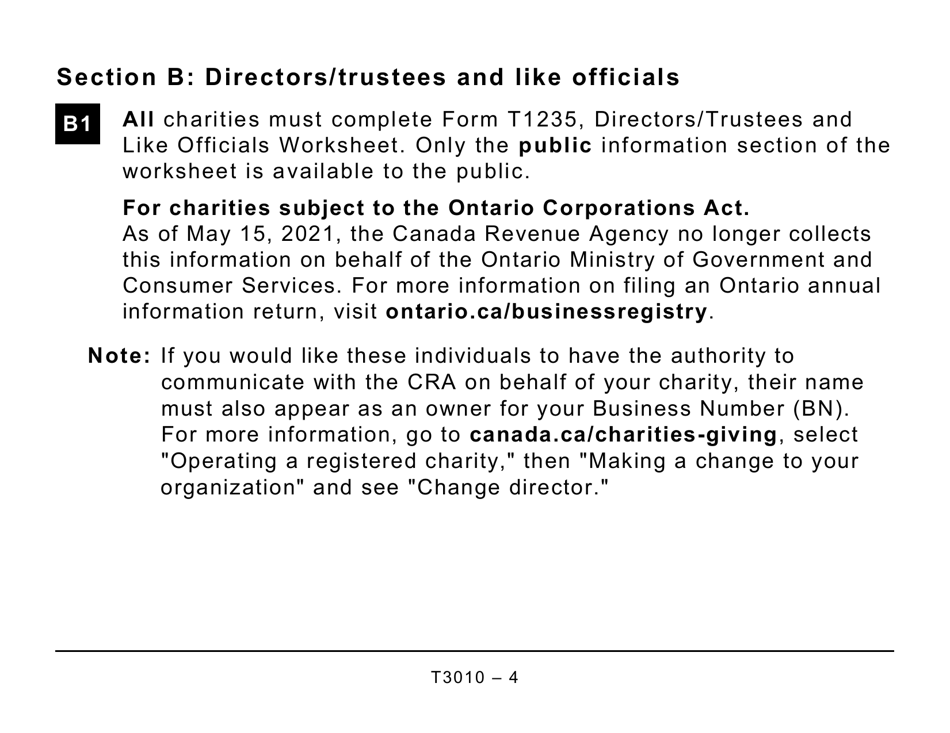

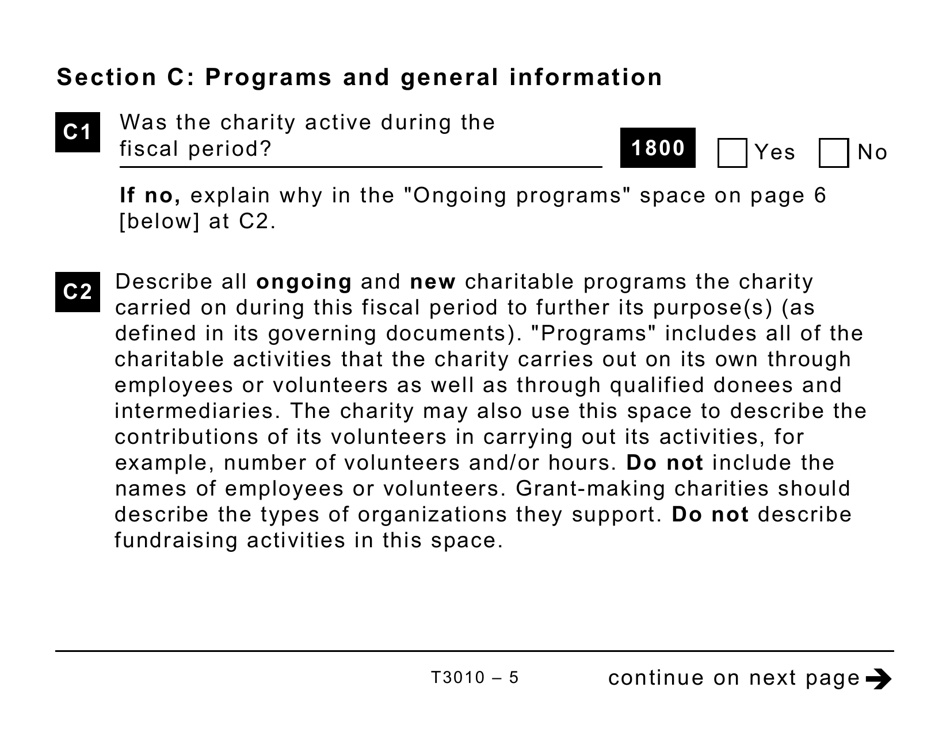

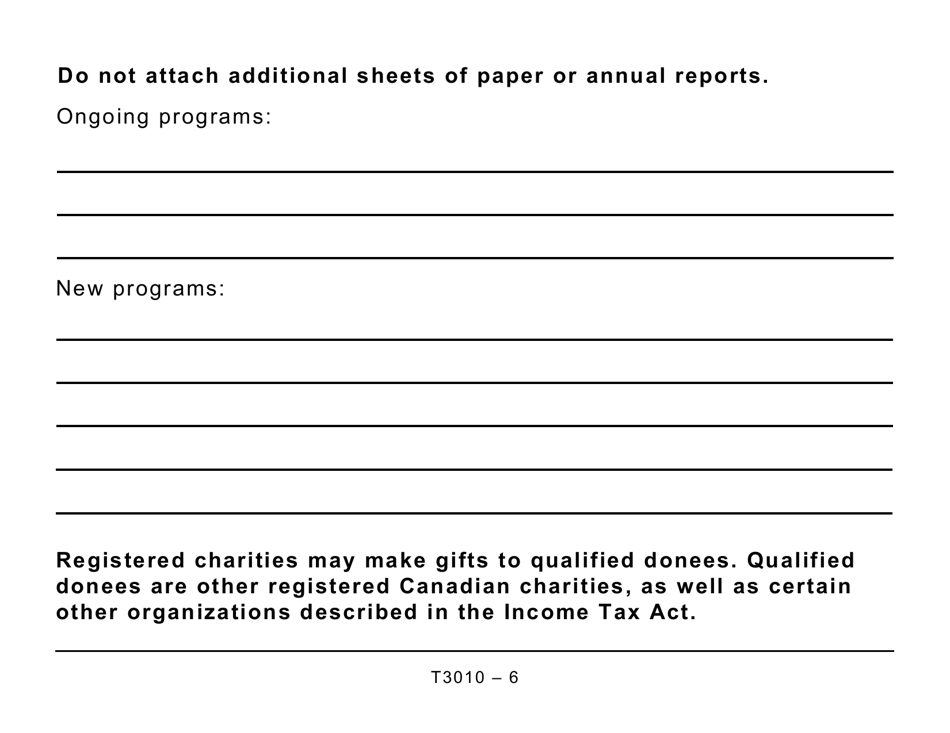

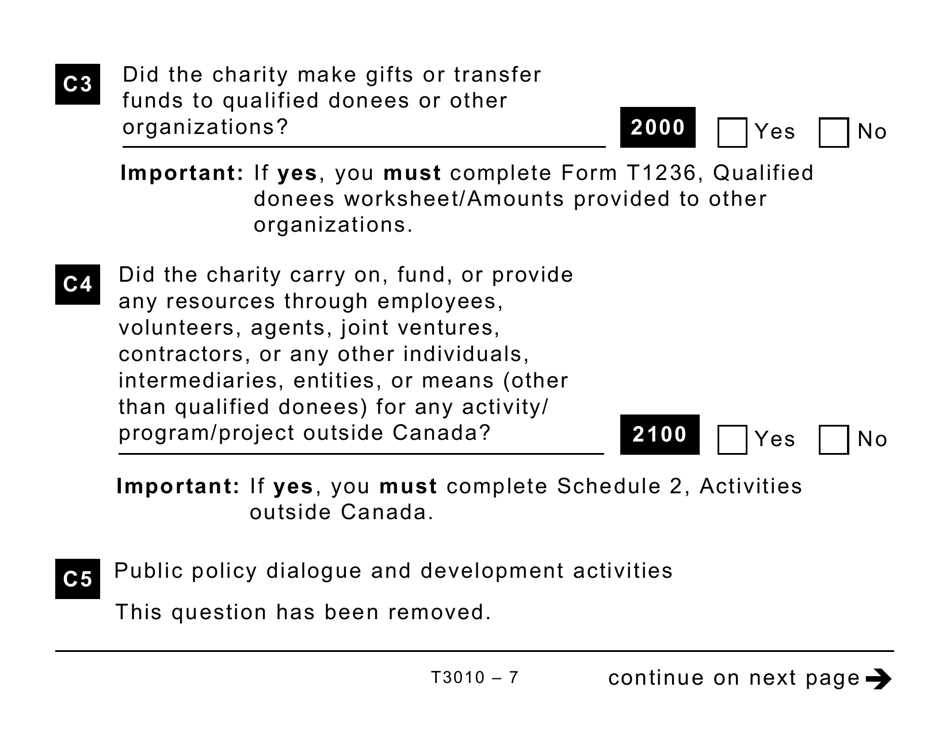

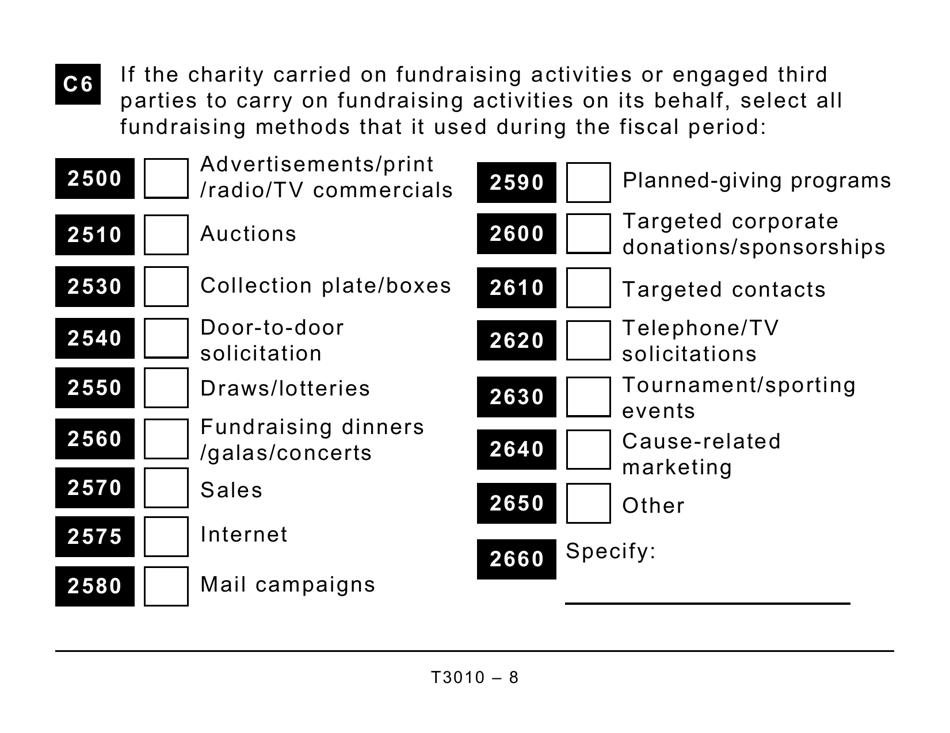

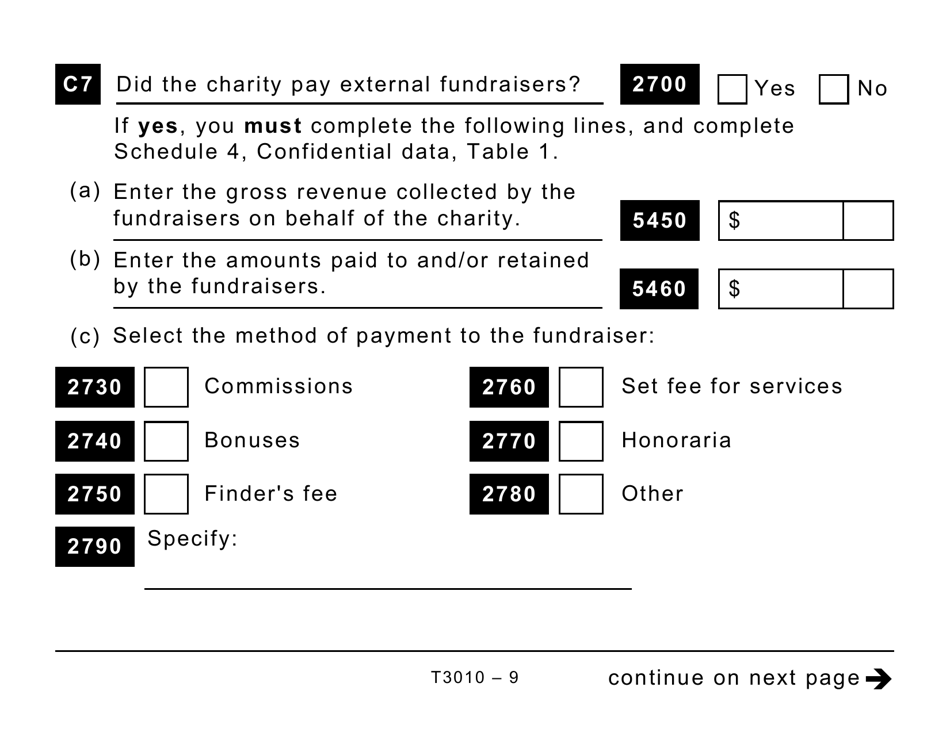

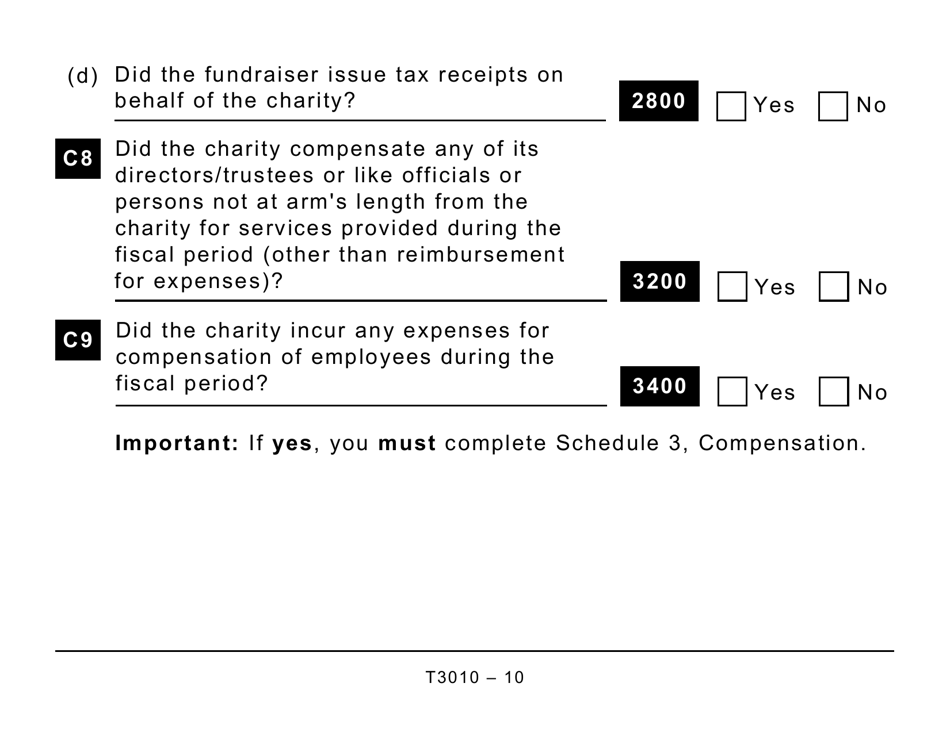

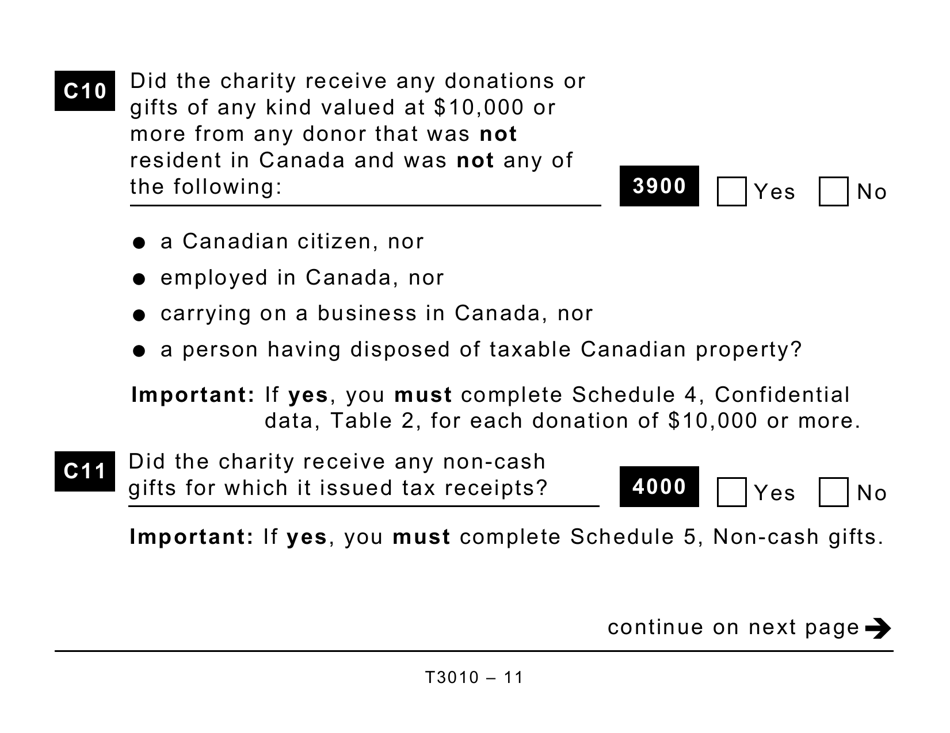

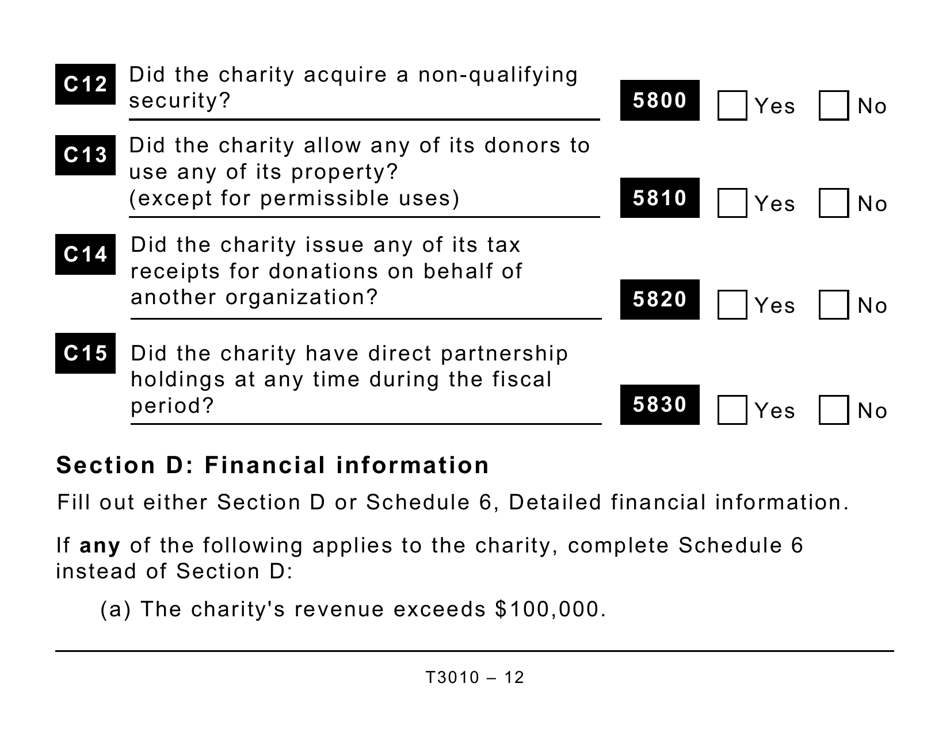

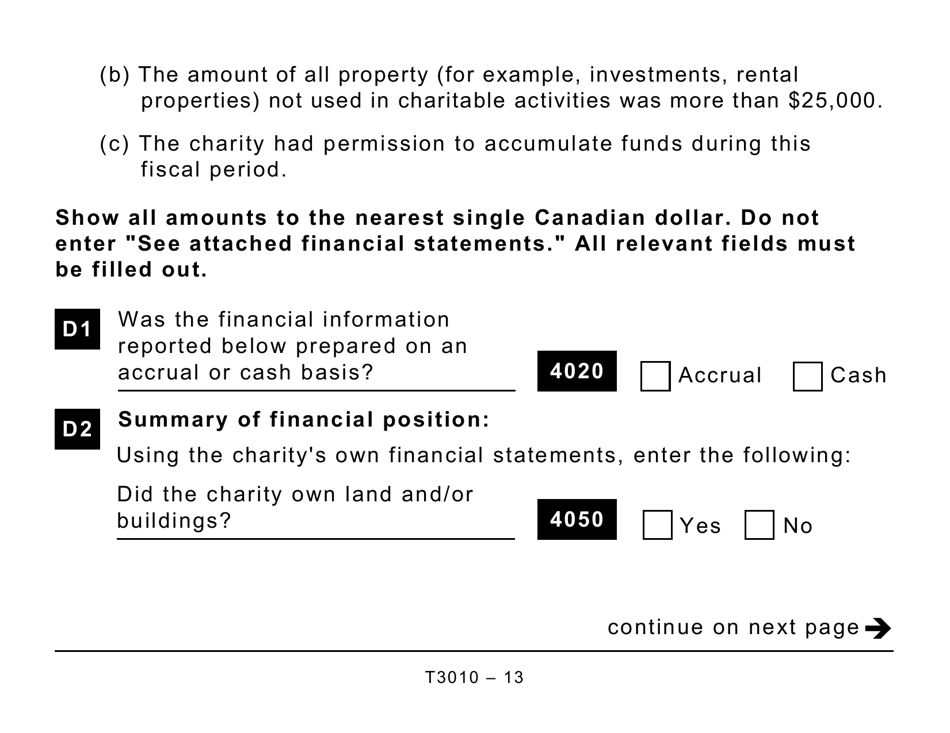

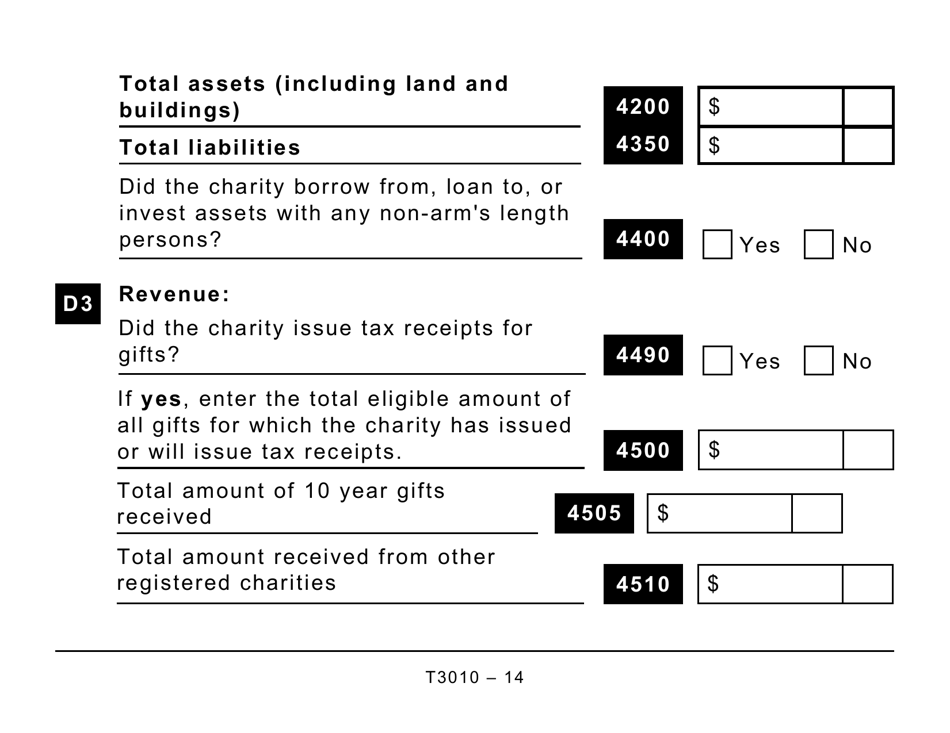

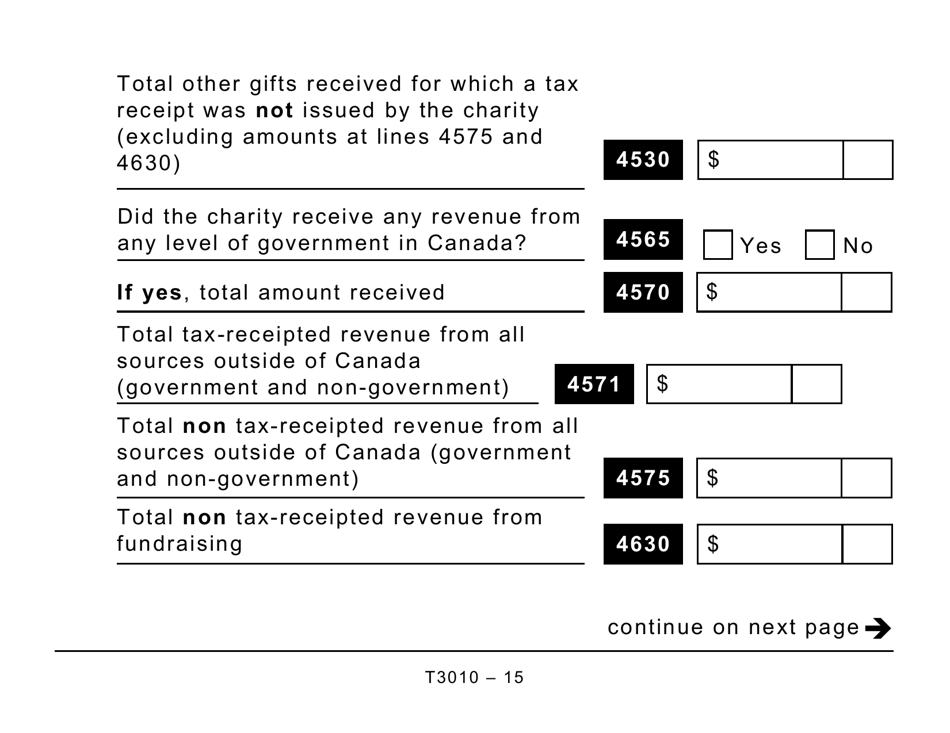

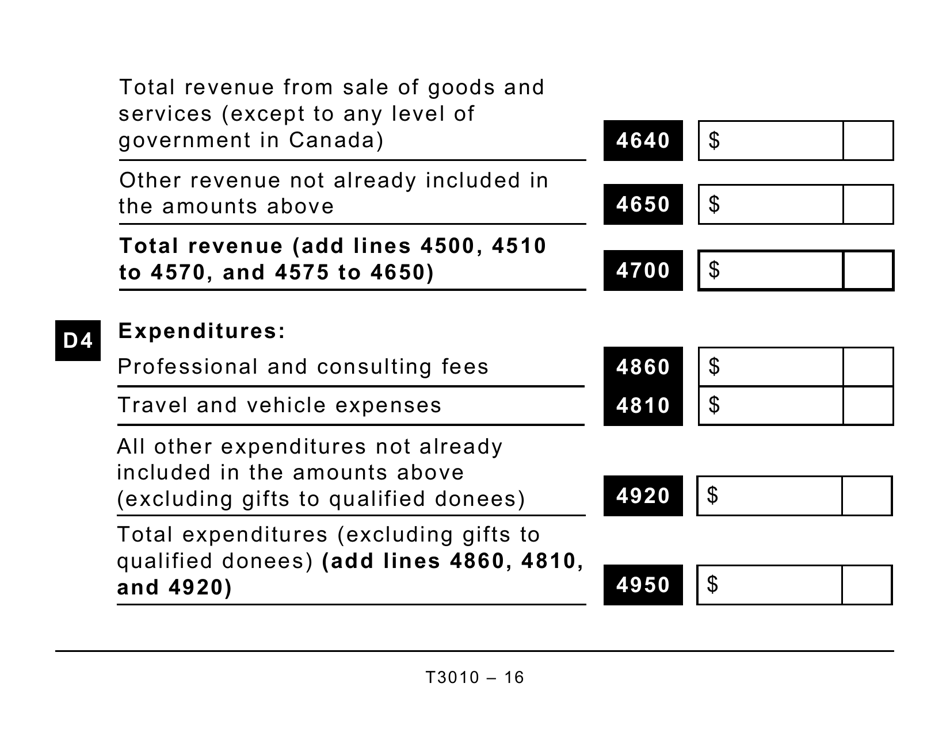

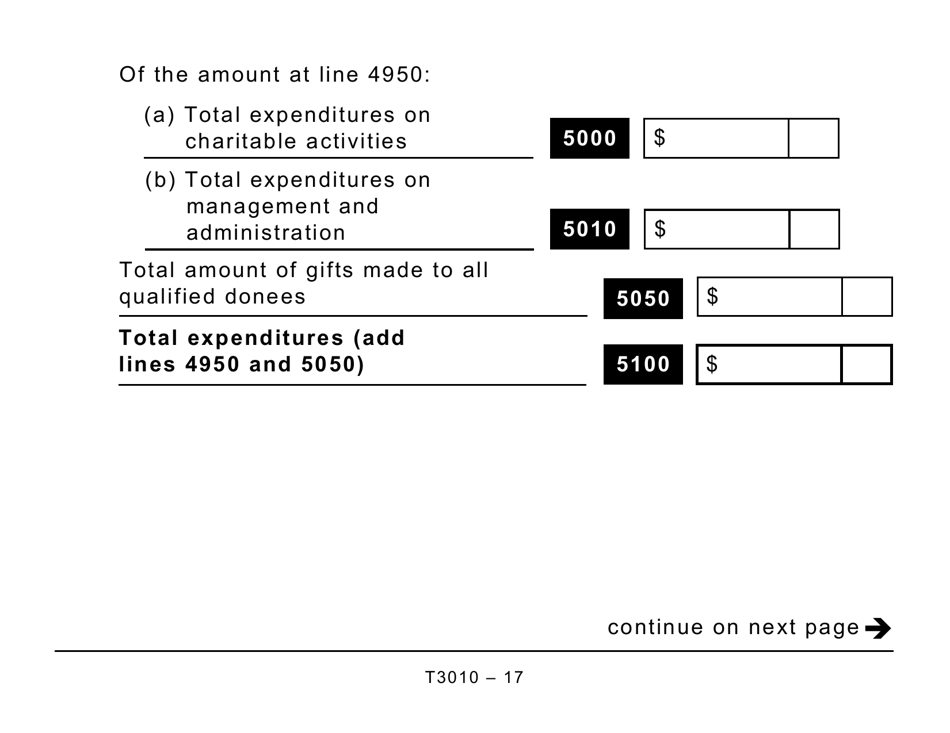

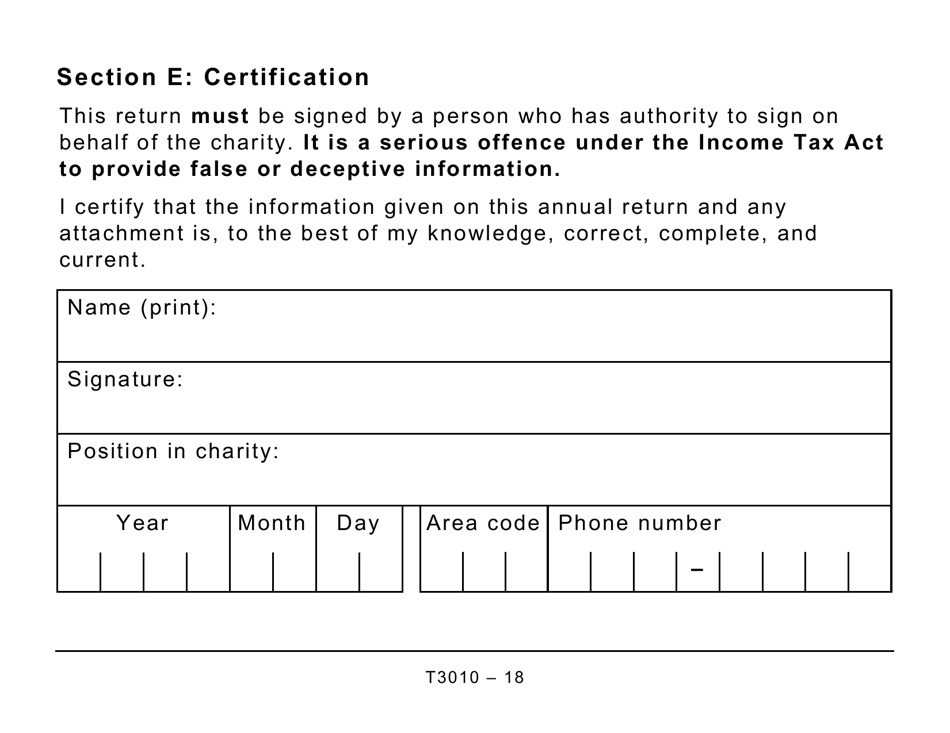

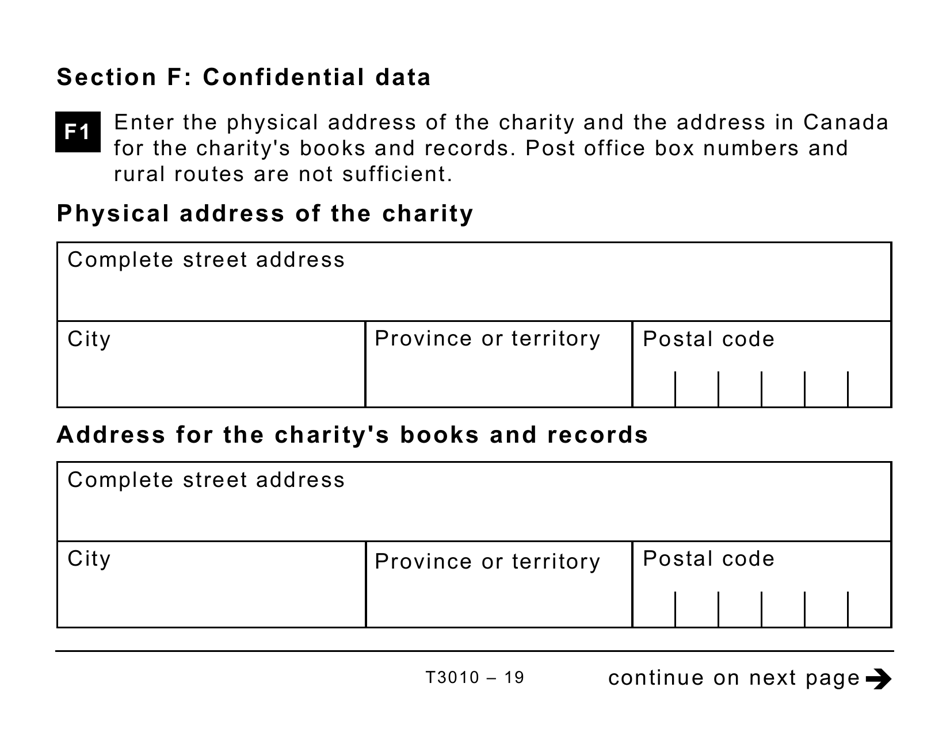

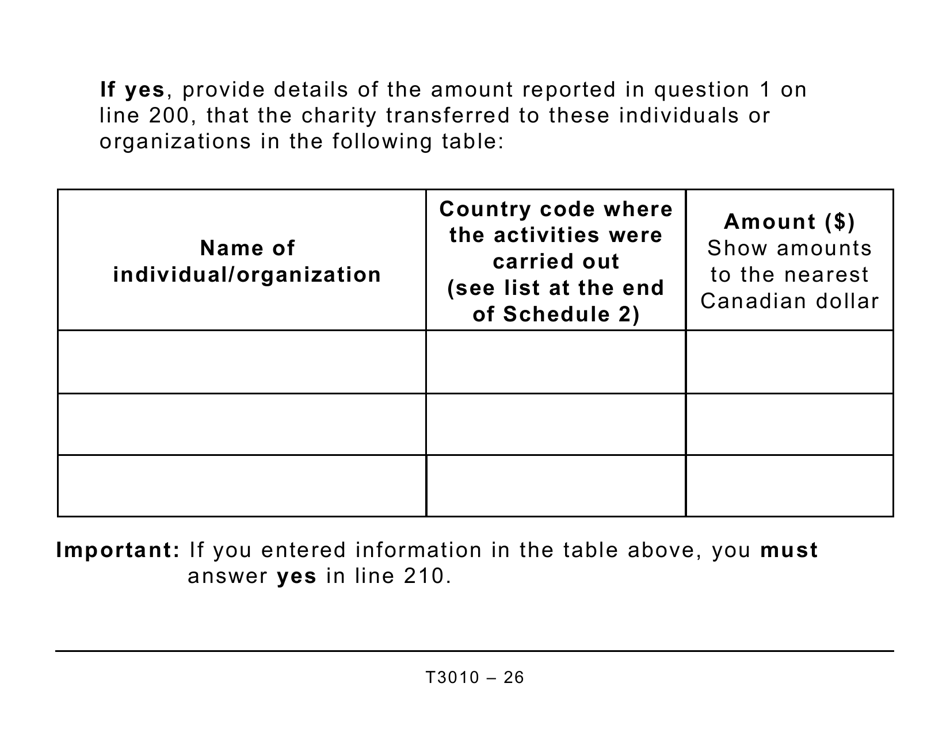

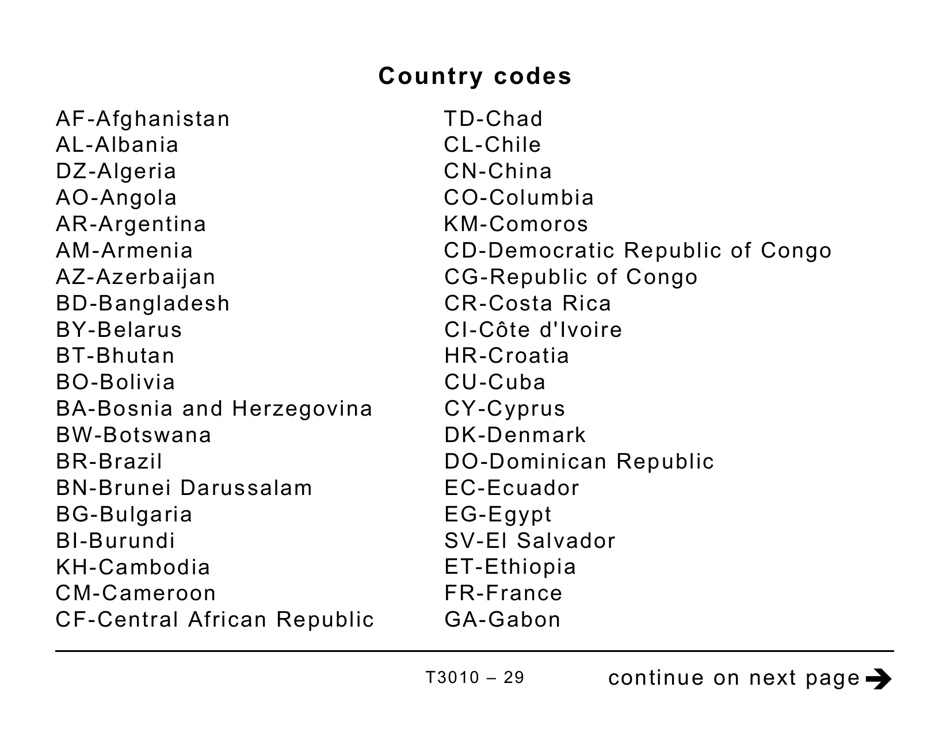

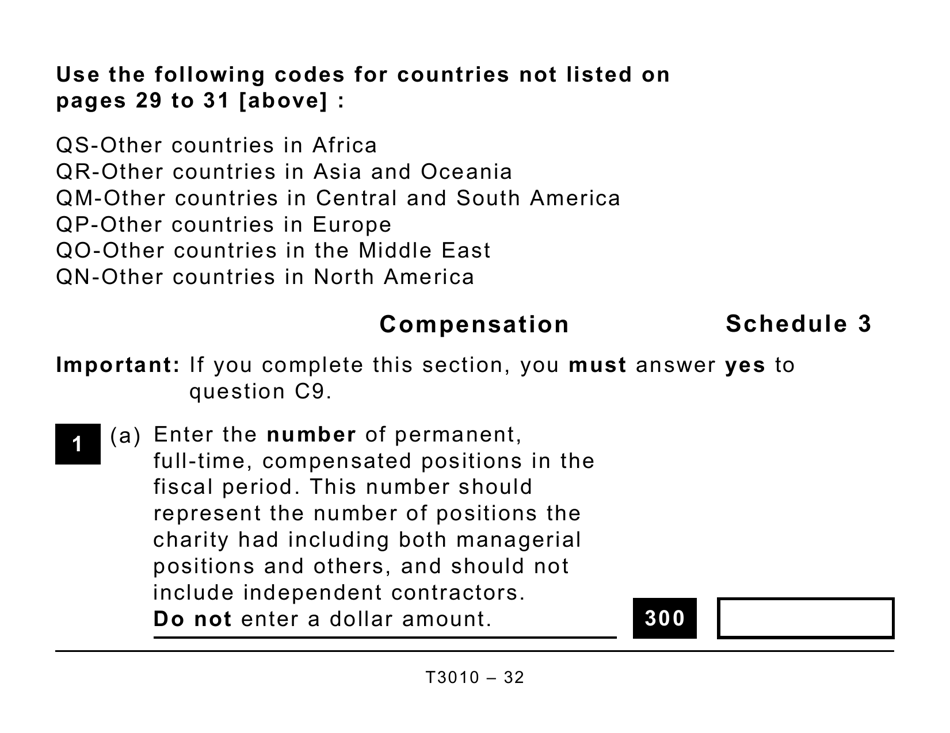

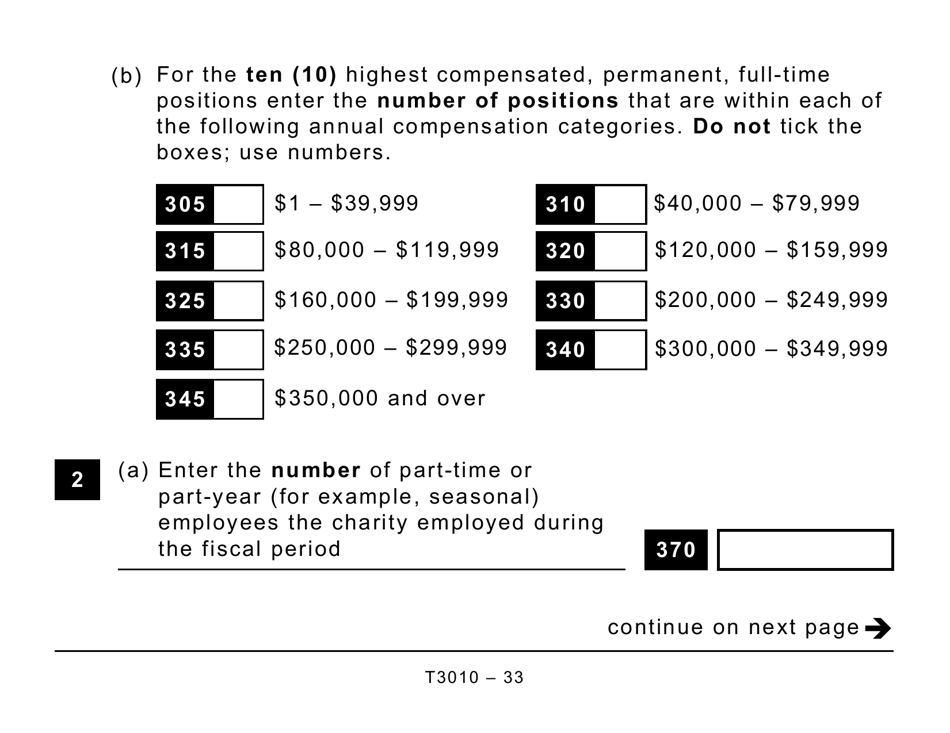

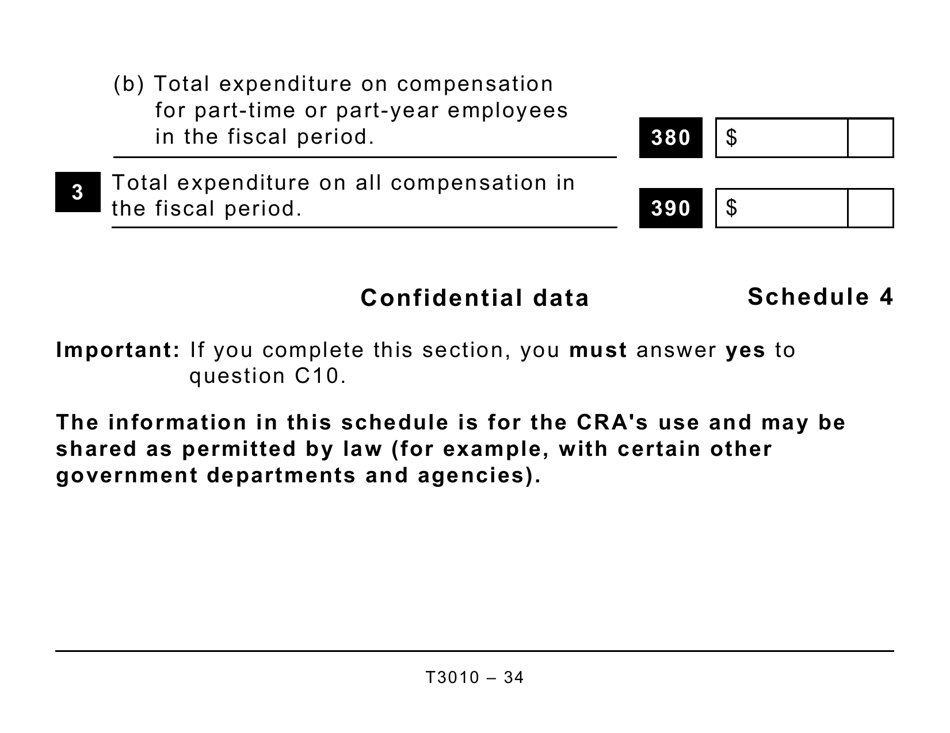

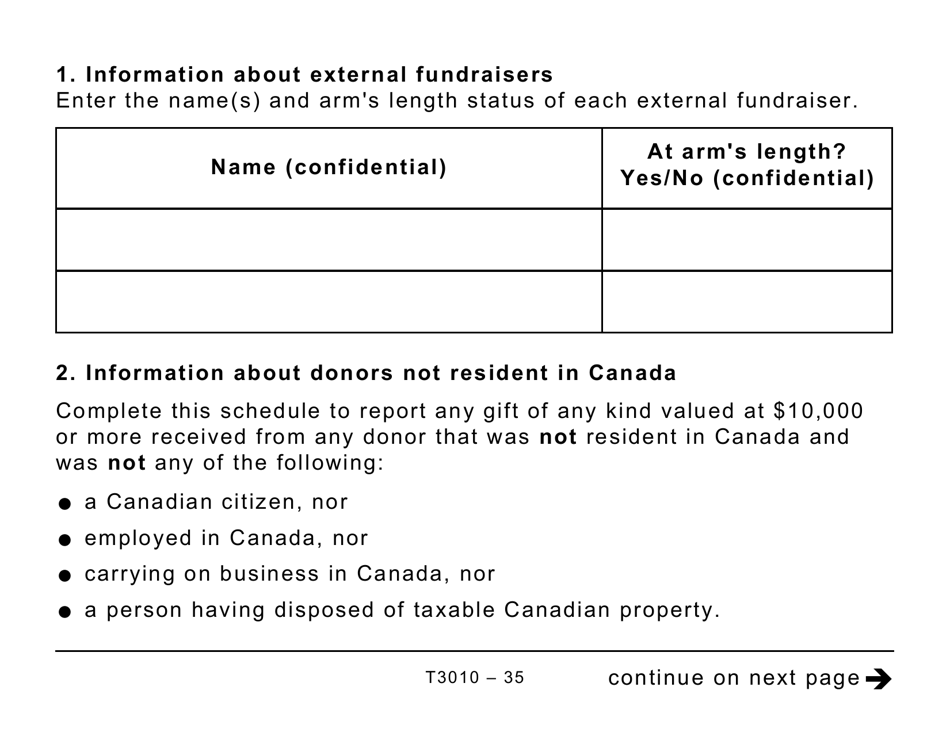

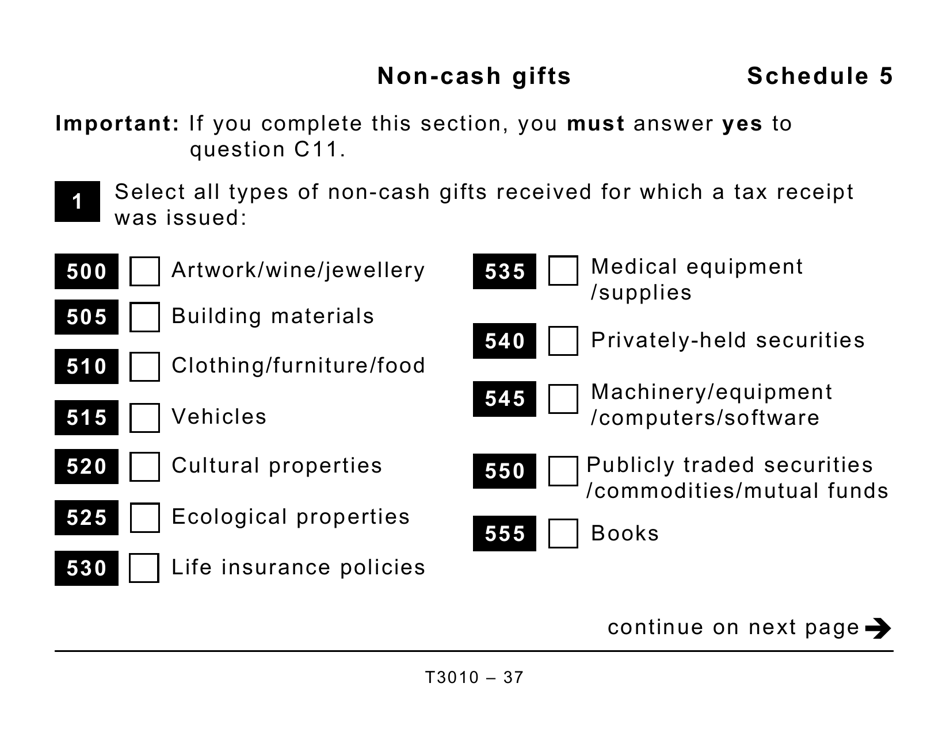

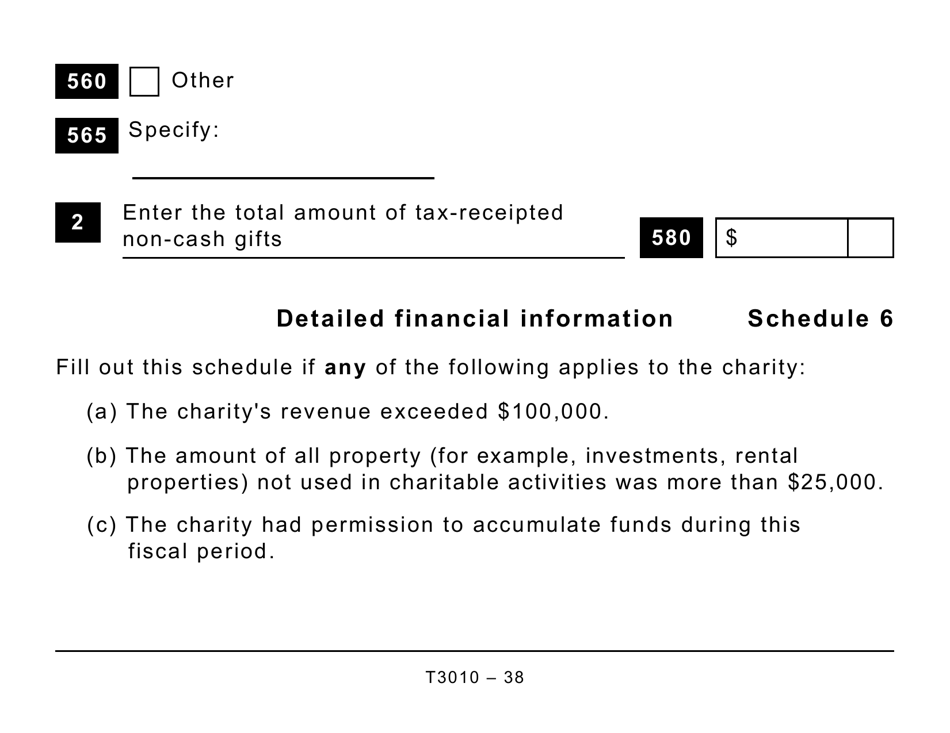

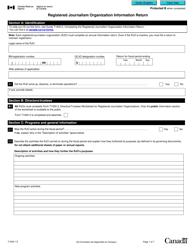

Q: What information is required on Form T3010?

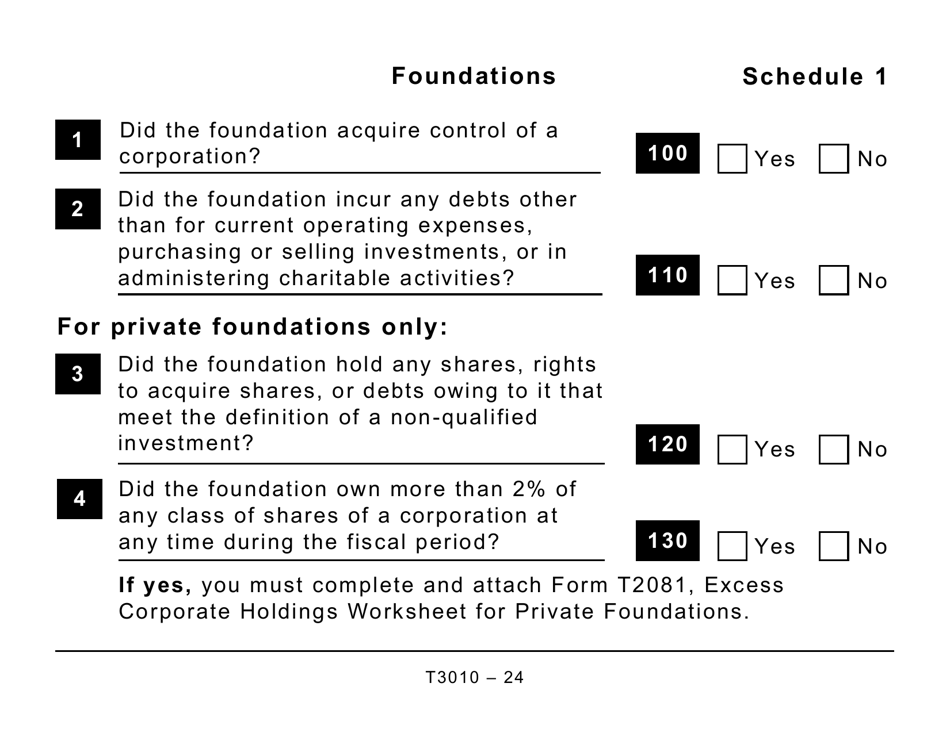

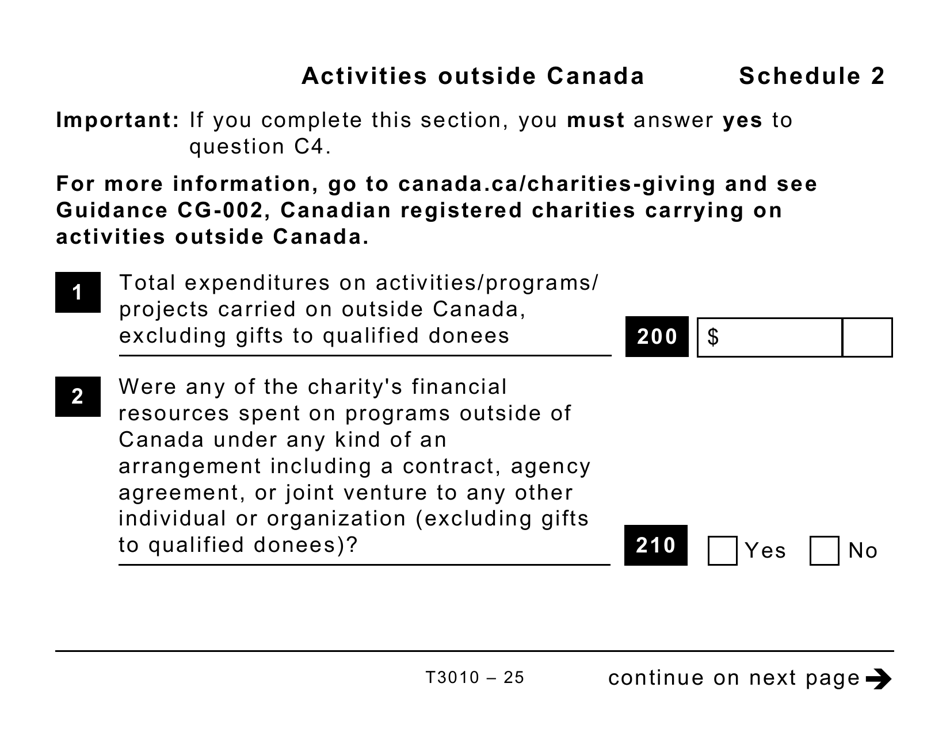

A: Form T3010 requires information about the charity's activities, finances, and governance.

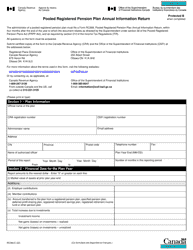

Q: Is there a deadline for filing Form T3010?

A: Yes, registered charities must file Form T3010 within six months after the end of their fiscal year.

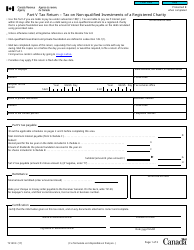

Q: Are there any penalties for not filing Form T3010?

A: Yes, failure to file Form T3010 on time may result in penalties or loss of registered charity status.

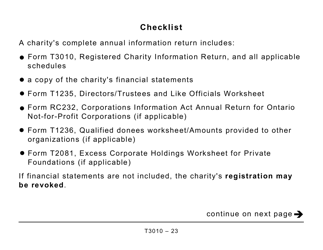

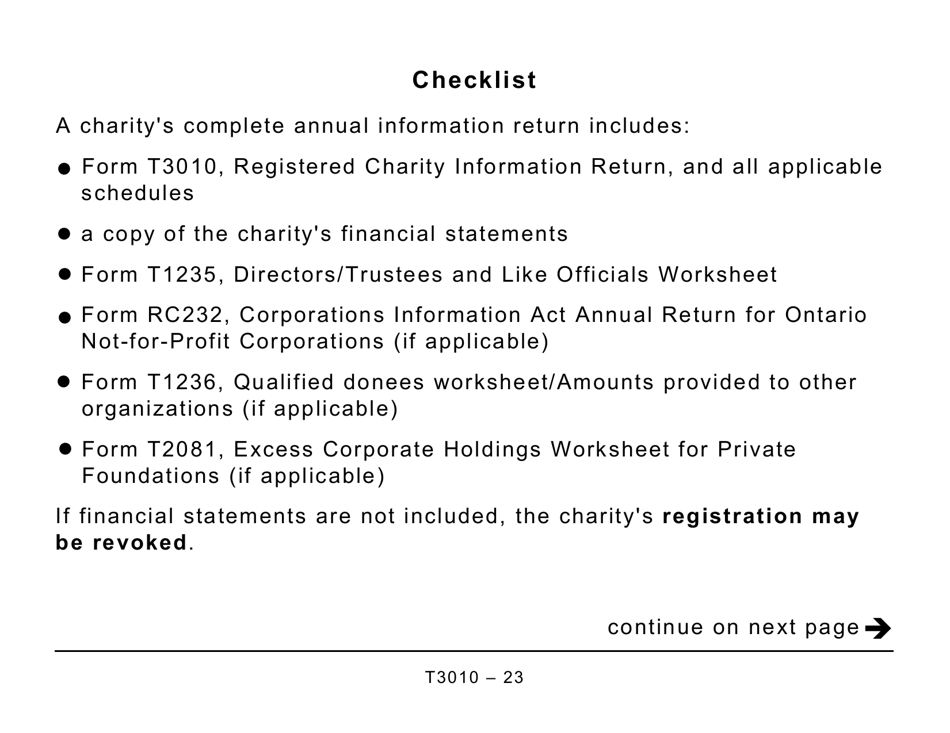

Q: Do I need to submit any supporting documents with Form T3010?

A: Registered charities may need to submit additional documents, such as financial statements, depending on their specific circumstances.

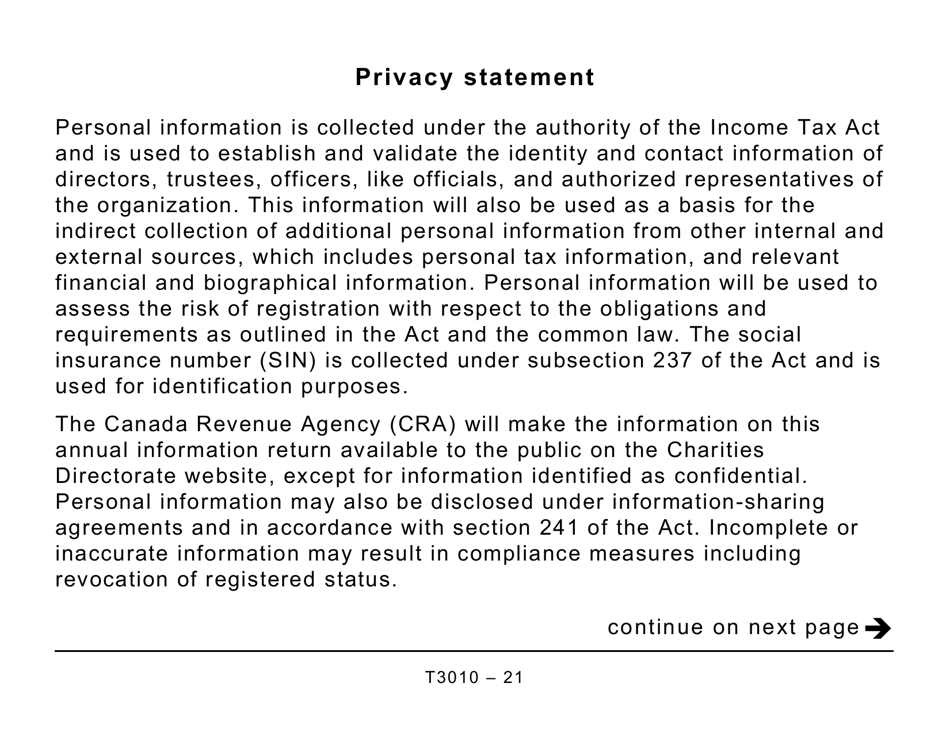

Q: What happens after I file Form T3010?

A: The Canada Revenue Agency (CRA) will review the form and may request additional information or conduct an audit.

Q: How can I contact the Canada Revenue Agency (CRA) for questions about Form T3010?

A: You can contact the Charities Directorate of the Canada Revenue Agency (CRA) for questions about Form T3010.