This version of the form is not currently in use and is provided for reference only. Download this version of

Form T936

for the current year.

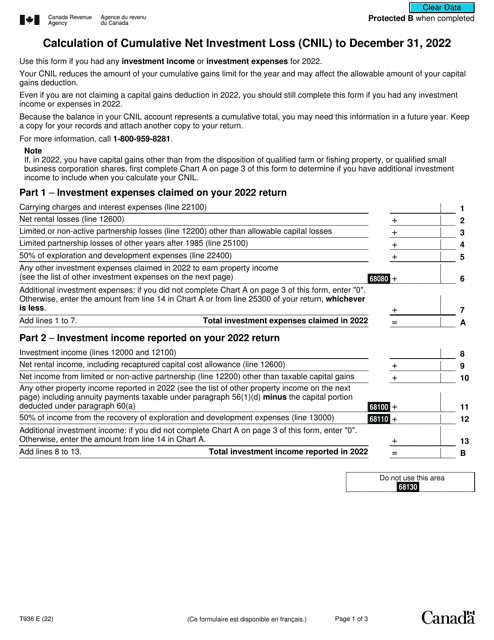

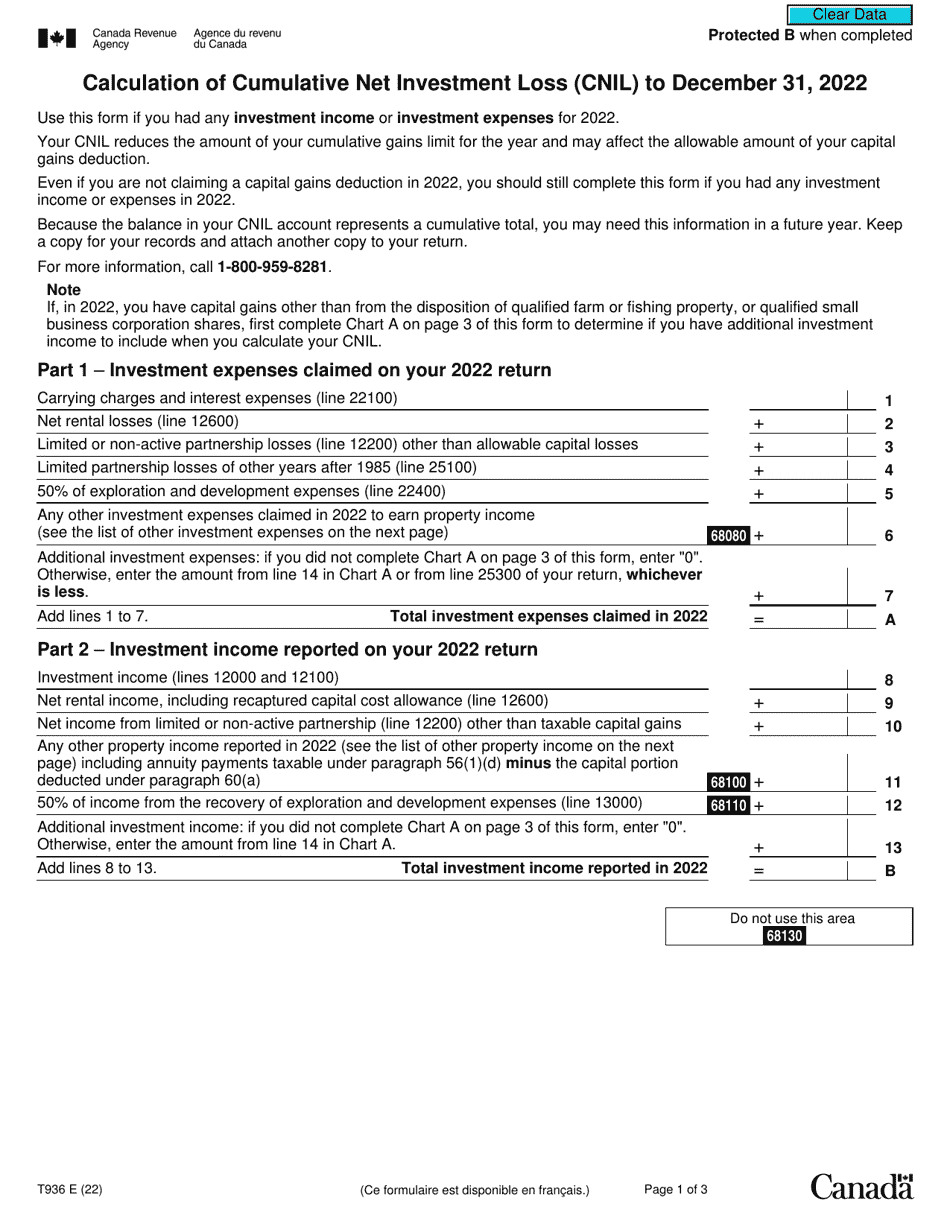

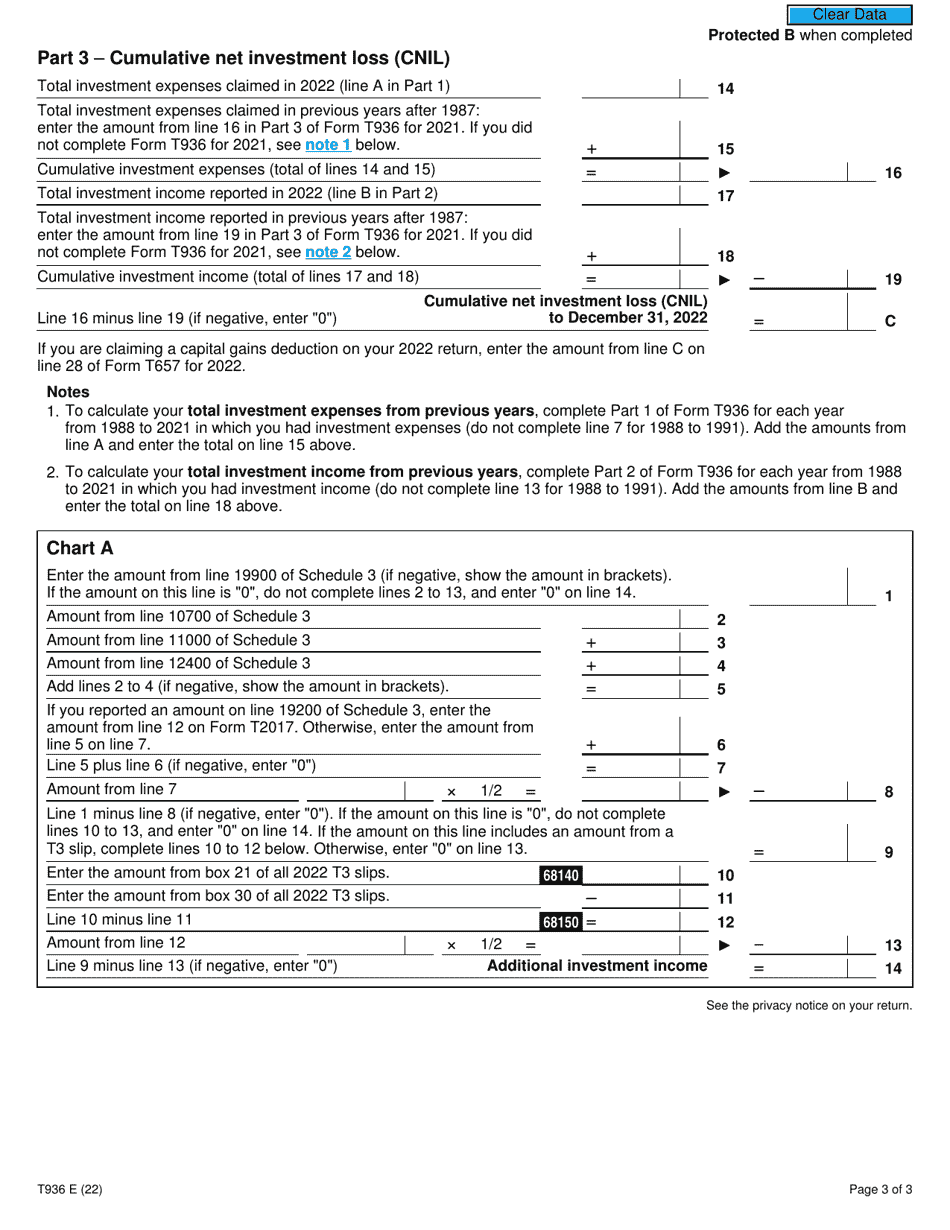

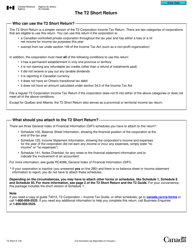

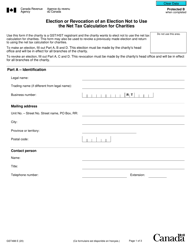

Form T936 Calculation of Cumulative Net Investment Loss (CNIL) - Canada

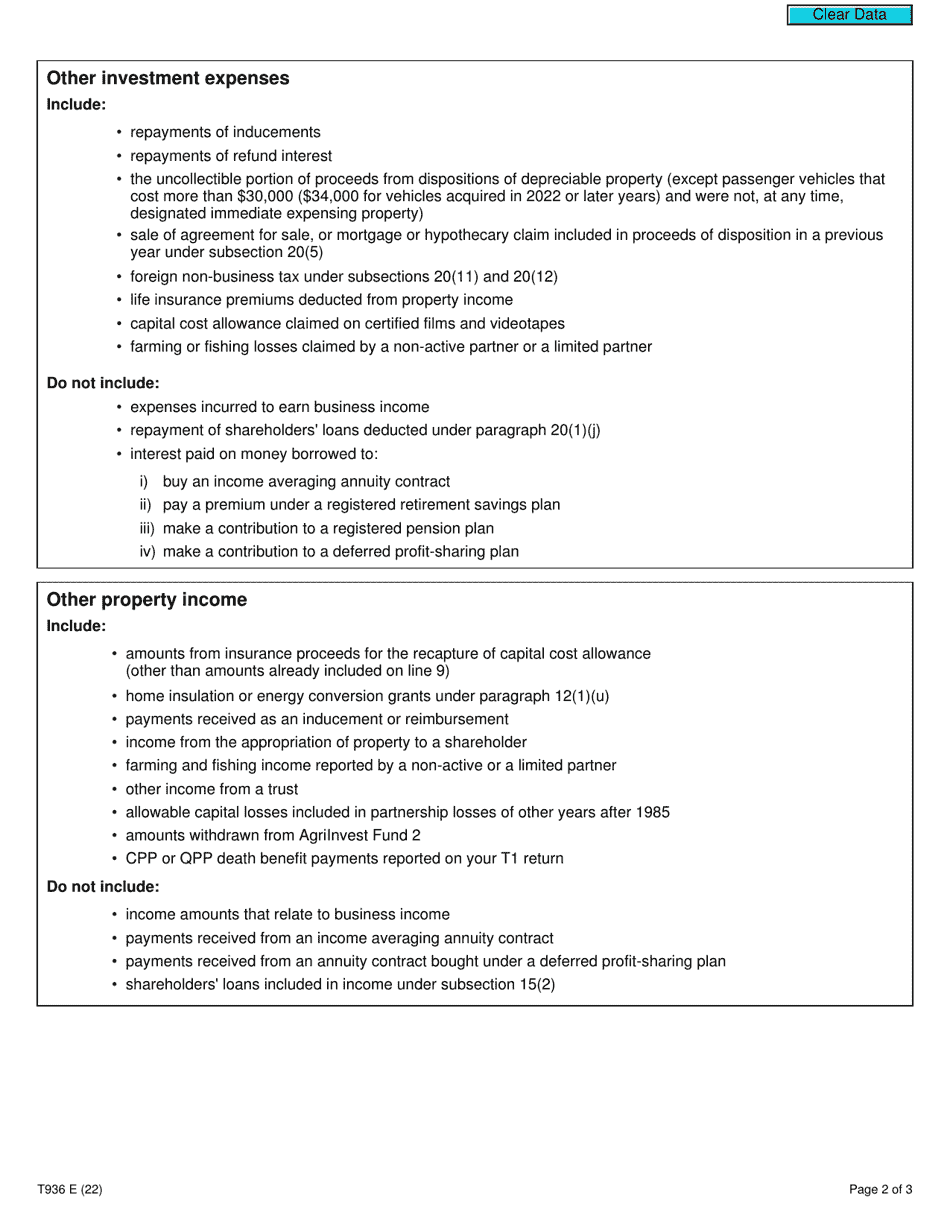

Form T936 Calculation of Cumulative Net Investment Loss (CNIL) in Canada is used to calculate the cumulative net investment loss for Canadian taxpayers who have disposed of property outside of Canada. The CNIL amount is used to determine the amount of foreign tax credits that can be claimed on the taxpayer's Canadian tax return.

In Canada, the Form T936 Calculation of Cumulative Net Investment Loss (CNIL) is filed by individuals and corporations who have incurred a cumulative net investment loss.

FAQ

Q: What is Form T936?

A: Form T936 is a tax form used in Canada to calculate the Cumulative Net Investment Loss (CNIL).

Q: What is the Cumulative Net Investment Loss (CNIL)?

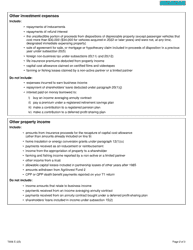

A: The Cumulative Net Investment Loss (CNIL) is a measure used in Canada to determine how much of a taxpayer's investment losses can be used to offset future capital gains.

Q: Why is Form T936 used?

A: Form T936 is used to calculate and report the CNIL, which is an important factor in determining the allowable deduction for investment losses in Canada.

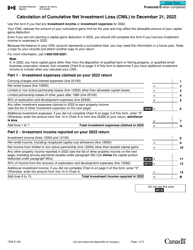

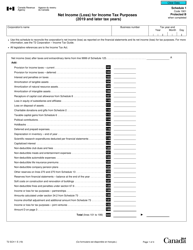

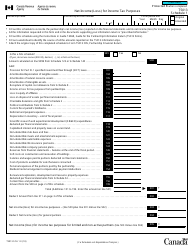

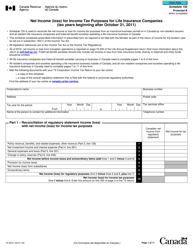

Q: How is the CNIL calculated?

A: The CNIL is calculated by taking the cumulative amount of investment losses incurred by the taxpayer and subtracting any previous deductions claimed.

Q: Are there any restrictions on using the CNIL?

A: Yes, there are restrictions on using the CNIL. It can only be offset against future capital gains and cannot be used to reduce other types of income.

Q: Are there any time limits for using the CNIL?

A: Yes, there is a time limit for using the CNIL. It can be carried forward indefinitely to offset future capital gains, but it cannot be carried back to prior years.

Q: Do I need to attach Form T936 to my tax return?

A: Yes, if you have a CNIL balance to report, you need to complete and attach Form T936 to your tax return.

Q: Is Form T936 specific to Canada?

A: Yes, Form T936 is specific to Canada and is used for Canadian tax purposes.

Q: What should I do if I need help with Form T936?

A: If you need help with Form T936 or have questions about calculating the CNIL, it is recommended to consult a tax professional or contact the Canada Revenue Agency (CRA).