This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3M

for the current year.

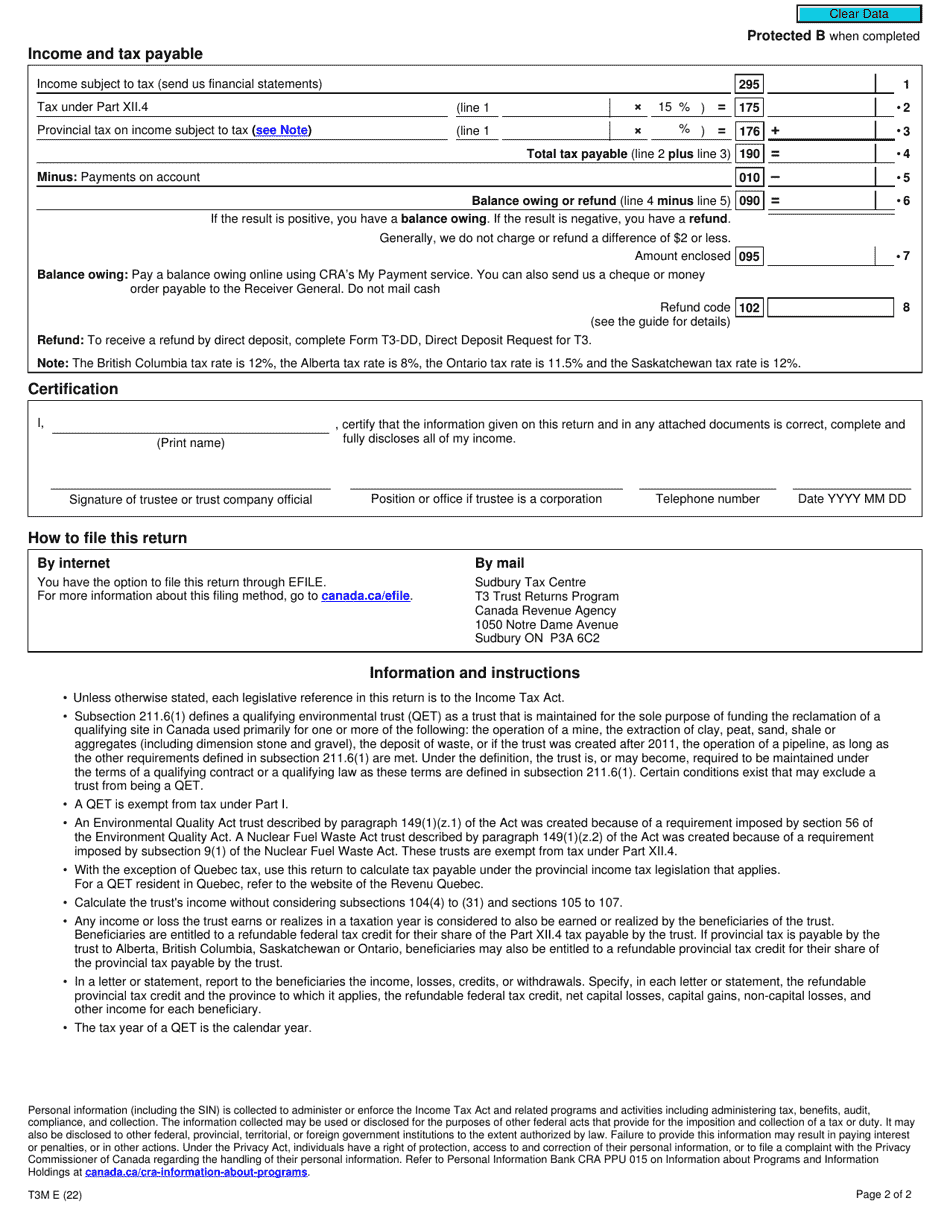

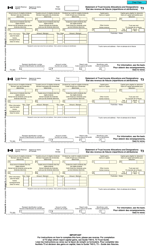

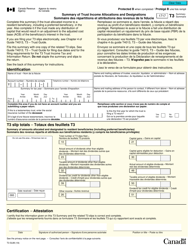

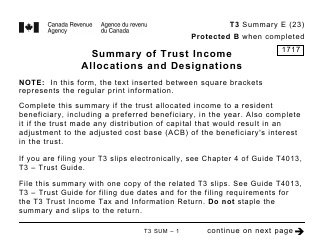

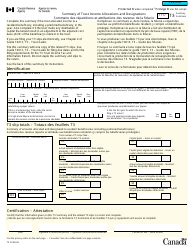

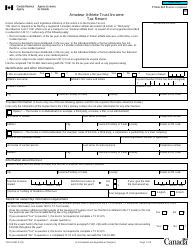

Form T3M Environmental Trust Income Tax Return - Canada

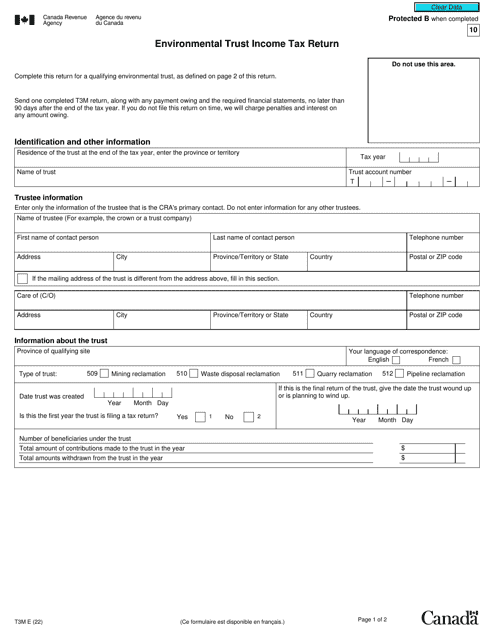

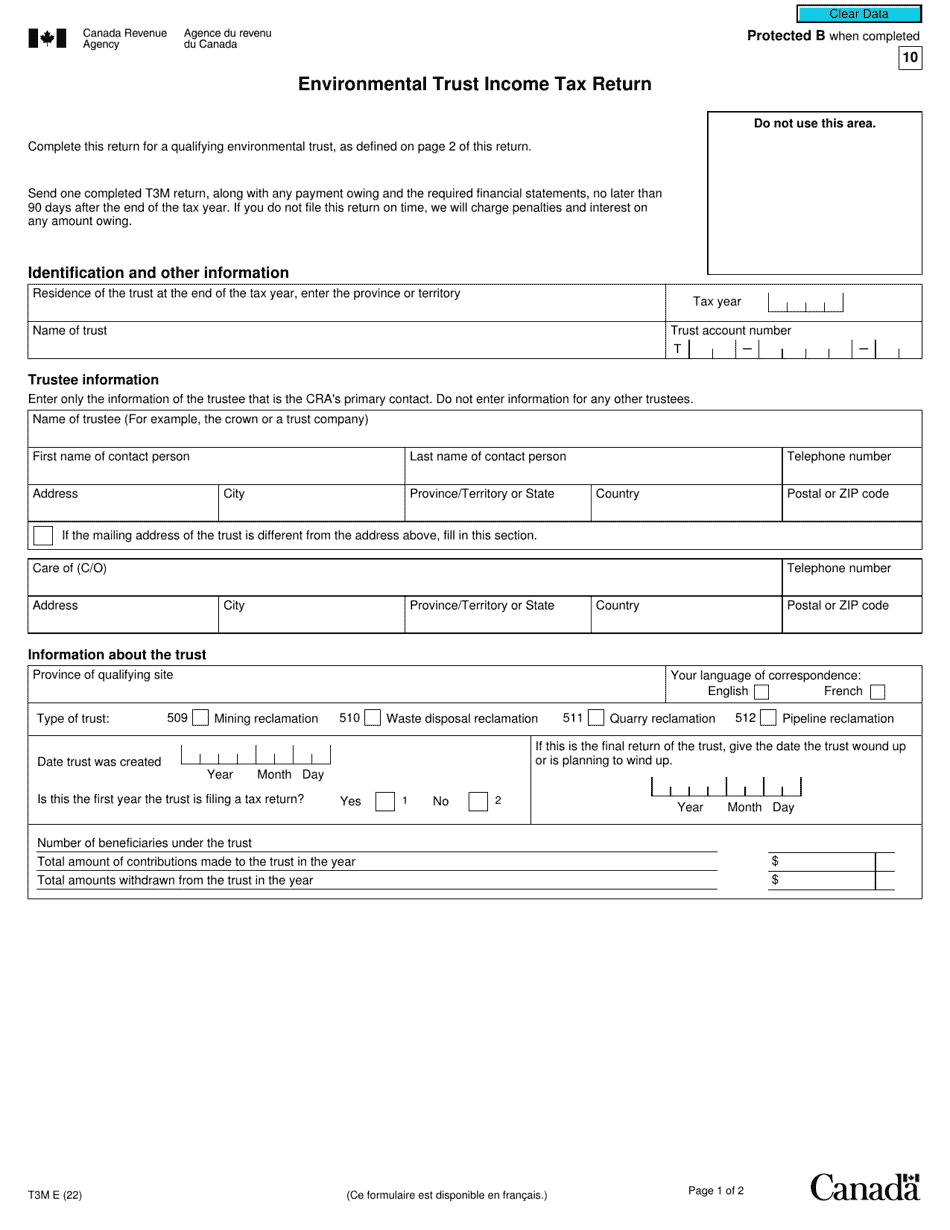

Form T3M Environmental Trust Income Tax Return is used by trusts in Canada that have been designated as environmental trusts to report their income and claim deductions specific to their environmental activities. These trusts are established to facilitate the reclamation or remediation of polluted or contaminated sites.

The Form T3M Environmental Trust Income Tax Return in Canada is filed by the trustee of the environmental trust.

FAQ

Q: What is Form T3M?

A: Form T3M is the Environmental Trust Income Tax Return in Canada.

Q: Who needs to file Form T3M?

A: Trusts established for the purpose of environmental protection in Canada need to file Form T3M.

Q: What is the purpose of Form T3M?

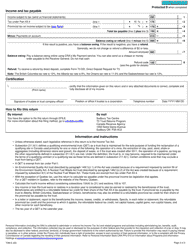

A: Form T3M is used to report income, deductions, and taxes related to a trust established for environmental protection purposes.

Q: When is the deadline to file Form T3M?

A: The deadline to file Form T3M is typically 90 days after the end of the trust's taxation year.

Q: Are there any penalties for late filing of Form T3M?

A: Yes, there may be penalties for late filing of Form T3M, so it's important to file on time.

Q: What if I need help with filing Form T3M?

A: If you need help with filing Form T3M, you can contact the Canada Revenue Agency (CRA) for assistance.