This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3NL

for the current year.

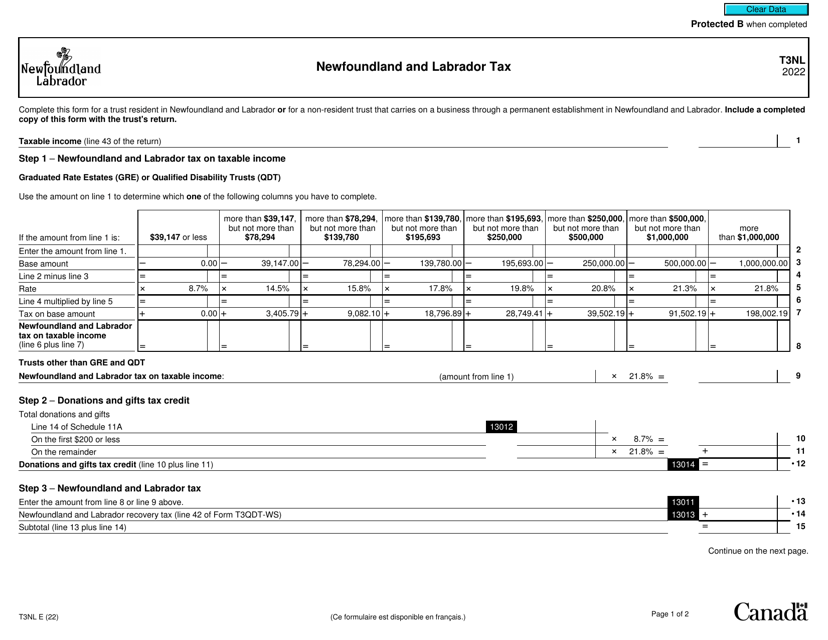

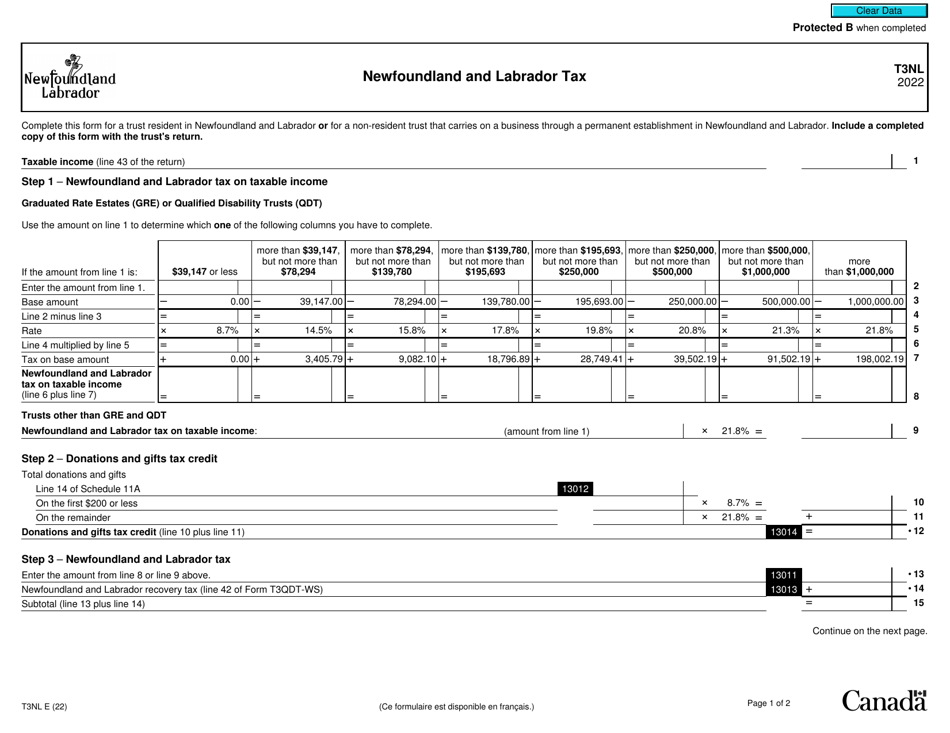

Form T3NL Newfoundland and Labrador Tax - Canada

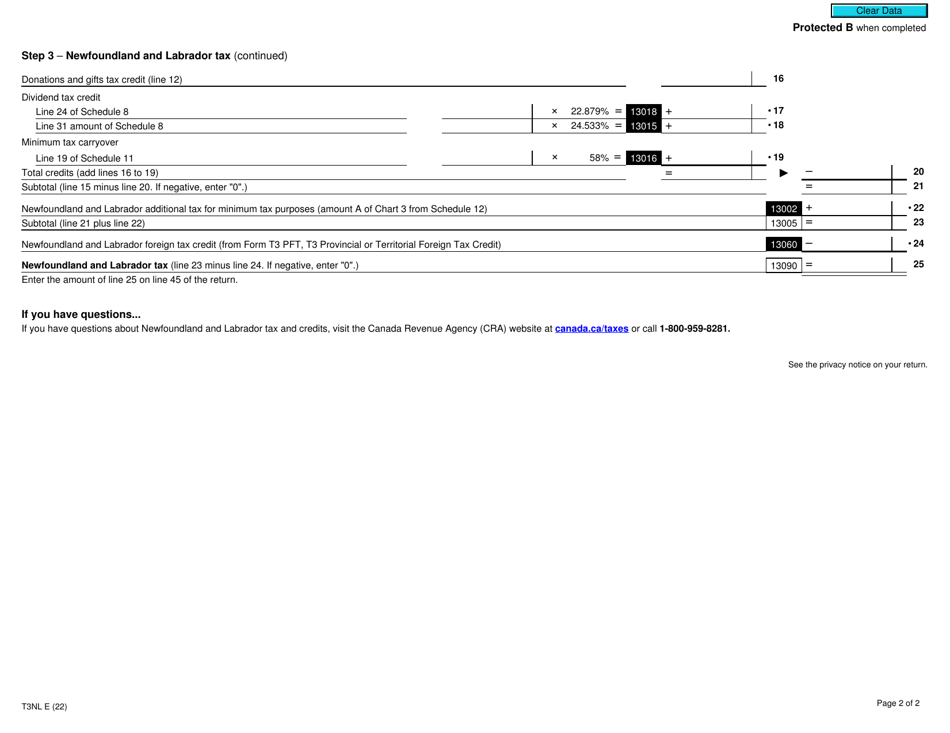

Form T3NL, Newfoundland and Labrador Tax, is used to report and calculate provincial tax owed by residents of Newfoundland and Labrador, Canada. It is specifically for reporting provincial income tax, credits, and deductions for individuals who are required to file a federal income tax return.

The Form T3NL Newfoundland and Labrador Tax is filed by individuals and businesses who are residents of Newfoundland and Labrador, Canada.

FAQ

Q: What is Form T3NL?

A: Form T3NL is a tax form specific to residents of Newfoundland and Labrador in Canada.

Q: Who needs to file Form T3NL?

A: Residents of Newfoundland and Labrador who have income that is subject to provincial tax need to file Form T3NL.

Q: What is the purpose of Form T3NL?

A: The purpose of Form T3NL is to report income earned by residents of Newfoundland and Labrador and calculate the provincial tax owed.

Q: What information is required on Form T3NL?

A: Form T3NL requires information about the taxpayer's income, deductions, and provincial tax credits.

Q: When is the deadline to file Form T3NL?

A: The deadline to file Form T3NL is the same as the federal incometax deadline, which is usually April 30th.

Q: What happens if I don't file Form T3NL?

A: If you don't file Form T3NL, you may be subject to penalties and interest charges by the provincial tax authorities.

Q: Is Form T3NL only for residents of Newfoundland and Labrador?

A: Yes, Form T3NL is specific to residents of Newfoundland and Labrador and is used to calculate provincial taxes.

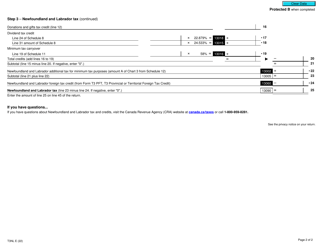

Q: Can I claim both federal and provincial tax credits on Form T3NL?

A: No, Form T3NL is only used to calculate provincial tax credits. Federal tax credits are claimed on the federal income tax return.