This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1079

for the current year.

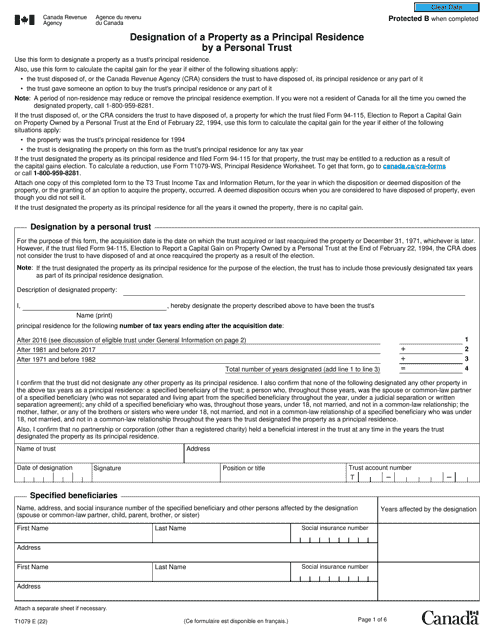

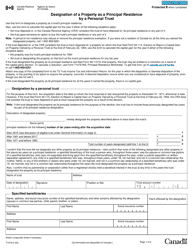

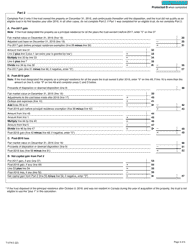

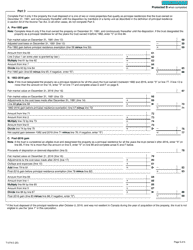

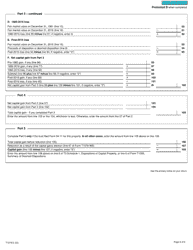

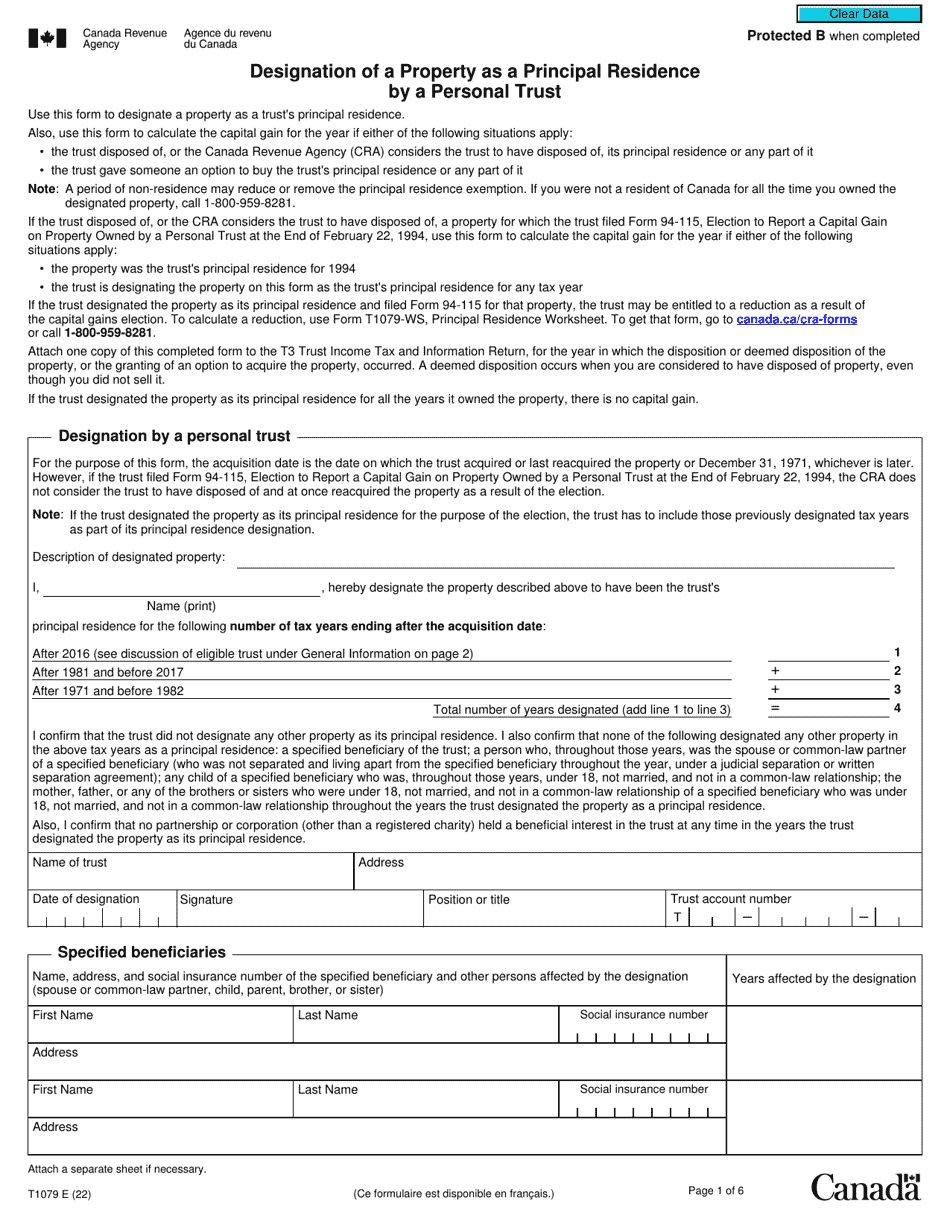

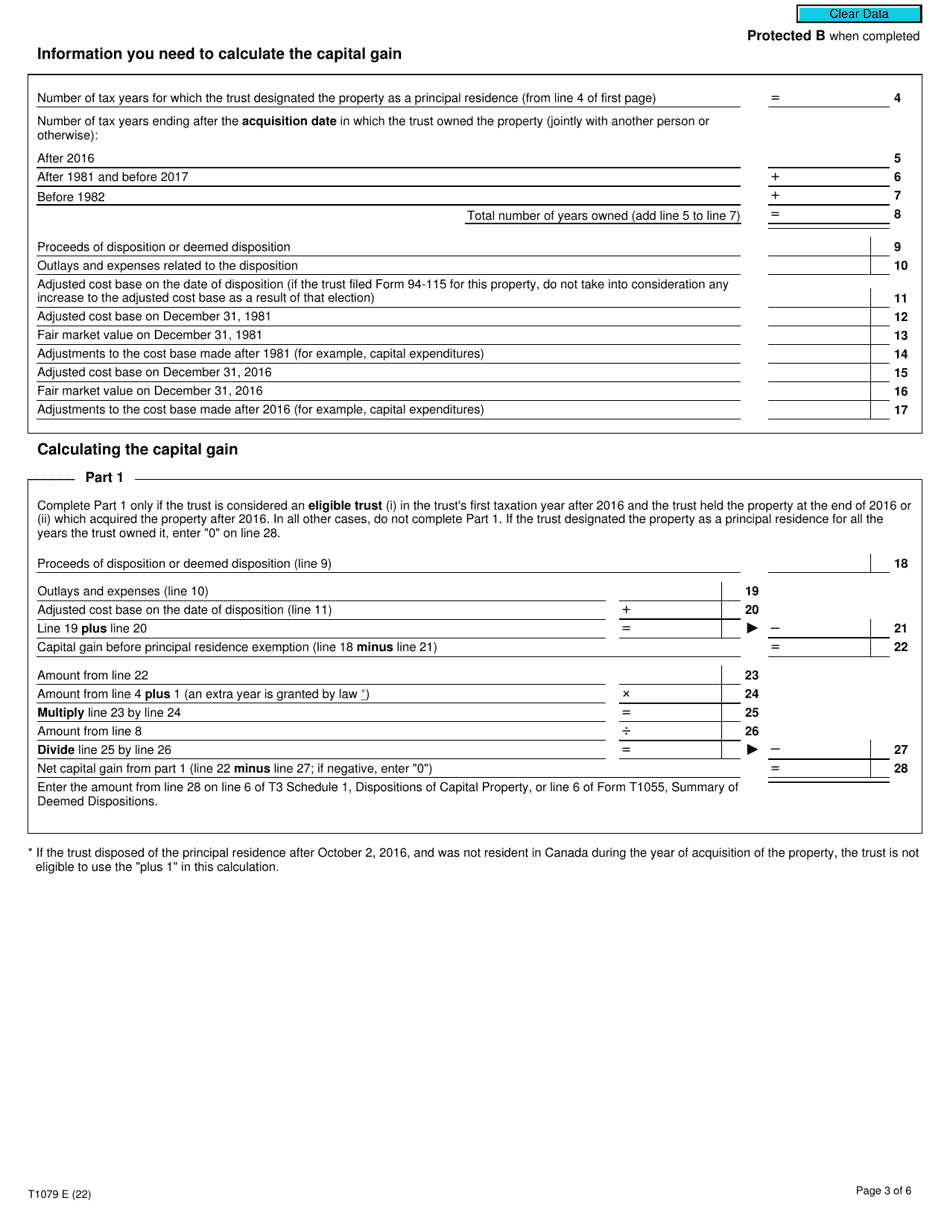

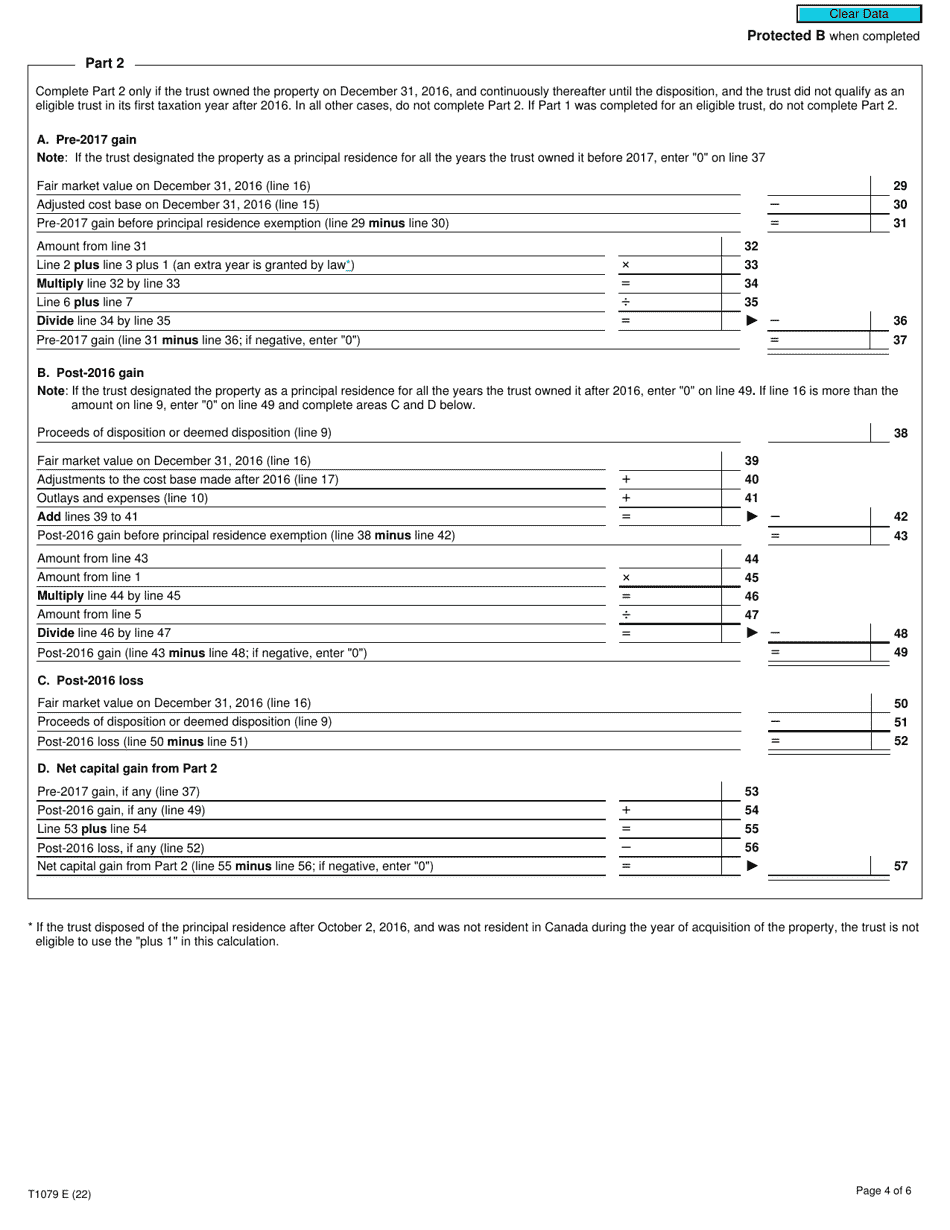

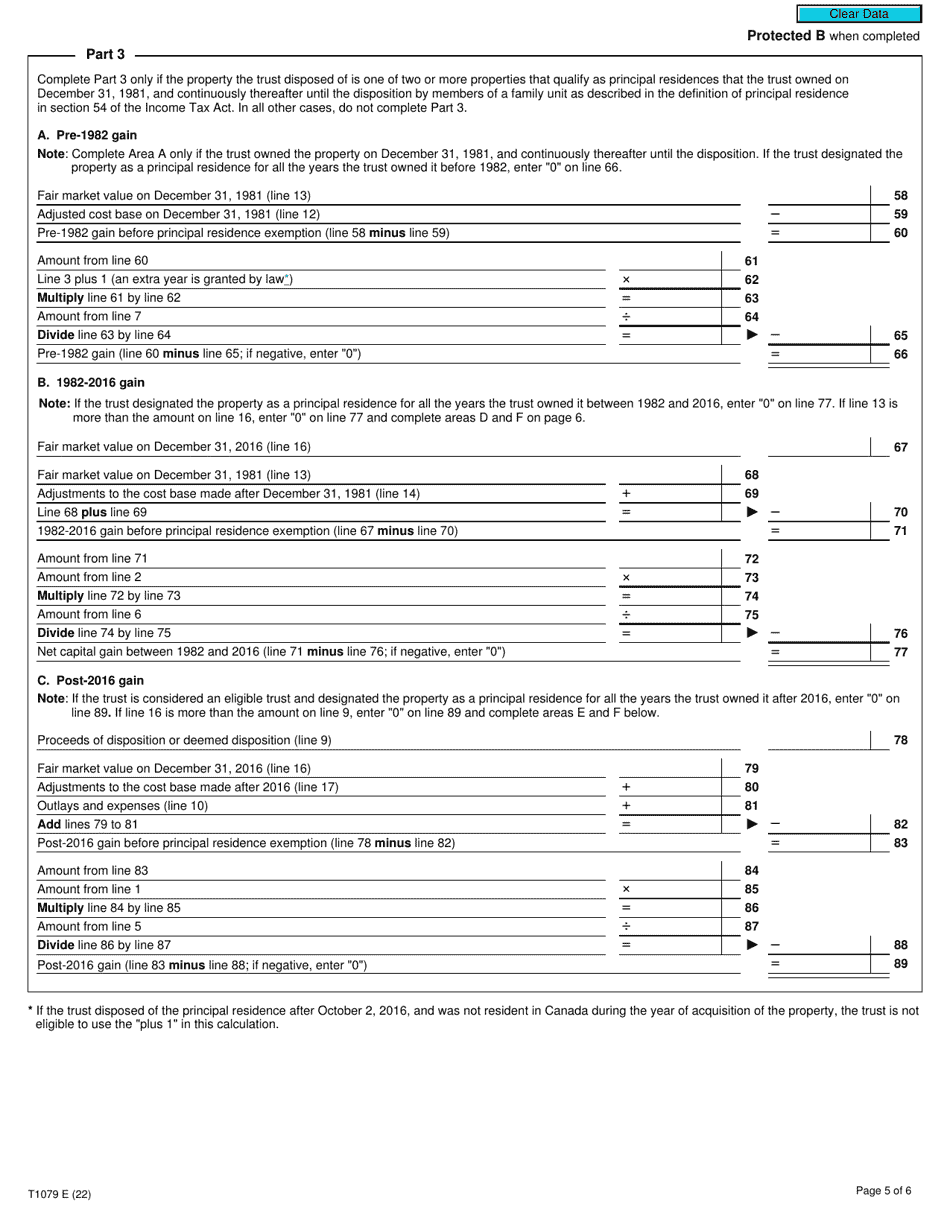

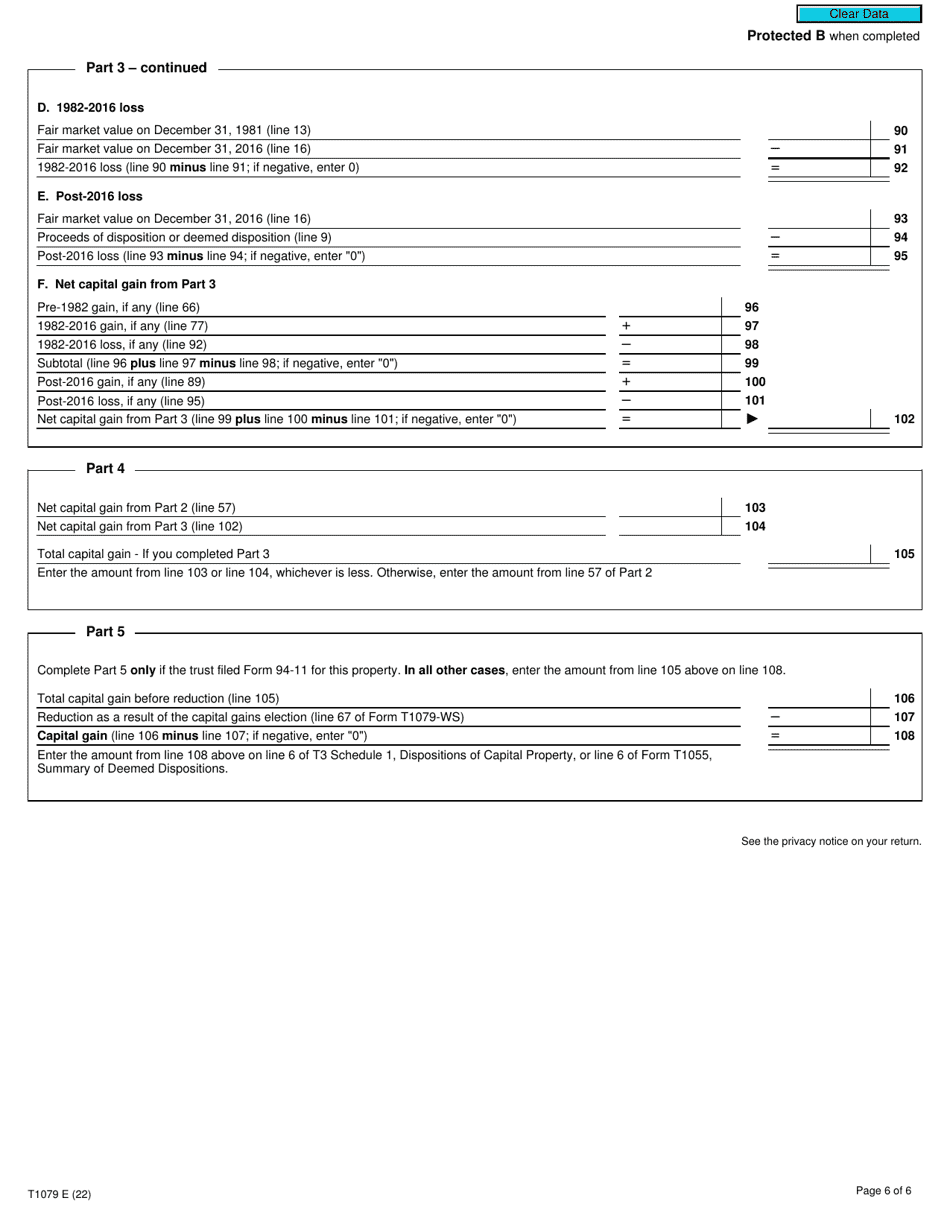

Form T1079 Designation of a Property as a Principal Residence by a Personal Trust - Canada

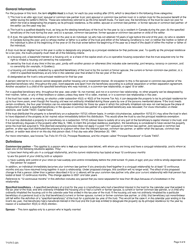

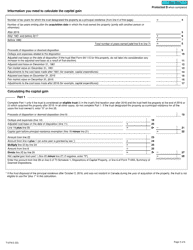

Form T1079 Designation of a Property as a Principal Residence by a Personal Trust in Canada is used to claim the Principal Residence Exemption for a property owned by a personal trust. It helps determine the tax treatment of the property for capital gains purposes.

In Canada, the Form T1079 Designation of a Property as a Principal Residence by a Personal Trust is filed by the trustee of the personal trust.

FAQ

Q: What is Form T1079?

A: Form T1079 is a tax form used in Canada to designate a property as a principal residence by a personal trust.

Q: Why would a personal trust need to designate a property as a principal residence?

A: A personal trust may need to designate a property as a principal residence for tax purposes, to claim the principal residence exemption.

Q: What is the principal residence exemption?

A: The principal residence exemption is a tax benefit in Canada that allows individuals to exclude the capital gains on the sale of their principal residence from their taxable income.

Q: How does Form T1079 work?

A: Form T1079 is used to notify the Canada Revenue Agency (CRA) of the personal trust's designation of a property as a principal residence. The form must be filed with the trust's tax return for the year the designation is made.

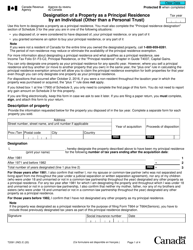

Q: Are there any requirements or conditions for a property to be designated as a principal residence?

A: Yes, there are several requirements and conditions, including that the property must be a housing unit, it must be occupied by a specified individual, and it must meet certain usage criteria.

Q: Are there any penalties for not filing Form T1079?

A: Failure to file Form T1079 when required may result in penalties or the loss of the principal residence exemption.

Q: Is Form T1079 only for personal trusts?

A: Yes, Form T1079 is specifically for personal trusts to designate a property as a principal residence. Other entities, such as individuals or corporations, have different forms and processes for designation.

Q: Can a personal trust designate more than one property as a principal residence?

A: No, a personal trust can only designate one property as a principal residence for a given tax year.

Q: Is Form T1079 applicable in the United States?

A: No, Form T1079 is specific to Canada and is not applicable in the United States.