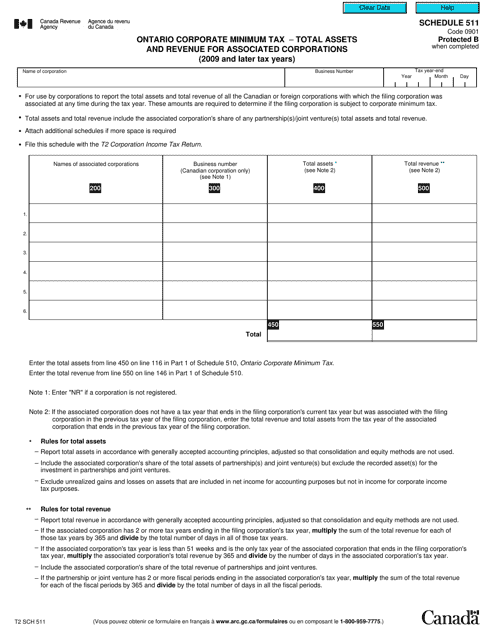

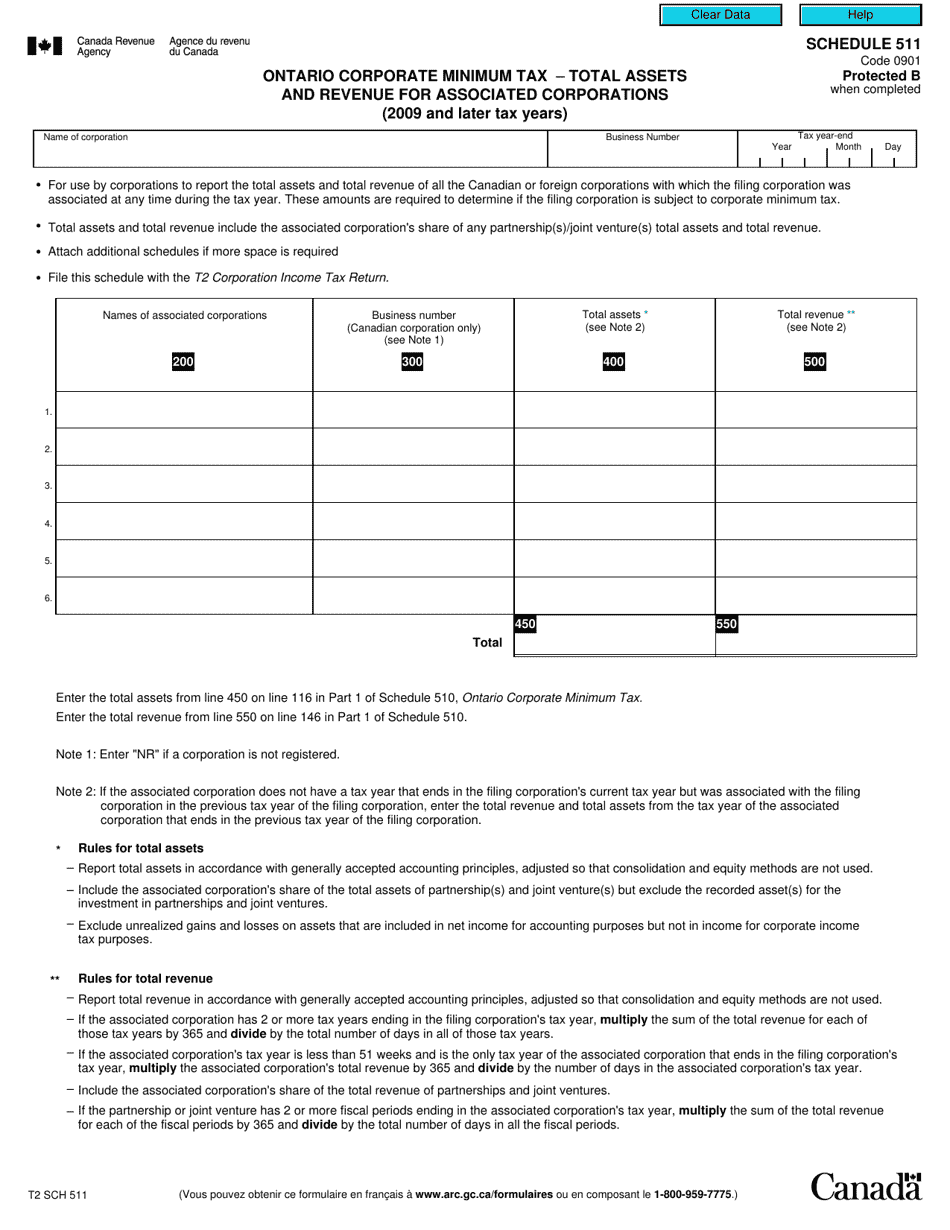

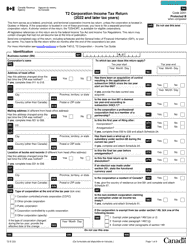

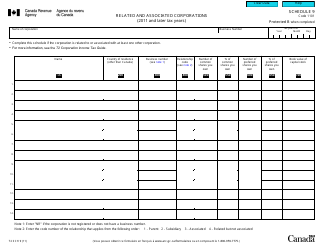

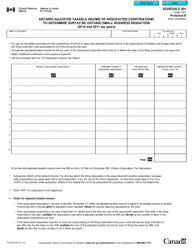

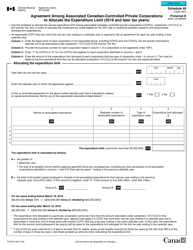

Form T2 Schedule 511 Ontario Corporate Minimum Tax - Total Assets and Revenue for Associated Corporations (2009 and Later Tax Years) - Canada

Form T2 Schedule 511 is used in Canada for reporting the total assets and revenue for associated corporations in the province of Ontario. It is specifically meant for calculating the Ontario Corporate Minimum Tax for tax years 2009 and later.

The corporation in Ontario files the Form T2 Schedule 511 Ontario Corporate Minimum Tax - Total Assets and Revenue for Associated Corporations (2009 and Later Tax Years) in Canada.

FAQ

Q: What is Form T2 Schedule 511?

A: Form T2 Schedule 511 is a tax form used in Canada for Ontario Corporate Minimum Tax.

Q: What does T2 Schedule 511 measure?

A: T2 Schedule 511 measures the total assets and revenue for associated corporations in Ontario.

Q: Which tax years does T2 Schedule 511 apply to?

A: T2 Schedule 511 applies to tax years 2009 and later.

Q: Who needs to fill out T2 Schedule 511?

A: Corporations in Ontario that have associated corporations need to fill out T2 Schedule 511.

Q: What information is required for T2 Schedule 511?

A: The total assets and revenue for associated corporations in Ontario is required for T2 Schedule 511.