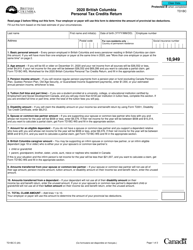

This version of the form is not currently in use and is provided for reference only. Download this version of

Form TD1

for the current year.

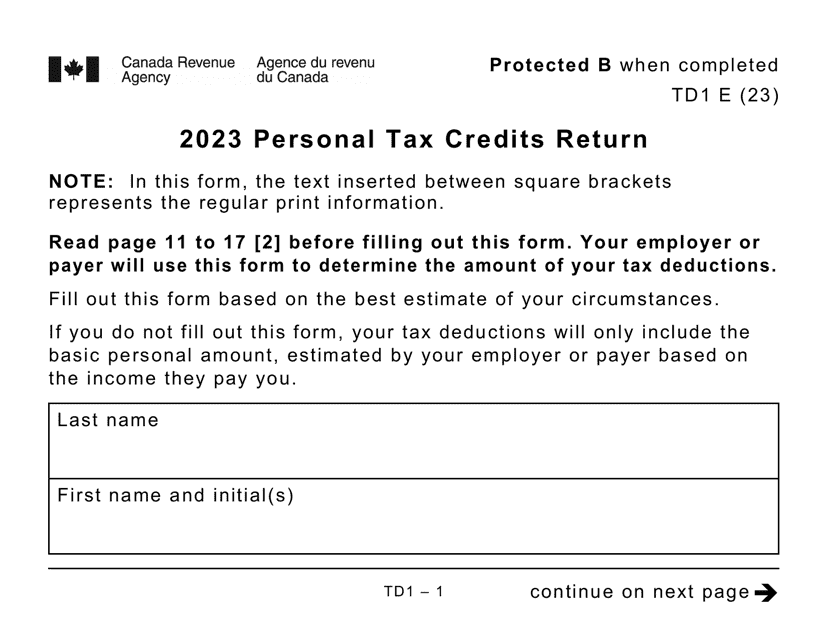

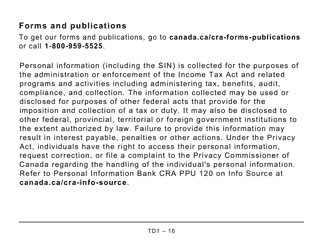

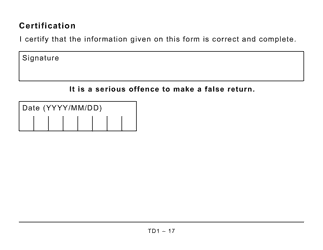

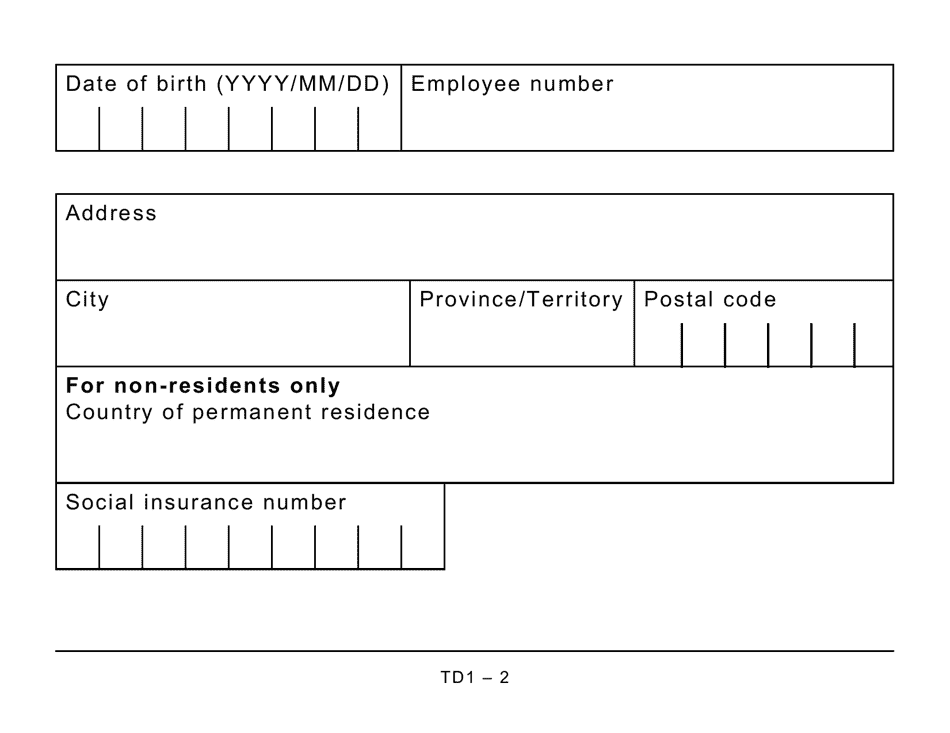

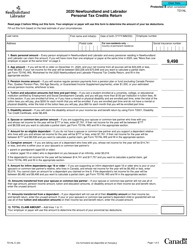

Form TD1 Personal Tax Credits Return (Large Print) - Canada

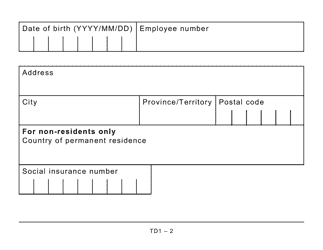

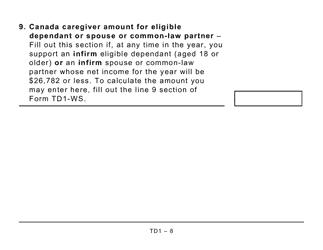

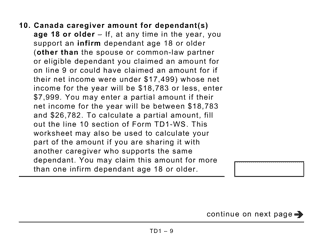

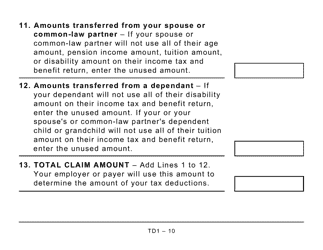

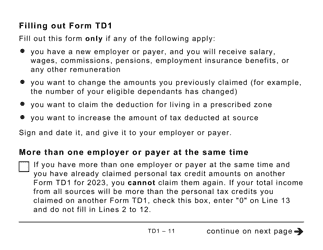

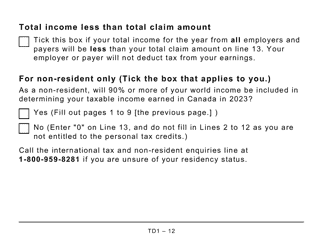

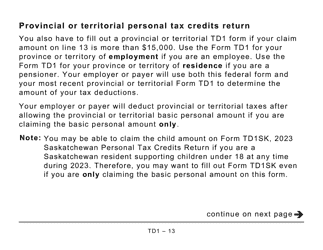

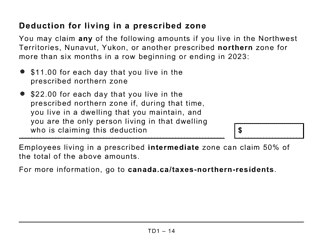

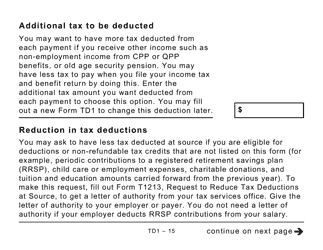

Form TD1 Personal Tax Credits Return (Large Print) in Canada is used to calculate the amount of tax that should be deducted from an individual's income throughout the year. It allows taxpayers to claim various tax credits and deductions they may be eligible for, such as the basic personal amount and additional tax credits. The form helps employers determine the correct amount of tax to withhold from an employee's income.

The Form TD1 Personal Tax Credits Return (Large Print) in Canada is typically filed by individuals who want to claim certain tax credits or deductions on their personal income tax return.

FAQ

Q: What is Form TD1 Personal Tax Credits Return?

A: Form TD1 Personal Tax Credits Return is a form used by individuals in Canada to apply for tax credits that can reduce the amount of income tax they owe.

Q: Who should use Form TD1 Personal Tax Credits Return?

A: Any individual who wants to claim certain tax credits or reduce the amount of income tax withheld from their paycheck should use Form TD1 Personal Tax Credits Return.

Q: When should I submit Form TD1 Personal Tax Credits Return?

A: You should submit Form TD1 Personal Tax Credits Return to your employer as soon as possible, preferably before you start receiving income from that employer.

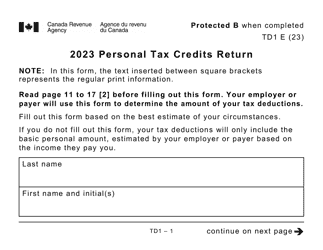

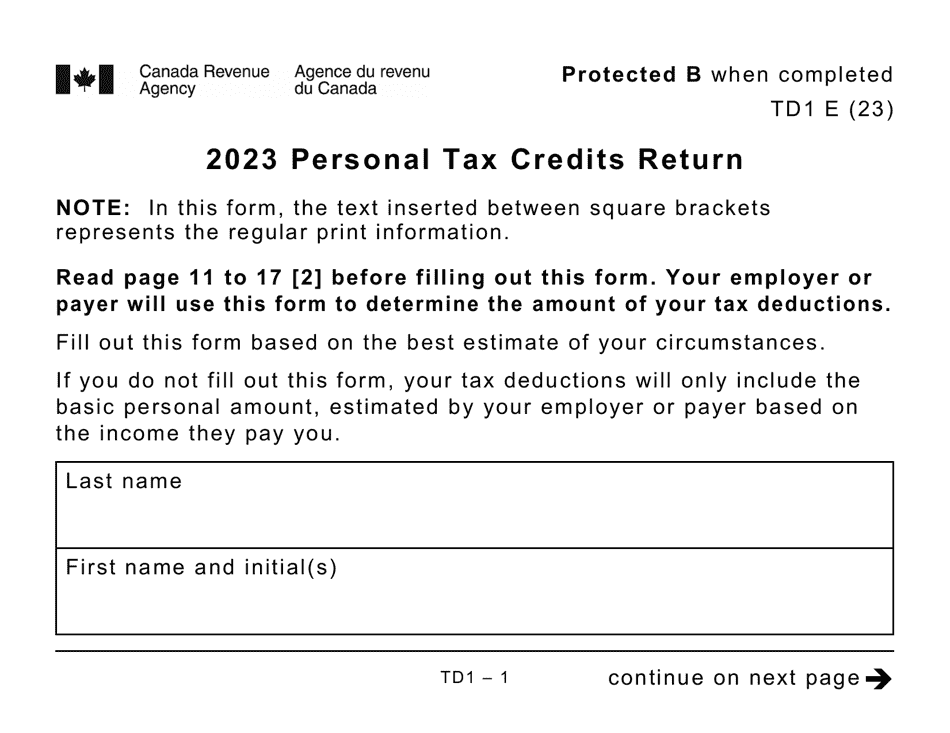

Q: What information do I need to complete Form TD1 Personal Tax Credits Return?

A: You will need information about your personal circumstances, such as your marital status, number of dependents, and other eligible tax credits you want to claim.