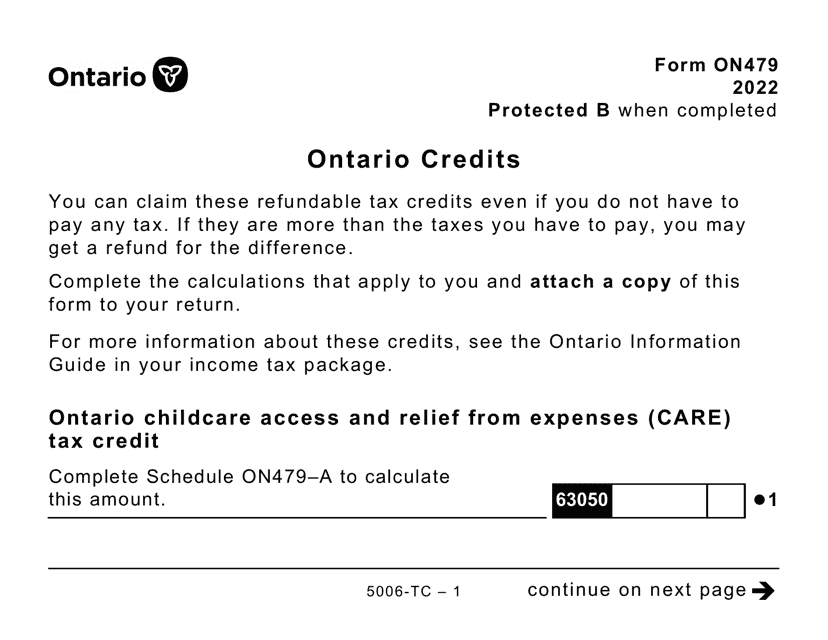

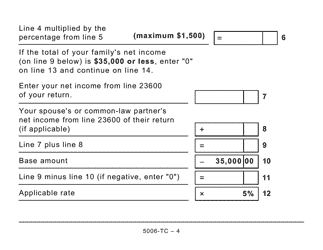

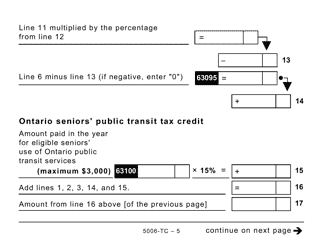

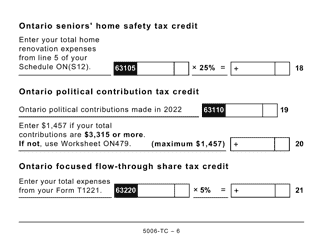

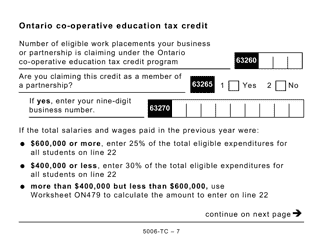

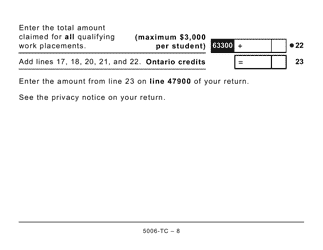

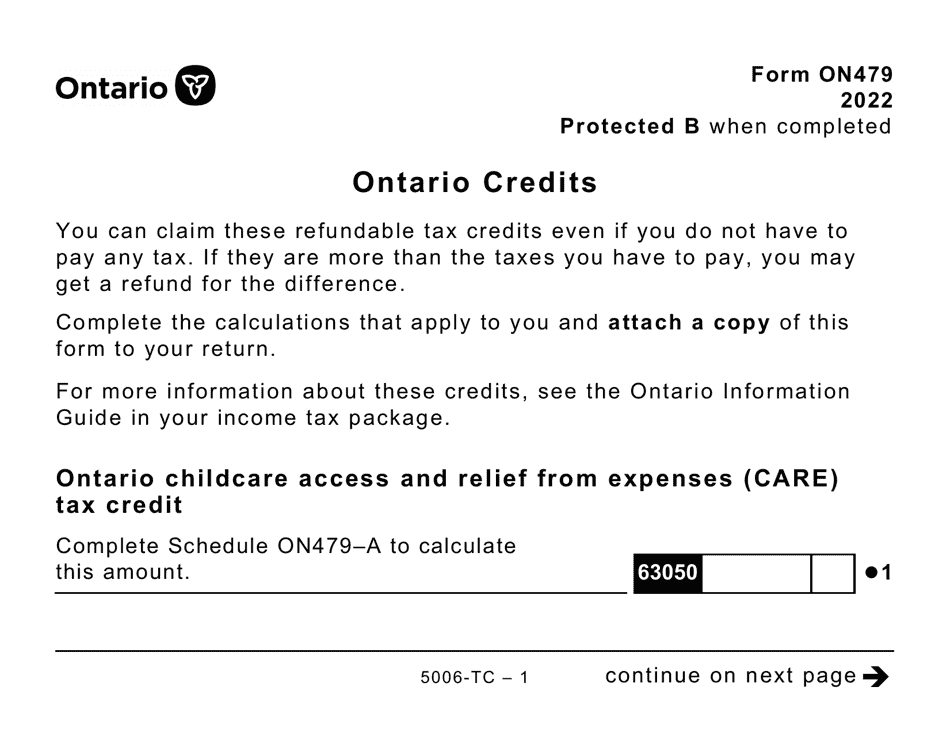

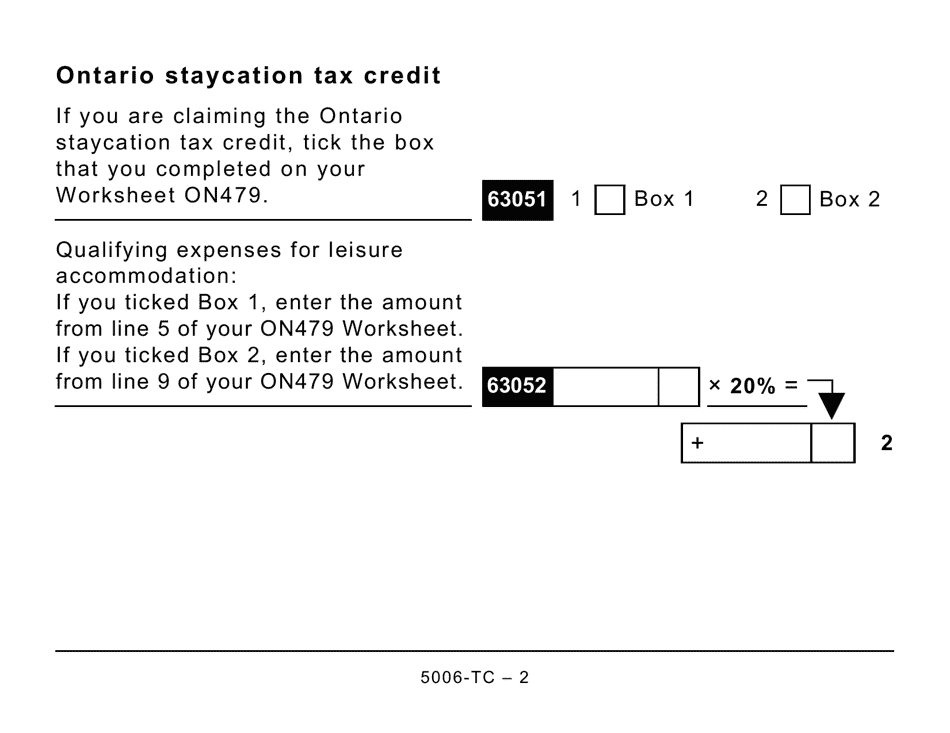

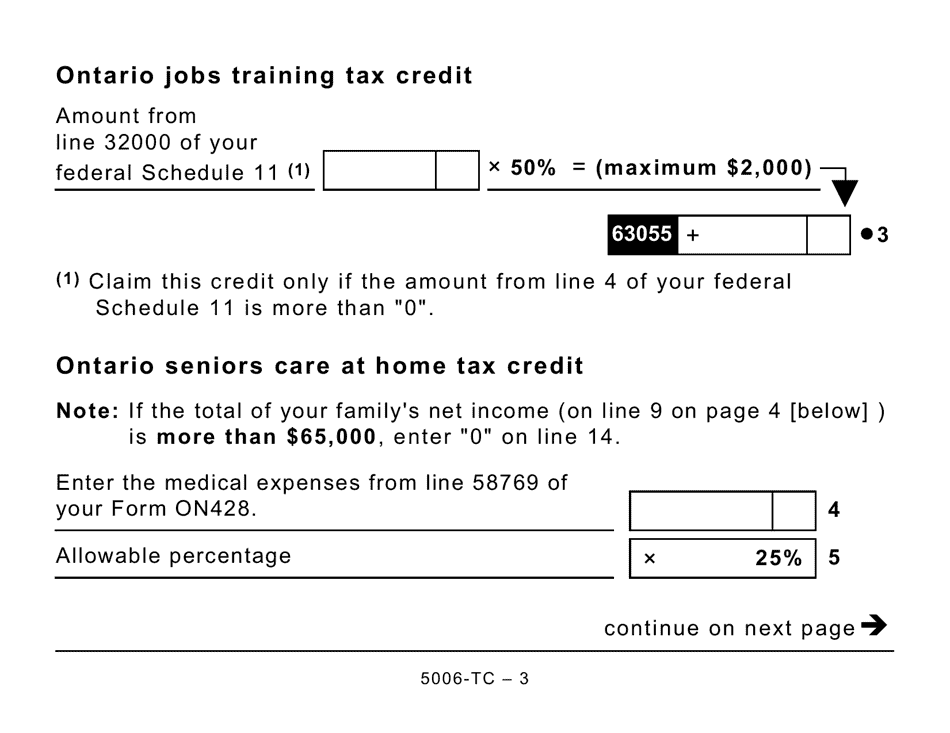

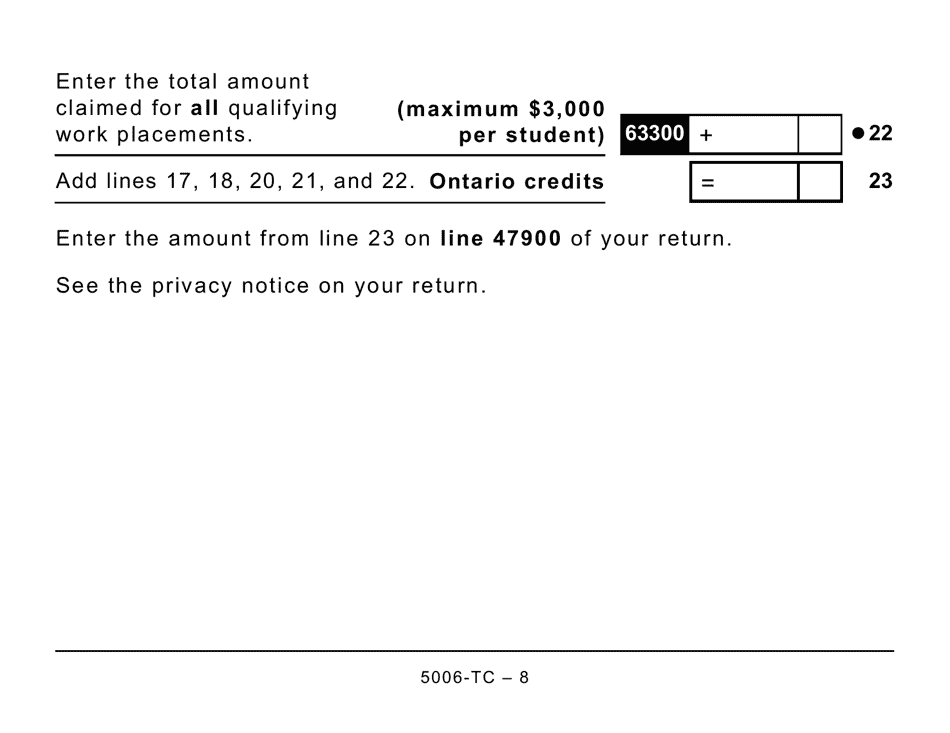

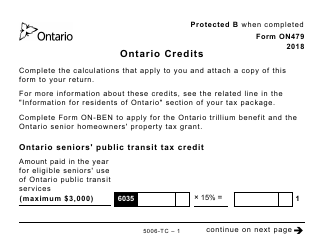

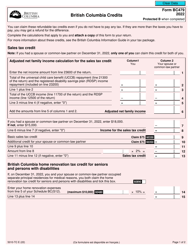

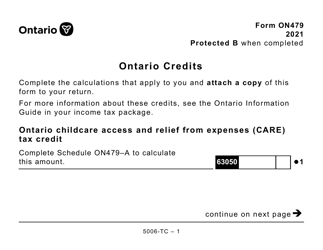

Form 5006-TC (ON479) Ontario Credits (Large Print) - Canada

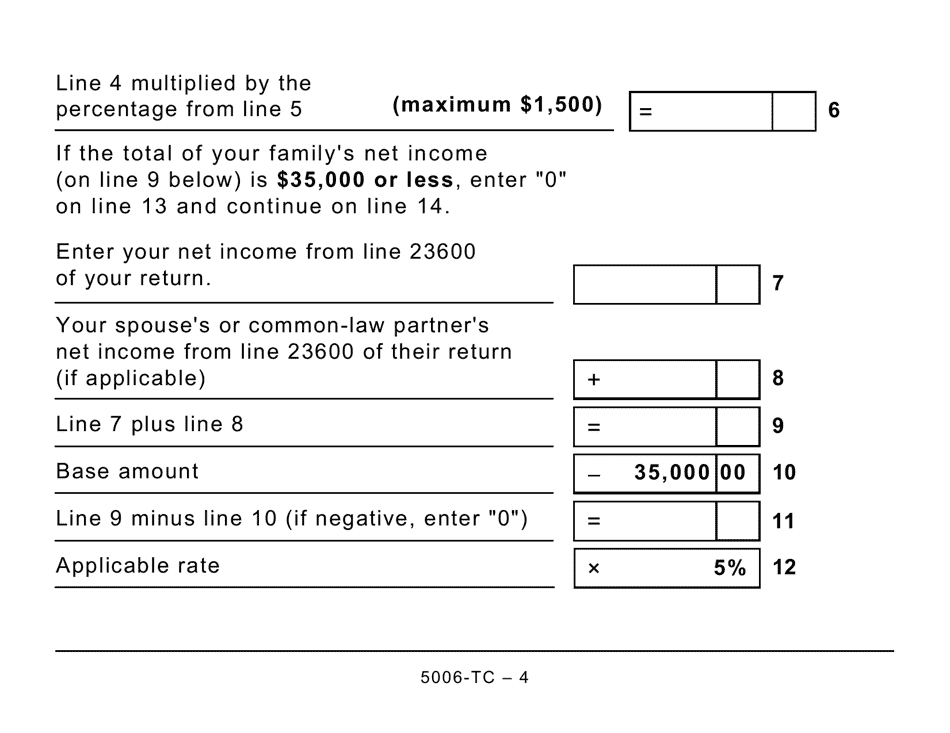

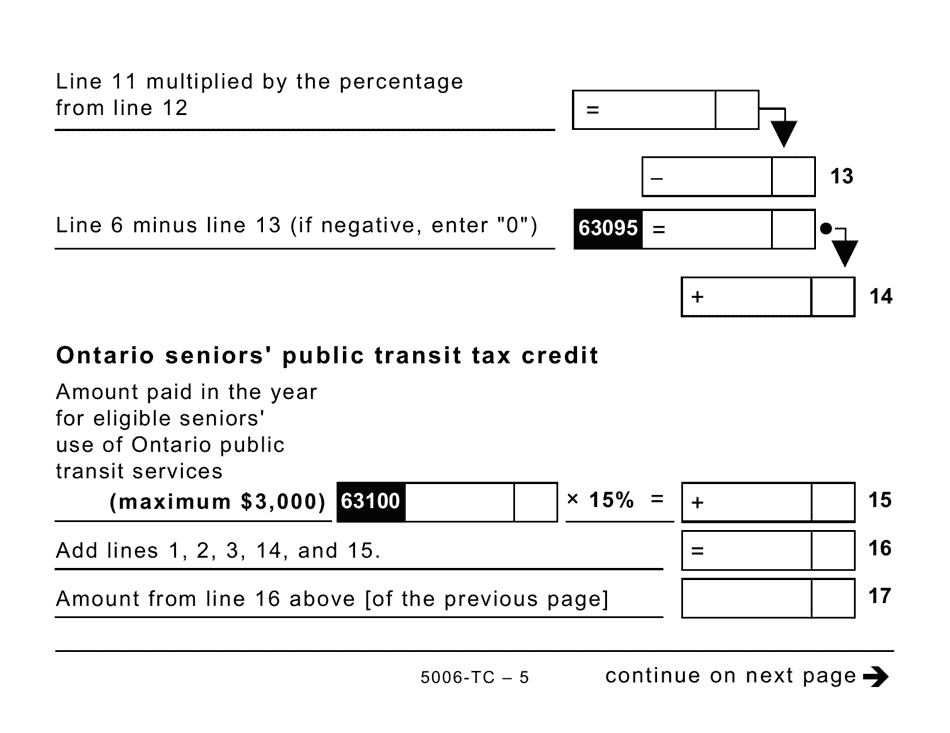

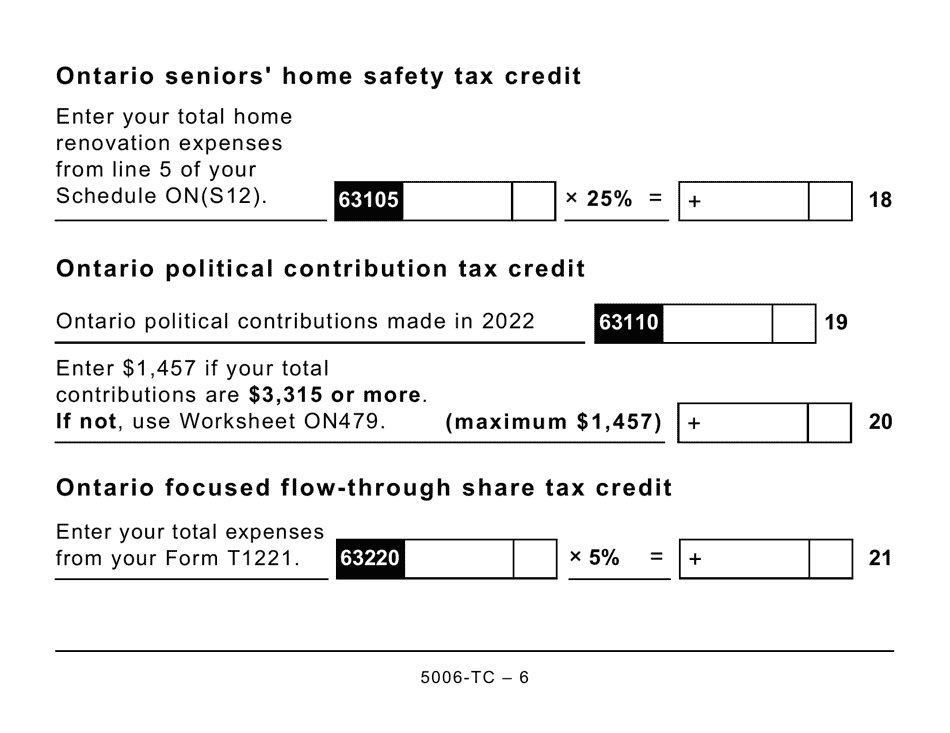

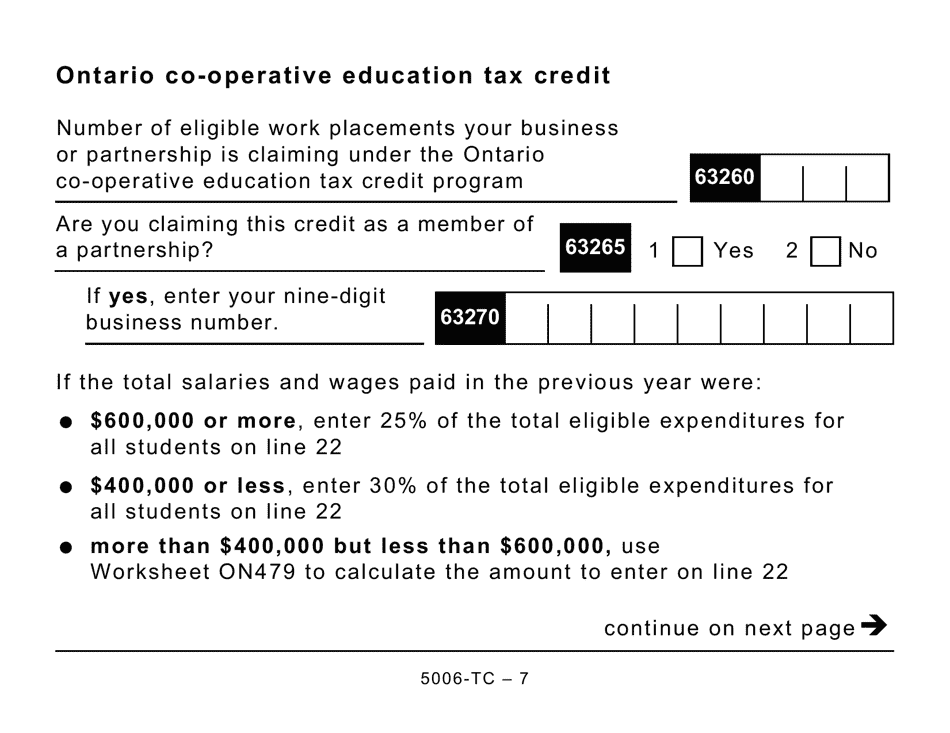

Form 5006-TC (ON479) Ontario Credits (Large Print) is used in Canada for claiming provincial tax credits in Ontario.

The form 5006-TC (ON479) Ontario Credits (Large Print) is usually filed by individuals who are claiming Ontario tax credits in Canada.

FAQ

Q: What is Form 5006-TC?

A: Form 5006-TC is a tax form used in Ontario, Canada to claim tax credits.

Q: What is ON479?

A: ON479 is the specific form number for the Ontario Credits, commonly known as the Ontario Tax Credit form.

Q: What are tax credits?

A: Tax credits are deductions that reduce the amount of taxes you owe and can result in a refund if you have paid more taxes than necessary.

Q: Who is eligible for Ontario tax credits?

A: Residents of Ontario who have eligible expenses or meet specific criteria may be eligible for Ontario tax credits.

Q: What is the purpose of Form 5006-TC?

A: Form 5006-TC is used to calculate and claim various tax credits available to residents of Ontario, Canada.

Q: Do I need to file Form 5006-TC every year?

A: Form 5006-TC needs to be filed each year if you are claiming Ontario tax credits.

Q: What is the deadline for filing Form 5006-TC?

A: The deadline for filing Form 5006-TC is typically April 30th of the following year.

Q: Can I claim Ontario tax credits if I live in another province?

A: No, Ontario tax credits are only available to residents of Ontario.

Q: What should I do if I need assistance with Form 5006-TC?

A: You can seek assistance from the Canada Revenue Agency (CRA) or consult a tax professional for help with Form 5006-TC.