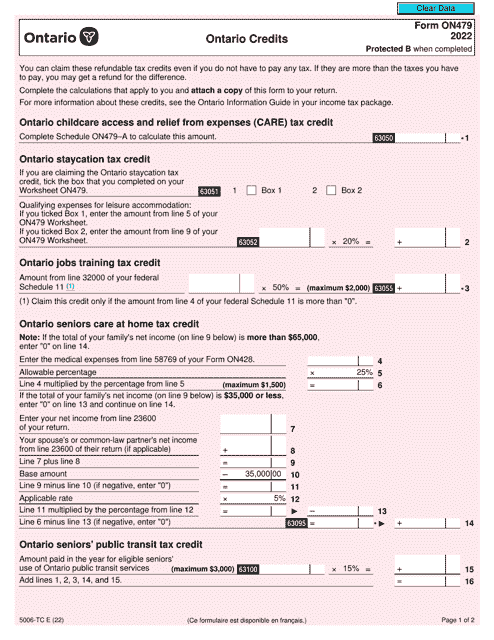

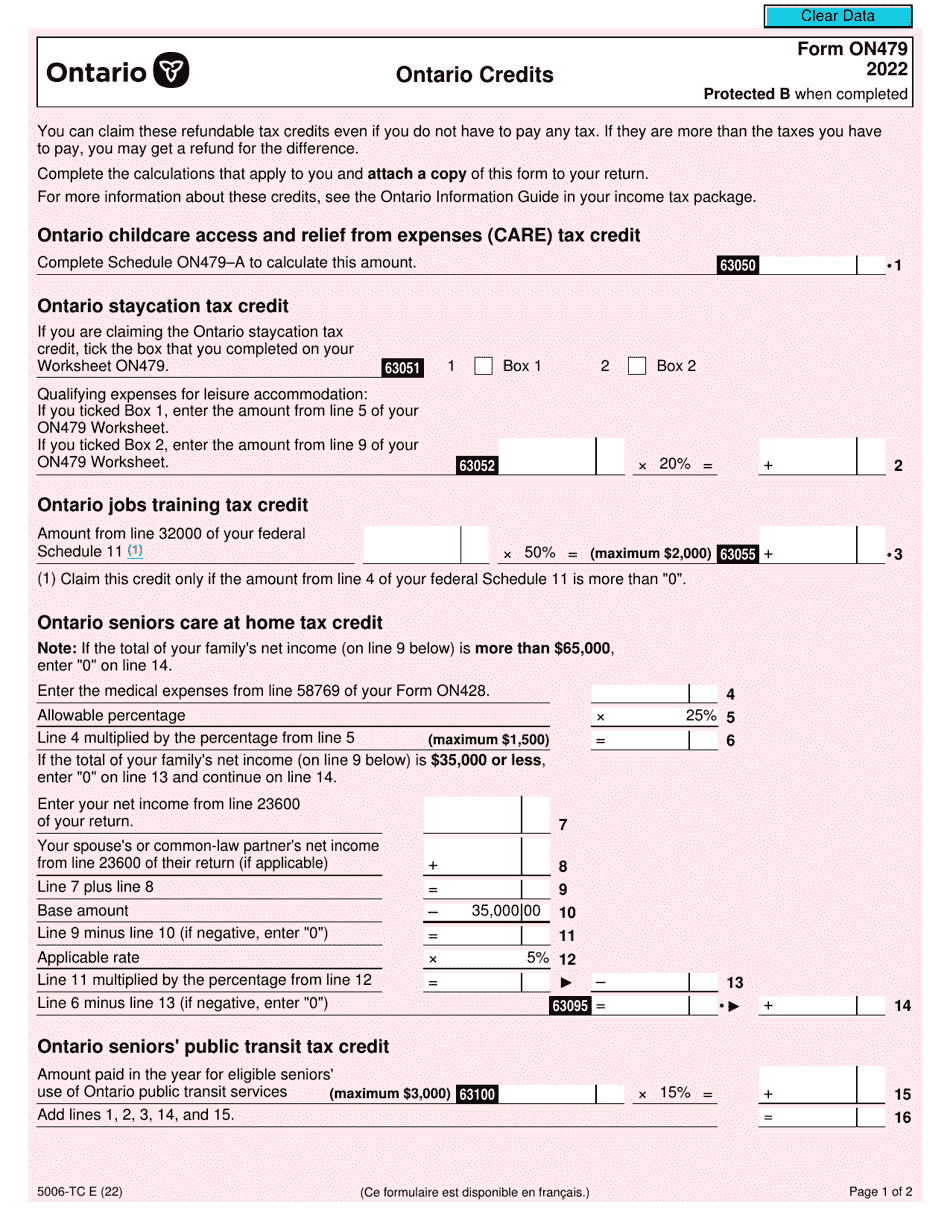

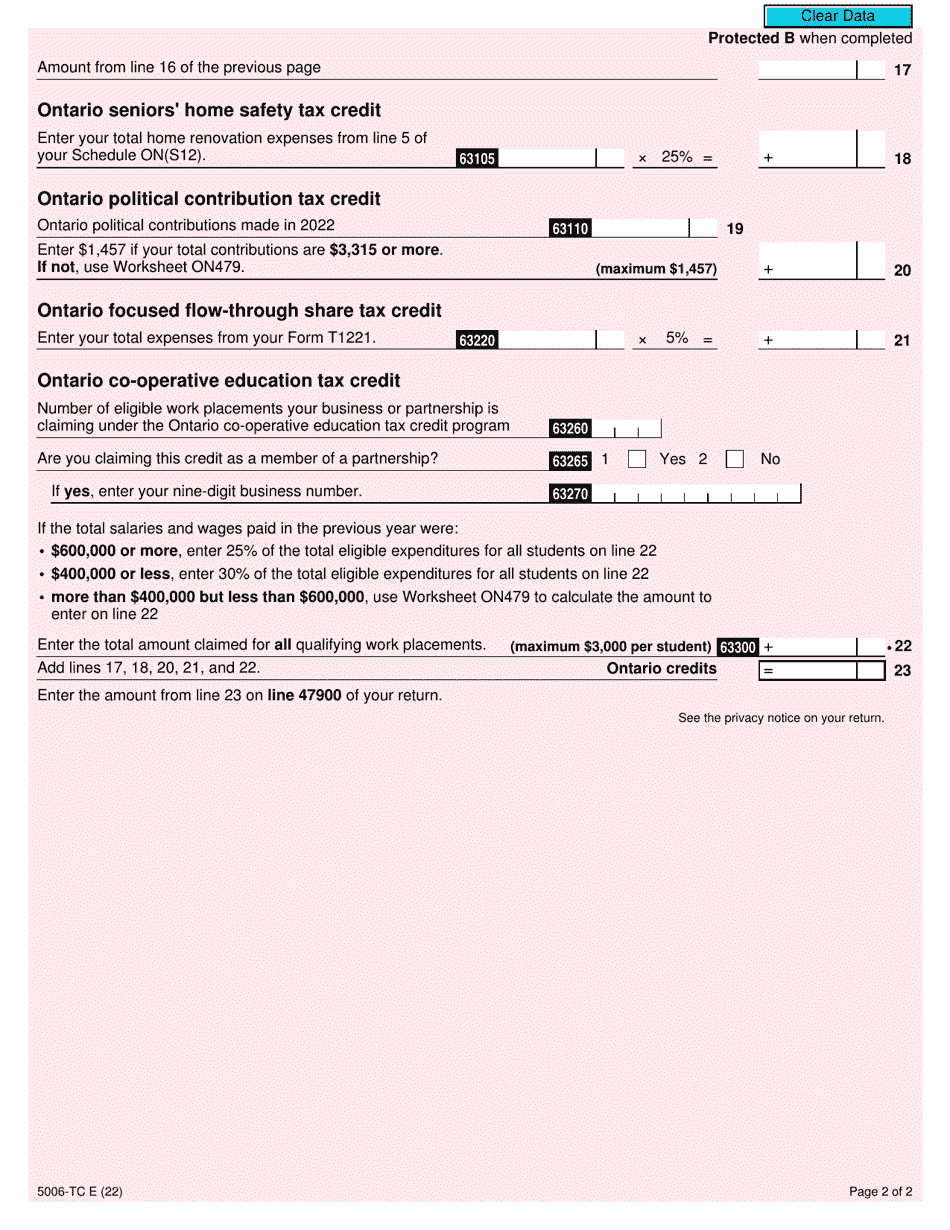

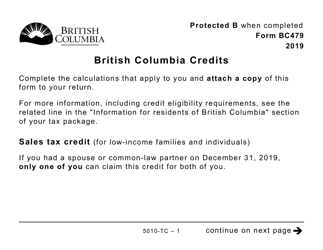

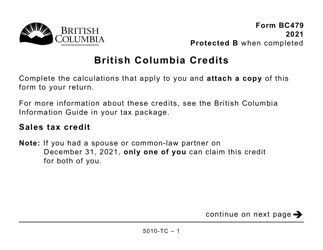

This version of the form is not currently in use and is provided for reference only. Download this version of

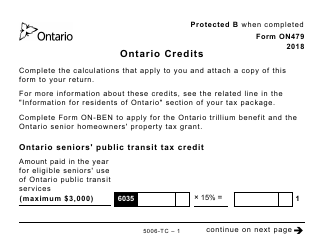

Form 5006-TC (ON479)

for the current year.

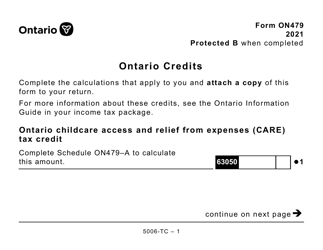

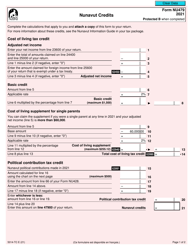

Form 5006-TC (ON479) Ontario Credits - Canada

Form 5006-TC (ON479) is used in Ontario, Canada to claim various tax credits such as the Ontario Trillium Benefit, Ontario Senior Homeowners' Property Tax Grant, and the Northern Ontario Energy Credit.

Individual taxpayers in Ontario who want to claim certain tax credits can file the Form 5006-TC (ON479) in Canada.

FAQ

Q: What is Form 5006-TC?

A: Form 5006-TC is a tax form used in Ontario, Canada.

Q: What is the purpose of Form 5006-TC?

A: Form 5006-TC is used to claim various tax credits specific to Ontario.

Q: What are Ontario credits?

A: Ontario credits are tax credits that are available to residents of Ontario, Canada.

Q: Who is eligible to file Form 5006-TC?

A: Residents of Ontario who qualify for the specific tax credits can file Form 5006-TC.

Q: When is the deadline to file Form 5006-TC?

A: The deadline to file Form 5006-TC is usually the same as the deadline to file your income tax return, which is April 30th of each year.

Q: What types of tax credits can be claimed on Form 5006-TC?

A: Form 5006-TC allows you to claim tax credits for things such as education, child care expenses, northern residents deductions, and more.

Q: Do I need to include supporting documents with Form 5006-TC?

A: Yes, you may need to include supporting documents such as receipts or certificates to substantiate your claims for the tax credits.

Q: Can I file Form 5006-TC electronically?

A: Yes, you can file Form 5006-TC electronically through the CRA's NETFILE service, or you can mail it to the CRA.

Q: What should I do if I have questions or need assistance with Form 5006-TC?

A: If you have questions or need assistance, you can contact the Canada Revenue Agency or seek help from a tax professional.