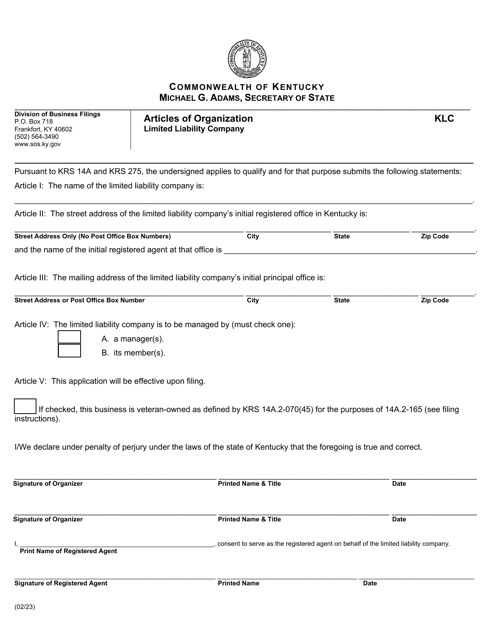

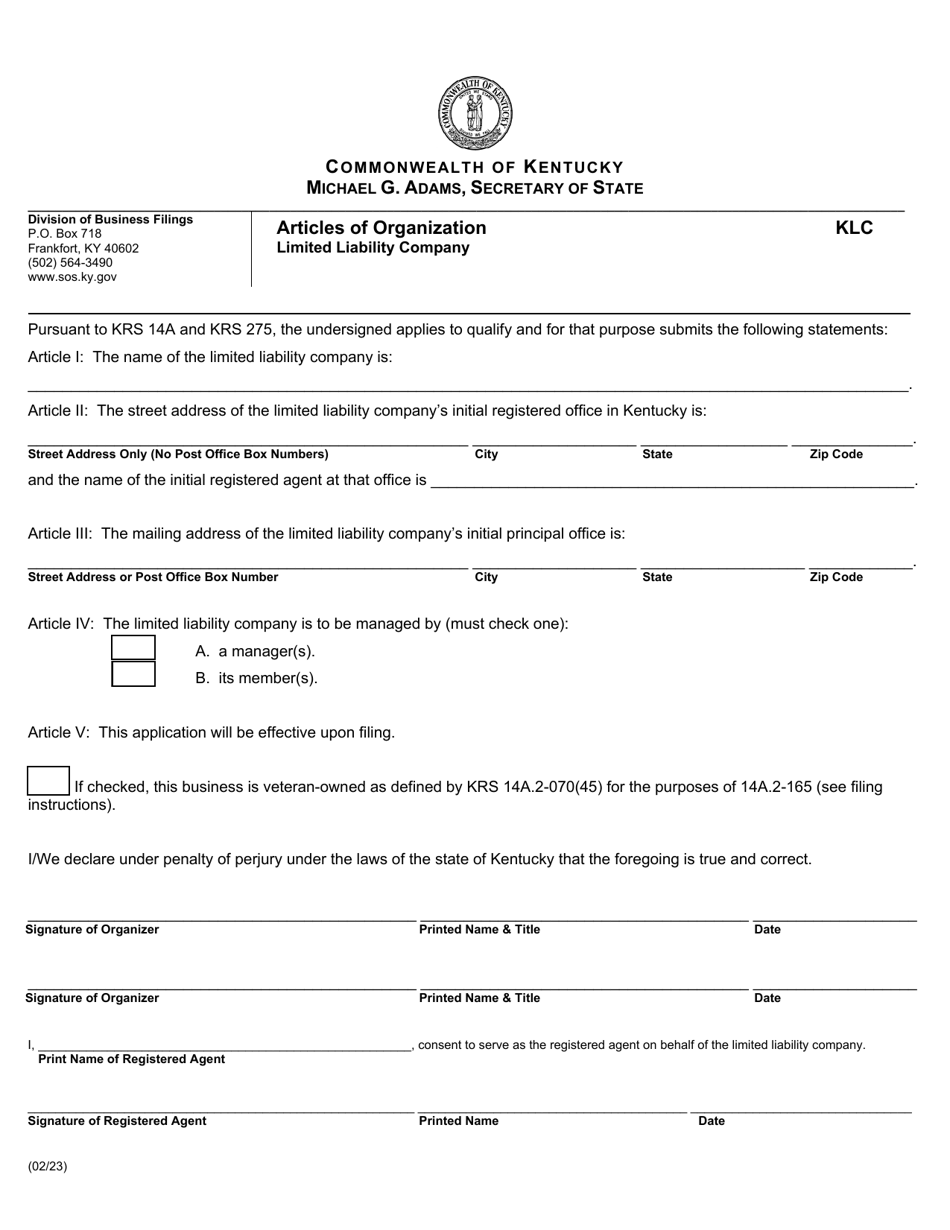

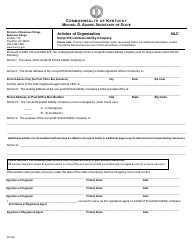

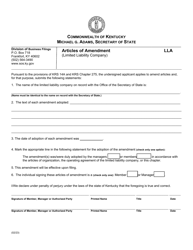

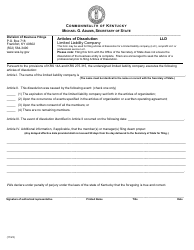

Form KLC Articles of Organization - Limited Liability Company - Kentucky

What Is Form KLC?

This is a legal form that was released by the Kentucky Secretary of State - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form KLC?

A: Form KLC is the Articles of Organization for a Limited Liability Company in Kentucky.

Q: What is a Limited Liability Company (LLC)?

A: A Limited Liability Company is a type of business entity that offers limited liability protection to its owners, known as members.

Q: Why do I need to file Form KLC?

A: You need to file Form KLC to officially create and register your LLC in the state of Kentucky.

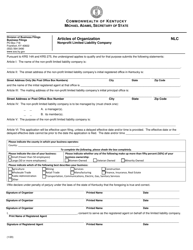

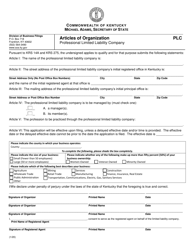

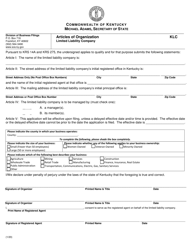

Q: What information do I need to provide in Form KLC?

A: You will need to provide information such as the name and address of your LLC, the names and addresses of the members, and other relevant details.

Q: Is there a fee for filing Form KLC?

A: Yes, there is a fee for filing Form KLC. The fee amount may vary, so it's best to check with the Kentucky Secretary of State for the current fee.

Q: What happens after I file Form KLC?

A: After you file Form KLC and pay the required fee, your LLC will be officially registered with the state of Kentucky.

Q: Are there any ongoing requirements for maintaining my LLC after filing Form KLC?

A: Yes, there are ongoing requirements such as filing annual reports and paying taxes to maintain your LLC's good standing in Kentucky.

Q: Can I make changes to my LLC after filing Form KLC?

A: Yes, you can make changes to your LLC by filing the appropriate forms with the Kentucky Secretary of State.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Kentucky Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form KLC by clicking the link below or browse more documents and templates provided by the Kentucky Secretary of State.