This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2220

for the current year.

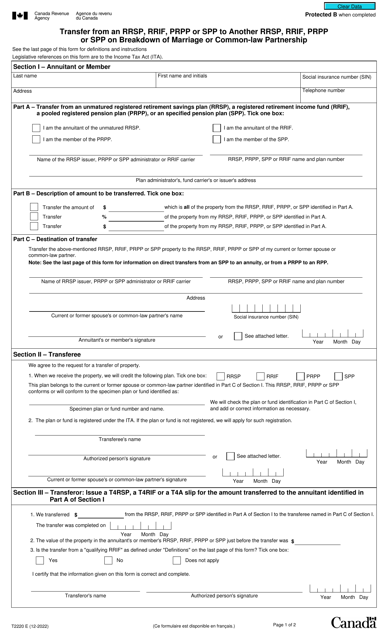

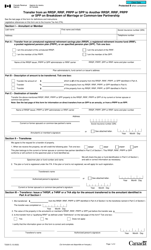

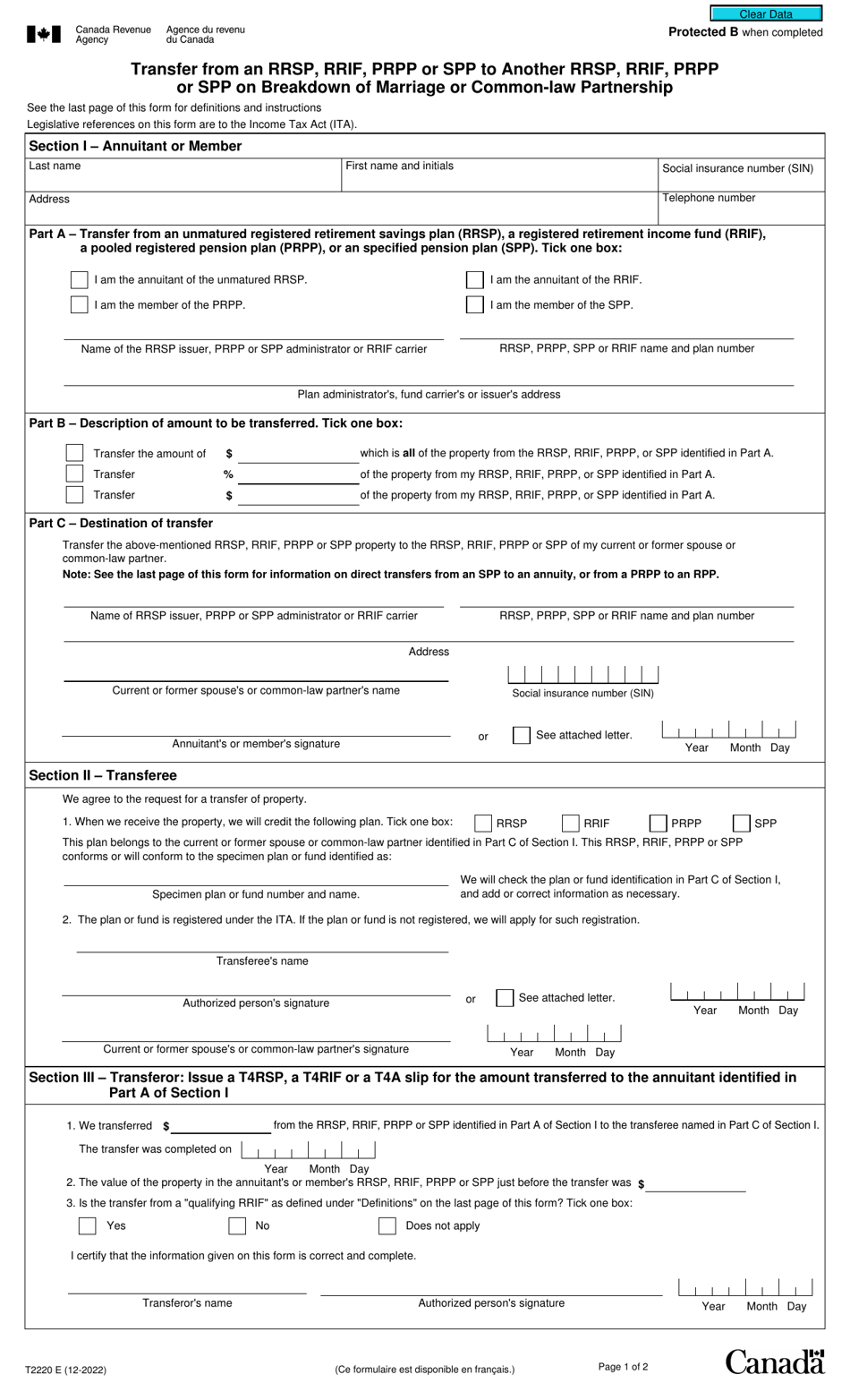

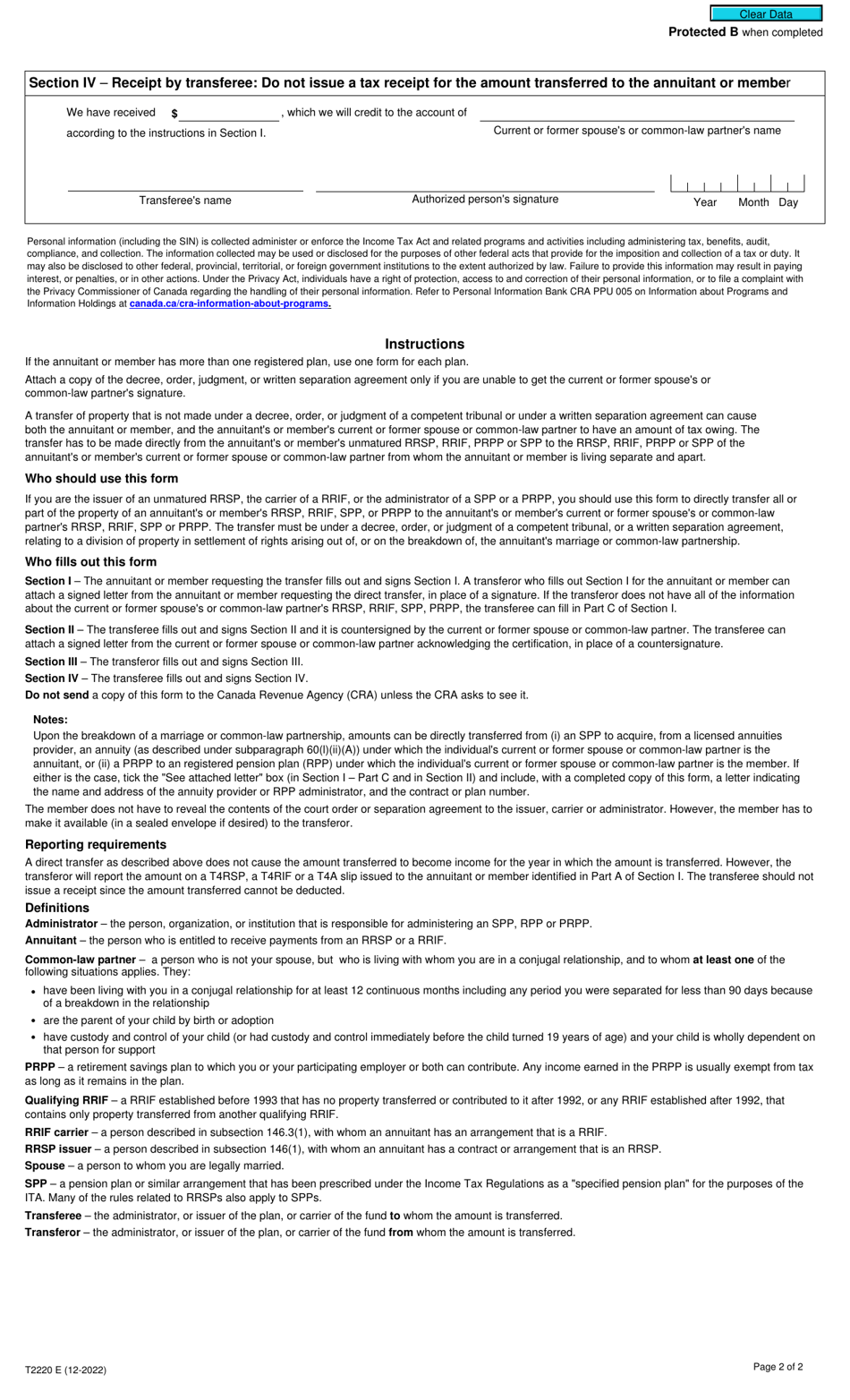

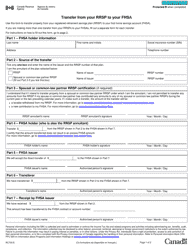

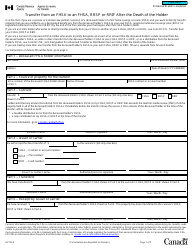

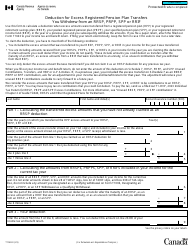

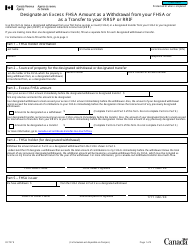

Form T2220 Transfer From an Rrsp, Rrif, Prpp or Spp to Another Rrsp, Rrif, Prpp or Spp on Breakdown of Marriage or Common-Law Partnership - Canada

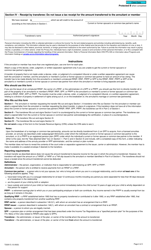

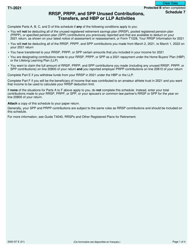

Form T2220 Transfer From an RRSP, RRIF, PRPP, or SPP to Another RRSP, RRIF, PRPP, or SPP on Breakdown of Marriage or Common-Law Partnership is used in Canada to report the transfer of retirement savings from one Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP) to another RRSP, RRIF, PRPP, or SPP as a result of a breakdown of marriage or common-law partnership. It helps individuals ensure that the transfers are eligible for special tax treatment under Canadian tax laws.

In Canada, the individual who wants to transfer funds from an RRSP, RRIF, PRPP, or SPP to another RRSP, RRIF, PRPP, or SPP due to a breakdown of marriage or common-law partnership is responsible for filing Form T2220.

FAQ

Q: What is Form T2220?

A: Form T2220 is a form used in Canada for transferring funds from one Registered Retirement Savings Plan (RRSP), Registered Retirement Income Fund (RRIF), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP) to another RRSP, RRIF, PRPP, or SPP in the event of a breakdown of marriage or common-law partnership.

Q: When is Form T2220 used?

A: Form T2220 is used when there is a breakdown of marriage or common-law partnership and the parties involved want to transfer funds from one retirement plan to another.

Q: What types of retirement plans can funds be transferred from using Form T2220?

A: Funds can be transferred from Registered Retirement Savings Plans (RRSPs), Registered Retirement Income Funds (RRIFs), Pooled Registered Pension Plans (PRPPs), or Specified Pension Plans (SPPs) using Form T2220.

Q: What is the purpose of transferring funds using Form T2220?

A: The purpose of transferring funds using Form T2220 is to allow individuals to split their retirement savings in the event of a breakdown of marriage or common-law partnership.

Q: Are there any tax implications for transferring funds using Form T2220?

A: Yes, there may be tax implications for transferring funds using Form T2220. It is recommended to consult with a tax professional or review the Canada Revenue Agency (CRA) guidelines for more information.