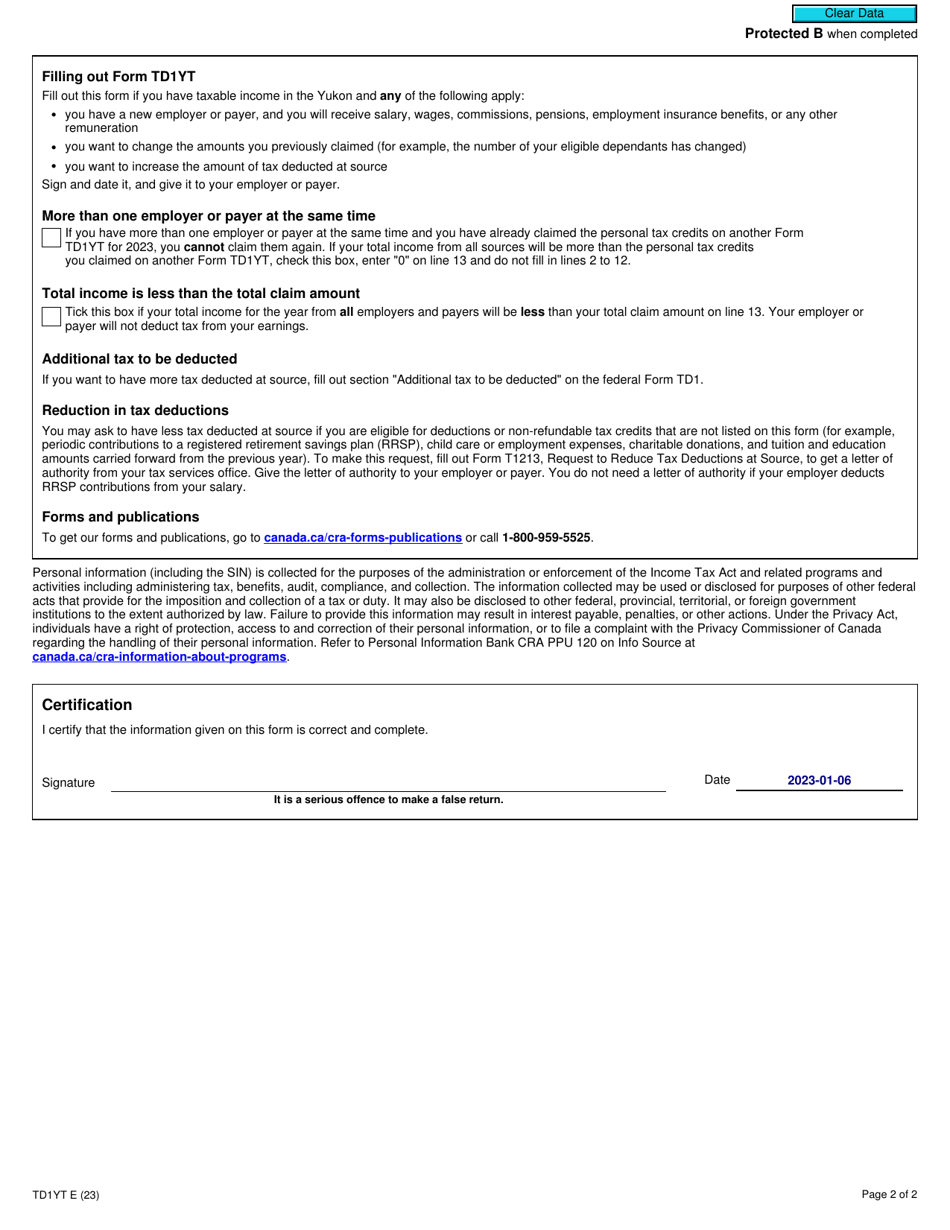

This version of the form is not currently in use and is provided for reference only. Download this version of

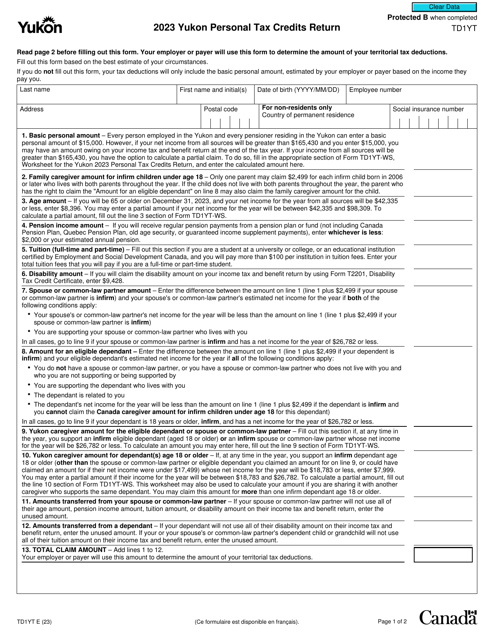

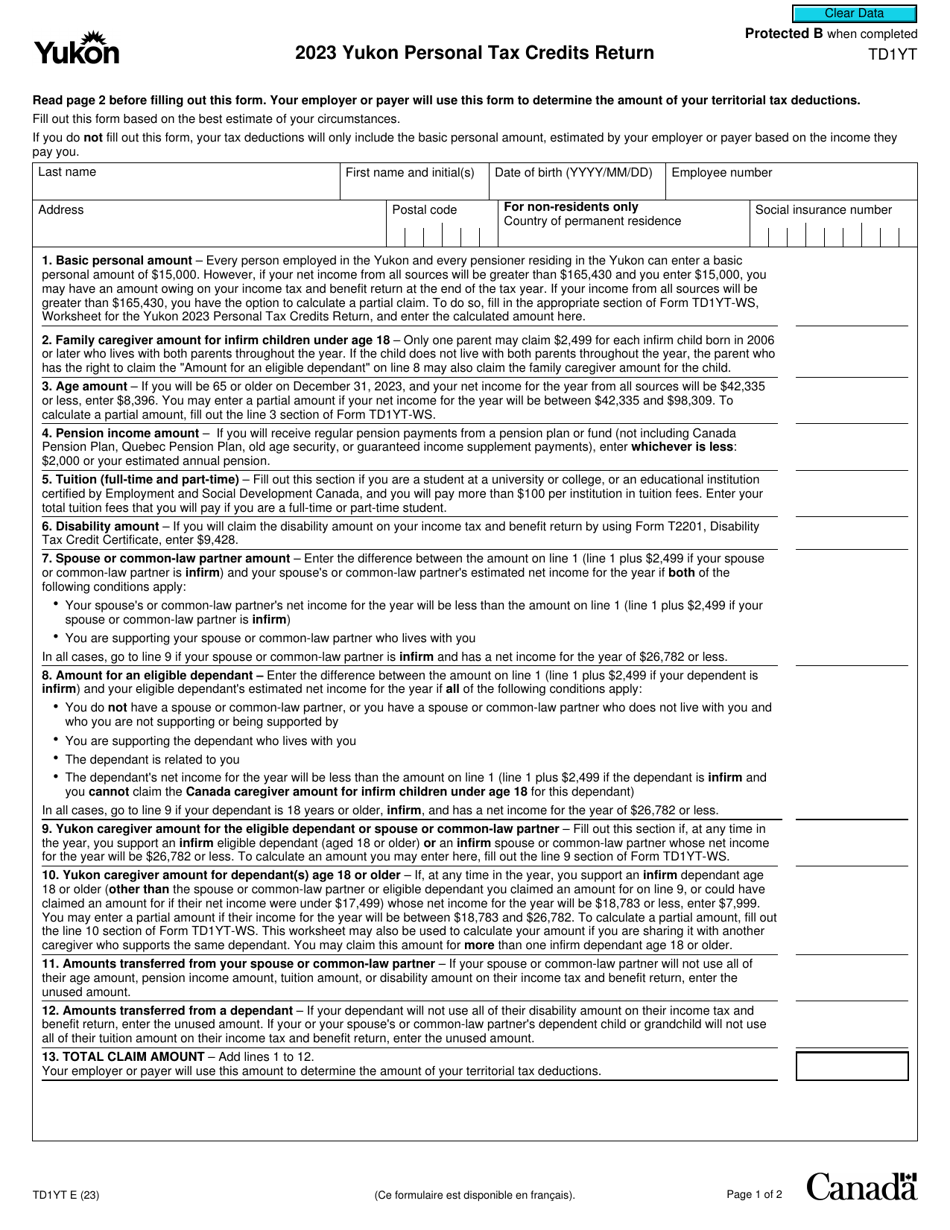

Form TD1YT

for the current year.

Form TD1YT Yukon Personal Tax Credits Return - Canada

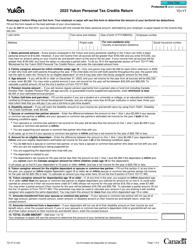

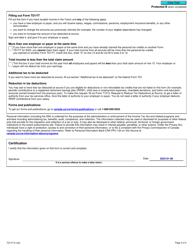

Form TD1YT Yukon Personal Tax Credits Return - Canada is used by residents of Yukon, Canada to calculate the amount of tax to be deducted from their employment income. It helps determine the amount of tax credits, such as basic personal amount and age amount, that an individual is eligible to claim.

The Form TD1YT Yukon Personal Tax Credits Return in Canada is typically filed by individuals who are residents of Yukon and want to claim personal tax credits.

FAQ

Q: What is Form TD1YT?

A: Form TD1YT is the Yukon Personal Tax Credits Return.

Q: What is the purpose of Form TD1YT?

A: The purpose of Form TD1YT is to determine the amount of income tax to be deducted from an individual's employment income, based on their personal tax credits.

Q: Who needs to complete Form TD1YT?

A: Residents of Yukon who want their employers to deduct less tax from their pay can complete Form TD1YT.

Q: Is Form TD1YT specific to Yukon?

A: Yes, Form TD1YT is specific to residents of Yukon.

Q: Do I need to submit Form TD1YT every year?

A: No, you only need to complete and submit Form TD1YT when there are changes to your personal circumstances that affect your tax credits.