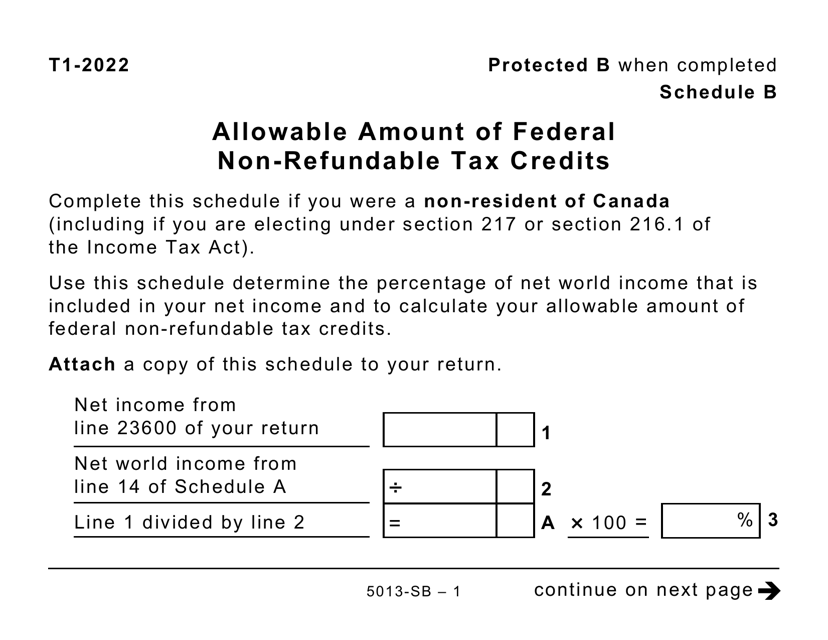

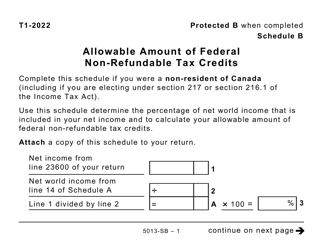

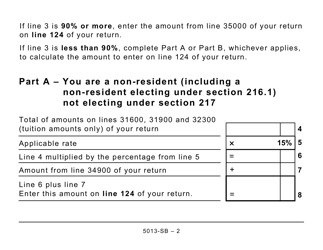

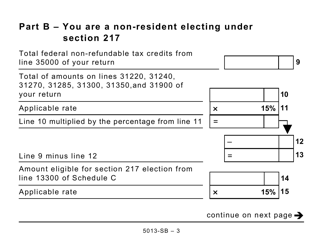

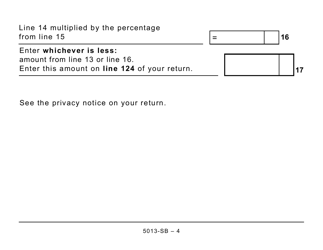

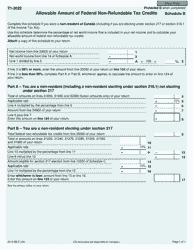

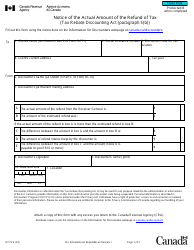

Form 5013-SB Schedule B Allowable Amount of Federal Non-refundable Tax Credits (Large Print) - Canada

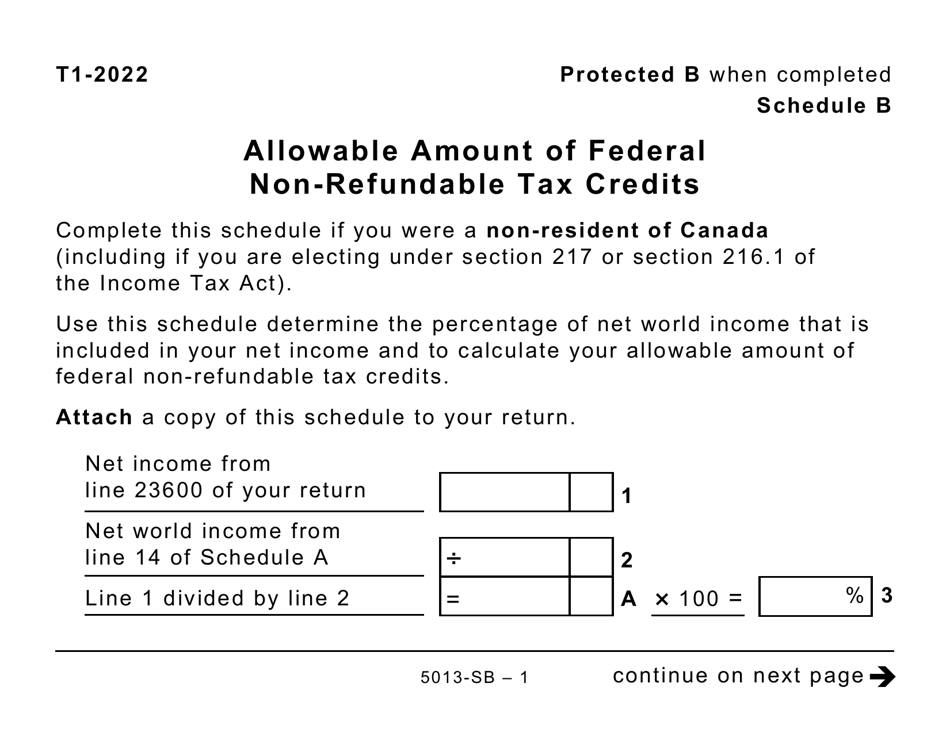

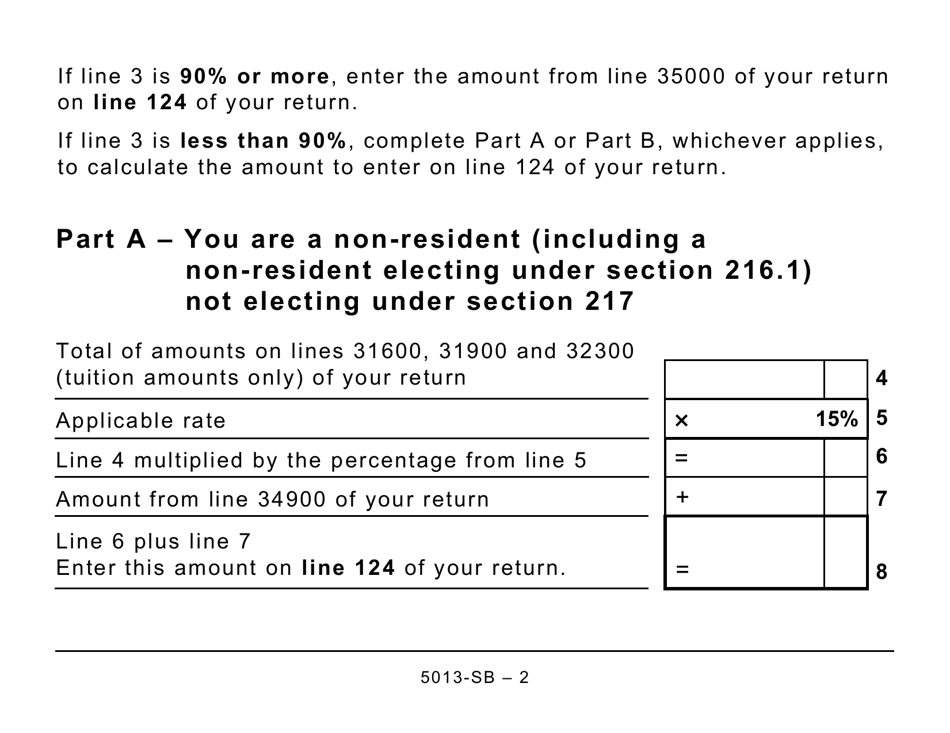

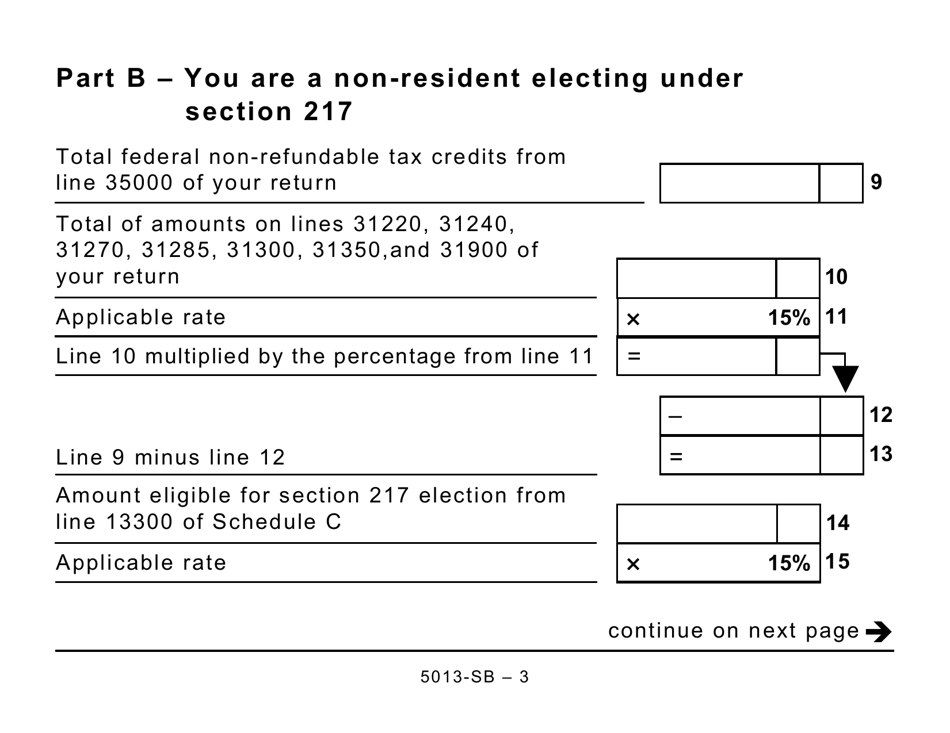

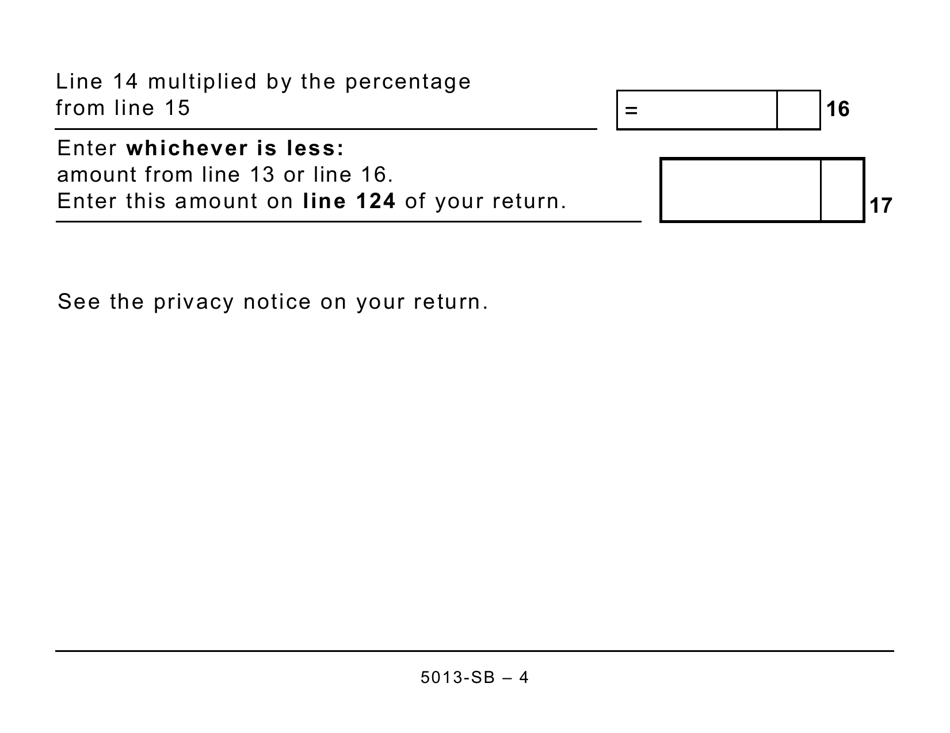

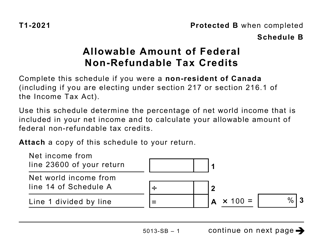

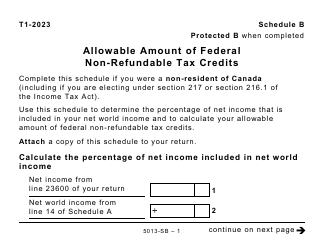

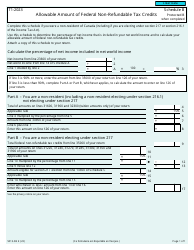

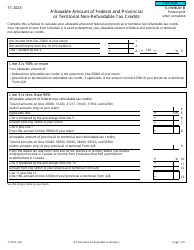

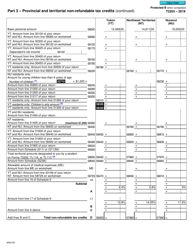

Form 5013-SB Schedule B Allowable Amount of Federal Non-refundable Tax Credits (Large Print) in Canada is used to calculate the total amount of federal non-refundable tax credits that can be applied to reduce your income tax payable.

FAQ

Q: What is Form 5013-SB?

A: Form 5013-SB is a form used in Canada to calculate the allowable amount of federal non-refundable tax credits.

Q: What is Schedule B?

A: Schedule B is a section of Form 5013-SB that specifically deals with the calculation of the allowable amount of federal non-refundable tax credits.

Q: What are federal non-refundable tax credits?

A: Federal non-refundable tax credits are deductions that can be claimed on your federal tax return to help reduce the amount of tax you owe.

Q: Why do I need to calculate the allowable amount of federal non-refundable tax credits?

A: Calculating the allowable amount of federal non-refundable tax credits is important to determine how much of these credits you can claim on your tax return.

Q: Is Form 5013-SB applicable only to large print?

A: No, Form 5013-SB is available in large print format, but it can also be accessed in other formats.

Q: Can I claim federal non-refundable tax credits in the United States?

A: No, Form 5013-SB and federal non-refundable tax credits are specific to Canada and cannot be claimed on U.S. tax returns.