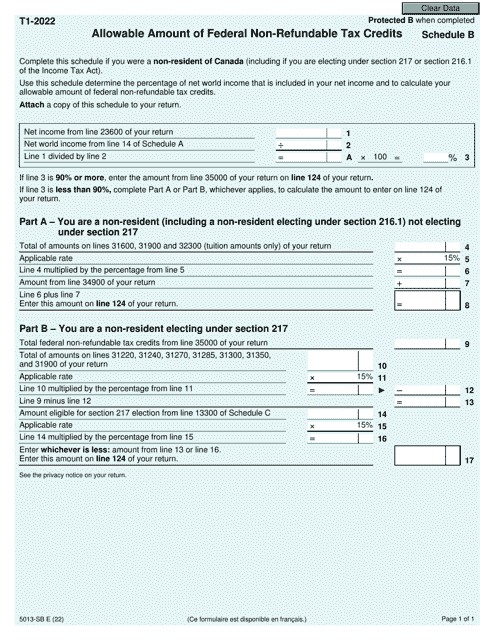

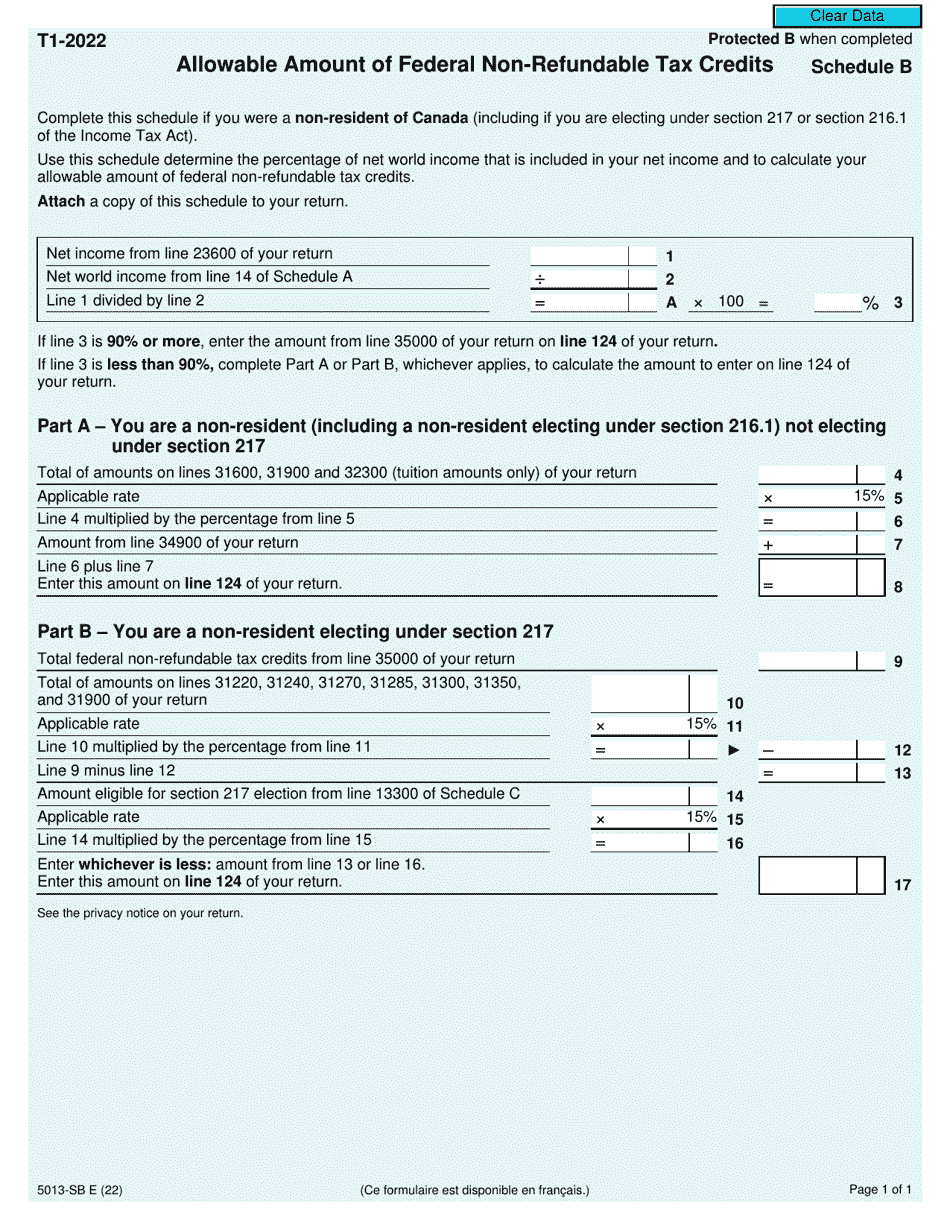

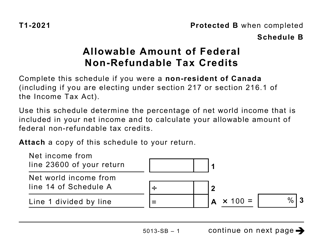

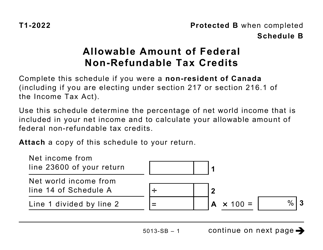

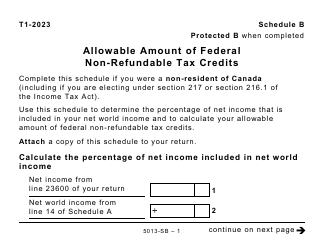

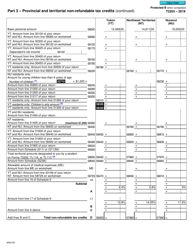

Form 5013 Schedule B Allowable Amount of Federal Non-refundable Tax Credits - Canada

Form 5013 Schedule B, Allowable Amount of Federal Non-refundable Tax Credits, is used in Canada to calculate the amount of federal non-refundable tax credits that can be claimed on your income tax return. These credits can help reduce your overall tax liability.

In Canada, the Form 5013 Schedule B for the allowable amount of federal non-refundable tax credits is typically filed by individual taxpayers when submitting their income tax return.

FAQ

Q: What is Form 5013 Schedule B?

A: Form 5013 Schedule B refers to a specific form used in Canada to calculate the allowable amount of federal non-refundable tax credits.

Q: What does Form 5013 Schedule B help determine?

A: Form 5013 Schedule B helps determine the amount of federal non-refundable tax credits that can be claimed.

Q: What are federal non-refundable tax credits?

A: Federal non-refundable tax credits are credits that can be claimed on your Canadian federal income tax return to reduce the amount of tax you owe.

Q: Why are non-refundable tax credits important?

A: Non-refundable tax credits are important as they can lower your overall tax liability, potentially resulting in a lower tax bill.

Q: What types of tax credits are considered non-refundable?

A: Some examples of non-refundable tax credits in Canada include the basic personal amount, tuition and education credits, and medical expense credits.

Q: How does Form 5013 Schedule B help calculate non-refundable tax credits?

A: Form 5013 Schedule B helps calculate non-refundable tax credits by allowing you to input relevant information about the credits you are eligible for.

Q: When do I need to fill out Form 5013 Schedule B?

A: You will need to fill out Form 5013 Schedule B when you are completing your Canadian federal income tax return and have eligible non-refundable tax credits to claim.

Q: Is Form 5013 Schedule B specific to Canada only?

A: Yes, Form 5013 Schedule B is specific to the Canadian tax system and cannot be used for US tax purposes.

Q: Can I claim both federal and provincial non-refundable tax credits?

A: Yes, you can usually claim both federal and provincial non-refundable tax credits as long as you meet the eligibility criteria.