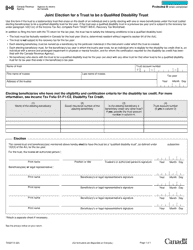

Form T1032 Joint Election to Split Pension Income (Large Print) - Canada

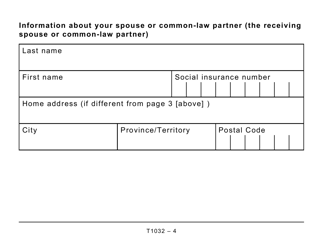

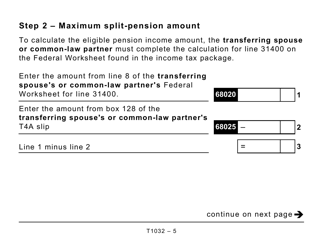

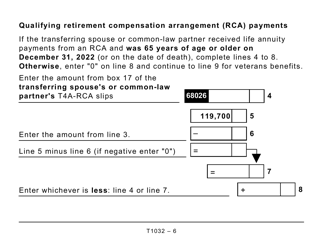

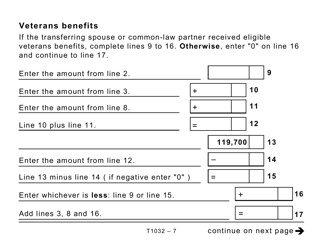

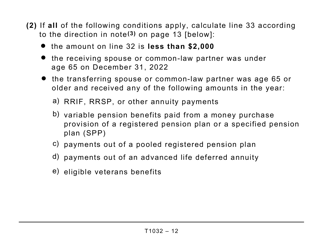

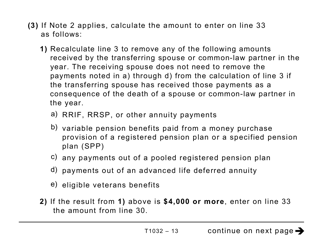

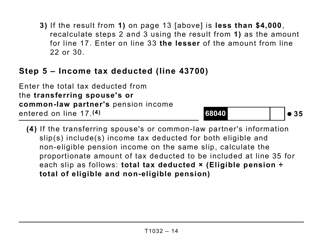

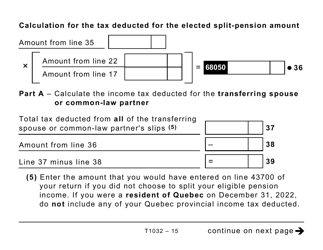

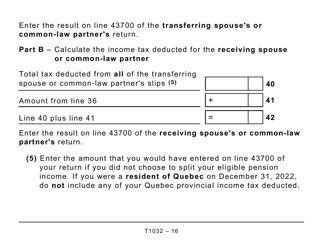

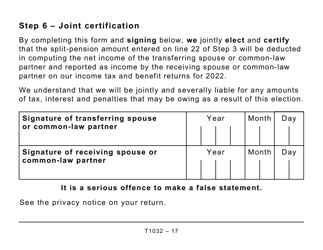

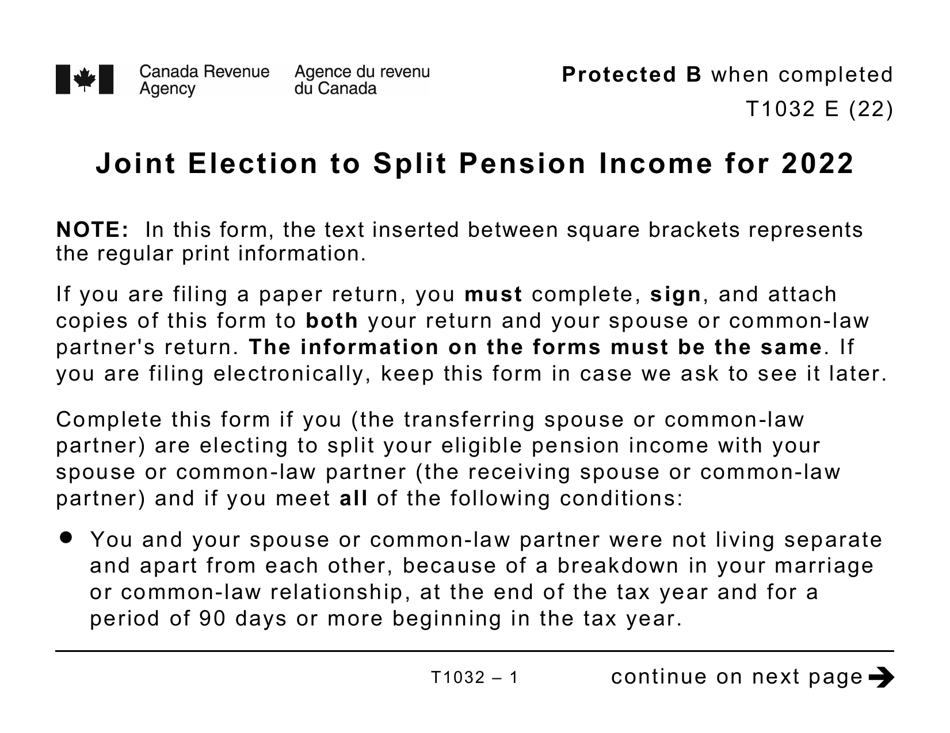

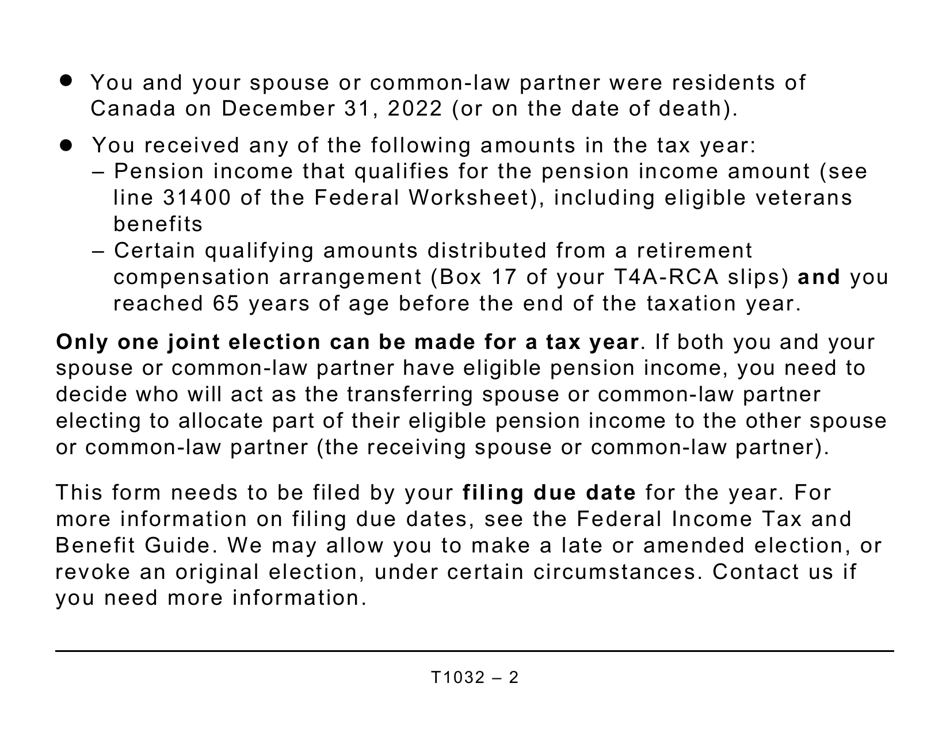

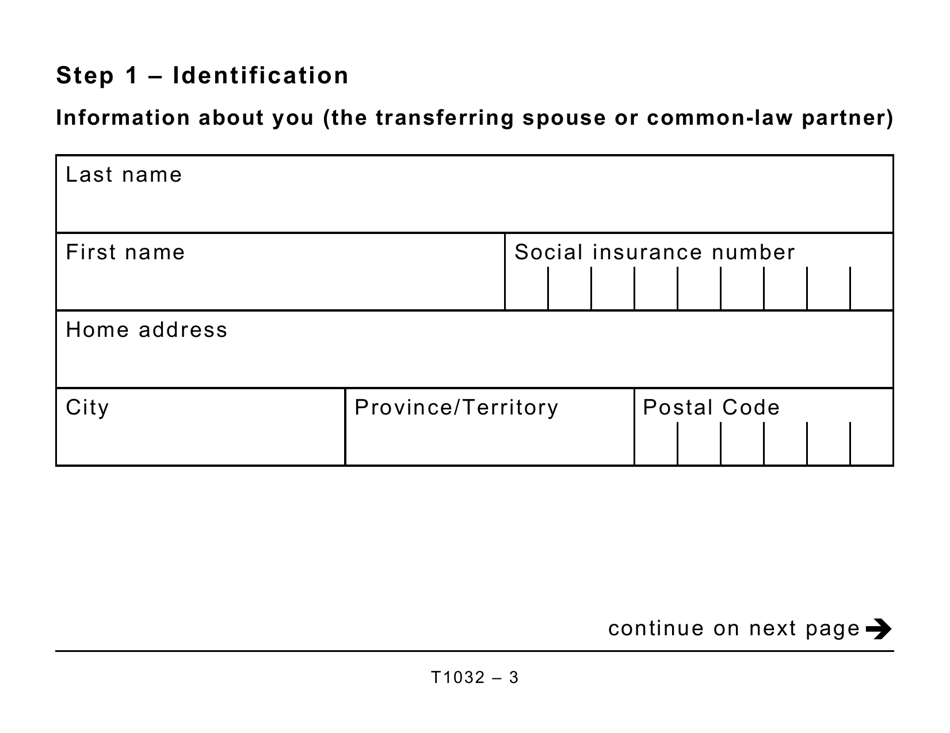

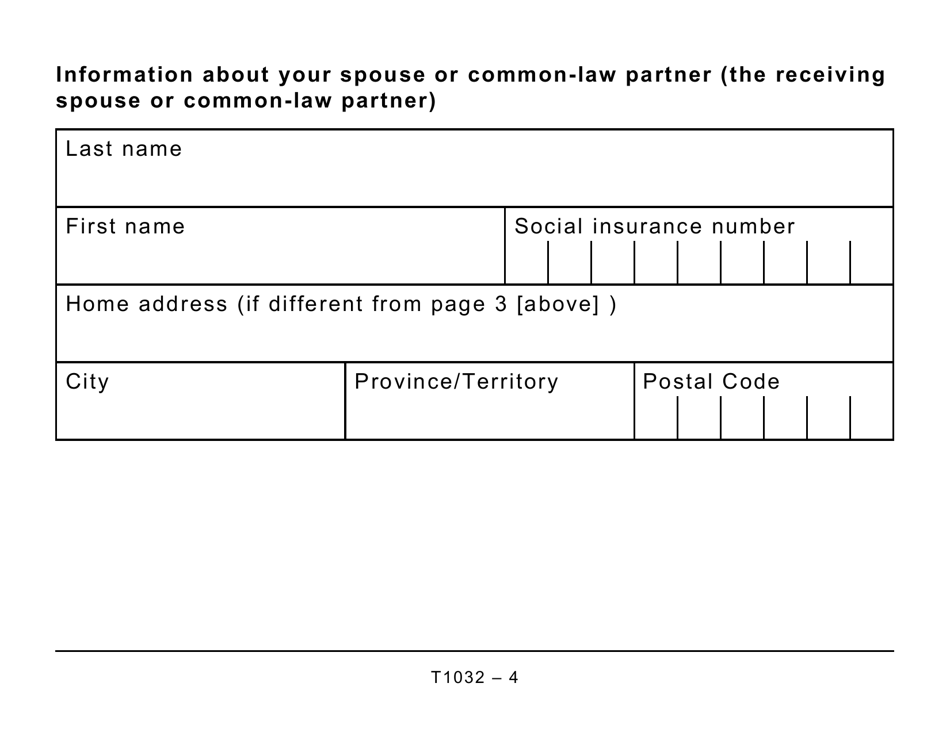

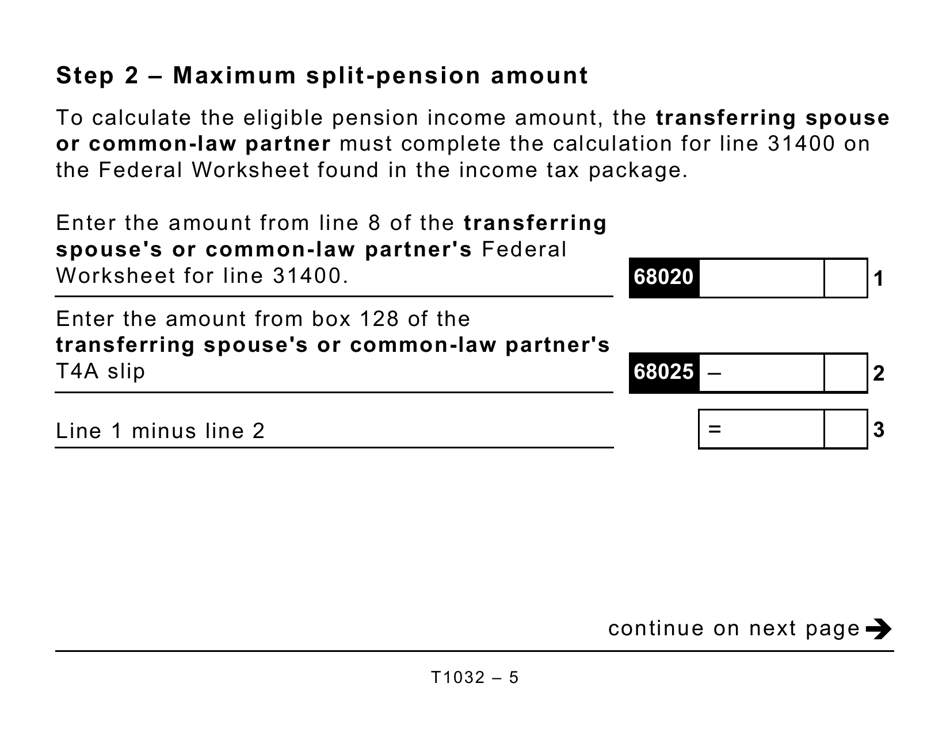

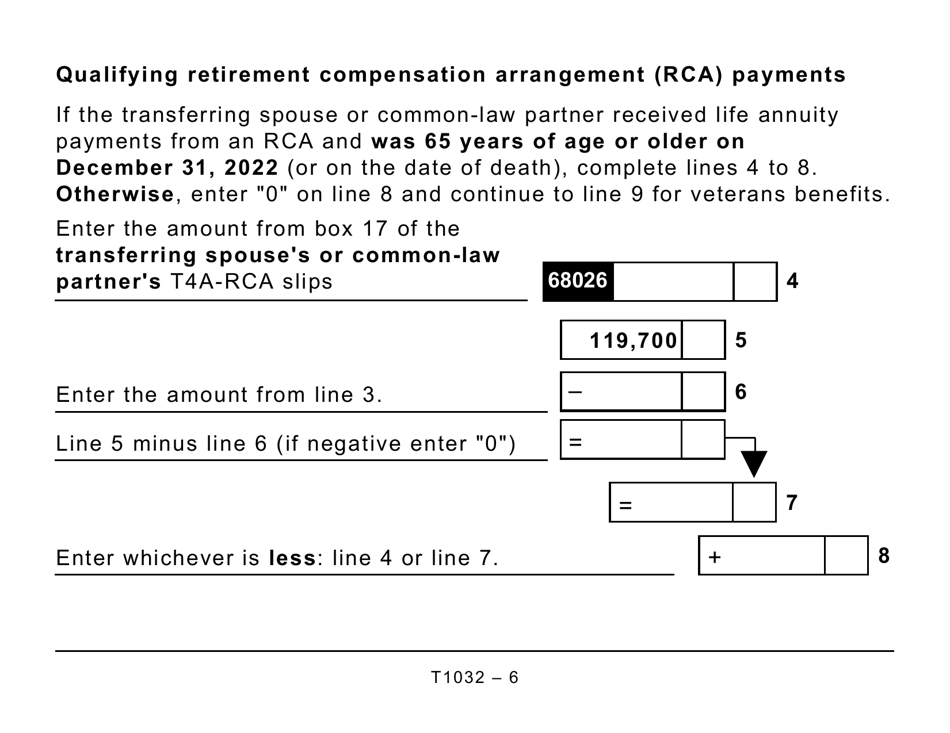

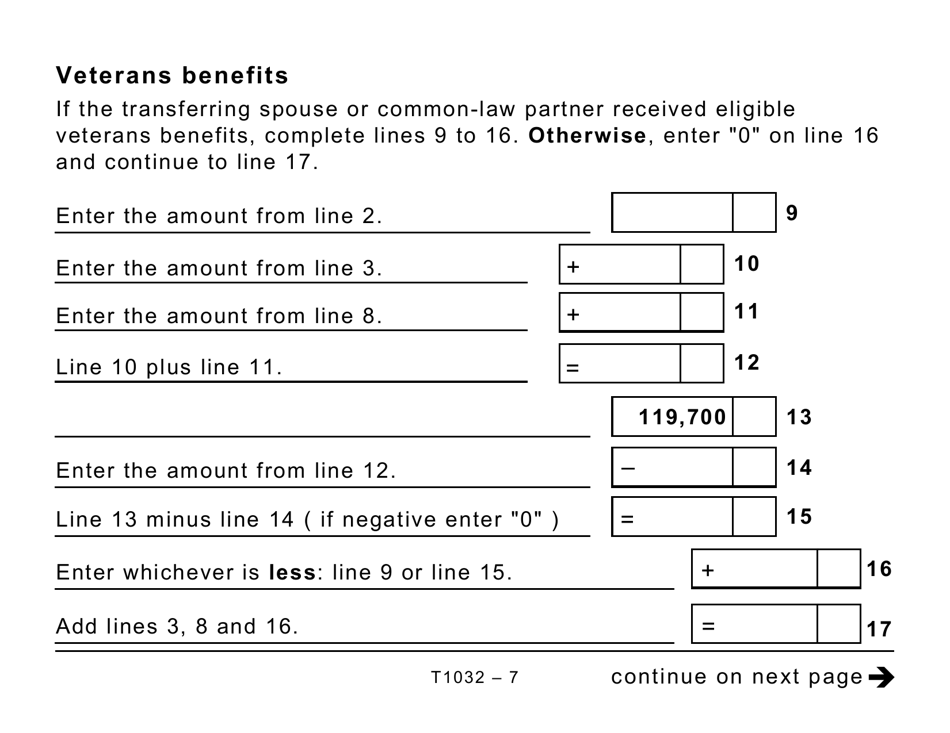

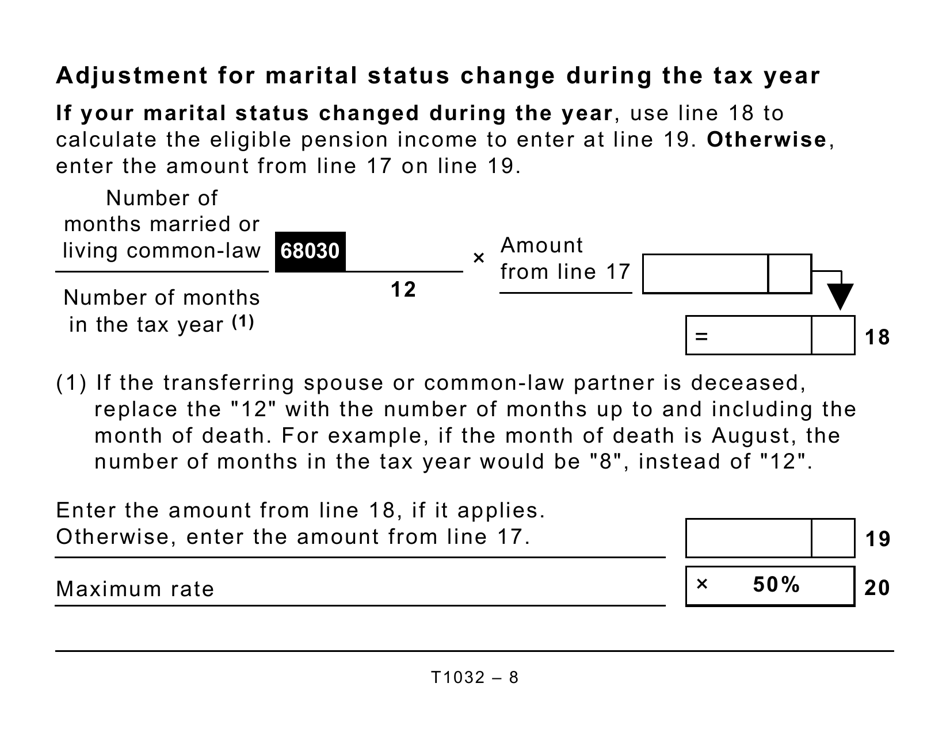

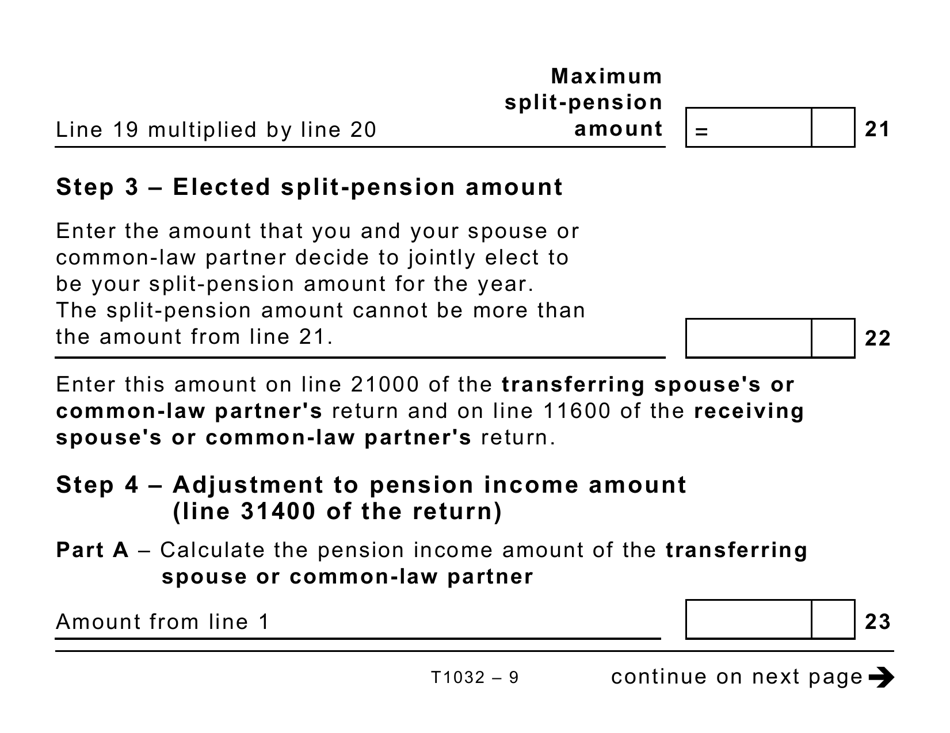

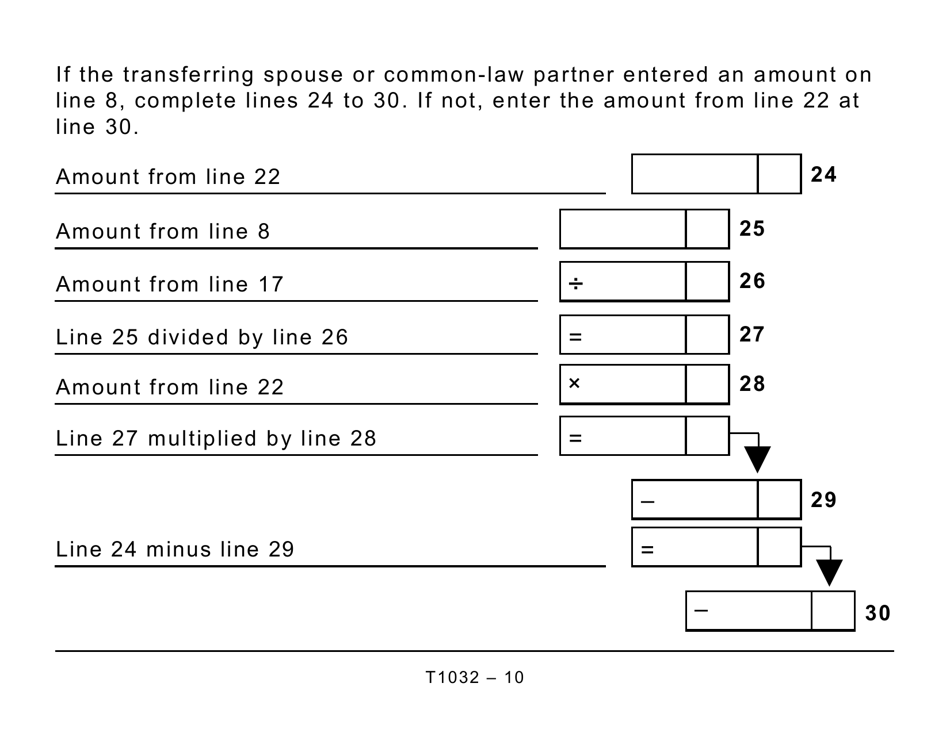

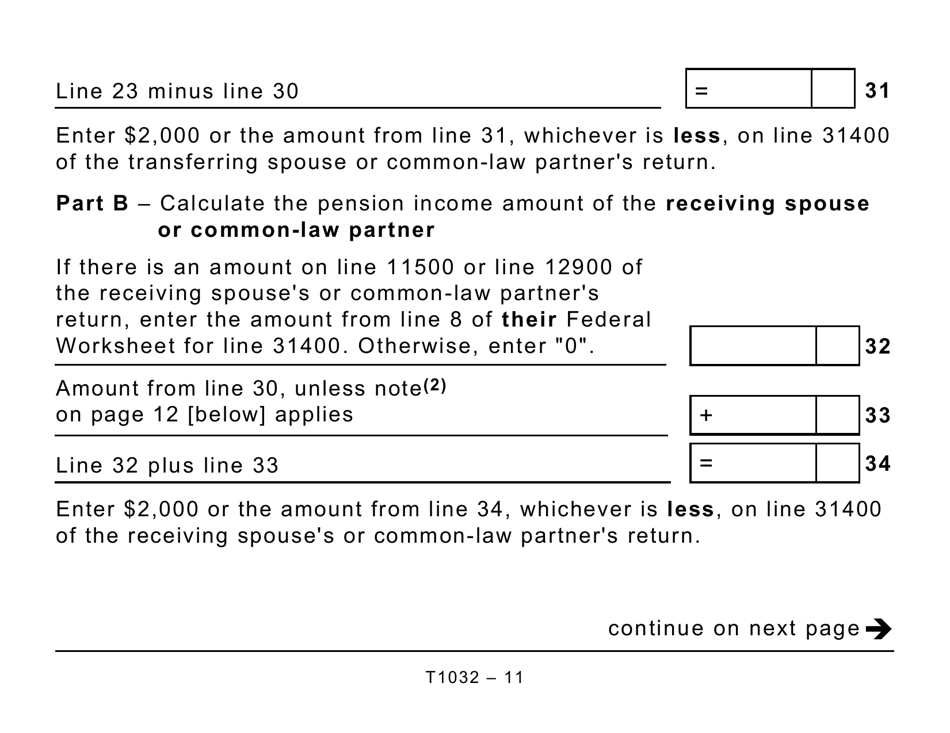

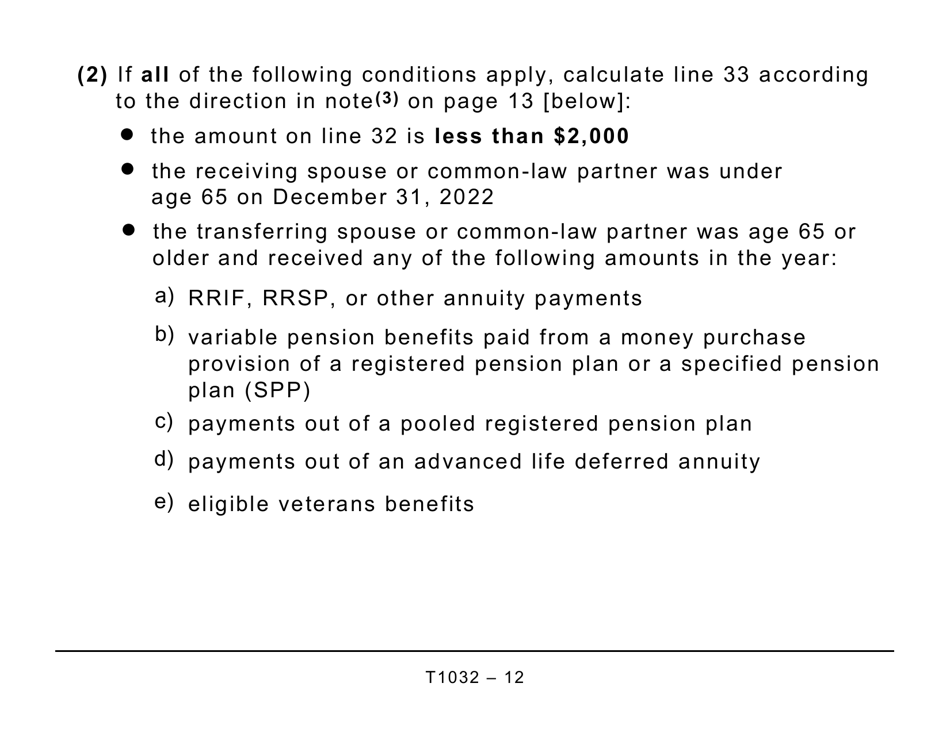

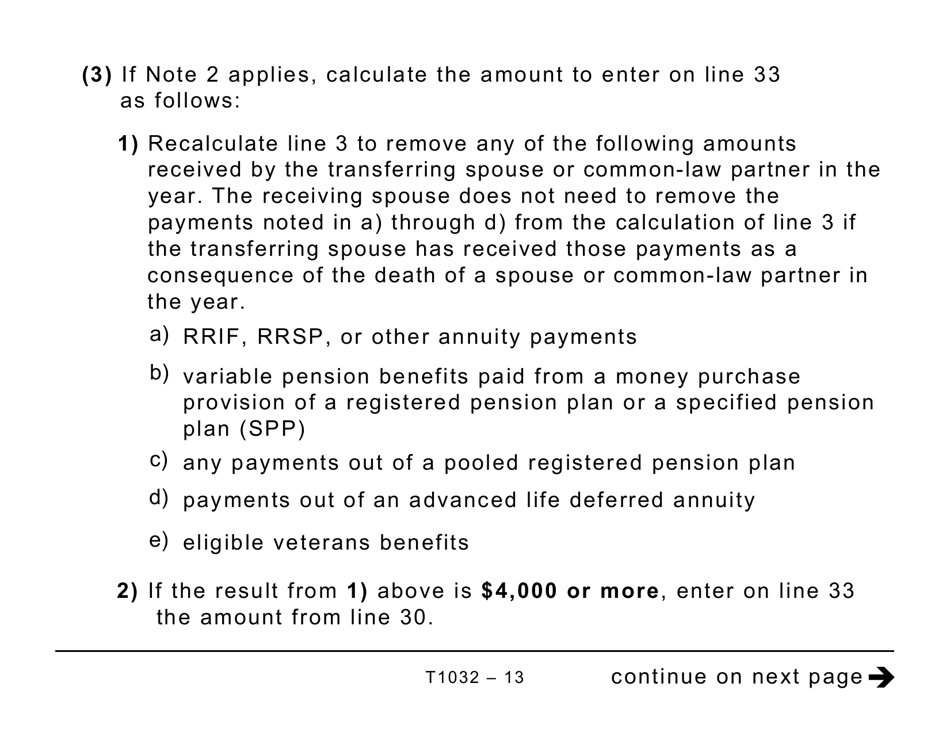

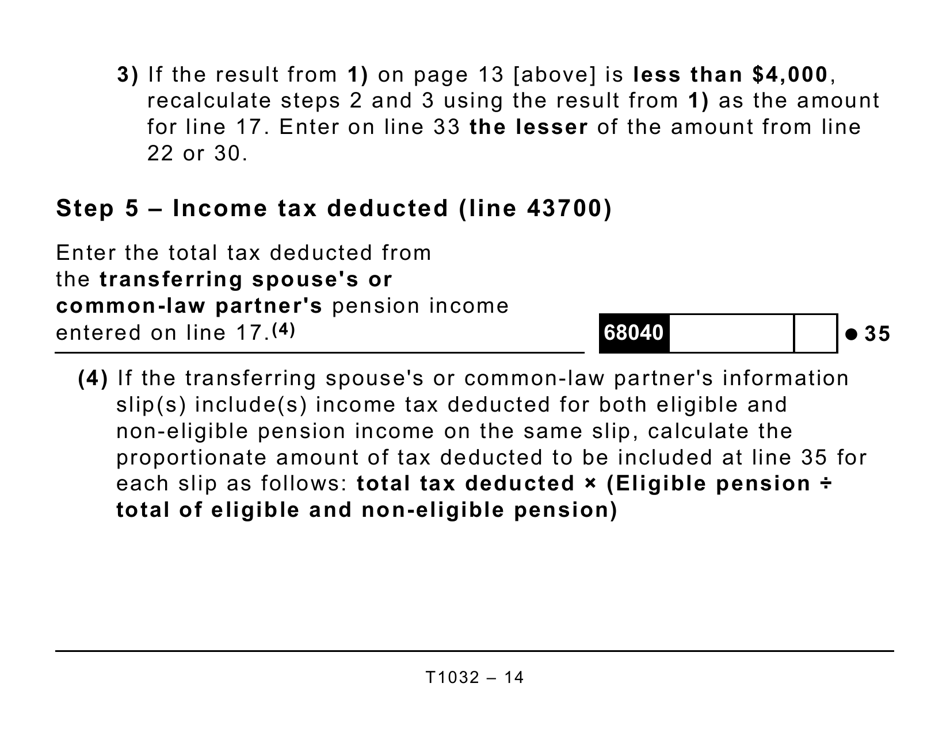

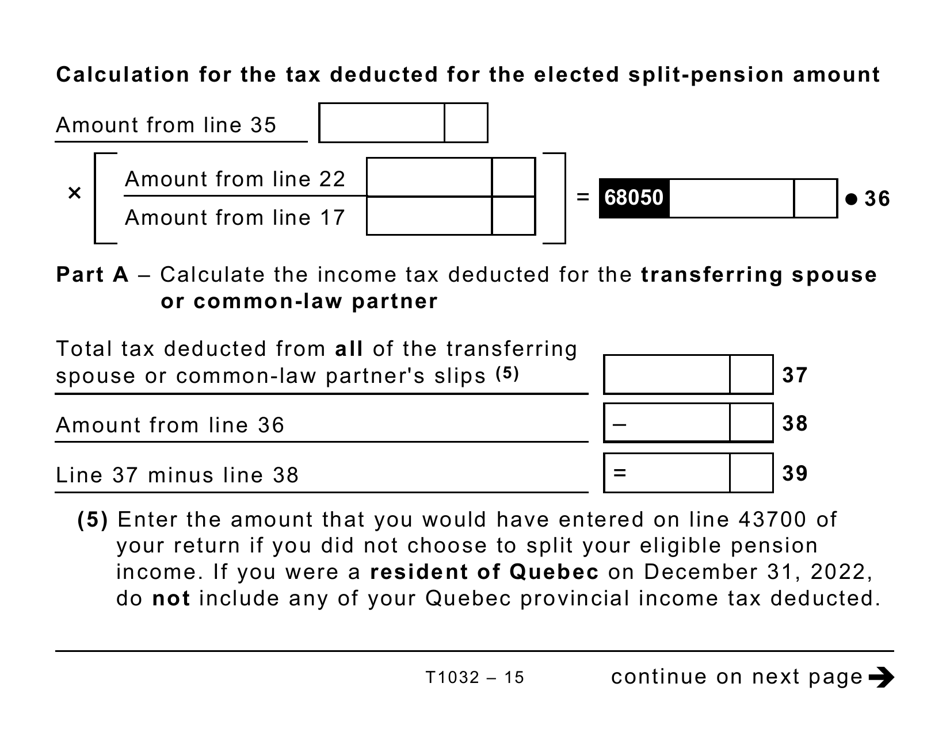

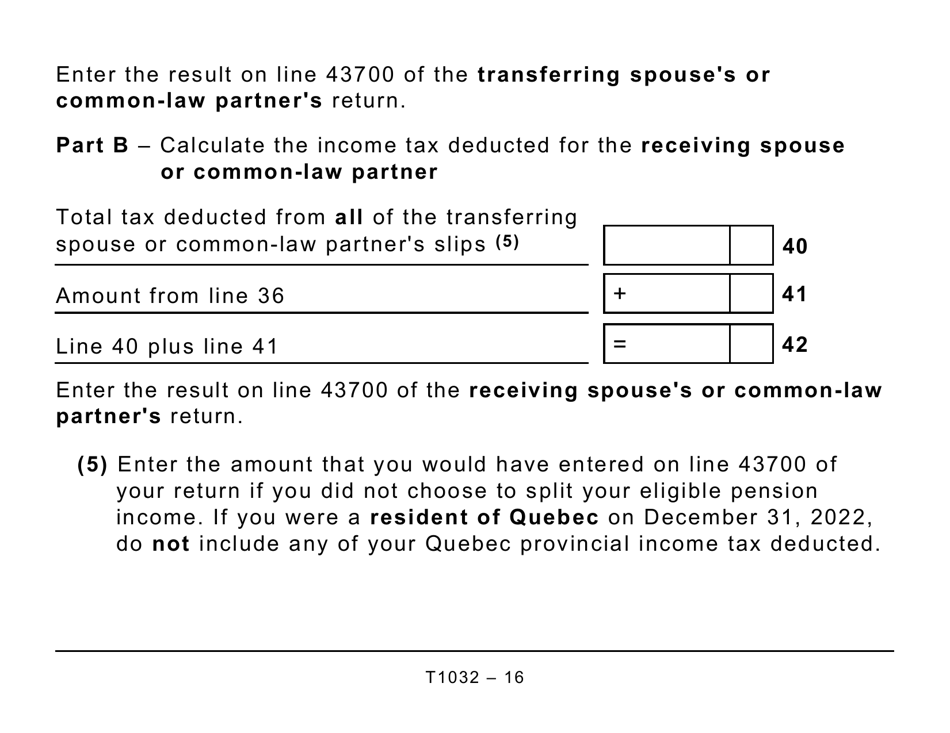

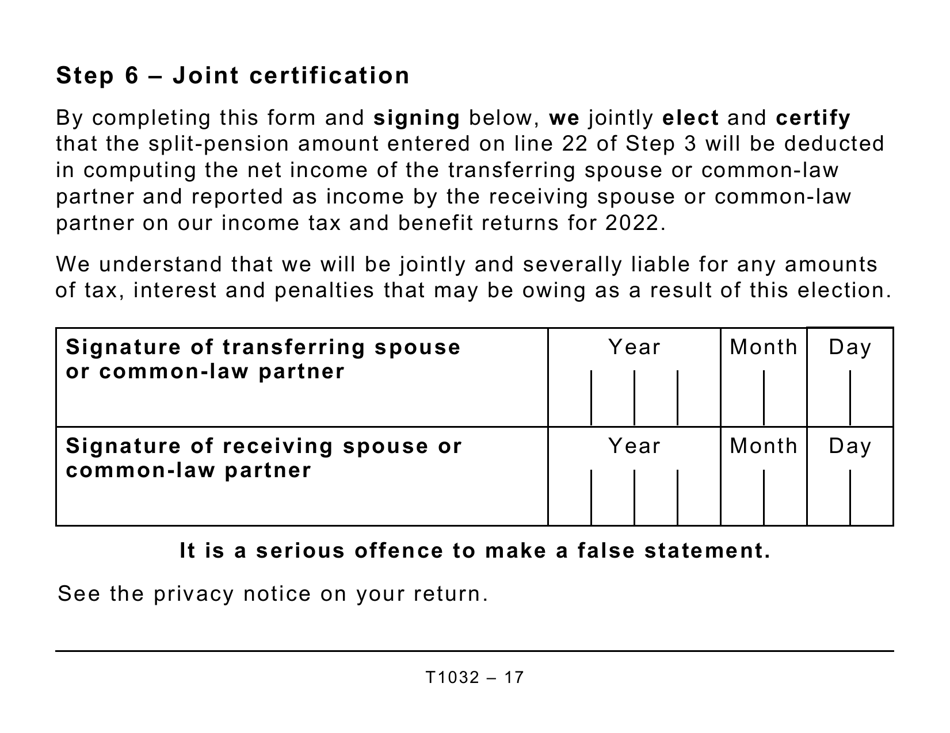

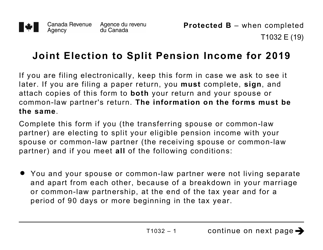

Form T1032 Joint Election to Split Pension Income (Large Print) in Canada is used by individuals who want to split their eligible pension income with their spouse or common-law partner. This form allows for the distribution of pension income between both partners, which can help reduce the overall tax burden.

The Form T1032 Joint Election to Split Pension Income (Large Print) in Canada is filed by individuals who want to split their pension income with their spouse or common-law partner for tax purposes.

FAQ

Q: What is the Form T1032?

A: The Form T1032 is a joint election to split pension income in Canada.

Q: Who can use the Form T1032?

A: The Form T1032 can be used by individuals who want to split their pension income with their spouse or common-law partner.

Q: What is pension income?

A: Pension income includes payments from a registered pension plan or an annuity.

Q: Why would someone want to split pension income?

A: Splitting pension income can help reduce the overall tax burden on a couple by allocating income to the lower-income spouse or partner.

Q: Is the Form T1032 mandatory?

A: No, the Form T1032 is not mandatory. It is an optional election that individuals can make to split their pension income.

Q: Is there a deadline to submit the Form T1032?

A: The deadline to submit the Form T1032 is the same as the deadline for filing your income tax return, which is generally April 30th of each year.

Q: Can I split pension income with a former spouse or partner?

A: No, the Form T1032 can only be used to split pension income with a current spouse or common-law partner.

Q: What are the benefits of splitting pension income?

A: Some of the benefits of splitting pension income include reducing overall tax liability, potentially qualifying for income-based government benefits, and optimizing retirement income planning.