This version of the form is not currently in use and is provided for reference only. Download this version of

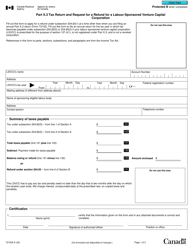

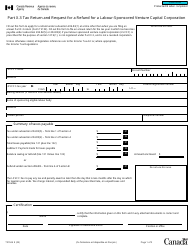

Form T224

for the current year.

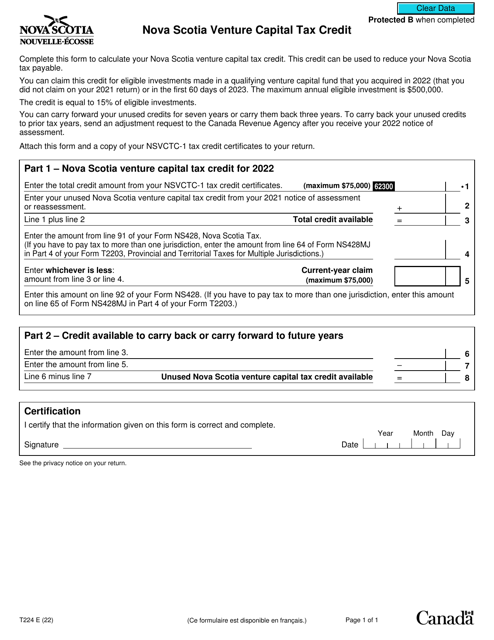

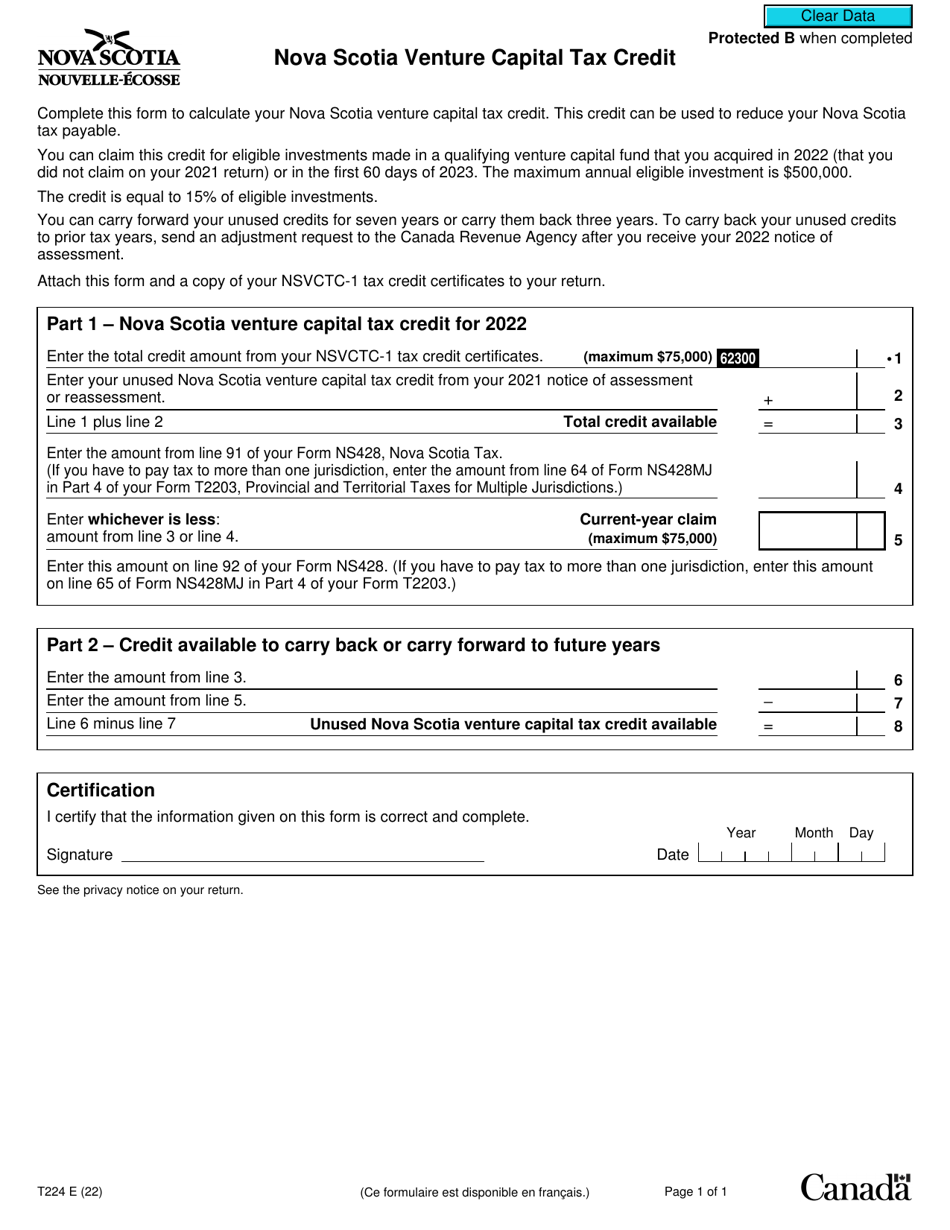

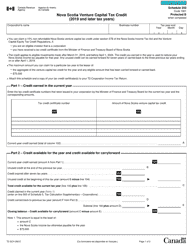

Form T224 Nova Scotia Venture Capital Tax Credit - Canada

Form T224 Nova Scotia Venture Capital Tax Credit is used to claim the tax credit for eligible investments made in designated venture capital corporations (DVCCs) in Nova Scotia, Canada.

The form T224 Nova Scotia Venture Capital Tax Credit in Canada is filed by individuals or corporations who are eligible to claim the Nova Scotia venture capital tax credit.

FAQ

Q: What is Form T224 Nova Scotia Venture Capital Tax Credit?

A: Form T224 Nova Scotia Venture Capital Tax Credit is a tax form used in Canada to claim the Nova Scotia Venture Capital Tax Credit.

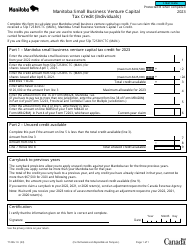

Q: What is the purpose of the Nova Scotia Venture Capital Tax Credit?

A: The purpose of the Nova Scotia Venture Capital Tax Credit is to encourage investment in eligible businesses in Nova Scotia, Canada.

Q: Who is eligible to claim the Nova Scotia Venture Capital Tax Credit?

A: Individuals or corporations that have investments in eligible businesses in Nova Scotia may be eligible to claim the Nova Scotia Venture Capital Tax Credit.

Q: What is the benefit of claiming the Nova Scotia Venture Capital Tax Credit?

A: Claiming the Nova Scotia Venture Capital Tax Credit can result in a non-refundable tax credit that can be used to reduce the amount of income tax owed.

Q: How can I claim the Nova Scotia Venture Capital Tax Credit?

A: To claim the Nova Scotia Venture Capital Tax Credit, you need to complete and file Form T224 with your annual tax return.