This version of the form is not currently in use and is provided for reference only. Download this version of

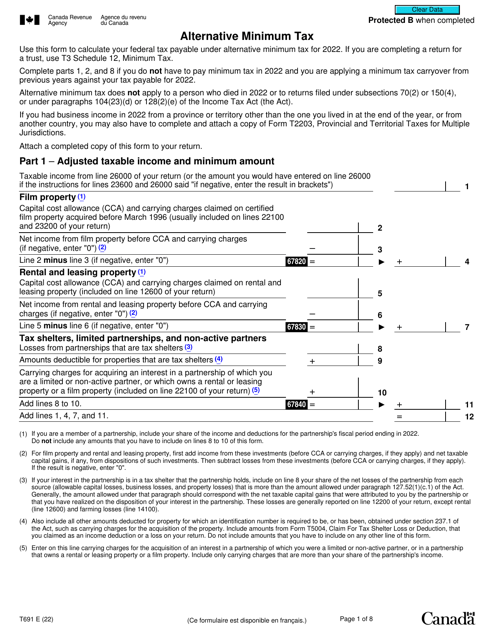

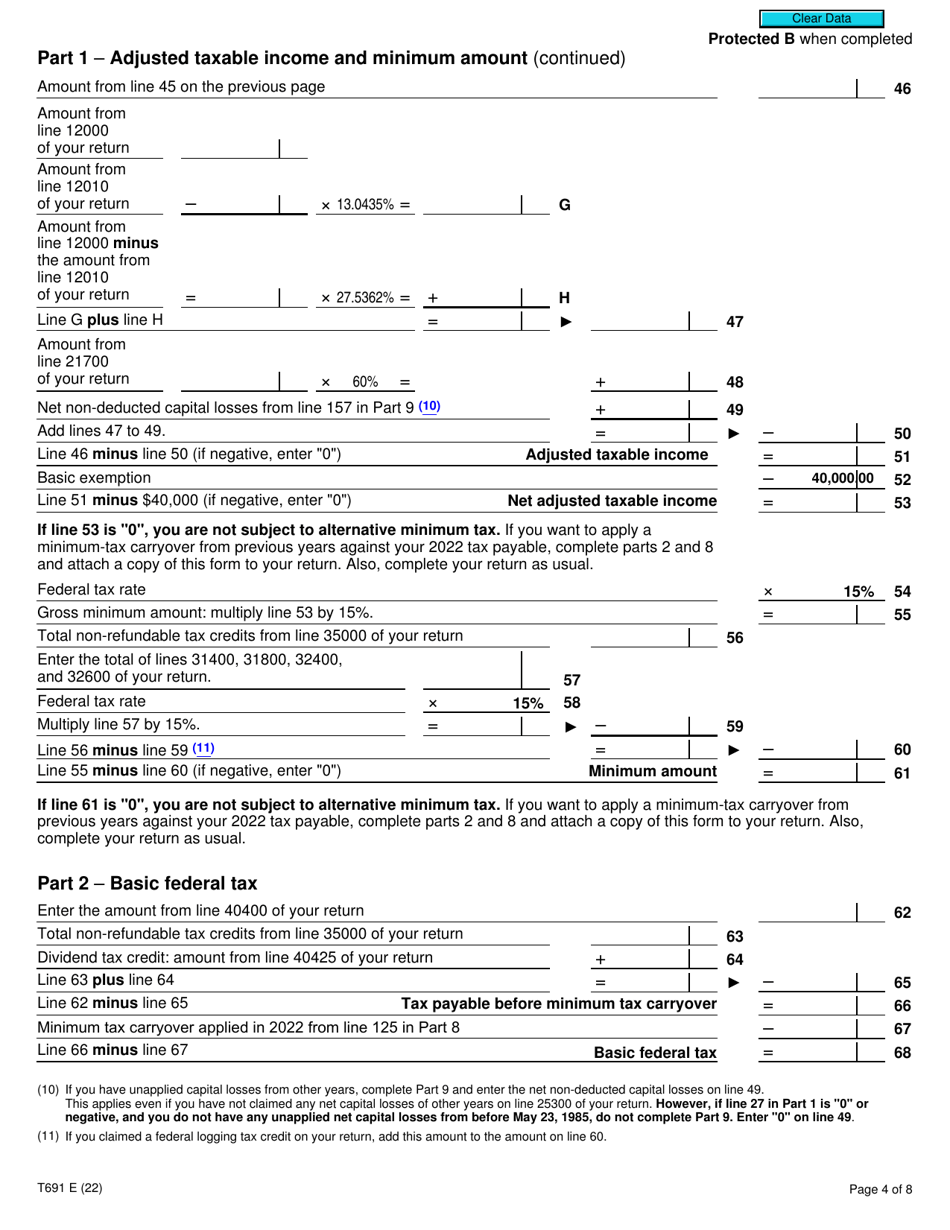

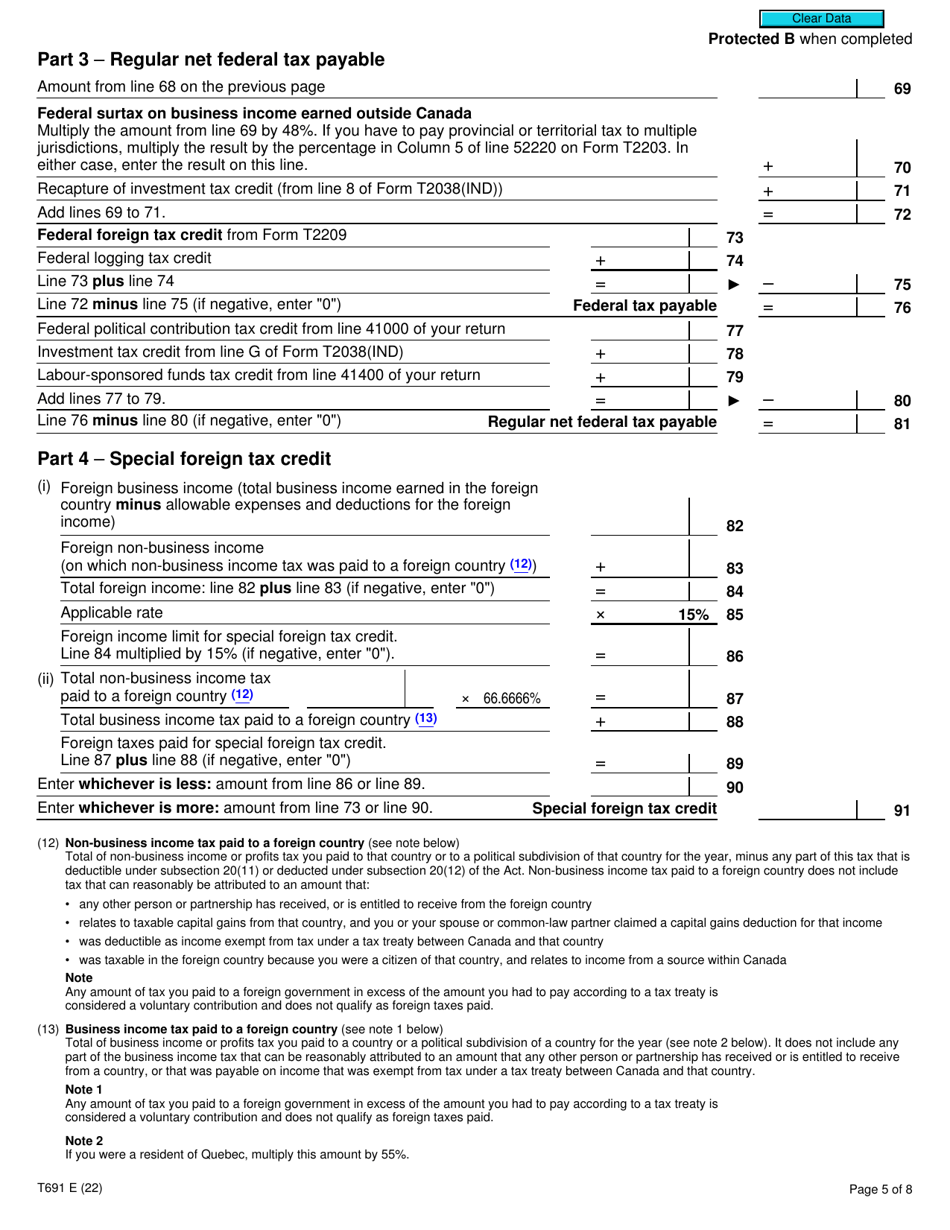

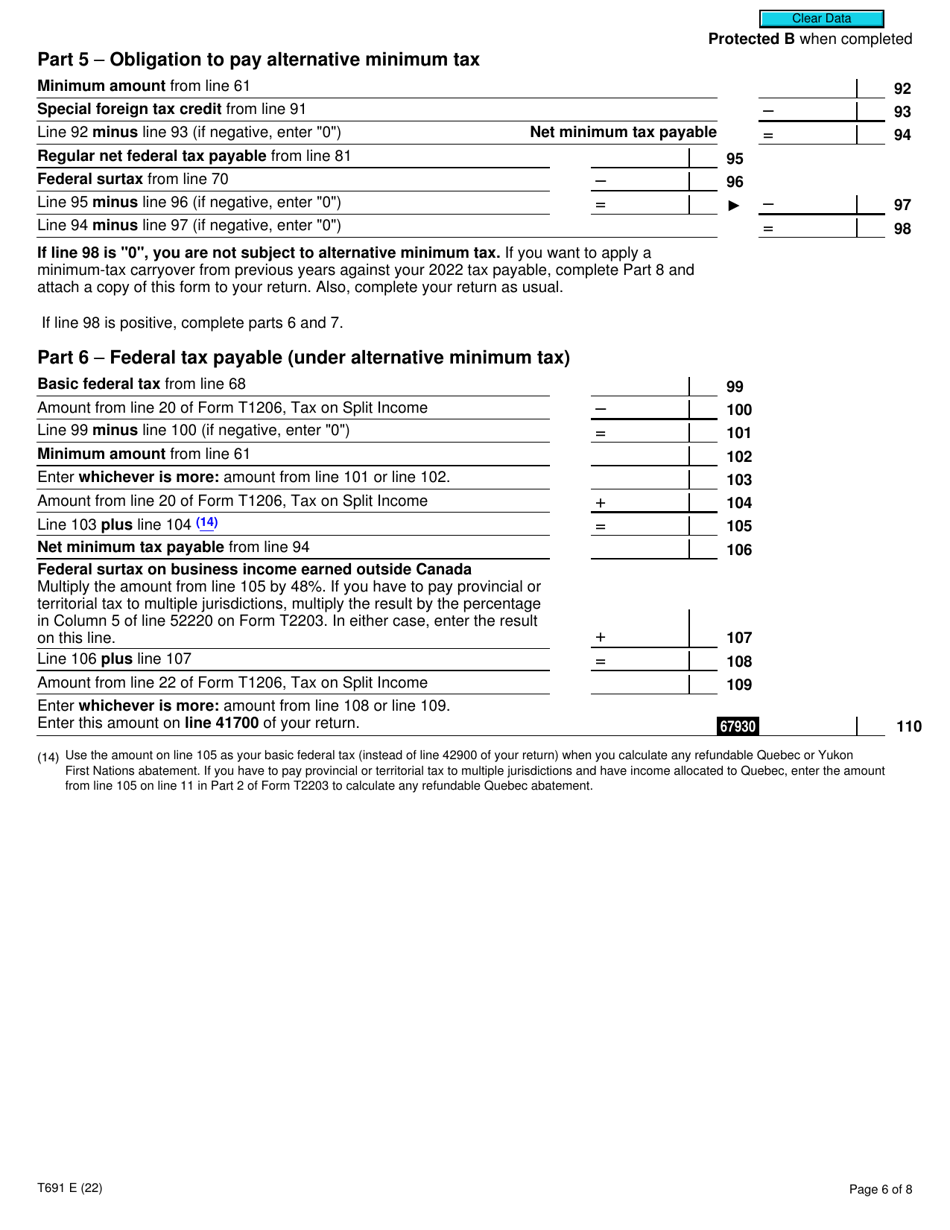

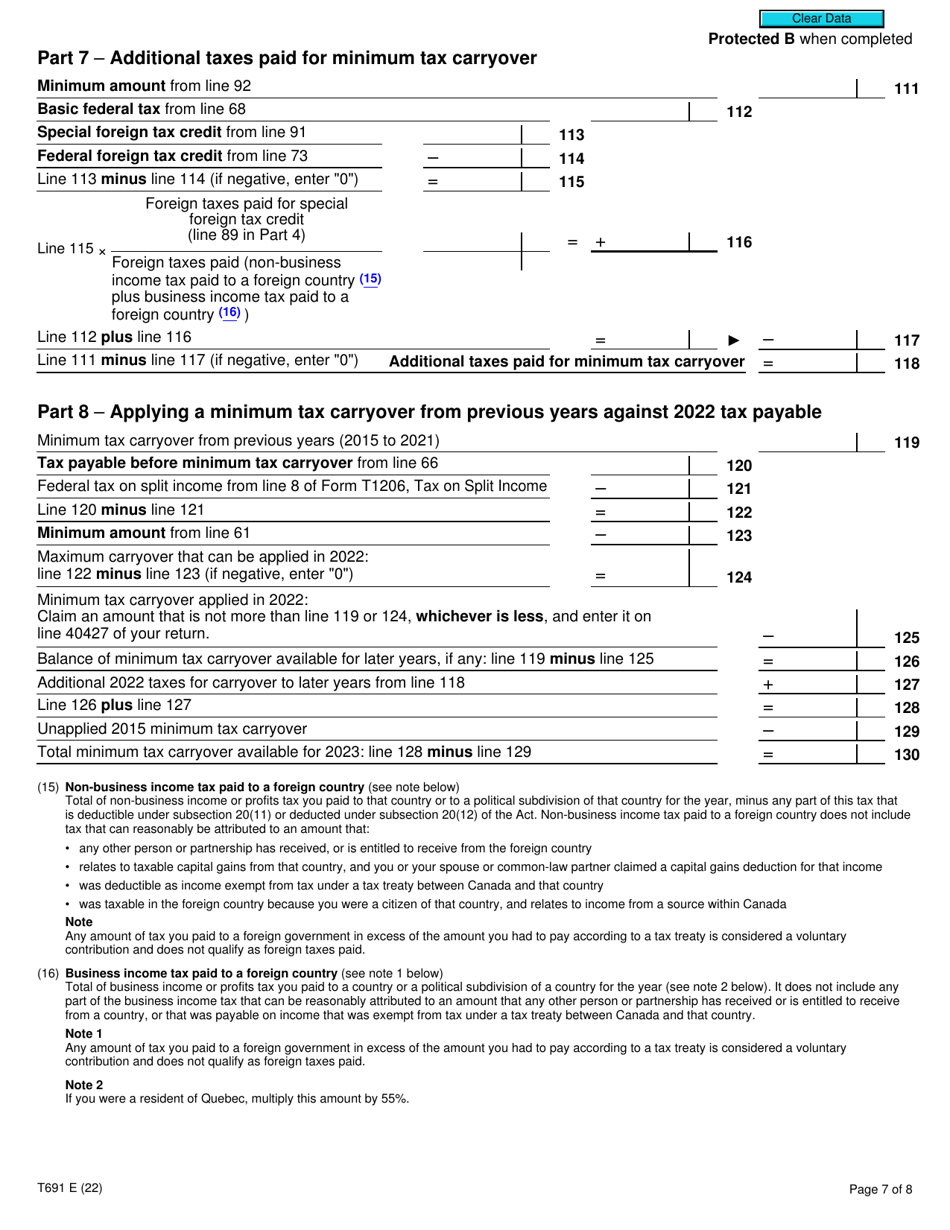

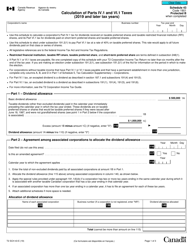

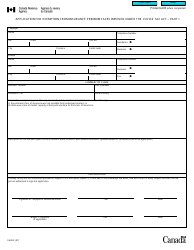

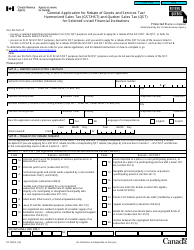

Form T691

for the current year.

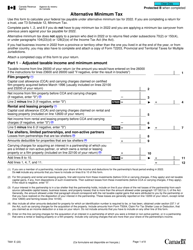

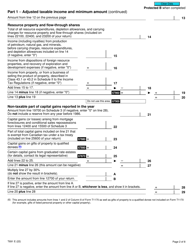

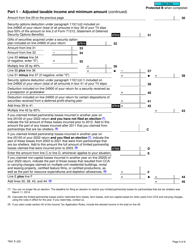

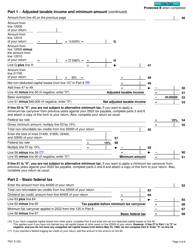

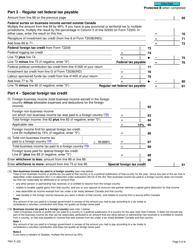

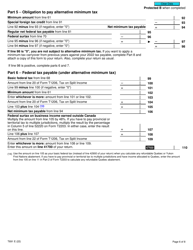

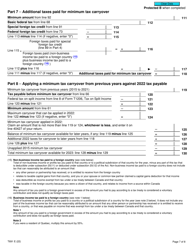

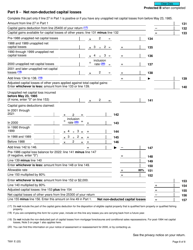

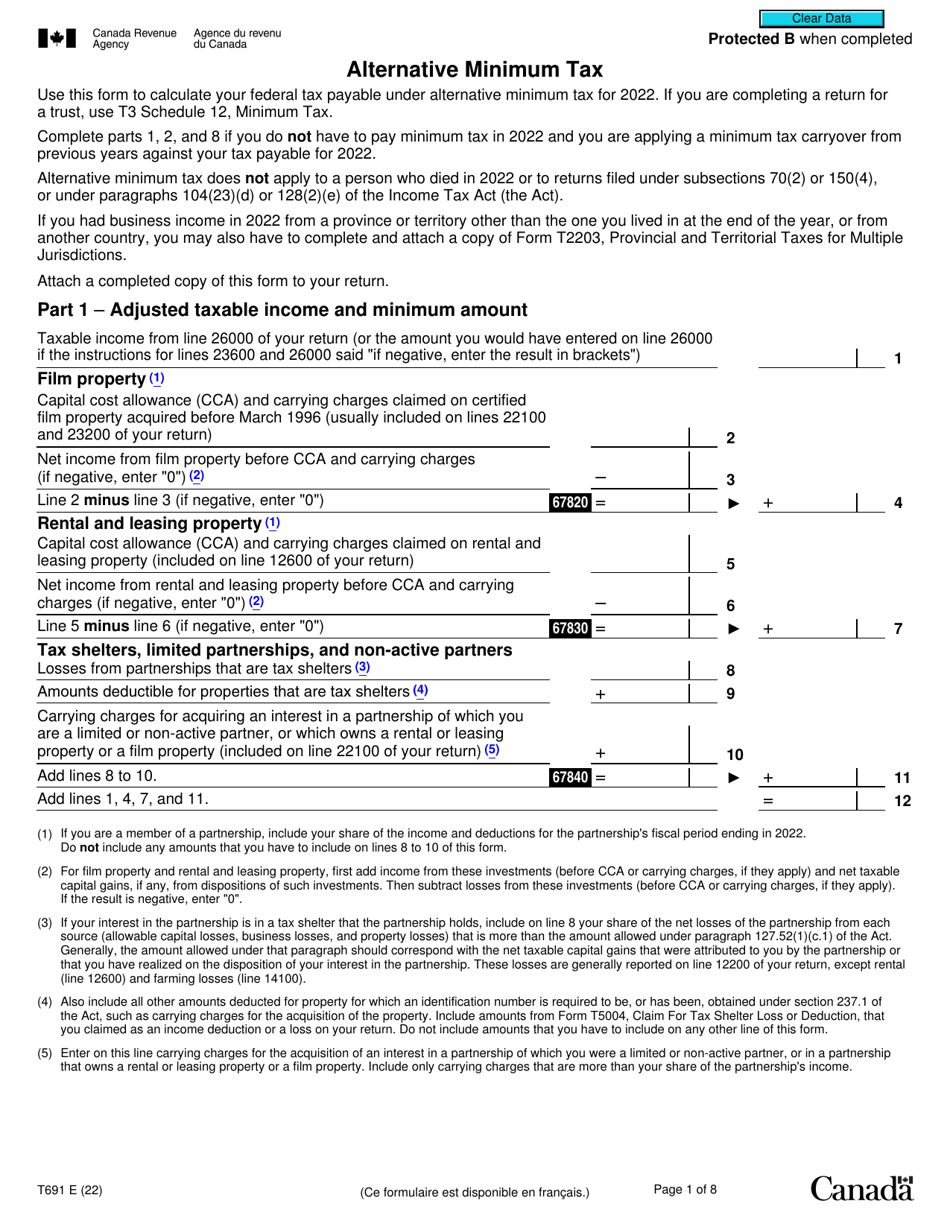

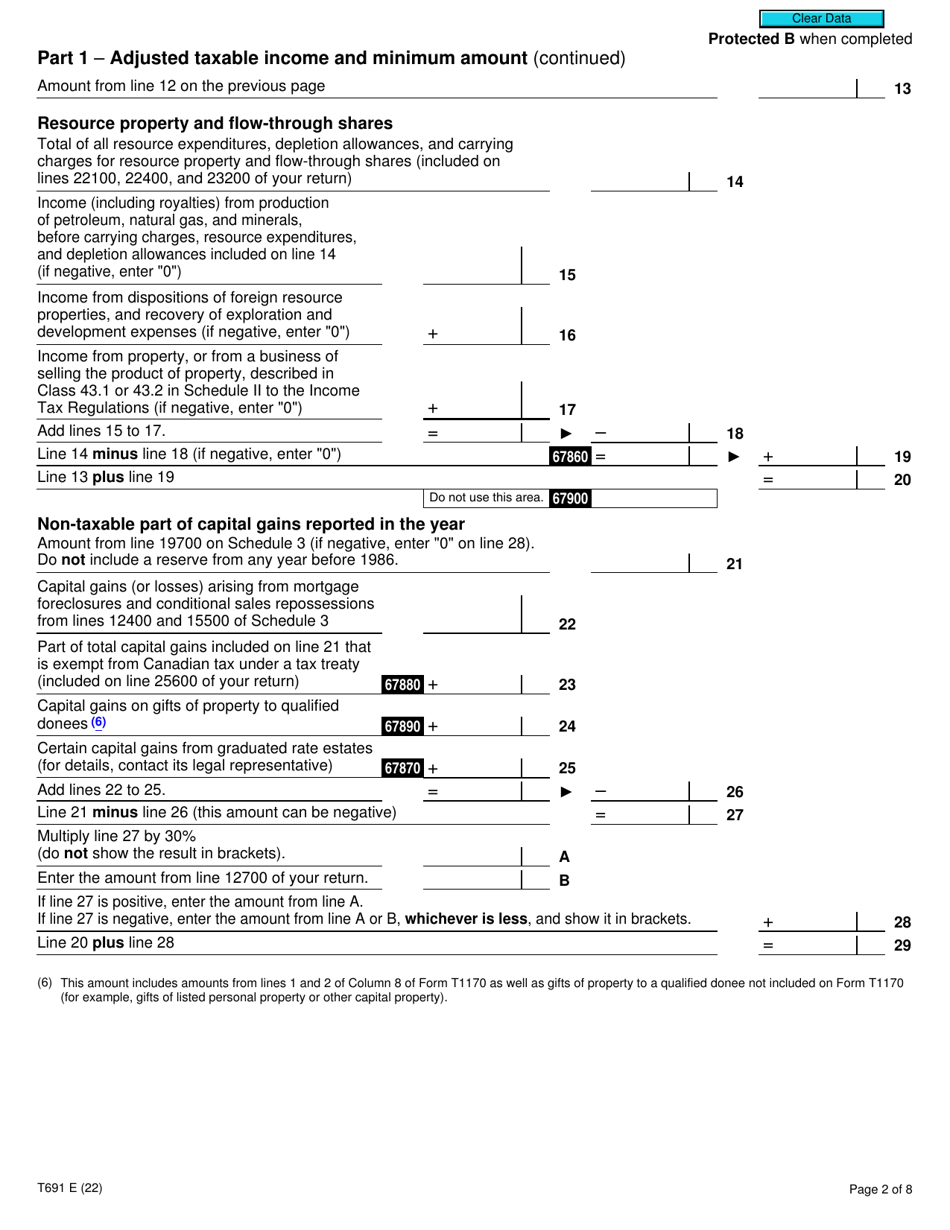

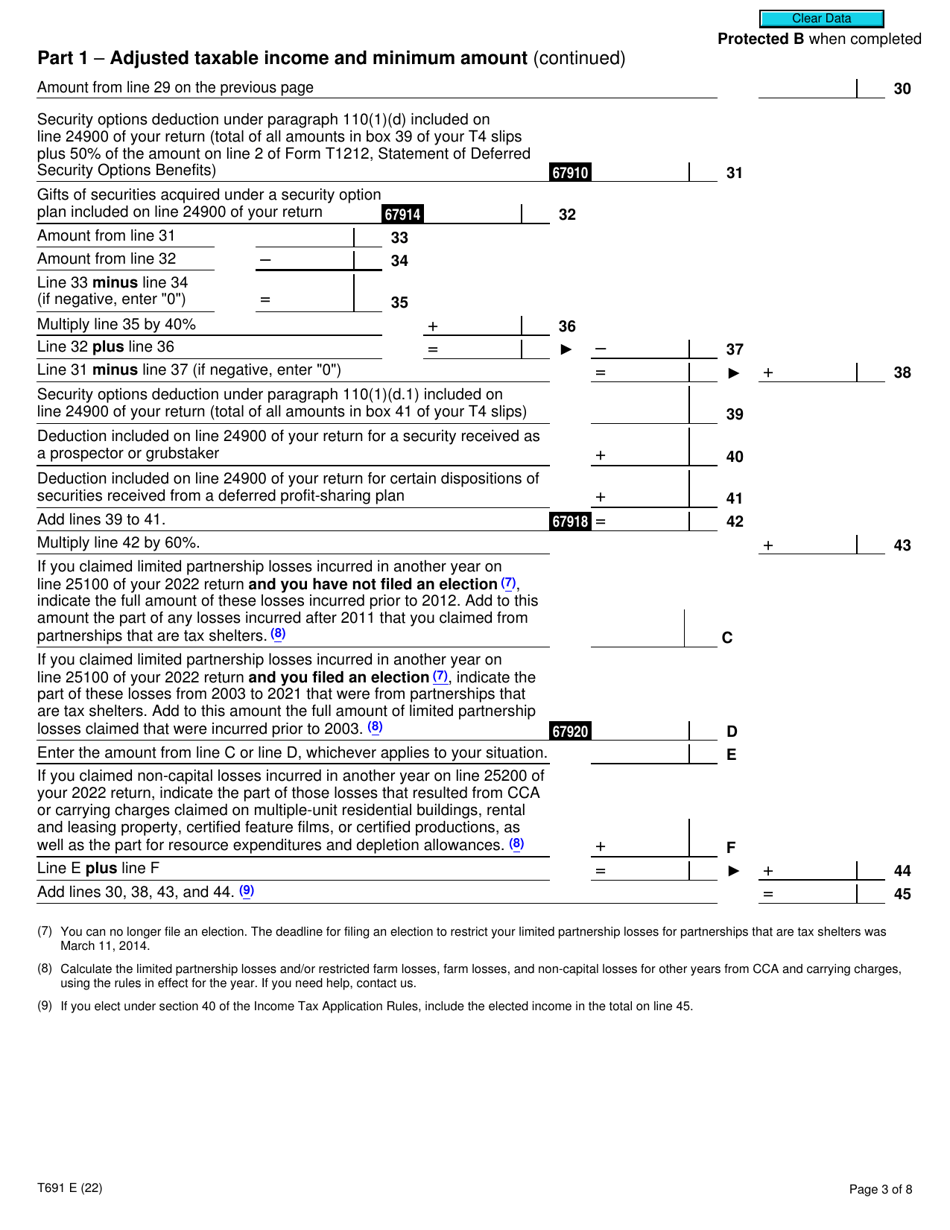

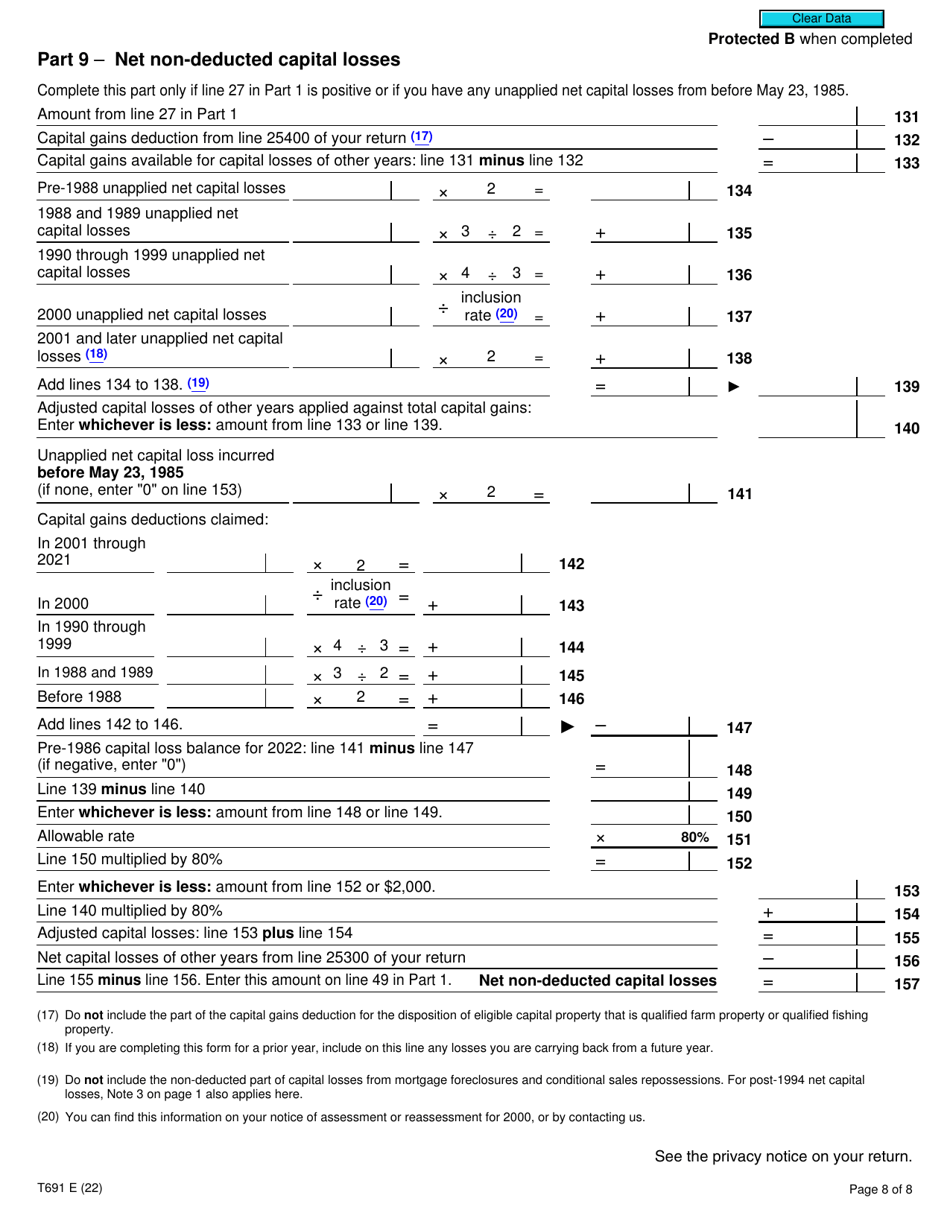

Form T691 Alternative Minimum Tax - Canada

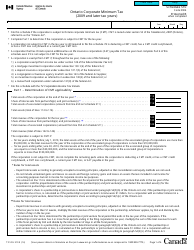

Form T691 Alternative Minimum Tax is a form used in Canada to calculate and report any alternative minimum tax (AMT) that may be owed by an individual or corporation. The AMT is a separate tax system designed to ensure that taxpayers with high deductions and credits still pay a minimum amount of tax. This form helps determine if the AMT applies and calculates the amount owed, if any.

The individual taxpayer files the Form T691 Alternative Minimum Tax in Canada.

FAQ

Q: What is Form T691?

A: Form T691 is a tax form used in Canada to calculate the Alternative Minimum Tax (AMT).

Q: What is the Alternative Minimum Tax (AMT)?

A: The Alternative Minimum Tax (AMT) is a separate calculation of income tax that ensures individuals with high income cannot use certain deductions and credits to reduce their tax liability significantly.

Q: Who is required to complete Form T691?

A: Individuals who have certain types of income or who claim certain deductions and credits may be required to complete Form T691.

Q: What types of income are subject to the Alternative Minimum Tax?

A: Certain passive or tax-preferred income, such as capital gains, stock option benefits, and foreign investment income, may be subject to the Alternative Minimum Tax.

Q: What deductions and credits are disallowed under the Alternative Minimum Tax?

A: Some common deductions and credits disallowed under the Alternative Minimum Tax include certain medical expenses, investment expenses, and certain foreign tax credits.

Q: When is Form T691 due?

A: Form T691 is typically due at the same time as your regular income tax return, which is usually on April 30th for individuals.

Q: Are there any penalties for not completing Form T691?

A: Failure to complete Form T691 when required may result in penalties and interest charges from the Canada Revenue Agency.