This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1E-OVP

for the current year.

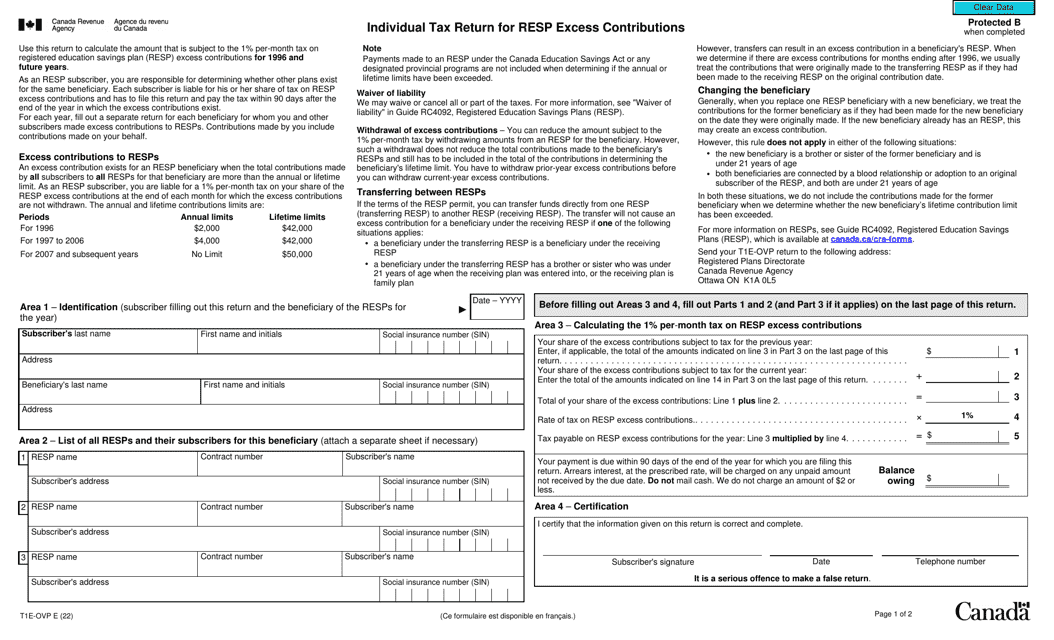

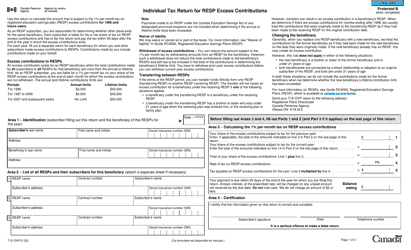

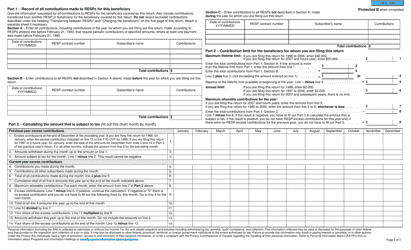

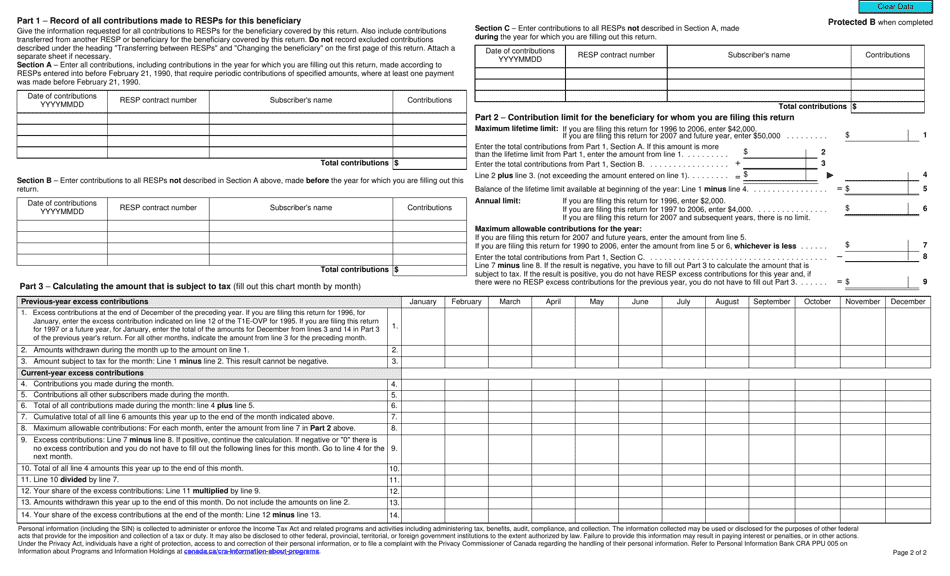

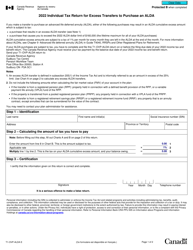

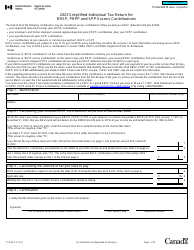

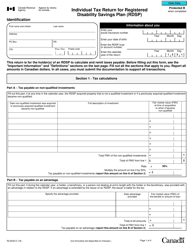

Form T1E-OVP Individual Tax Return for Resp Excess Contributions - Canada

Form T1E-OVP Individual Tax Return for Resp Excess Contributions in Canada allows individuals to report and correct any excess contributions made to a Registered Education Savings Plan (RESP) and claim the appropriate tax deductions or credits.

The individual taxpayer files the Form T1E-OVP for RESP excess contributions in Canada.

FAQ

Q: What is Form T1E-OVP?

A: Form T1E-OVP is the Individual Tax Return for RESP Excess Contributions in Canada.

Q: What is RESP?

A: RESP stands for Registered Education Savings Plan, which is a tax-advantaged investment account in Canada.

Q: What are excess contributions?

A: Excess contributions are the contributions made to an RESP that exceed the annual limits set by the government.

Q: Why do I need to file Form T1E-OVP?

A: You need to file Form T1E-OVP to report and reconcile any excess contributions made to your RESP.

Q: What information is required on Form T1E-OVP?

A: Form T1E-OVP requires information about your RESP account, excess contributions made, and any other required details.

Q: Are there any penalties for excess contributions?

A: Yes, there may be penalties for excess contributions, including additional taxes and potential loss of government grants.

Q: When is the deadline to file Form T1E-OVP?

A: The deadline to file Form T1E-OVP is usually April 30th of the year following the taxation year.

Q: Do I need to attach any supporting documents with Form T1E-OVP?

A: You may need to attach supporting documents such as receipts or statements to validate the excess contributions reported on the form.