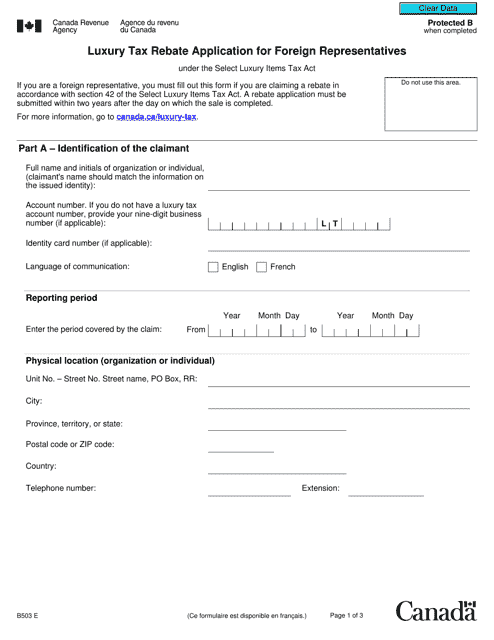

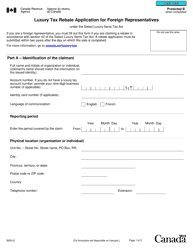

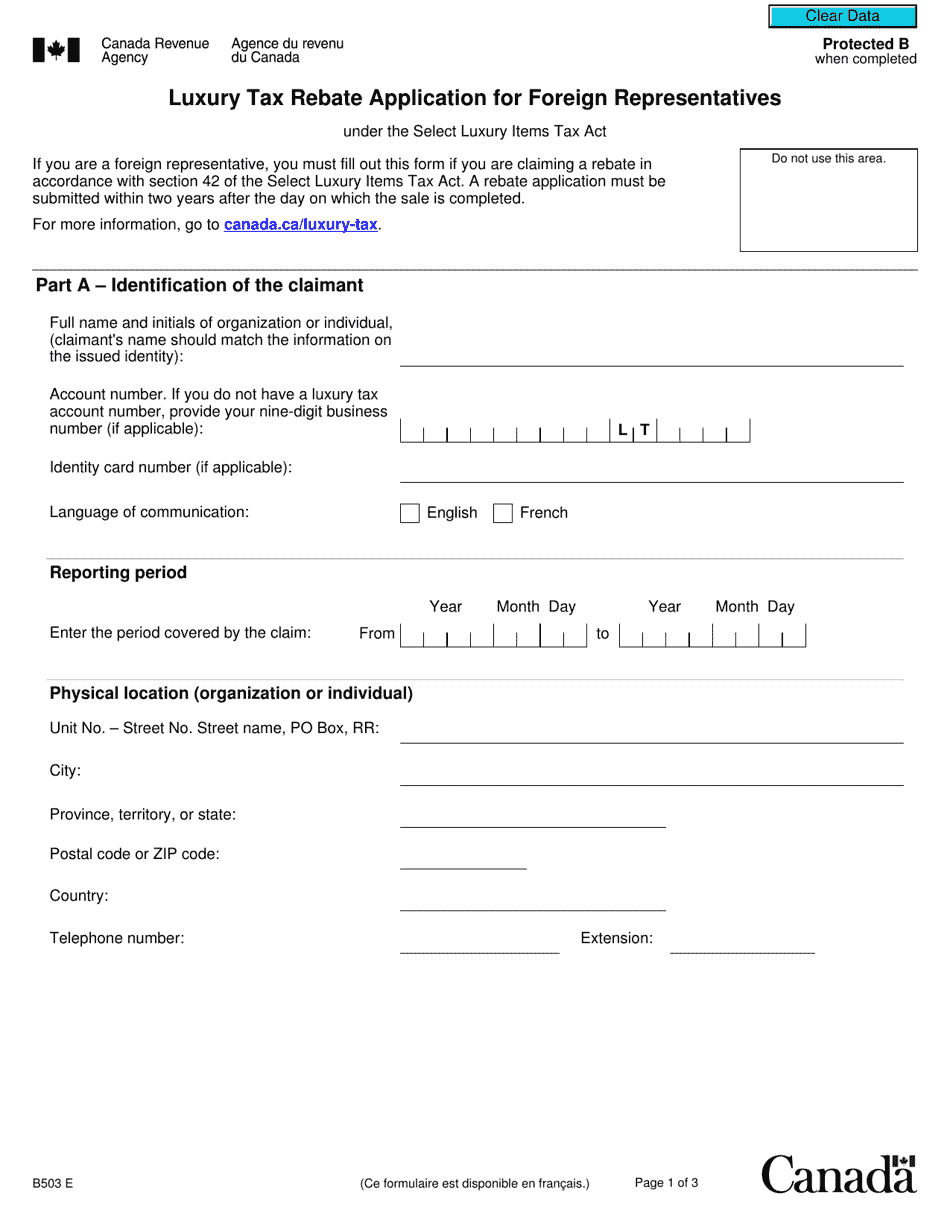

Form B503 Luxury Tax Rebate Application for Foreign Representatives - Canada

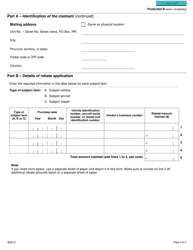

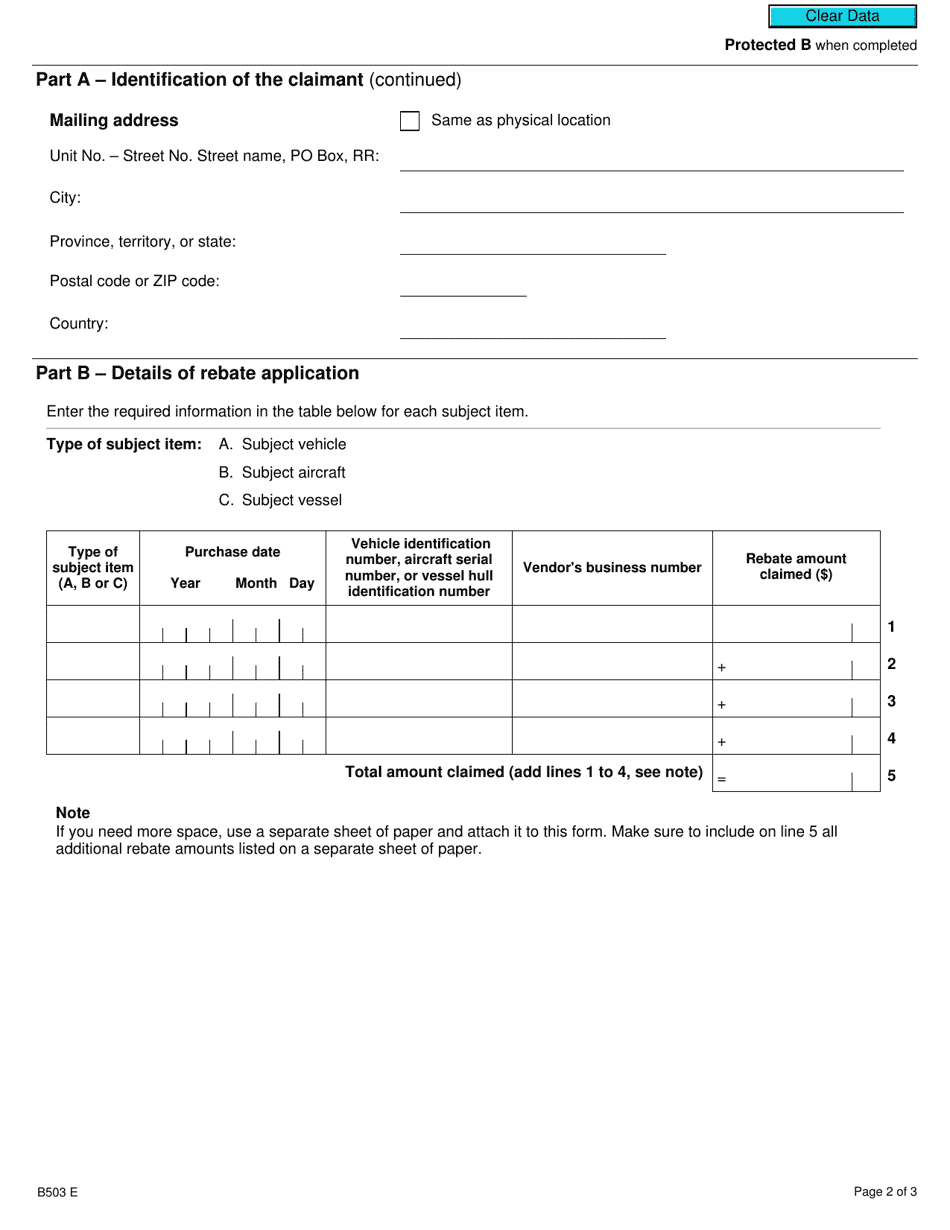

Form B503 Luxury Tax Rebate Application for Foreign Representatives - Canada is used by foreign representatives in Canada to apply for a rebate of the Goods and Services Tax (GST) they paid on certain luxury goods and vehicles. This form allows them to claim a refund of the tax amount.

Foreign representatives in Canada are responsible for filing the Form B503 Luxury Tax Rebate Application.

FAQ

Q: What is Form B503?

A: Form B503 is the Luxury Tax Rebate Application for Foreign Representatives in Canada.

Q: Who can use Form B503?

A: Form B503 is used by foreign representatives in Canada to apply for a luxury tax rebate.

Q: What is a luxury tax rebate?

A: A luxury tax rebate is a refund of the luxury tax paid on certain goods.

Q: How do I qualify for a luxury tax rebate?

A: Foreign representatives in Canada may qualify for a luxury tax rebate if they meet certain criteria.

Q: What should I include with my Form B503?

A: You should include all required supporting documents, such as receipts and proof of eligibility, with your Form B503.

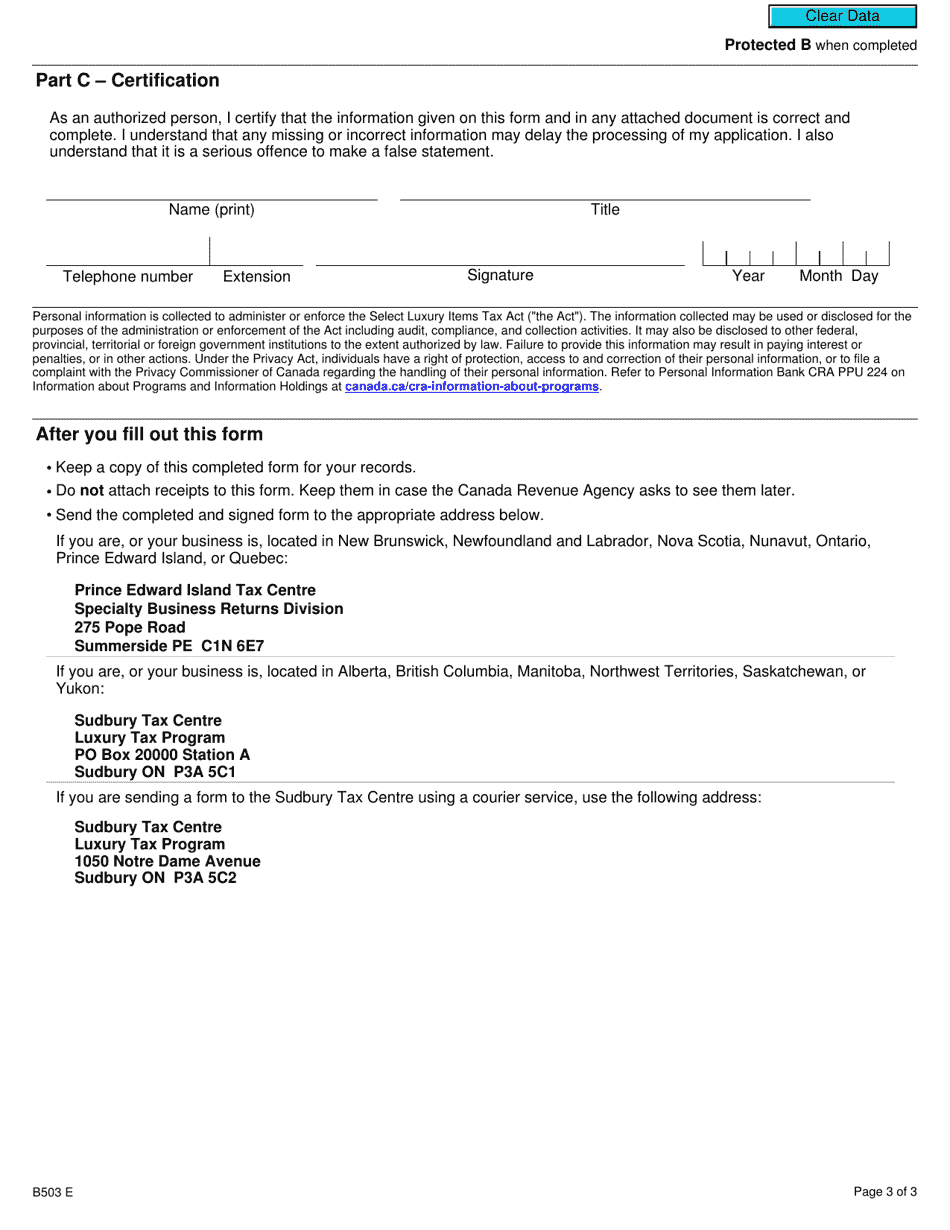

Q: How long does it take to process a luxury tax rebate application?

A: The processing time for a luxury tax rebate application may vary, so it is best to contact the government office for an estimation.