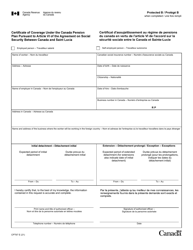

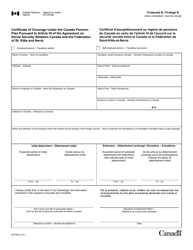

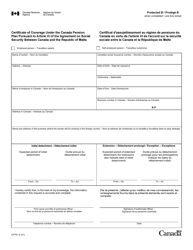

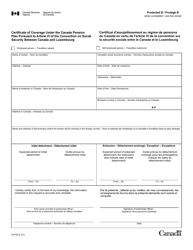

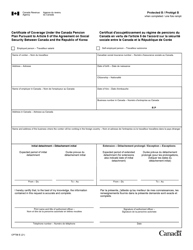

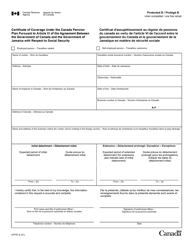

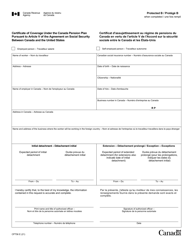

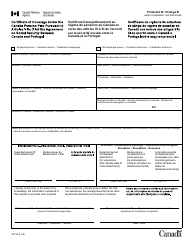

This version of the form is not currently in use and is provided for reference only. Download this version of

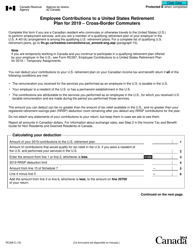

Form RC269

for the current year.

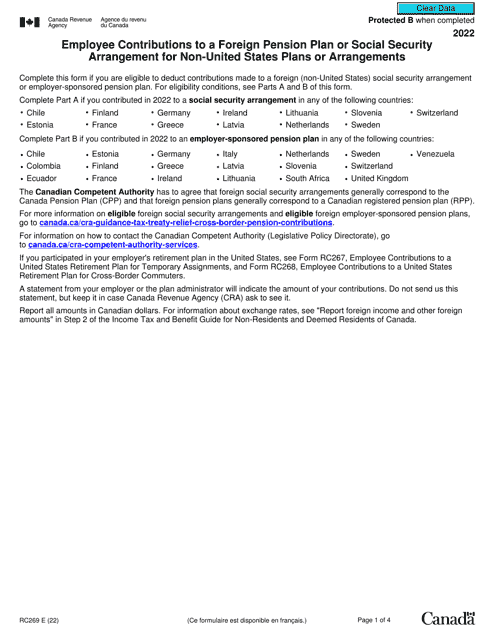

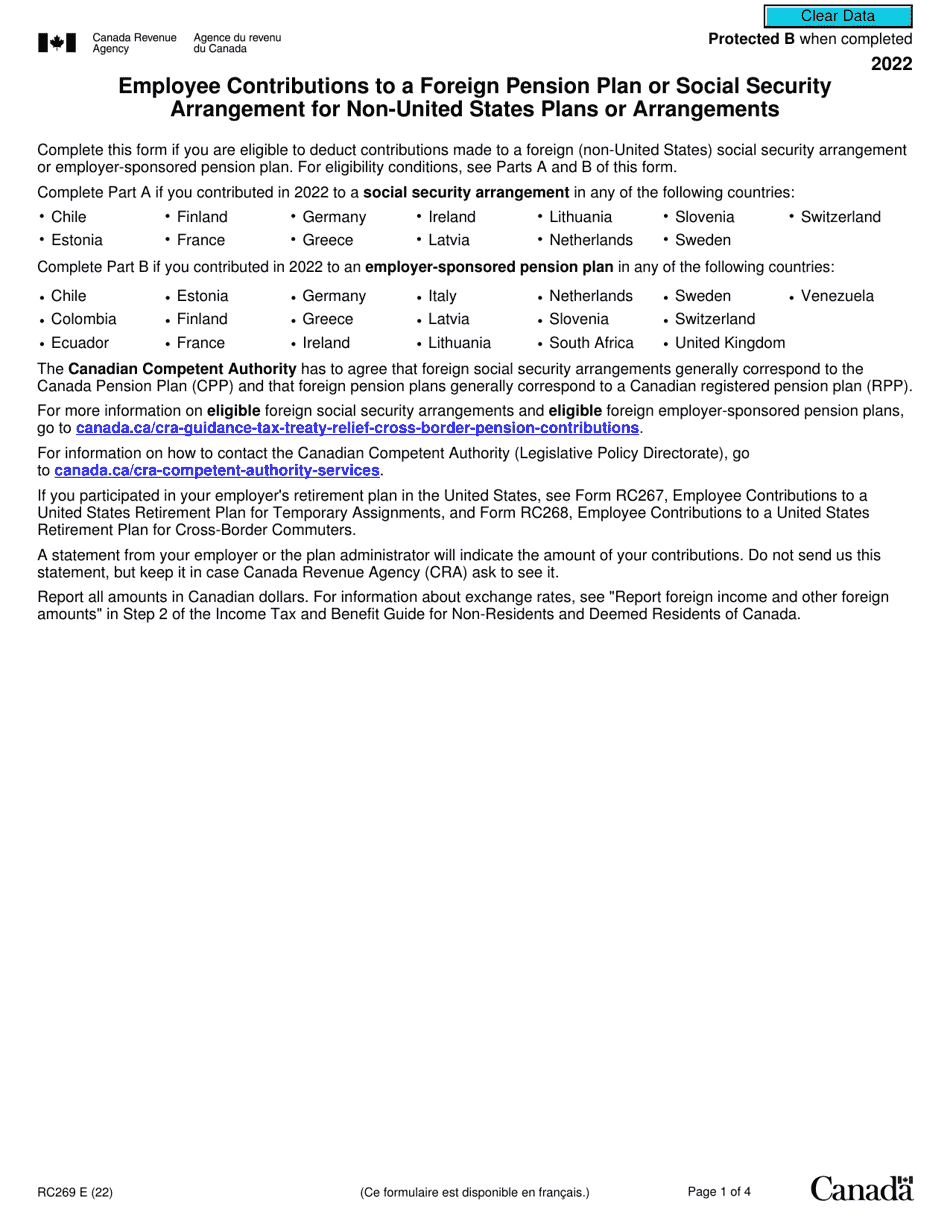

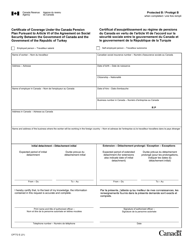

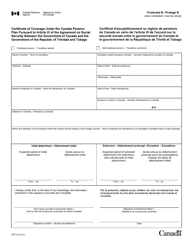

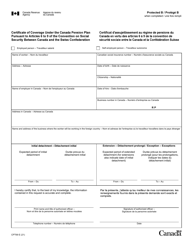

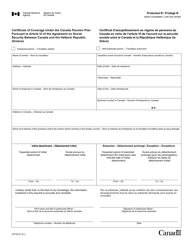

Form RC269 Employee Contributions to a Foreign Pension Plan or Social Security Arrangement for Non-united States Plans or Arrangements - Canada

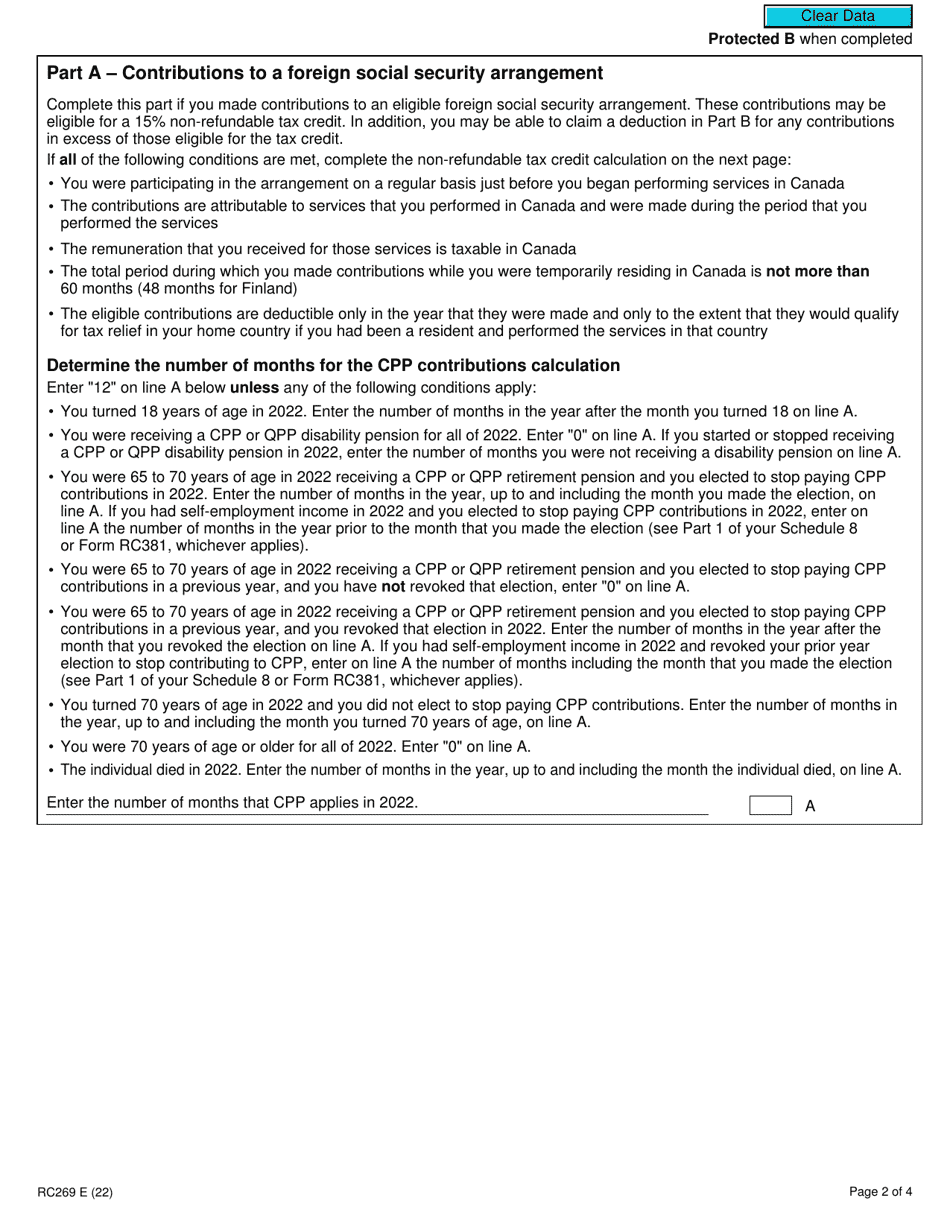

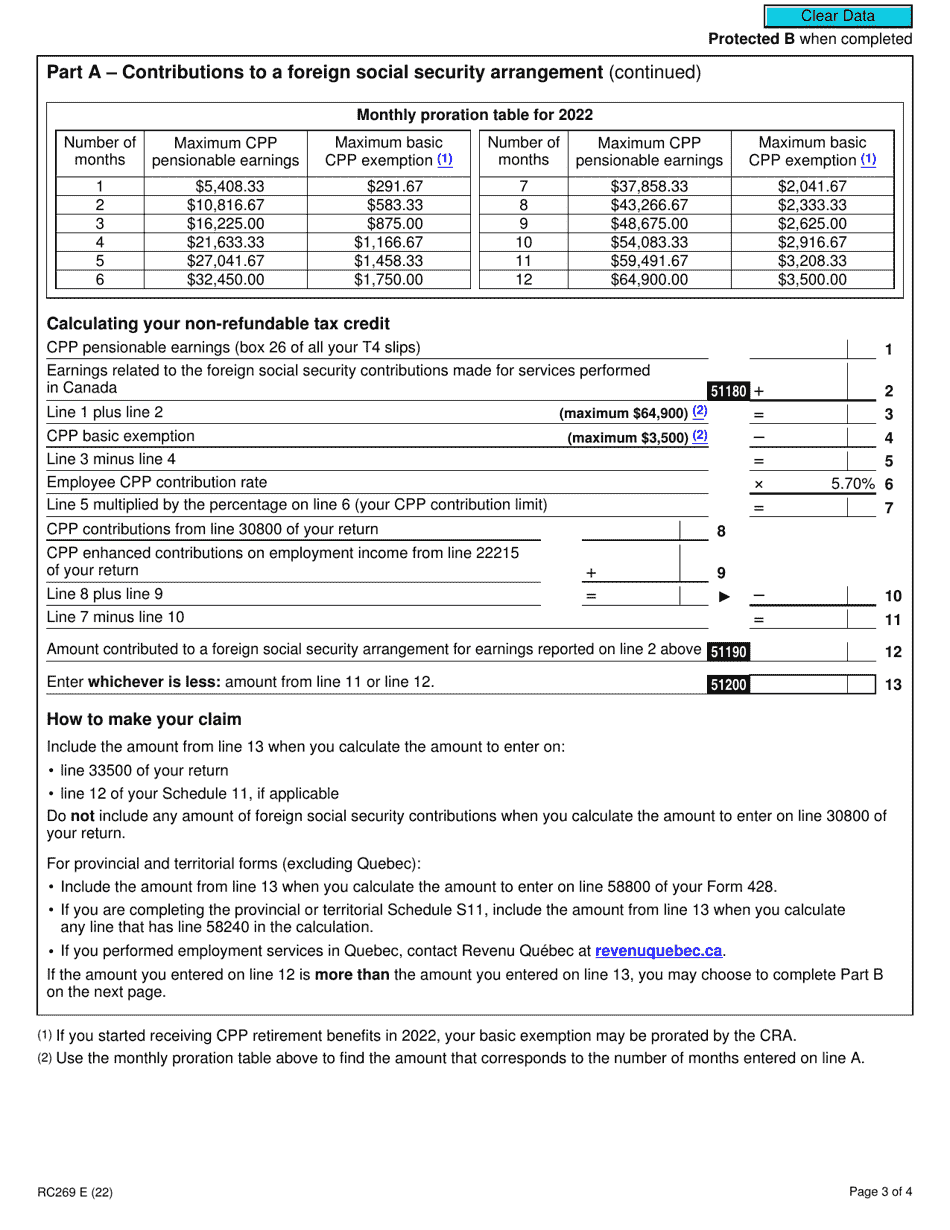

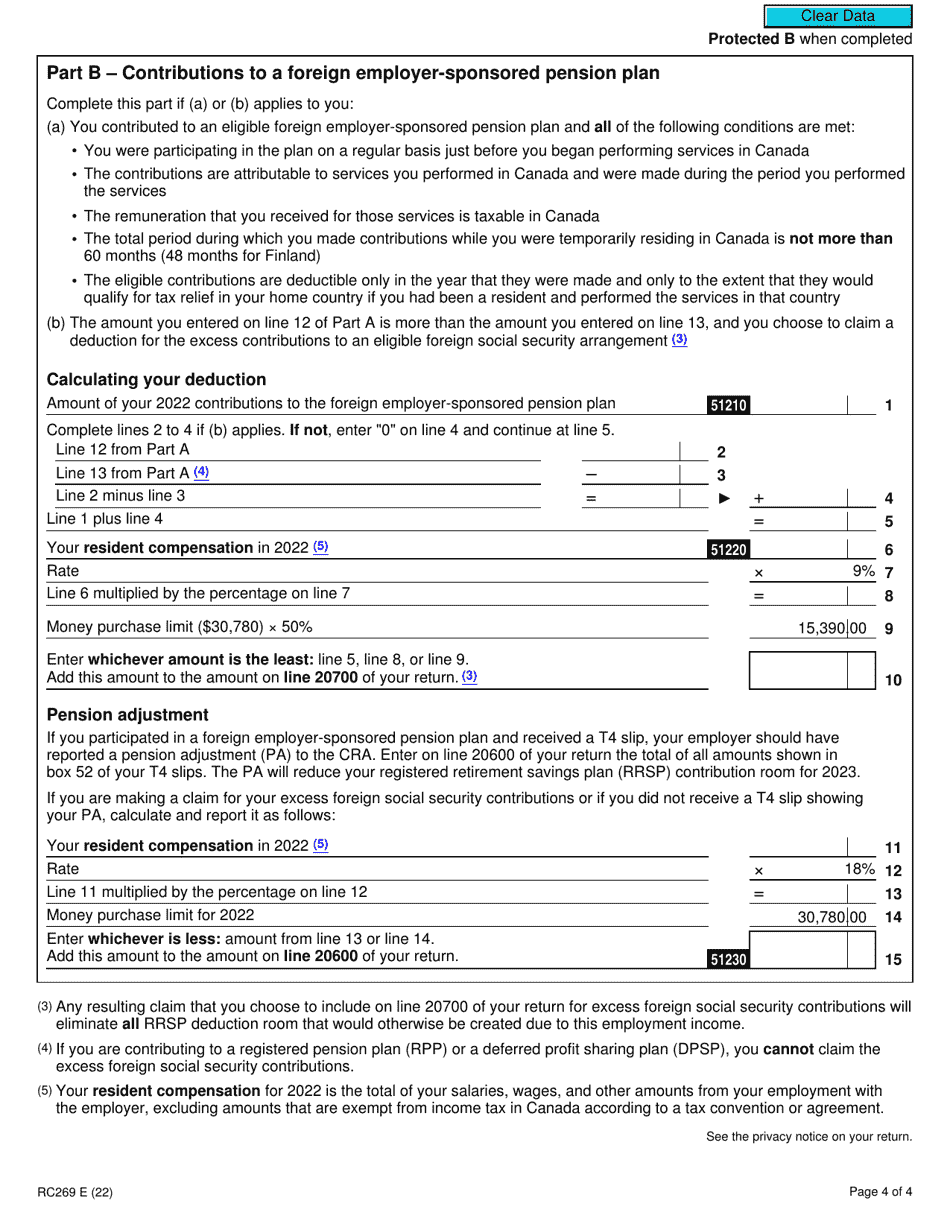

Form RC269 Employee Contributions to a Foreign Pension Plan or Social Security Arrangement is used by individuals in Canada to report their contributions to a foreign pension plan or social security arrangement that is not from the United States. It is used to ensure compliance with Canadian tax laws regarding foreign pension contributions.

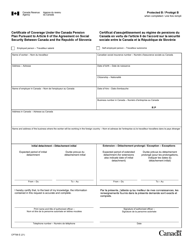

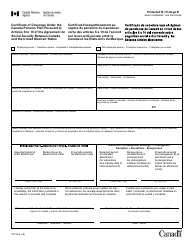

The employer files the Form RC269 for non-United States pension plans or social security arrangements in Canada.

FAQ

Q: What is form RC269?

A: Form RC269 is a tax form used in Canada to report employee contributions to a foreign pension plan or social security arrangement.

Q: Who uses form RC269?

A: Form RC269 is used by Canadian residents who have made contributions to a non-United States pension plan or social security arrangement.

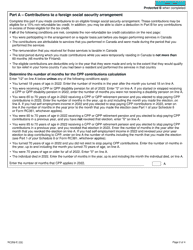

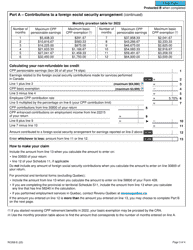

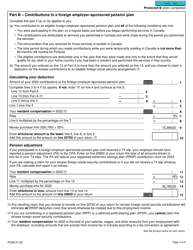

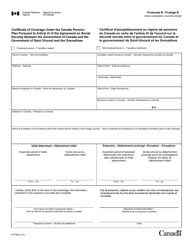

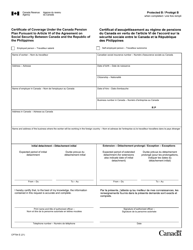

Q: What information is required on form RC269?

A: Form RC269 requires details about the foreign pension plan or social security arrangement, the contributions made by the employee, and any amounts refunded or transferred.

Q: Is form RC269 mandatory?

A: Yes, if you have made any contributions to a non-United States pension plan or social security arrangement, you are required to report it on form RC269.

Q: When is form RC269 due?

A: Form RC269 is generally due on or before your personal income tax returnfiling deadline, which is April 30th for most individuals in Canada.

Q: Can I claim a tax deduction for contributions to a foreign pension plan or social security arrangement?

A: The tax treatment of contributions to foreign pension plans or social security arrangements can vary. It is recommended to consult with a tax professional or the CRA for specific guidance.

Q: What happens if I don't report my contributions to a foreign pension plan on form RC269?

A: Failing to report your contributions to a foreign pension plan or social security arrangement on form RC269 can result in penalties and interest imposed by the CRA.