This version of the form is not currently in use and is provided for reference only. Download this version of

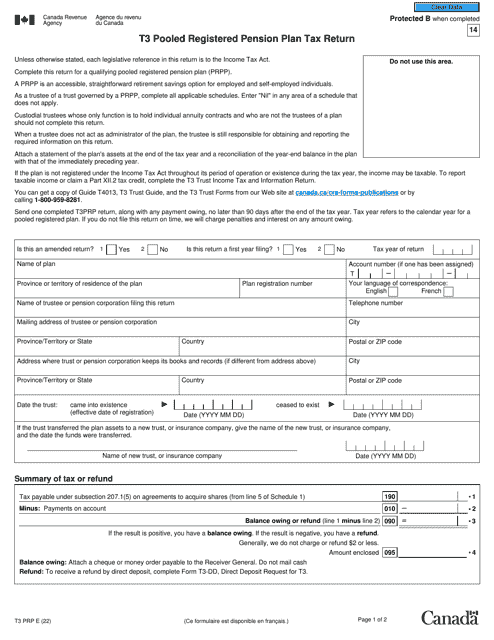

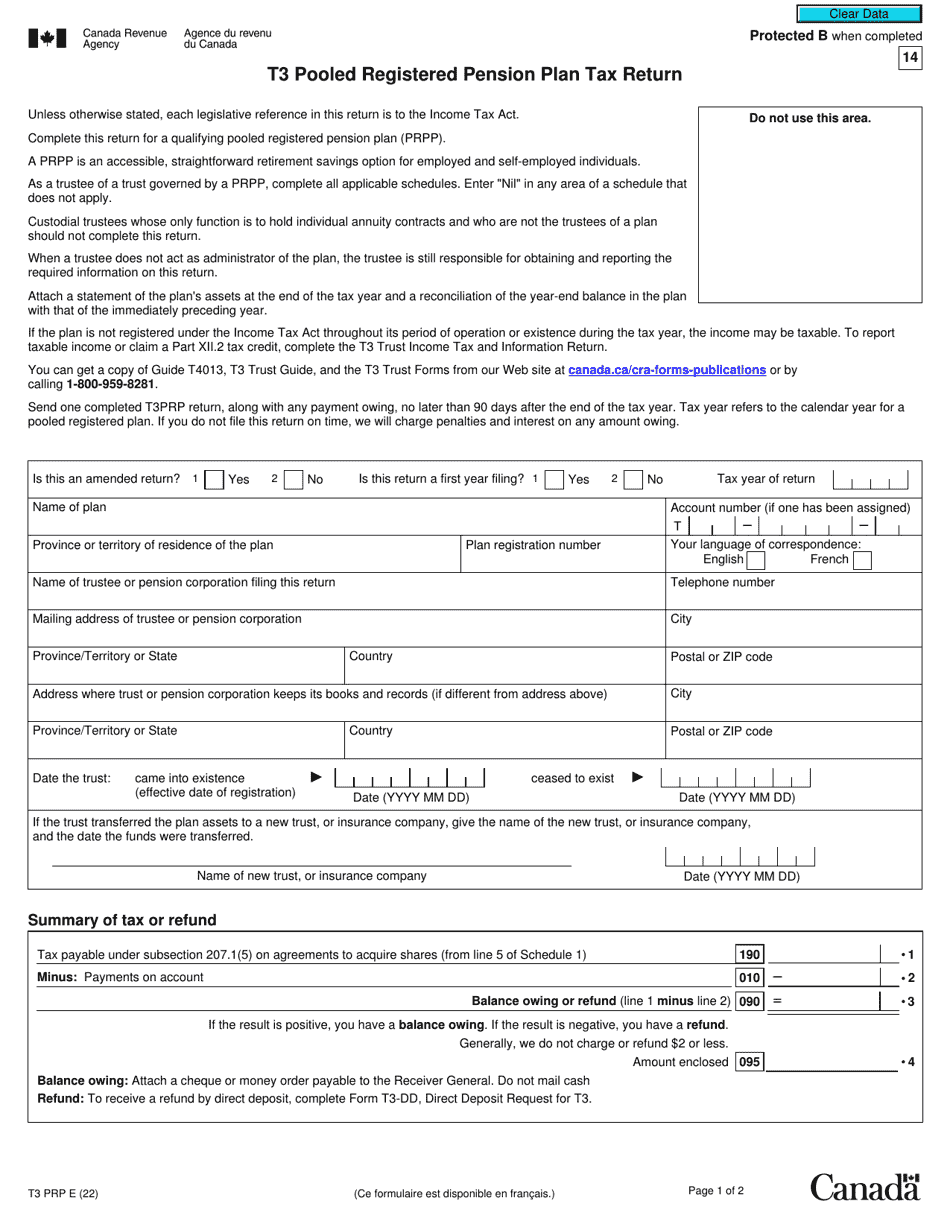

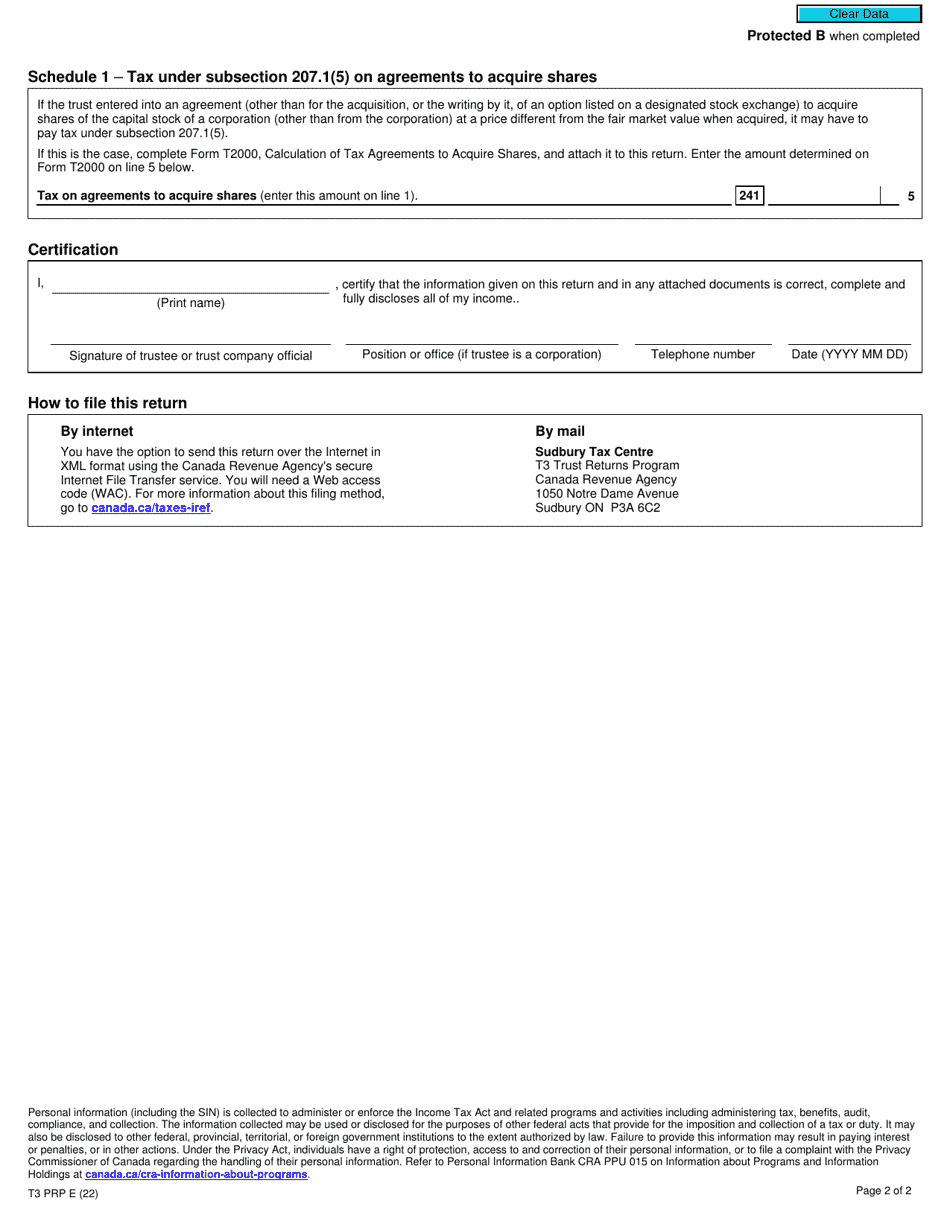

Form T3 PRP

for the current year.

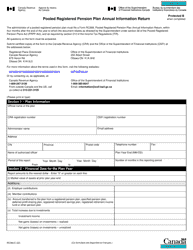

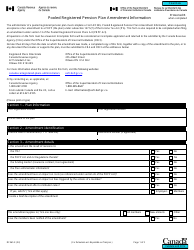

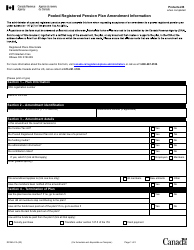

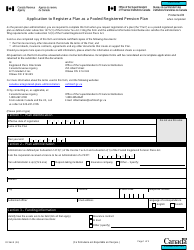

Form T3 PRP T3 Pooled Registered Pension Plan Tax Return - Canada

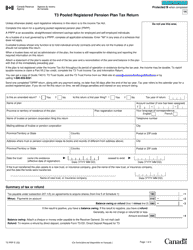

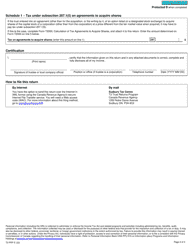

Form T3 PRP is used for reporting and filing taxes related to Pooled Registered Pension Plans (PRPPs) in Canada. It is specifically designed for PRPP administrators to report information about the plan and its members, and to calculate the tax liabilities for the plan.

The T3 PRP (Pooled Registered Pension Plan) tax return in Canada is typically filed by the plan administrator or the trustee of the PRP.

FAQ

Q: What is Form T3 PRP?

A: Form T3 PRP is the tax return form for Pooled Registered Pension Plans (PRP) in Canada.

Q: Who needs to file Form T3 PRP?

A: Any administrator of a Pooled Registered Pension Plan in Canada needs to file Form T3 PRP.

Q: What is a Pooled Registered Pension Plan (PRP)?

A: A Pooled Registered Pension Plan (PRP) is a type of retirement savings plan that combines contributions from multiple individuals to be invested and provide retirement benefits.

Q: What information is required to complete Form T3 PRP?

A: You will need to provide information about the Pooled Registered Pension Plan, including the plan name, plan administrator, and details of contributions.

Q: When is the deadline to file Form T3 PRP?

A: The deadline to file Form T3 PRP is 90 days after the end of the PRP's taxation year.

Q: Are there any penalties for late filing of Form T3 PRP?

A: Yes, there are penalties for late filing of Form T3 PRP, which can vary depending on the length of the delay.