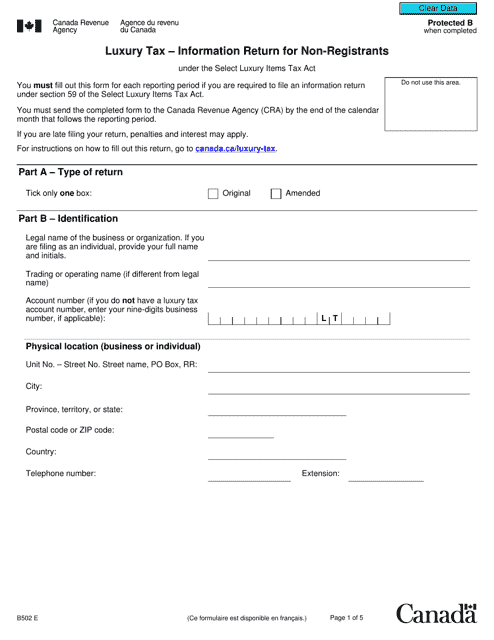

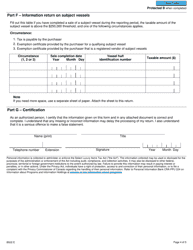

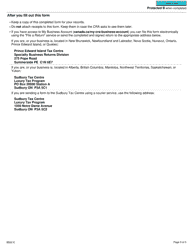

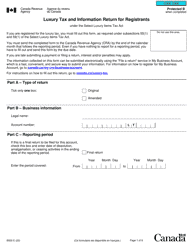

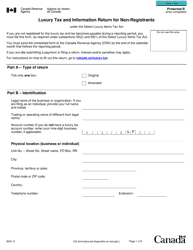

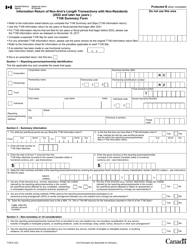

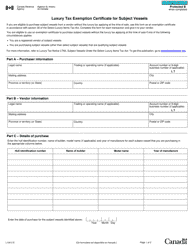

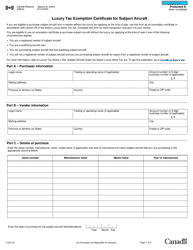

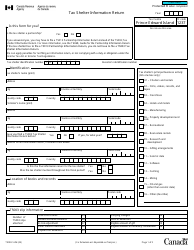

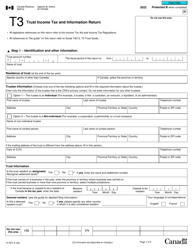

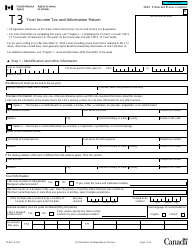

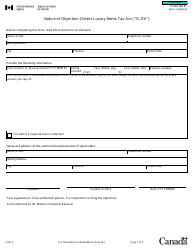

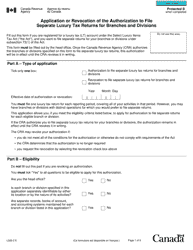

Form B502 Luxury Tax - Information Return for Non-registrants - Canada

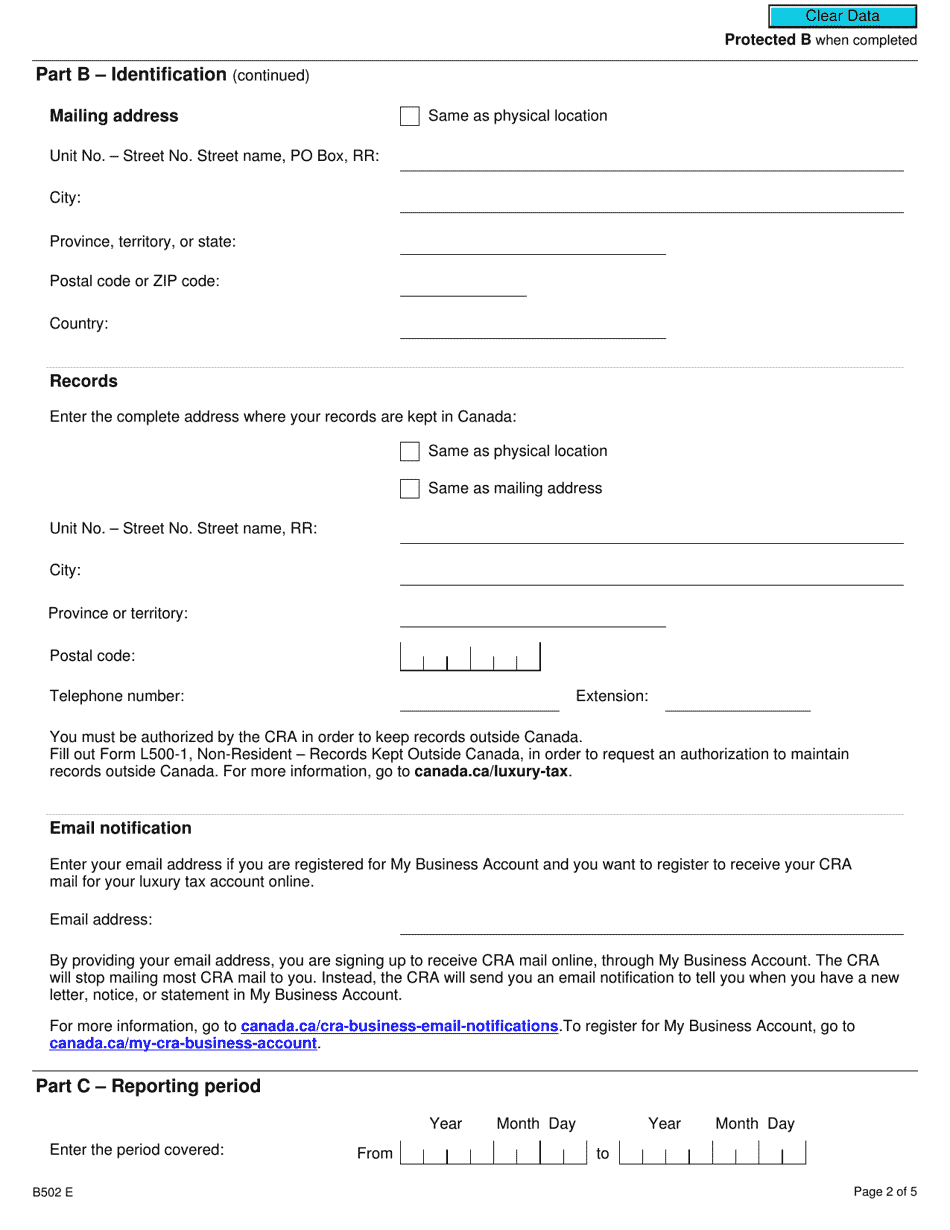

Form B502 Luxury Tax - Information Return for Non-registrants in Canada is used to report information about luxury goods that were purchased or imported into Canada by individuals or businesses that are not registered for the Goods and Services Tax/Harmonized Sales Tax (GST/HST). It helps the Canadian government monitor and collect taxes on luxury items.

The Form B502 Luxury Tax - Information Return for Non-registrants in Canada is filed by individuals or businesses who are not registered for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) but are engaged in activities subject to the luxury tax.

FAQ

Q: What is Form B502?

A: Form B502 is the Luxury Tax Information Return for Non-registrants in Canada.

Q: Who needs to file Form B502?

A: Non-registrants in Canada who are liable to pay luxury tax on certain goods and services need to file Form B502.

Q: What is luxury tax?

A: Luxury tax is a tax imposed on the purchase or use of certain luxury goods and services.

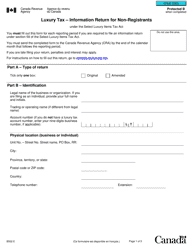

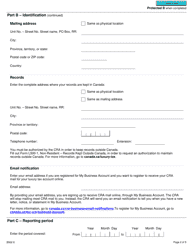

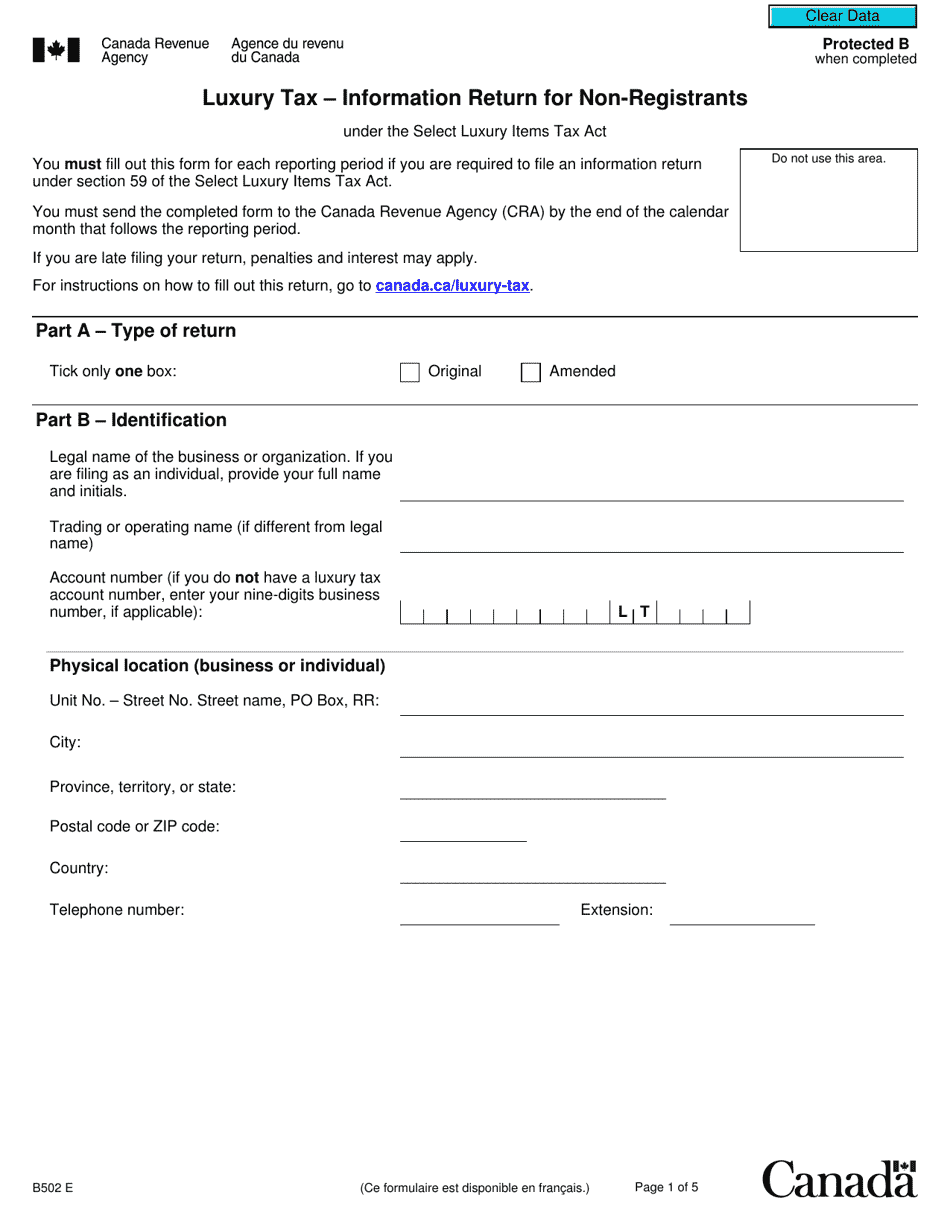

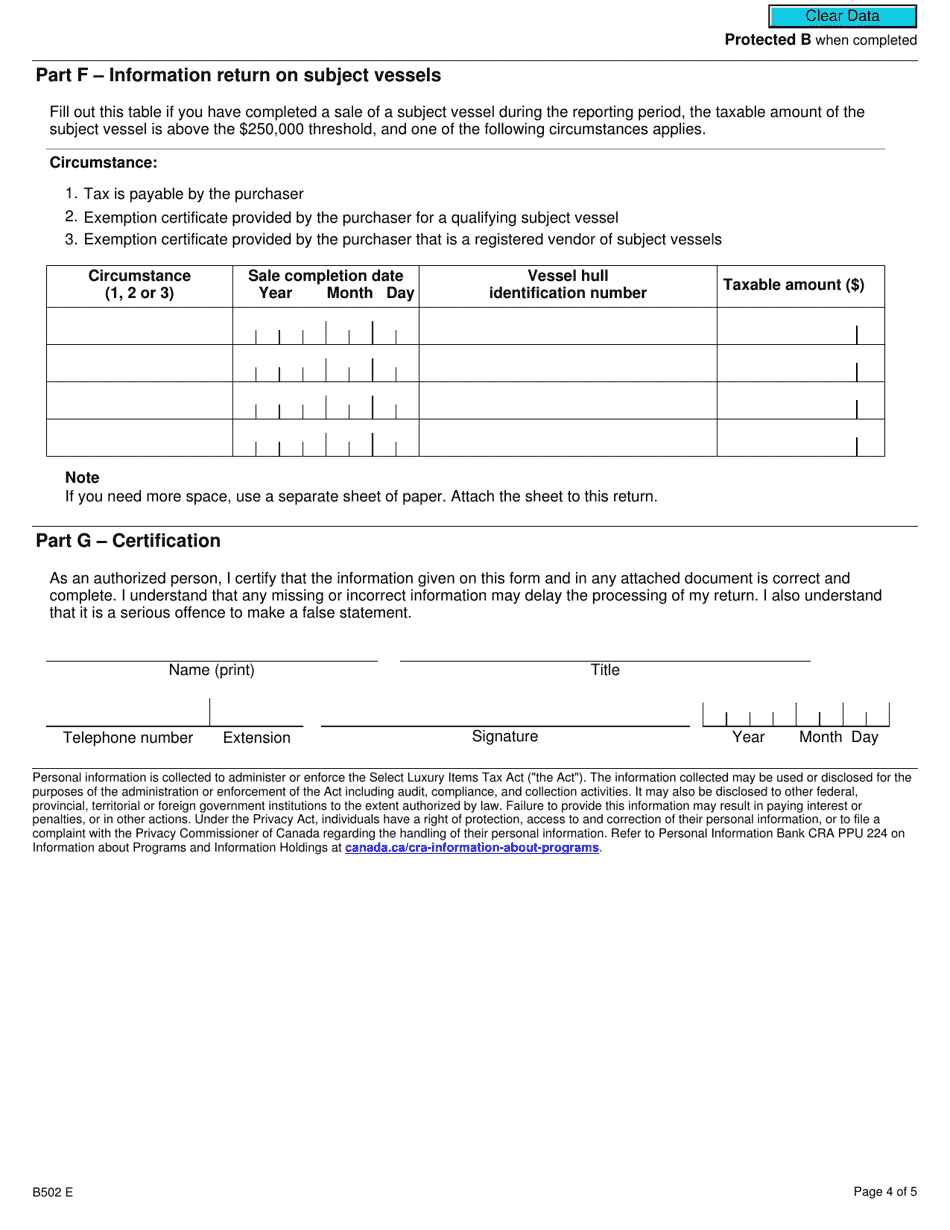

Q: What information is required to complete Form B502?

A: To complete Form B502, you will need to provide details about your purchases of taxable luxury goods and services.

Q: When is the due date for filing Form B502?

A: The due date for filing Form B502 is usually within 30 days after the end of each calendar quarter.

Q: How can I file Form B502?

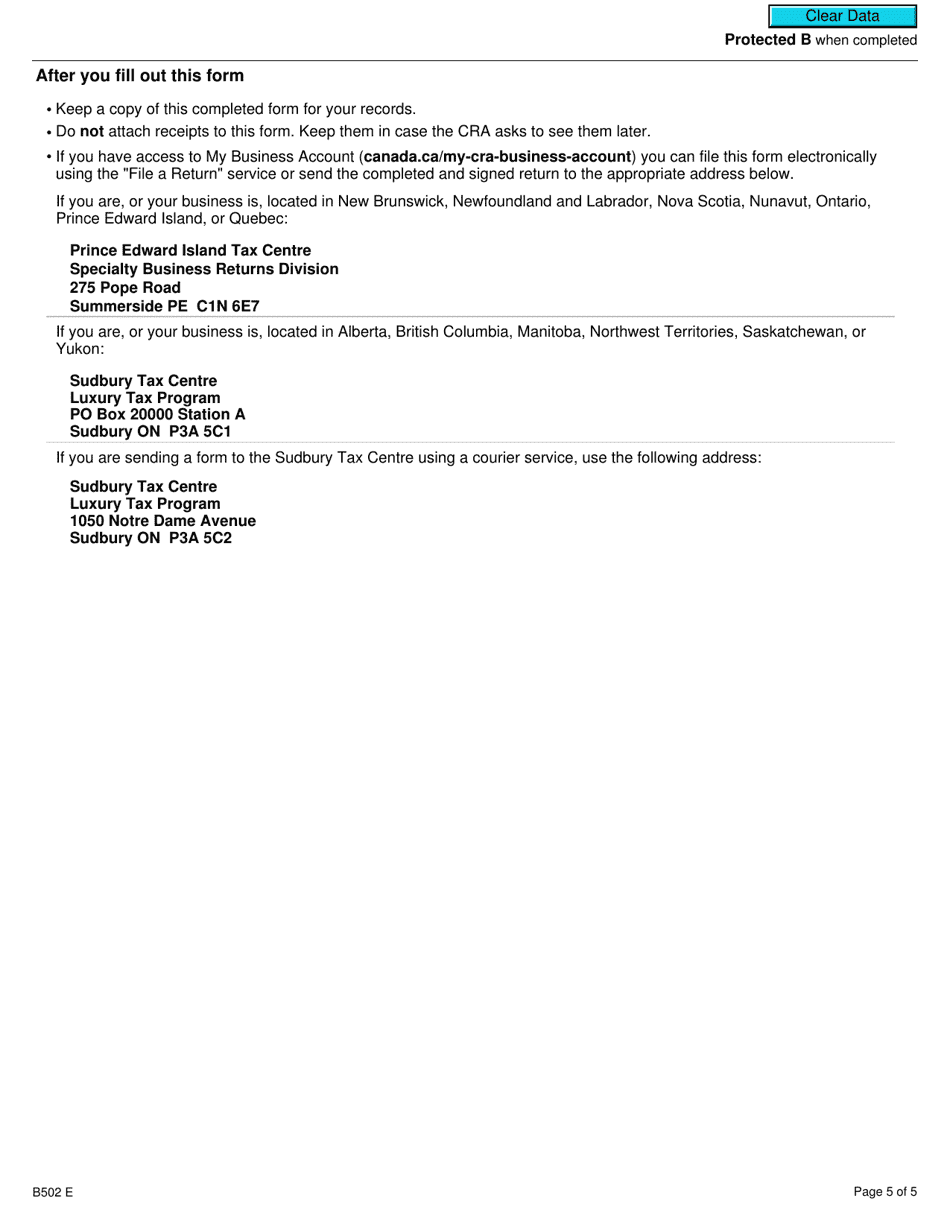

A: You can file Form B502 either electronically or by mail.

Q: Are there any penalties for late filing of Form B502?

A: Yes, there may be penalties for late filing of Form B502, so it's important to file on time.