This version of the form is not currently in use and is provided for reference only. Download this version of

Form PD24

for the current year.

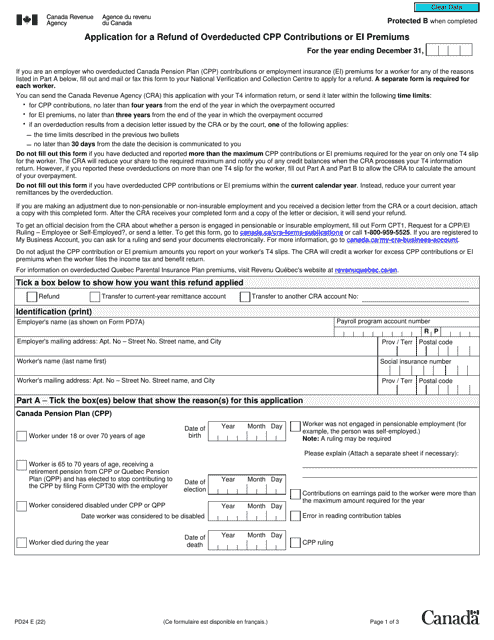

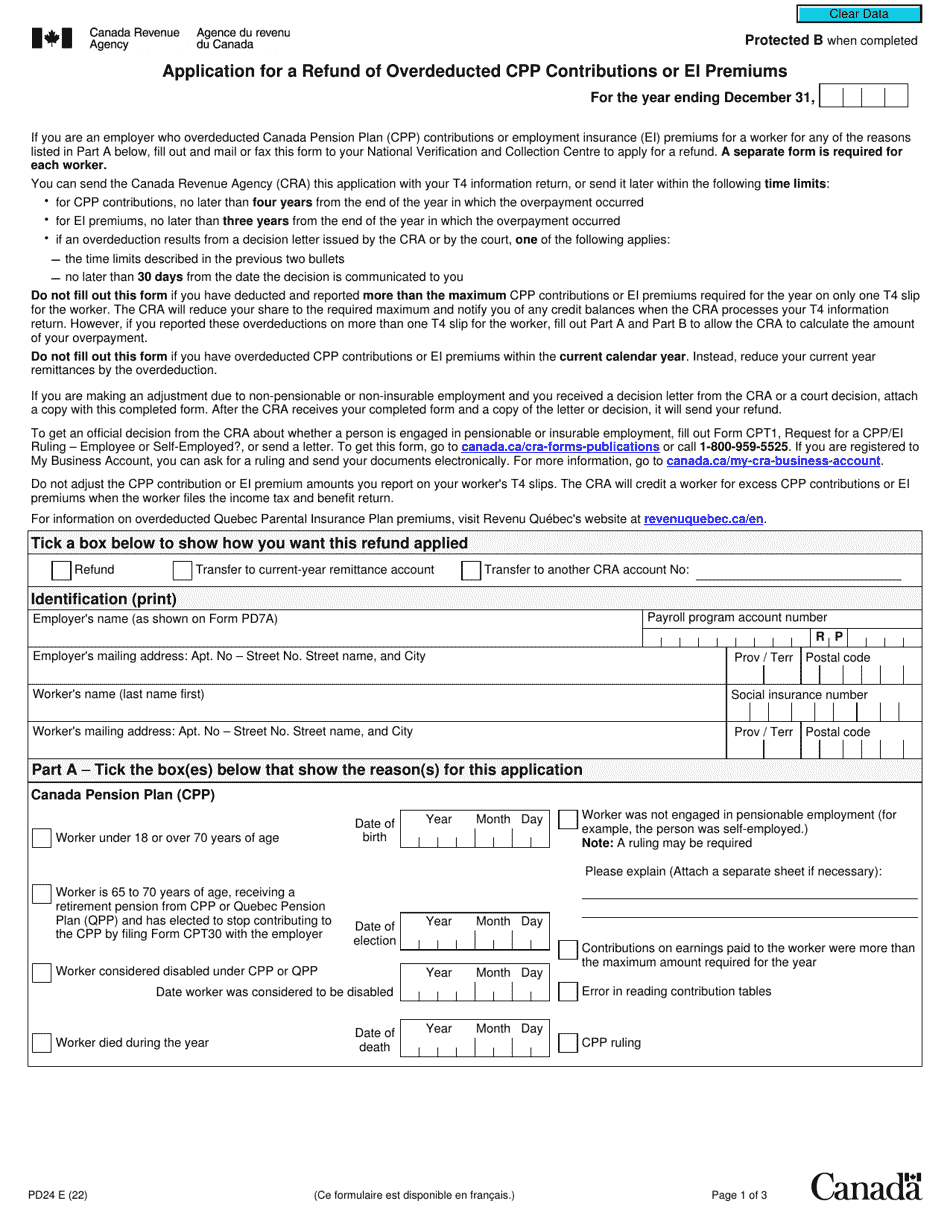

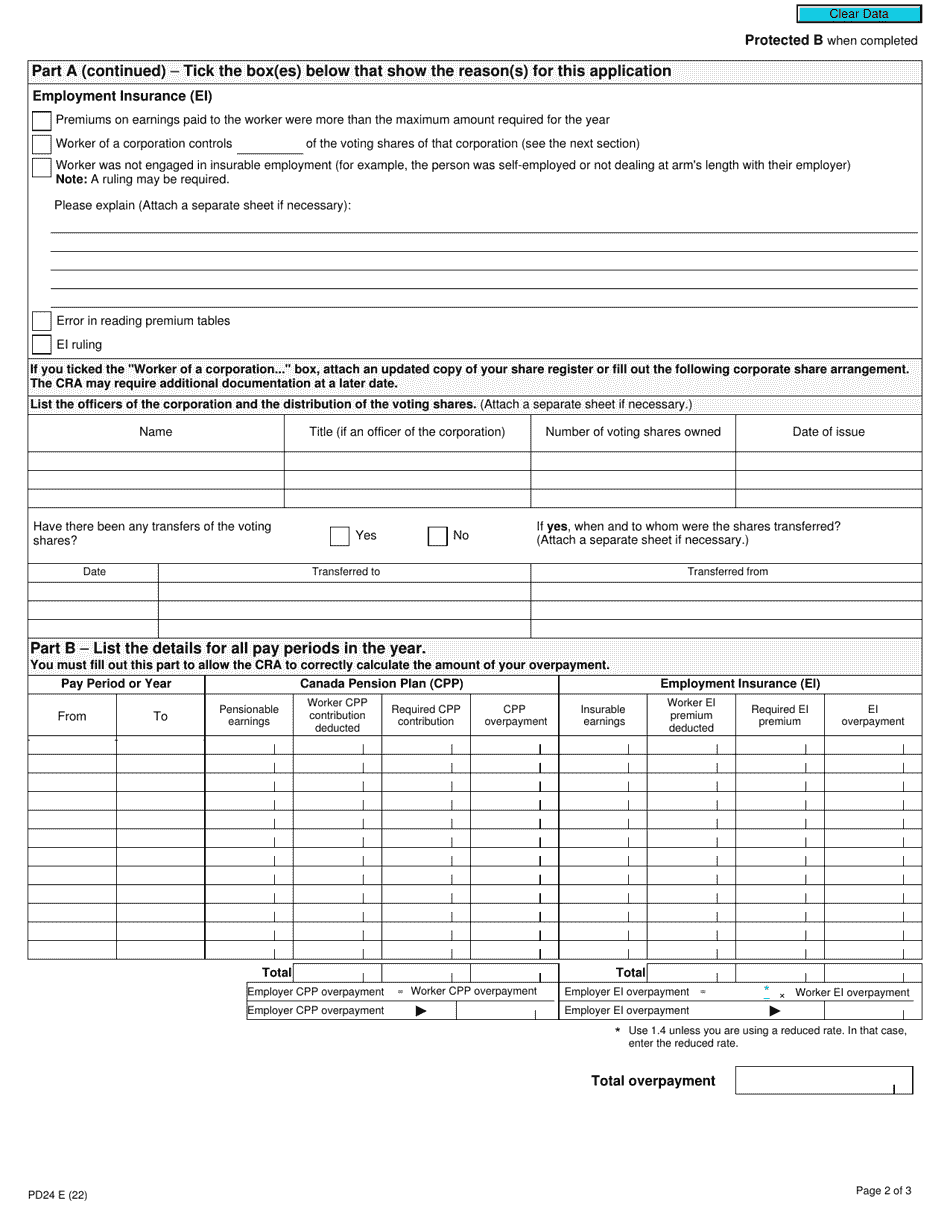

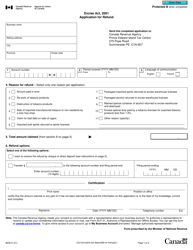

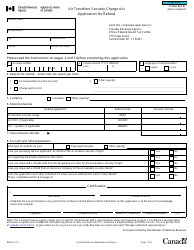

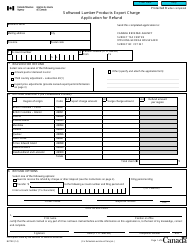

Form PD24 Application for a Refund of Overdeducted Cpp Contributions or Ei Premiums - Canada

Form PD24, Application for a Refund of Overdeducted CPP Contributions or EI Premiums, is used in Canada to request a refund of CPP (Canada Pension Plan) contributions or EI (Employment Insurance) premiums that have been overdeducted.

In Canada, the Form PD24 Application for a Refund of Overdeducted CPP Contributions or EI Premiums can be filed by employees who have had excess deductions for CPP (Canada Pension Plan) contributions or EI (Employment Insurance) premiums.

FAQ

Q: What is Form PD24?

A: Form PD24 is an application for a refund of overdeducted CPP contributions or EI premiums in Canada.

Q: Who can use Form PD24?

A: Any individual or employer who has overdeducted CPP contributions or EI premiums can use Form PD24 to apply for a refund.

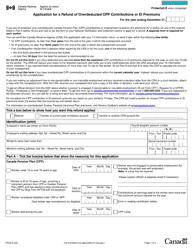

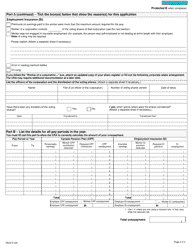

Q: How do I fill out Form PD24?

A: You need to provide your personal information, details of the overdeducted amounts, and the reason for the overdeduction on Form PD24.

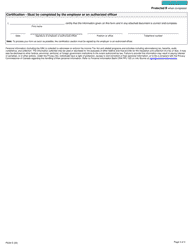

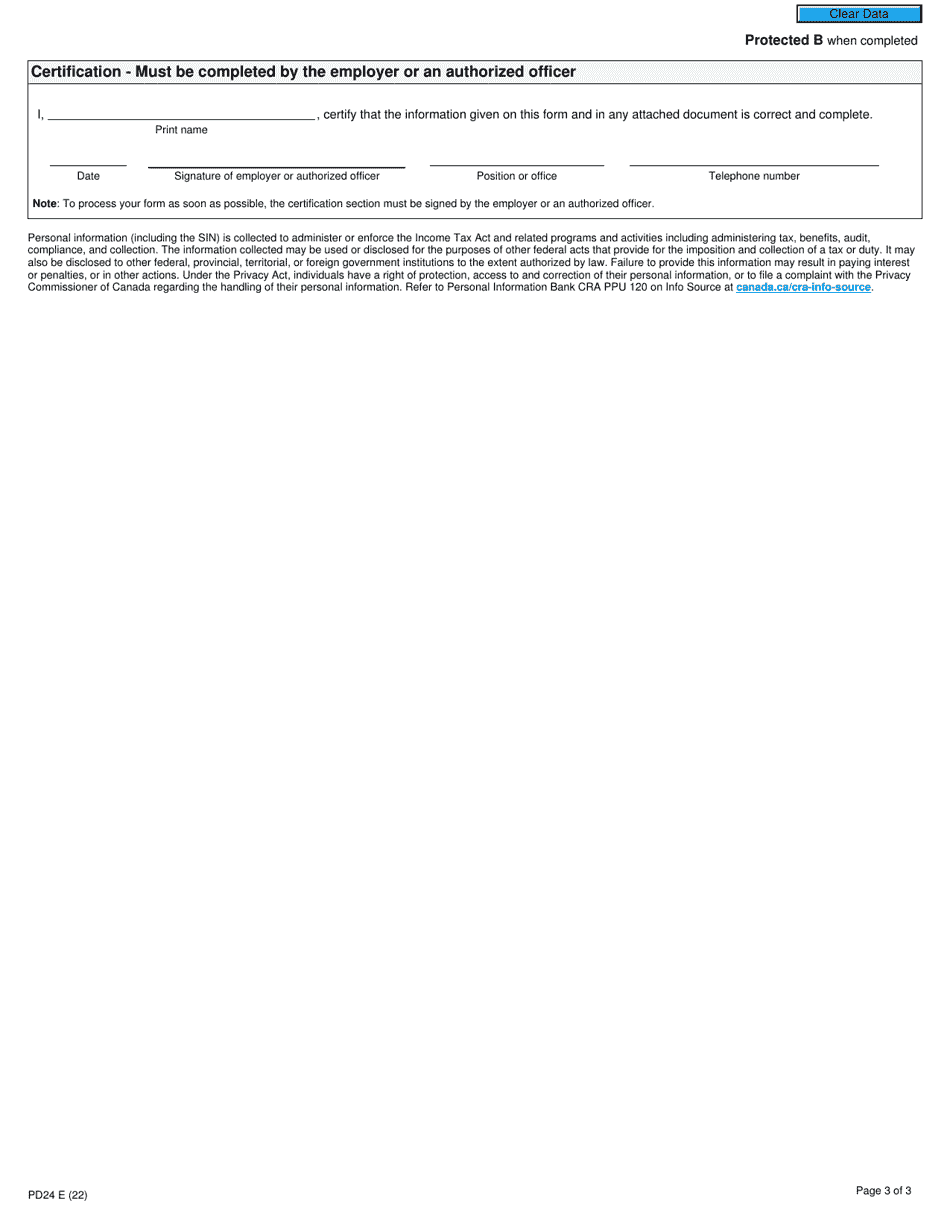

Q: What happens after I submit Form PD24?

A: The CRA will review your application and process your refund if you are eligible.

Q: Is there a deadline to submit Form PD24?

A: Yes, you need to submit Form PD24 within four years of the date of the overdeduction.