This version of the form is not currently in use and is provided for reference only. Download this version of

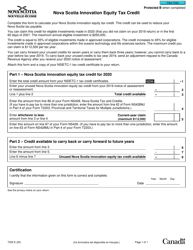

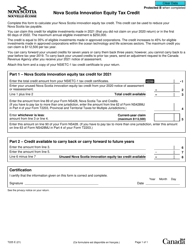

Form T1272

for the current year.

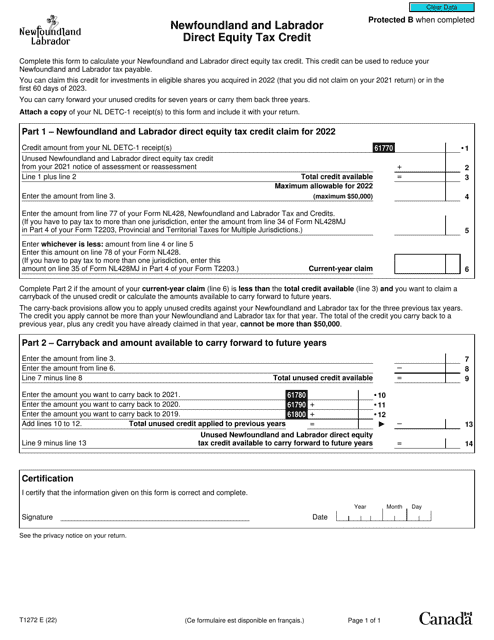

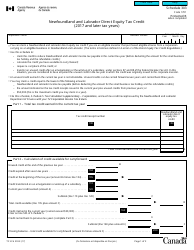

Form T1272 Newfoundland and Labrador Direct Equity Tax Credit - Canada

Form T1272 Newfoundland and Labrador Direct Equity Tax Credit - Canada is used for claiming the Newfoundland and Labrador Direct Equity Tax Credit. This tax credit is available to individuals who have invested in eligible businesses in Newfoundland and Labrador. It provides a tax credit for a portion of the investment made.

The Form T1272 Newfoundland and Labrador Direct Equity Tax Credit in Canada is filed by taxpayers who are eligible to claim this tax credit.

FAQ

Q: What is Form T1272?

A: Form T1272 is the official form used to claim the Newfoundland and Labrador Direct Equity Tax Credit in Canada.

Q: What is the Newfoundland and Labrador Direct Equity Tax Credit?

A: The Newfoundland and Labrador Direct Equity Tax Credit is a tax credit available to individuals who invest in eligible businesses in Newfoundland and Labrador.

Q: Who is eligible to claim the tax credit?

A: Individuals who invest in eligible businesses in Newfoundland and Labrador are generally eligible to claim the tax credit.

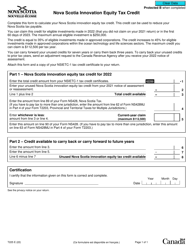

Q: How much is the tax credit?

A: The tax credit is equal to 35% of the eligible investment made in an eligible business.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to complete and file Form T1272 along with your tax return.

Q: Is there a limit to the amount of tax credit I can claim?

A: Yes, the maximum tax credit that can be claimed is $50,000 per year.

Q: Are there any restrictions on the type of businesses I can invest in?

A: Yes, the business must be a qualifying corporation engaged in an eligible business activity.

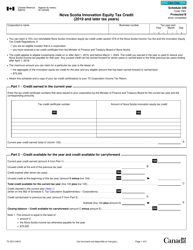

Q: Can I carry forward unused tax credits?

A: No, unused tax credits cannot be carried forward to future years.