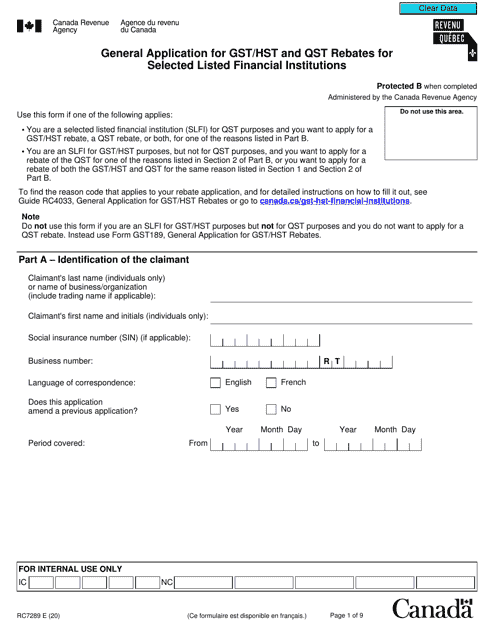

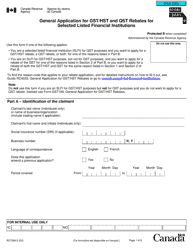

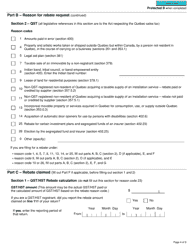

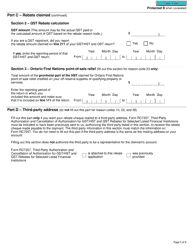

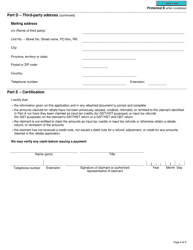

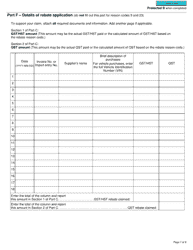

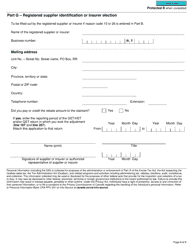

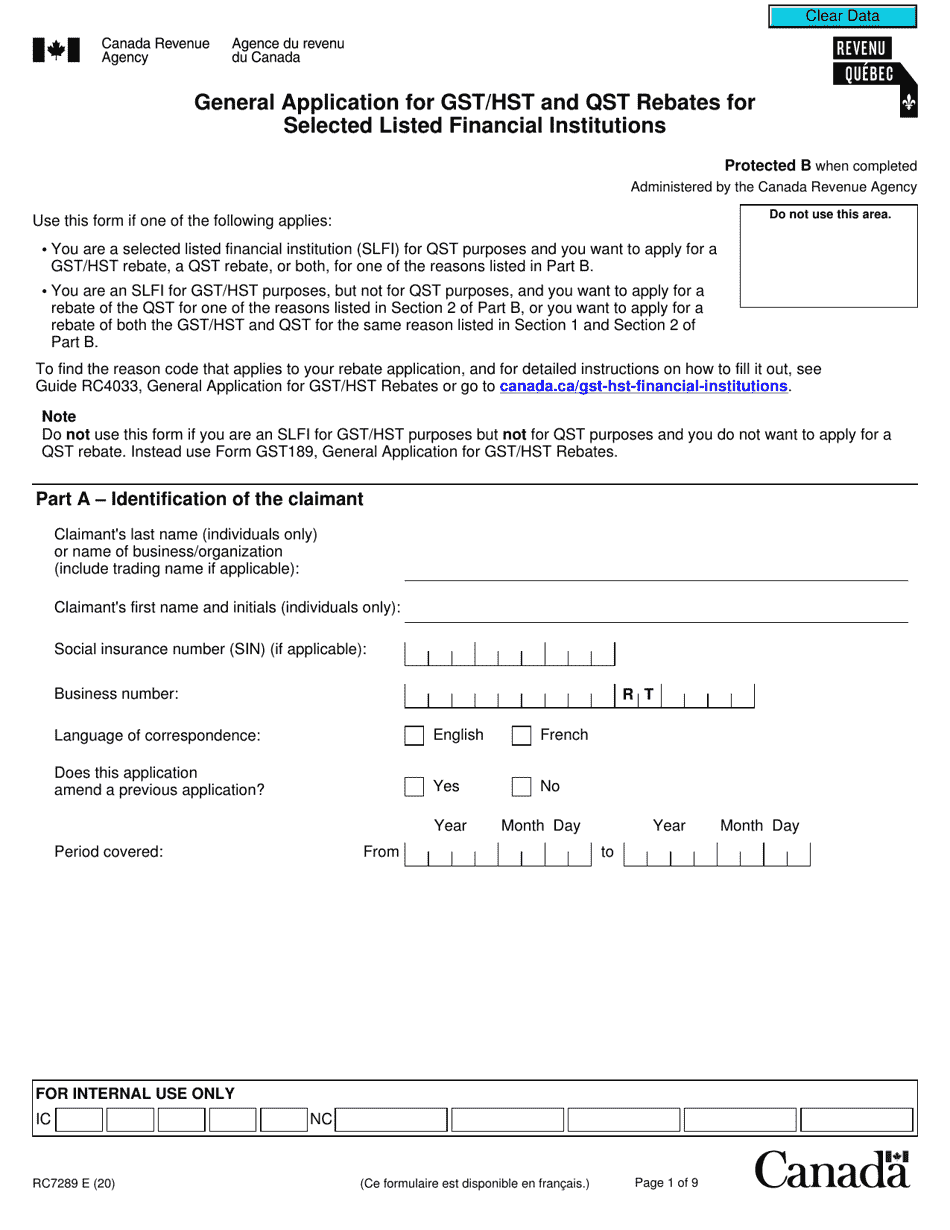

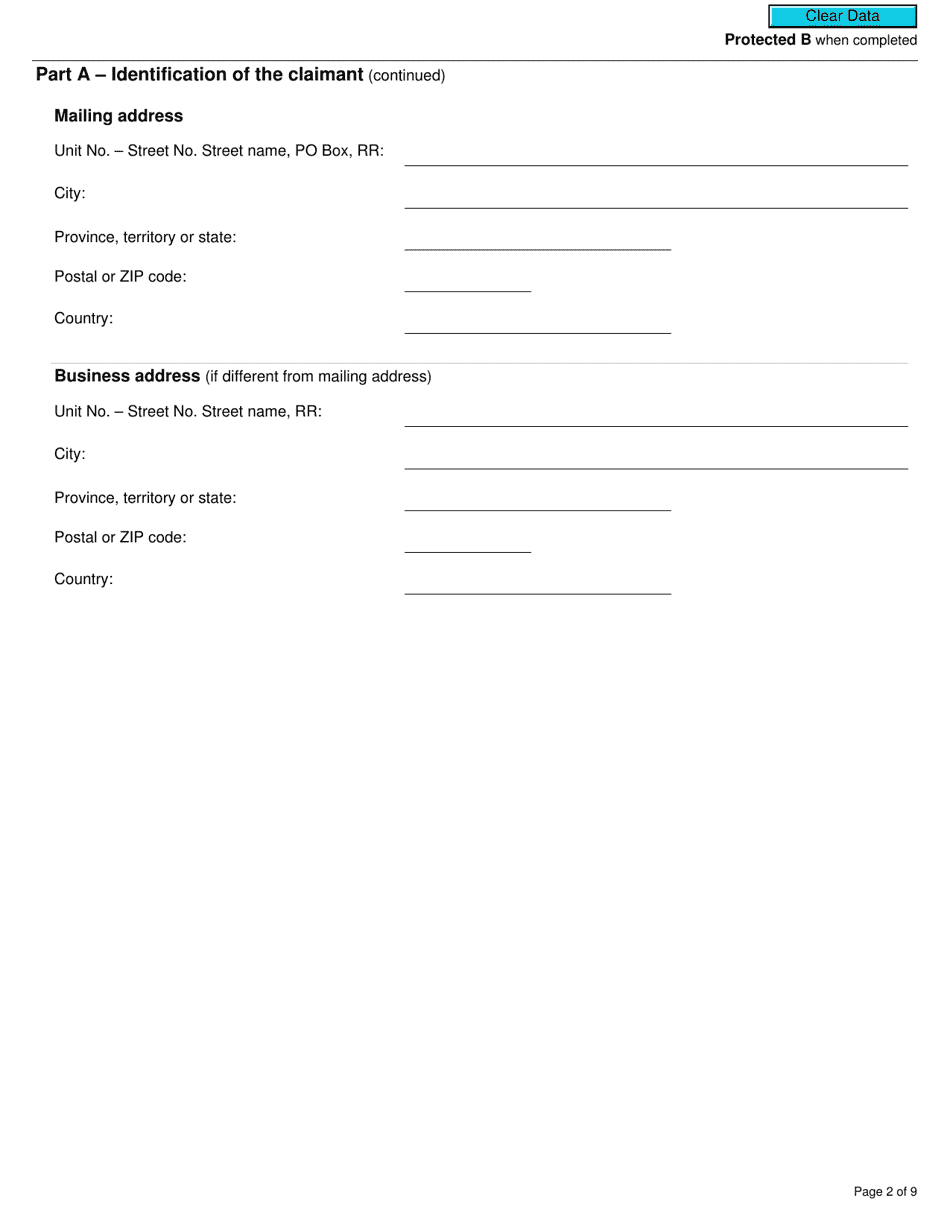

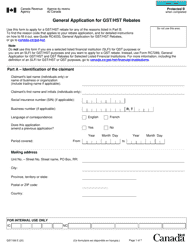

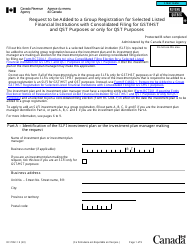

Form R7289 General Application for Gst / Hst and Qst Rebates for Selected Listed Financial Institutions - Canada

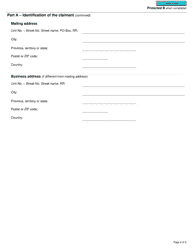

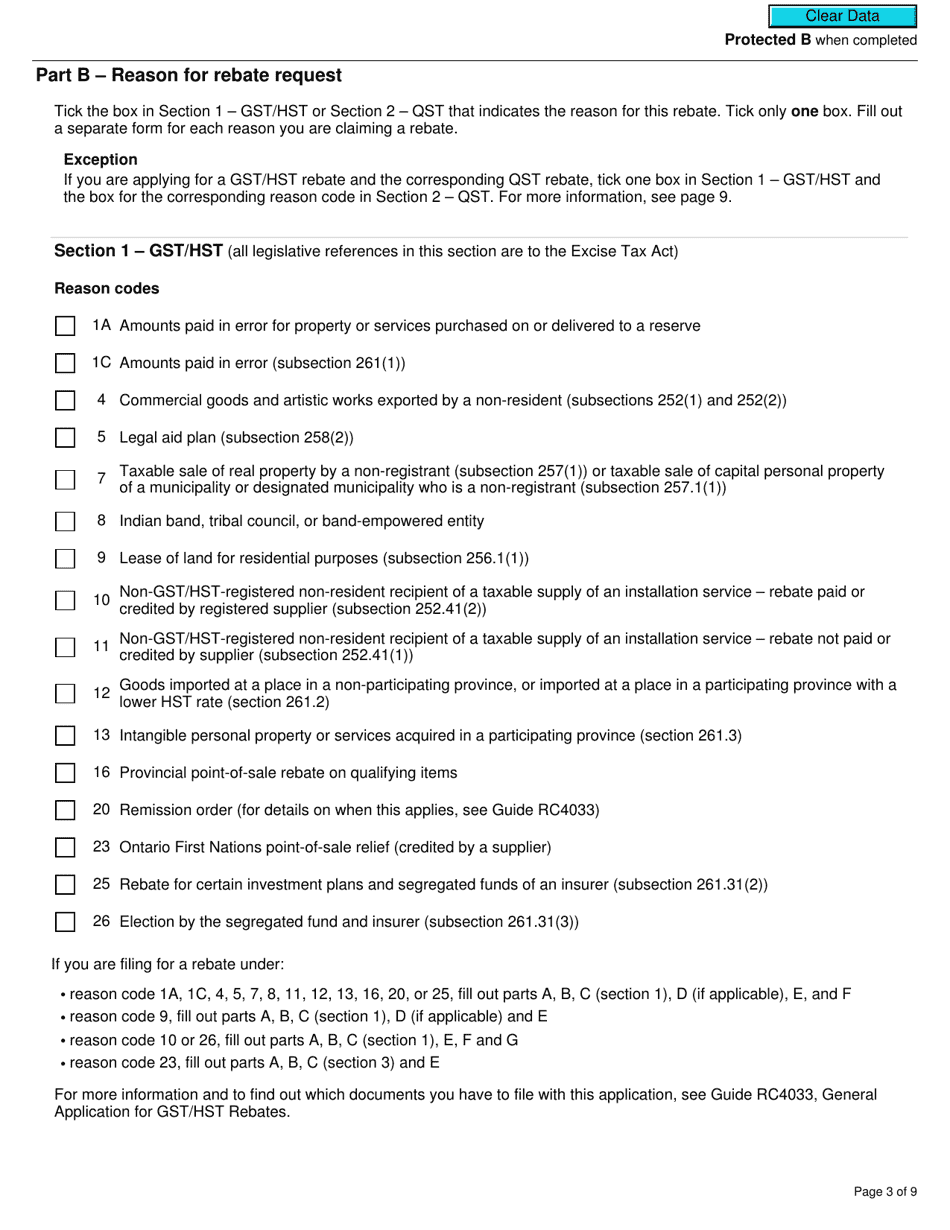

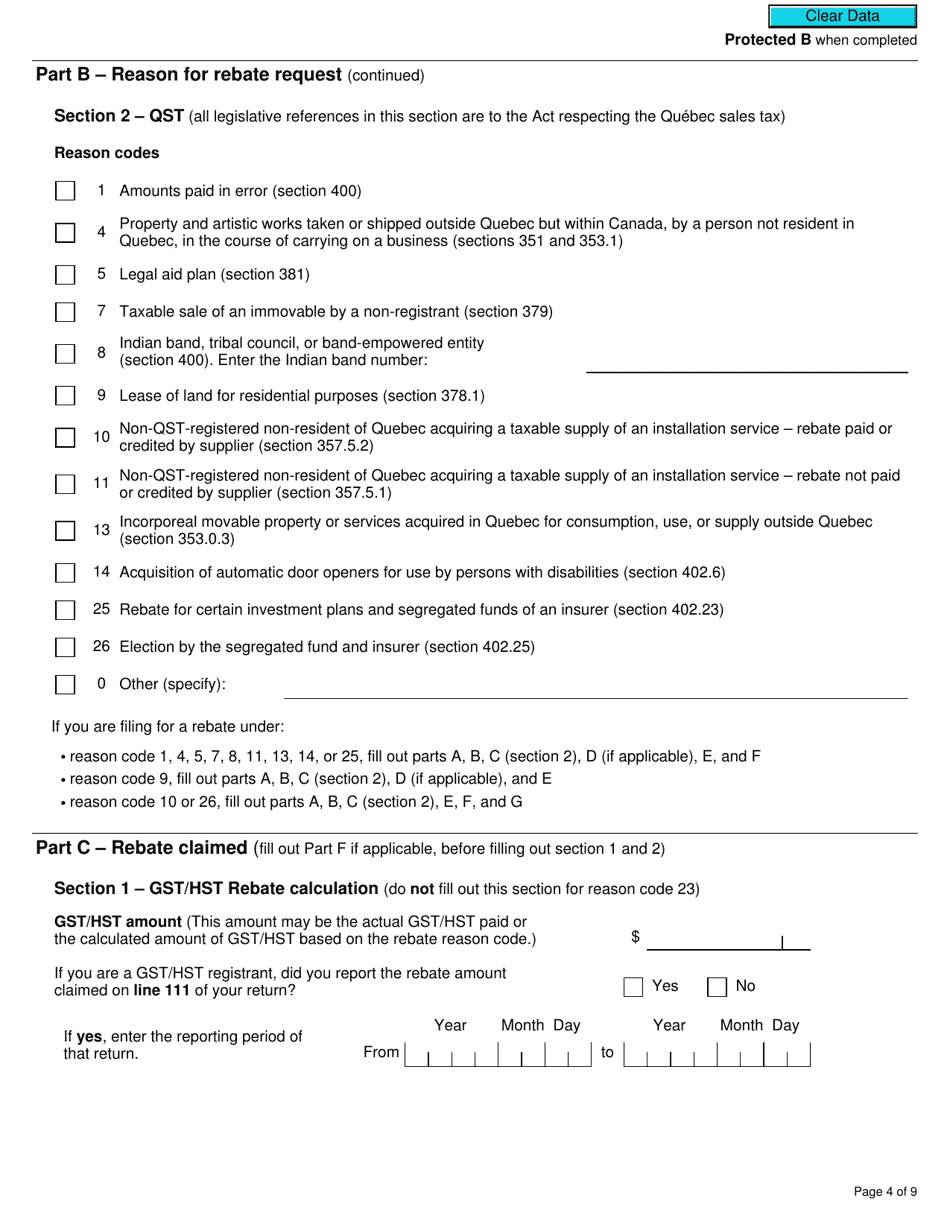

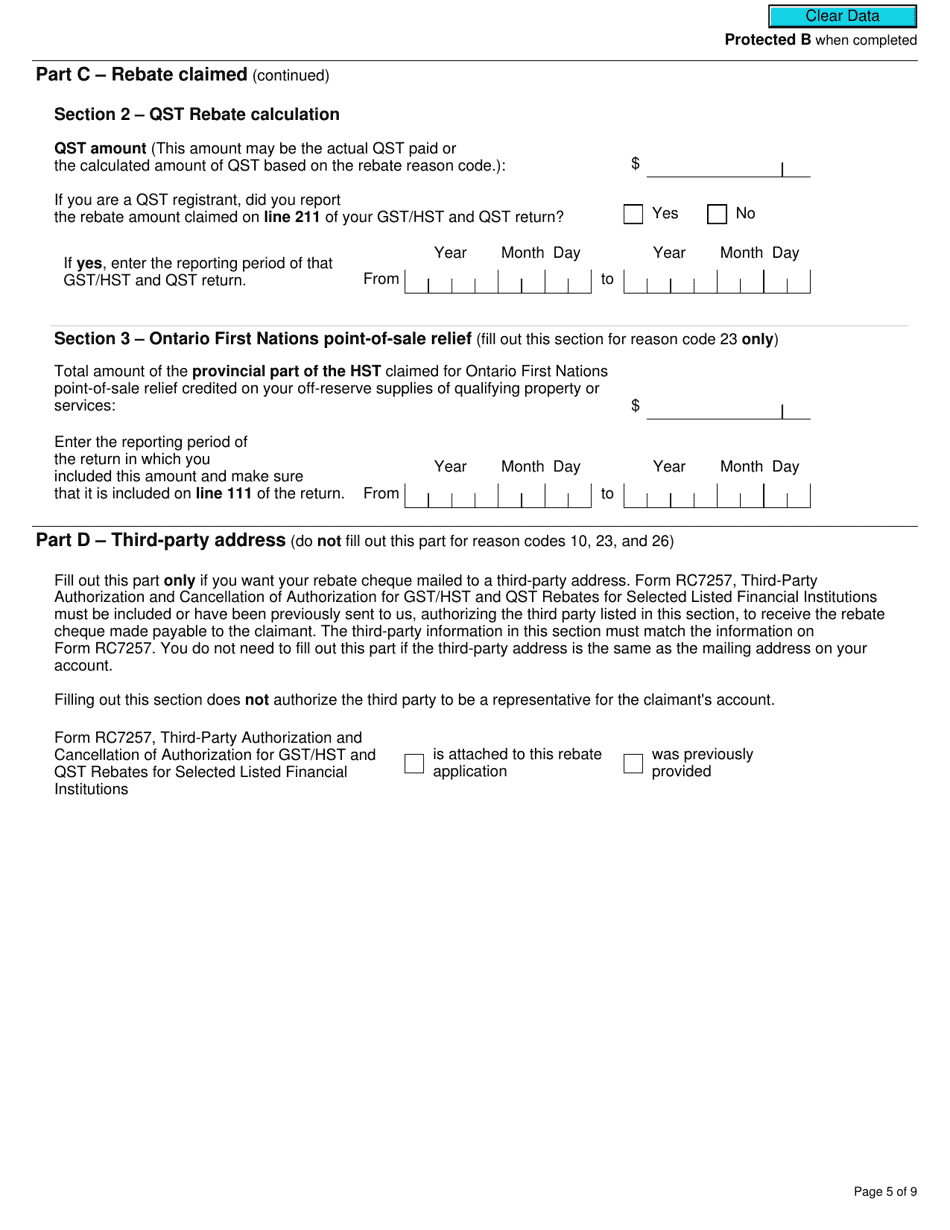

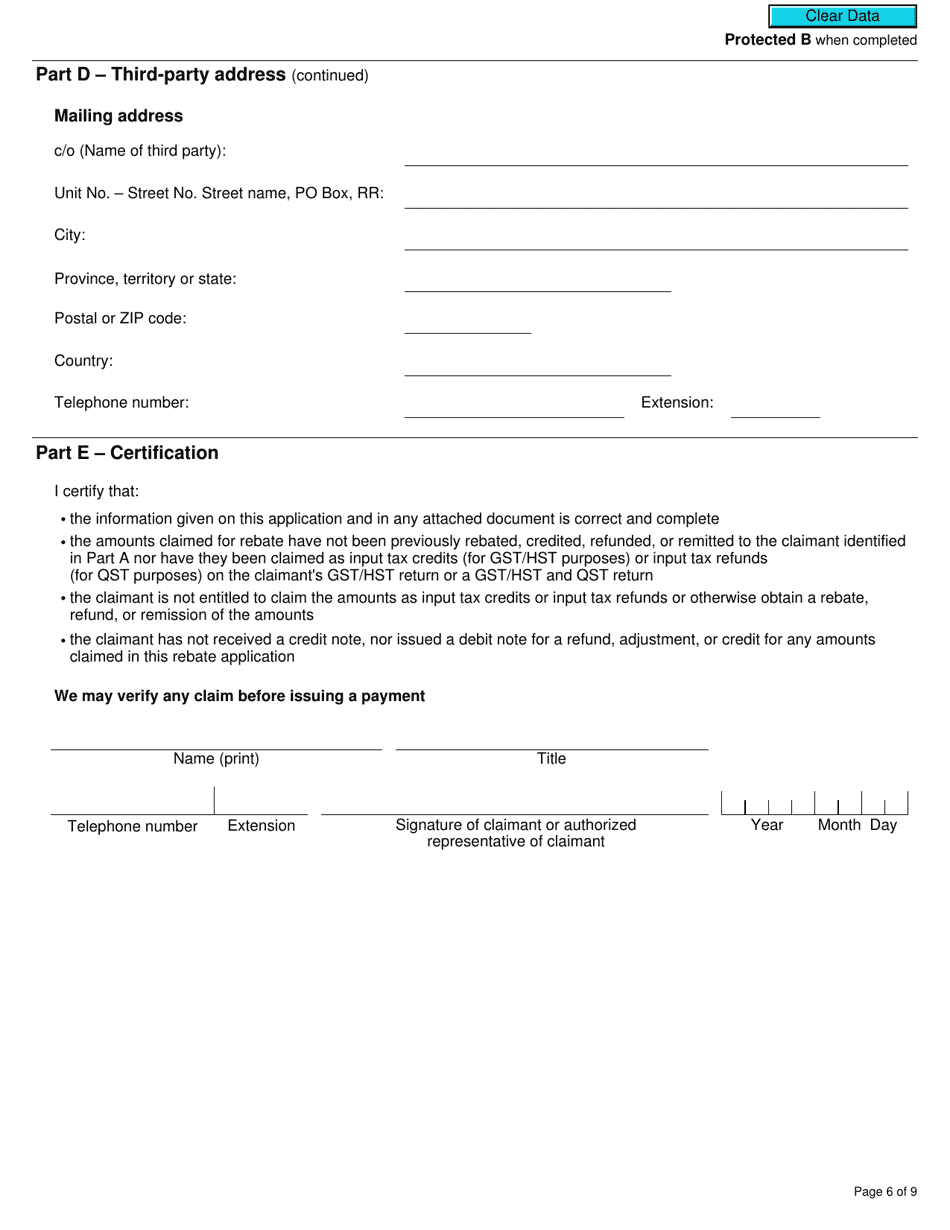

Form R7289 General Application for GST/HST and QST Rebates for Selected Listed Financial Institutions in Canada is used by financial institutions to apply for rebates on the Goods and Services Tax (GST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST) paid on certain expenses.

The Form R7289 General Application for GST/HST and QST Rebates for Selected Listed Financial Institutions in Canada is filed by the eligible financial institutions themselves.

FAQ

Q: What is Form R7289?

A: Form R7289 is a general application form used to apply for GST/HST and QST rebates for selected listed financial institutions in Canada.

Q: What is GST/HST?

A: GST/HST stands for Goods and Services Tax/Harmonized Sales Tax. It is a federal tax applied on most goods and services in Canada.

Q: What is QST?

A: QST stands for Quebec Sales Tax. It is a provincial tax applied on most goods and services in the province of Quebec.

Q: Who can use Form R7289?

A: Form R7289 can be used by selected listed financial institutions in Canada to apply for GST/HST and QST rebates.

Q: What are GST/HST and QST rebates?

A: GST/HST and QST rebates are refundable amounts that selected listed financial institutions can claim to recover the taxes paid on certain expenses.

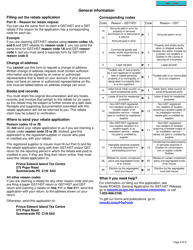

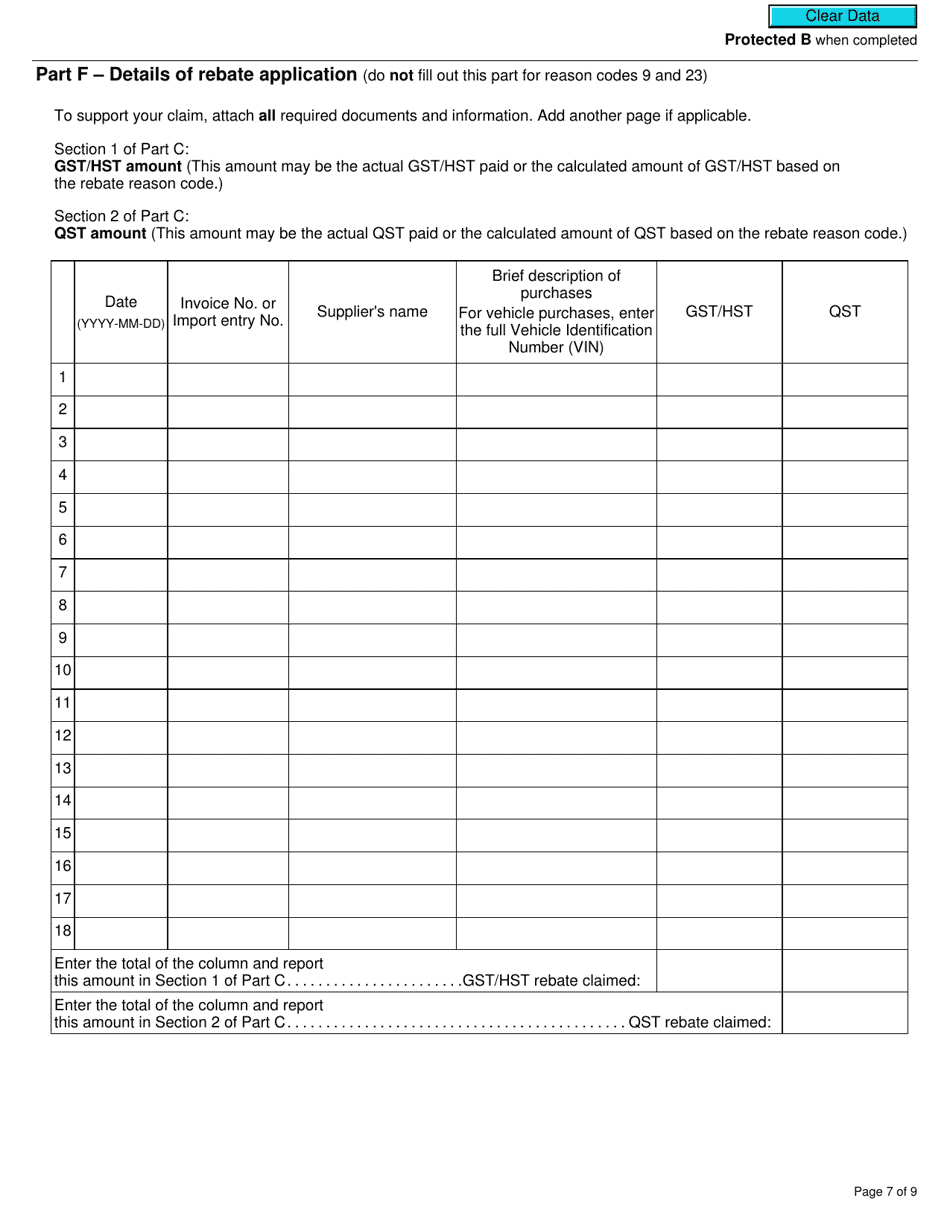

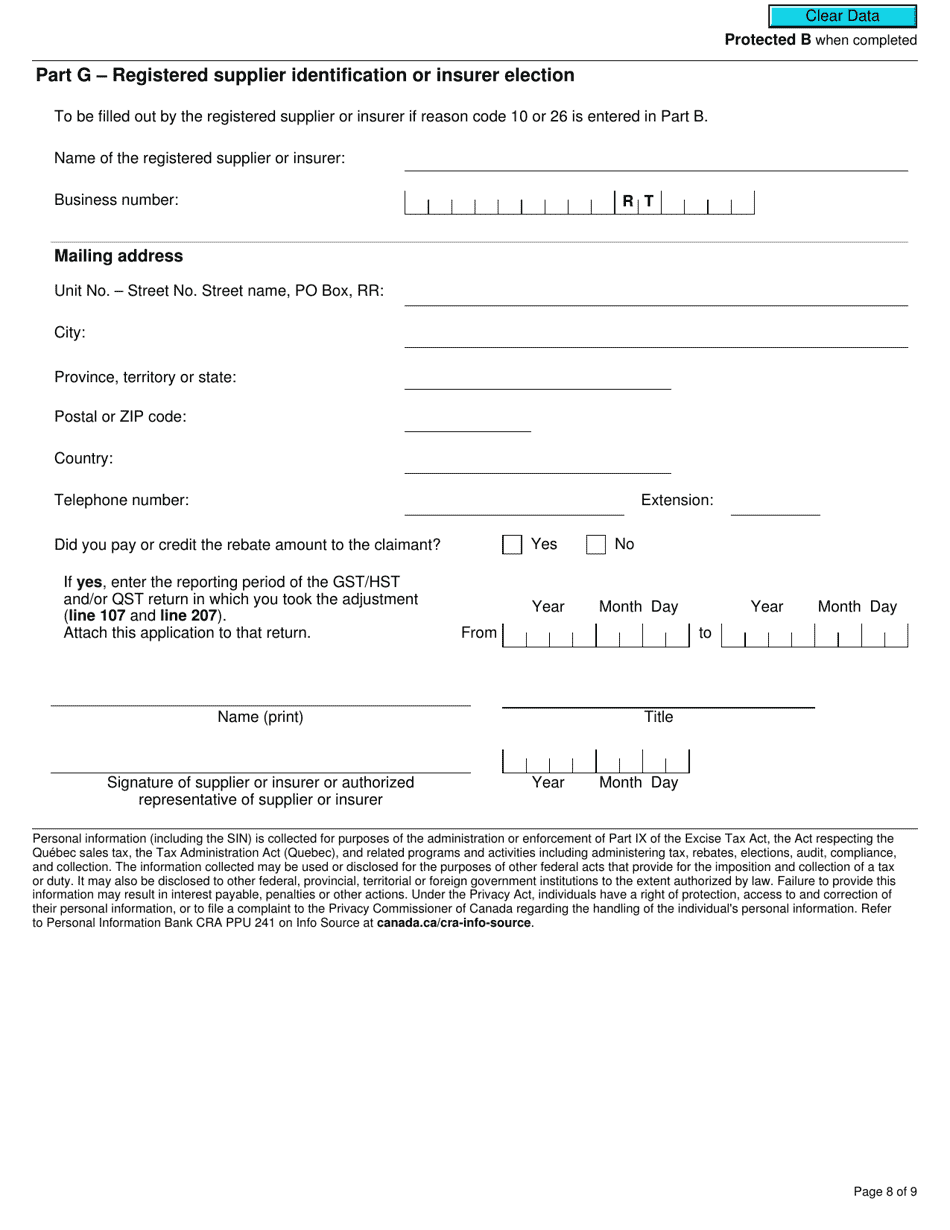

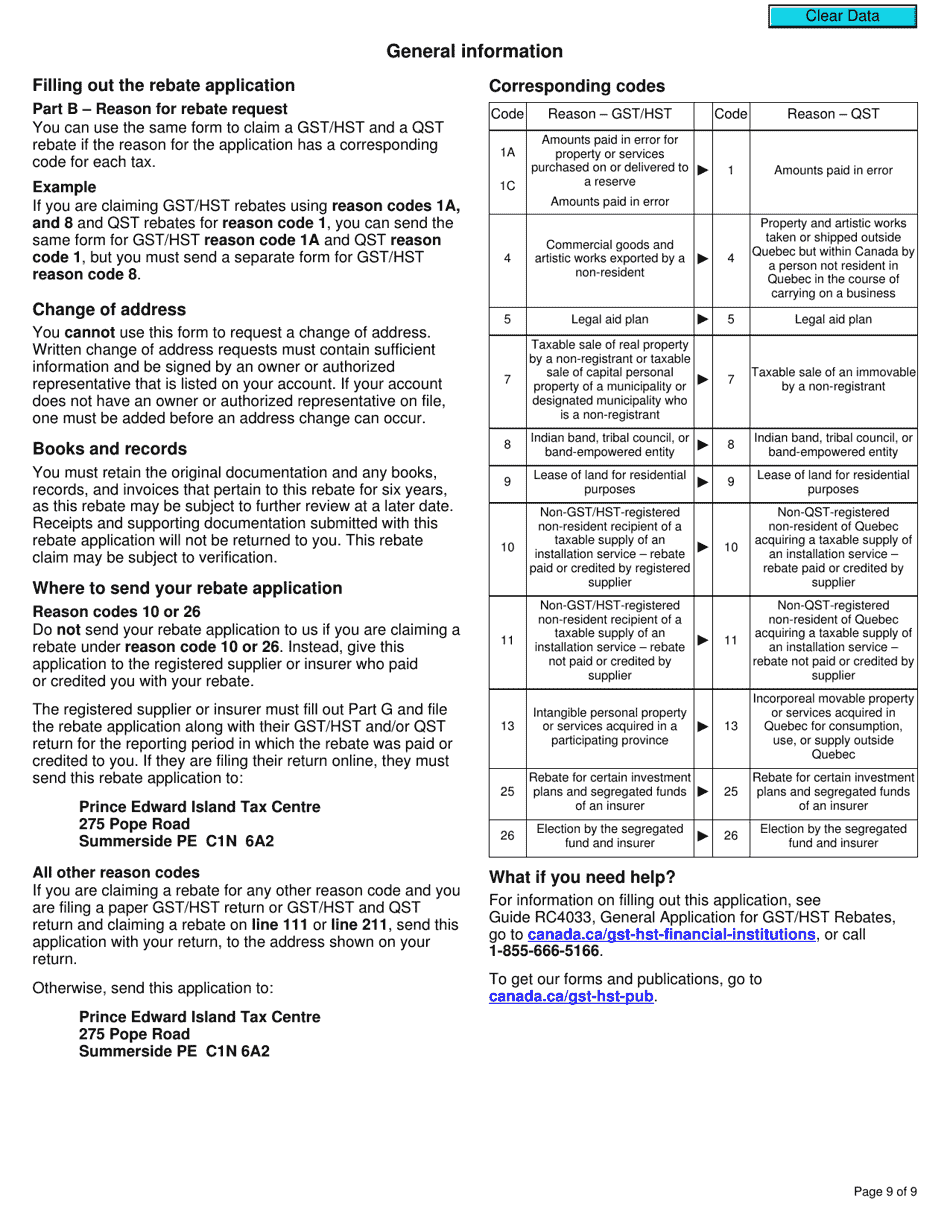

Q: How do I complete Form R7289?

A: The instructions for completing Form R7289 are provided on the form itself. Follow the instructions carefully to ensure accurate and complete filling of the form.

Q: Can individuals or non-financial institutions use Form R7289?

A: No, Form R7289 is specifically designed for selected listed financial institutions in Canada. Individuals and non-financial institutions should use the appropriate forms for their specific rebate applications.